|

Budget Allocation: The First Step in Personal Finance Part of Oak Street Advisors’ 10 Financial Commandments for Millennials series, budget building and understanding a general hierarchy of allocating extra income is crucial to getting a head start on retirement planning for millennials. Follow these steps and refer to the Personal Budget Template to begin. Make a budget and stick to it- seems obvious and easy right? Except for it’s not- not at all. Well, it is easy to make a budget. One that clearly has every bill, investment, savings contribution and living need covered. It looks so nice and neat when you’re done with it too! But…your budget won’t stay nice and neat. You overspend on a weekend getaway or spontaneous night out with friends and before you know it, that $300 that was supposed to be put into your IRA this month was spent on bar tabs and work lunches. Budgeting is hard work and life is expensive. Knowing that budgeting is hard is the first step to good budgeting. So, what does a decent budget look like for a young professional just starting out on the road to retirement? The answer is different from person to person but let’s start with the basics. 5 Steps in Basic Personal Budgeting

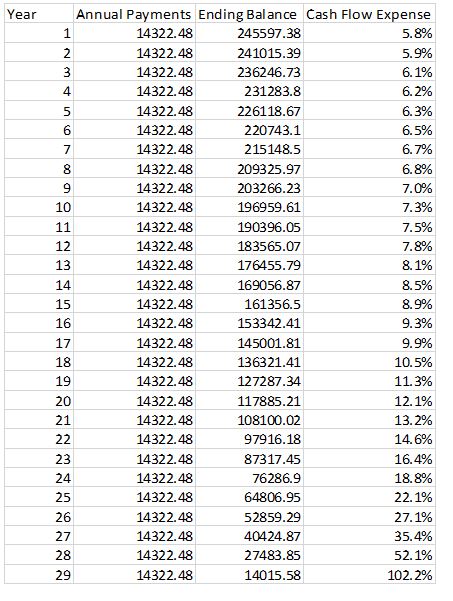

Step 1: Income – Fixed Expenses Always deduct your bills, insurance premiums, food allowance etc. directly from your paycheck. These are fixed unavoidable costs that cannot go unpaid. Now- how much is left in your checking account after you’ve paid for your next month’s existence? Step 2: Emergency Fund Savings We’re going to get into the Emergency Fund in an upcoming article, but what you need to know now is that after paying your living expenses you need to save an exact $ amount to cover your butt if any surprise expenses arise or you suffer a job loss. Step 3: Retirement Savings Once you’ve got your Emergency Fund completely funded start working on maxing out a retirement plan. Ideally, you’re participating in an employer sponsored plan like a 401(k) that will allow you to contribute up to $18,500 each year. If you’re not offered this type of plan, make sure to max out an IRA. Generally, a Roth IRA is advantageous for younger investors, however, check with your advisor or tax preparer about the implications in regard to your specific circumstances. You may consider mixing the tax-deferment of a 401(k) plan with the tax-free characteristics of a Roth IRA to play both sides of the income tax fence, so to speak. *Some young investors may consider college savings an integral part of their financial plan. Step 3 is a great place to include college savings Step 4: (Could be Step 3) Paying Down Debt Many young investors have student loans, credit cards, auto loans, mortgages etc. that can be mentally and financially draining. Depending on your situation, it may be advantageous to allocate a part of your monthly disposable income to paying down debt. It may be smart to allocate disposable income to savings, retirement, and paying down debt all at once--it truly depends on your unique circumstances. Step 5: Treat Yo’Self While allocating extra income towards improving your financial position both now and in the future is great fun-- spending your hard-earned dollars is fun as well. Ideally, you’d start saving for vacations or another ear-marked goal after the previous steps are taken care of, however, that is often not the case. We need to enjoy our money as much as we need to grow it- so don’t forget to enjoy the fruits of your labor! ----- Free Personal Budget Template Now that you have a basic guideline for creating and prioritizing your personal budget, why not take a crack at it yourself? Would a simplified Personal Budget Template help you organize your budget? Click that link to download the budget template I use personally as a CFP® practitioner and which I’ve customized to follow these budgeting steps. Carrying mortgage debt can be a contentious subject among financial planners. Some look at the leverage as an opportunity to build net worth. Others see mortgage debt as merely a necessary evil. Often clients believe the mortgage interest deduction is valuable, but with the new income tax rules effective January 1, the deduction is limited for some and worth less for others. So when should you try to be mortgage free? Certainly, by the time you plan to retire. I have given this advice to everyone who has the means to do so, and to a person, they have always commented that it was the best advice they ever received. The reason has little to do with money, but everything to do with peace of mind. Not having the expense of a mortgage often reduces your need for significant cash flows. Being mortgage free also means that if push comes to shove, how much does it really take to live each month? Your basic expenses are then whittled down to food, energy, medical, and insurance expenses. Retirement is also the point in your life where growing your net worth takes a back seat to generating income. I explain to clients that the easiest and safest way to earn 4% on your money is to avoid paying 4% for your money. Paying off a mortgage can be compared to purchasing a bond with a yield equal to your mortgage interest rate. I like to illustrate the value of paying off your mortgage in a very simple way. Below is a chart of the annual payments for a $250,000 mortgage at 4% interest. We can ignore escrow amounts, because that covers expenses that will continue regardless of whether or not you pay off the mortgage debt. Cash flow expense is simply the mortgage payments for the year divided by the payoff amount, or if you had the cash available to pay off the mortgage how much cash flow that money would have to produce to cover your mortgage payment.

You can see in this example that by year 15 the amount of money needed to pay off your mortgage would need to produce returns close to the historical equity market rates to be an even trade-off. By year 20 of a 30-year mortgage, or around the time many people are reaching retirement, the return on cash needed to make your mortgage payments has reached double digits. If you were retiring at that point and had $117,886 available in a taxable account I would encourage you to use that money to pay off your mortgage. With a cash on cash return of over 12% the odds of earning a higher return on that money is slim, and it gives you an extra ten years of a less stressful retirement. I once had a planning client come to me complaining that low CD rates were cutting into their lifestyle. The client felt they needed more income, but they were very risk averse. For them using the $100,000 to pay off their mortgage saved them from having $9,000 in annual expenses and did so without exposing them to any investment risk at all. Every situation is a bit different, but you should challenge your assumption that carrying mortgage debt in always a good strategy.  Whether you live paycheck to paycheck, or are fortunate enough to enjoy some financial breathing room. Once a month, I challenge you to enjoy the "No Spend Weekend". It might not sound feasible, but believe me, it can be done and is financially rewarding. Whether you go it alone or are married with or without kids, it's a great way to save some money and take control of your finances. I recommend going to the beach or park, enjoying a free local museum or social event, or simply getting some projects done around the house. The process is simple, just don't spend any money from Friday to Monday. You and your loved ones can enjoy some personal time, experience some things you don't typically do, and, oh yea...save some money!  Throw away your useless May 2016 monthly budget and just start over. Seriously, 99% of us have not stuck completely to the plan, and that’s expected. But that doesn’t mean you should go and spend as you please, it just means it’s time to start over. Reconstructing your budget around the middle of the month is a helpful way to stay in control of your money. By this time your bills are paid, mortgage/rent has been sent off, and you’re now dealing with necessities (gas, groceries etc.) and disposable income. The key here is disposable income. Have you already spent most of it? Do you have some surplus you should be putting into a savings account? Can you maintain the month’s plan without adding extra onto a credit card? These are all things you should be going back over in the middle of the month that will help you stay in control. Because there’s two ways we can live with money: You can control your money…or your money can control you.  savingNo matter how much we need to save, no matter how badly we want to break out of the paycheck to paycheck life, saving money is hard. It’s hard because we get an immediate reward for spending money. I give you $5 you give me a Mocha Latte. Saving on the other hand forces us to delay receiving our reward. I give you $5 and in twenty years or so you give me $20 to enjoy in my old age. Sometimes it helps if you can visualize the future. In 20 years I will spend my days walking in the woods and exploring new cities. I see myself spending my time with my grandchildren, going to the zoo, planting my garden. Visualization helps some but it’s still hard to save. You can also make saving easier by planning things you enjoy that are free or cost very little. Maybe you can go visit a museum or a nearby town. Go for a bike ride or a Sunday afternoon drive. Look for local festivals. Maybe only take a few dollars with you on these short trips so you won’t be tempted to spend. You can make saving automatic by having some amount debited from your paycheck or checking account each month or even each week. If you don’t see it, you won’t miss it. All these things can make saving easier, but it will never be easy.  As a financial advisor, I often talk about being aware of where you are spending your money, because I believe awareness triggers restraint and restraint leads to better savings habits. While saving money is a good thing, buying something that is cheap is often expensive. If you are planning a purchase look for value, don’t make a purchase just because an item is ‘cheap’. Mindful purchases that you have determined represents good value can bring years of joy and usefulness into your life. Making a spur of the moment purchase because something seems like a deal often leads to regret. Be frugal with your spending but never cheap. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed