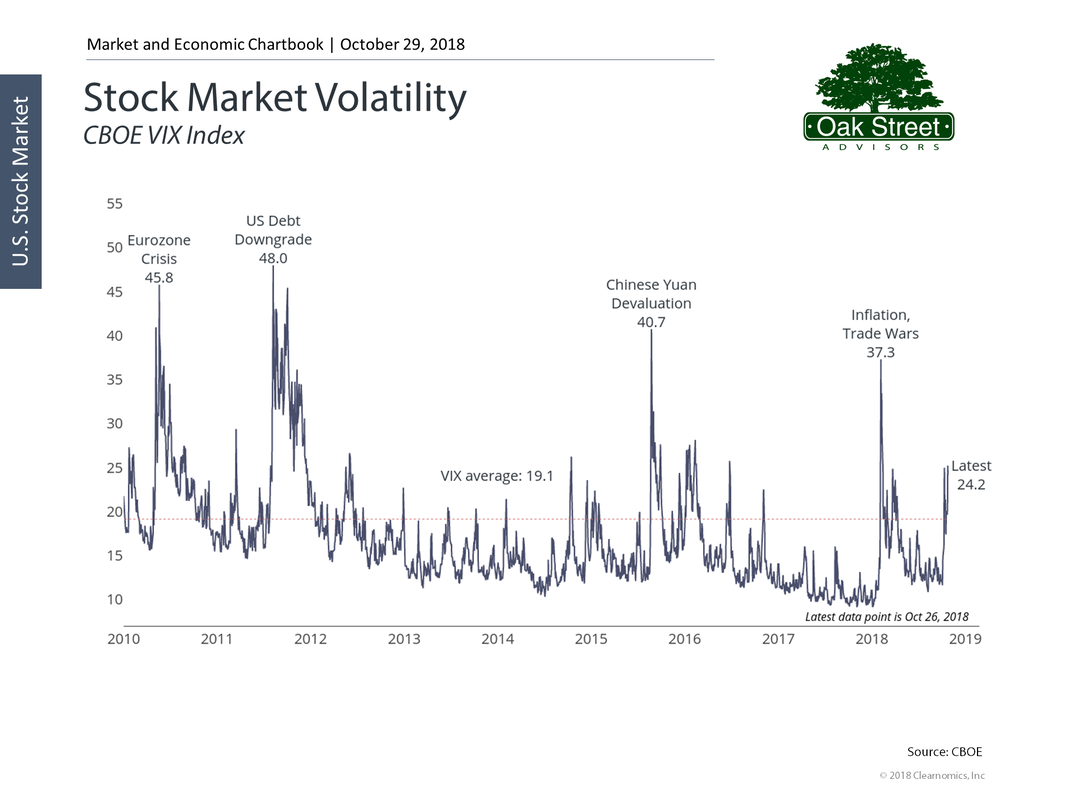

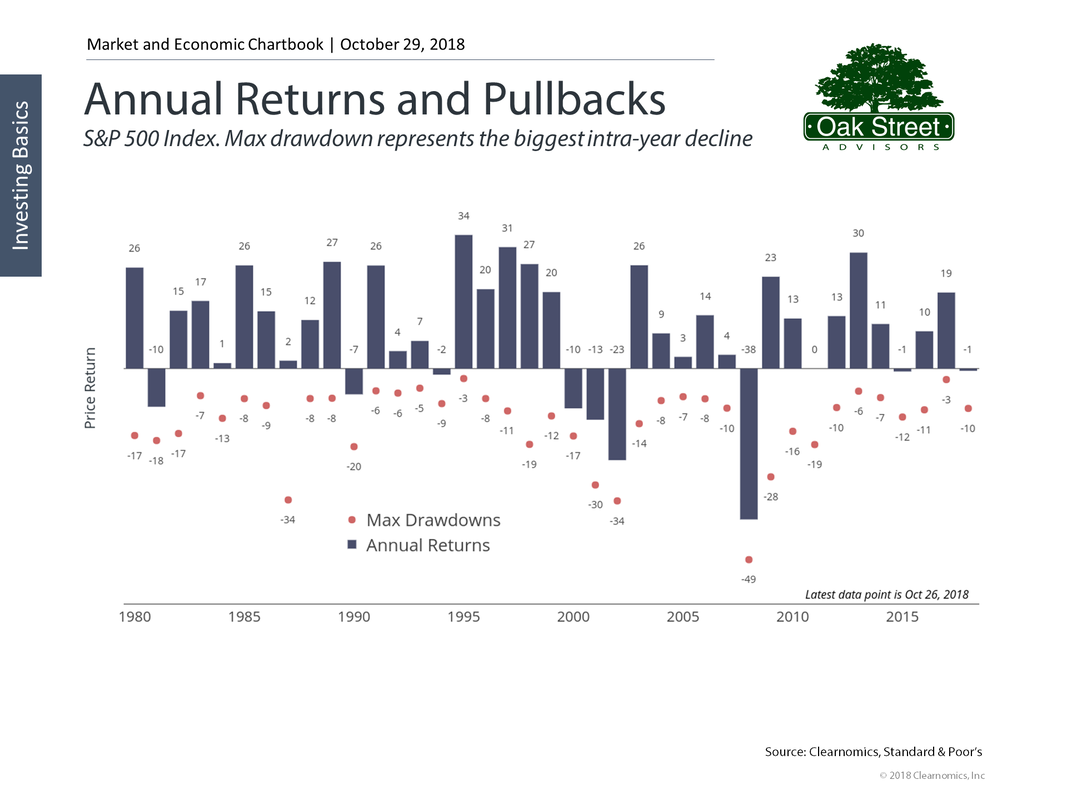

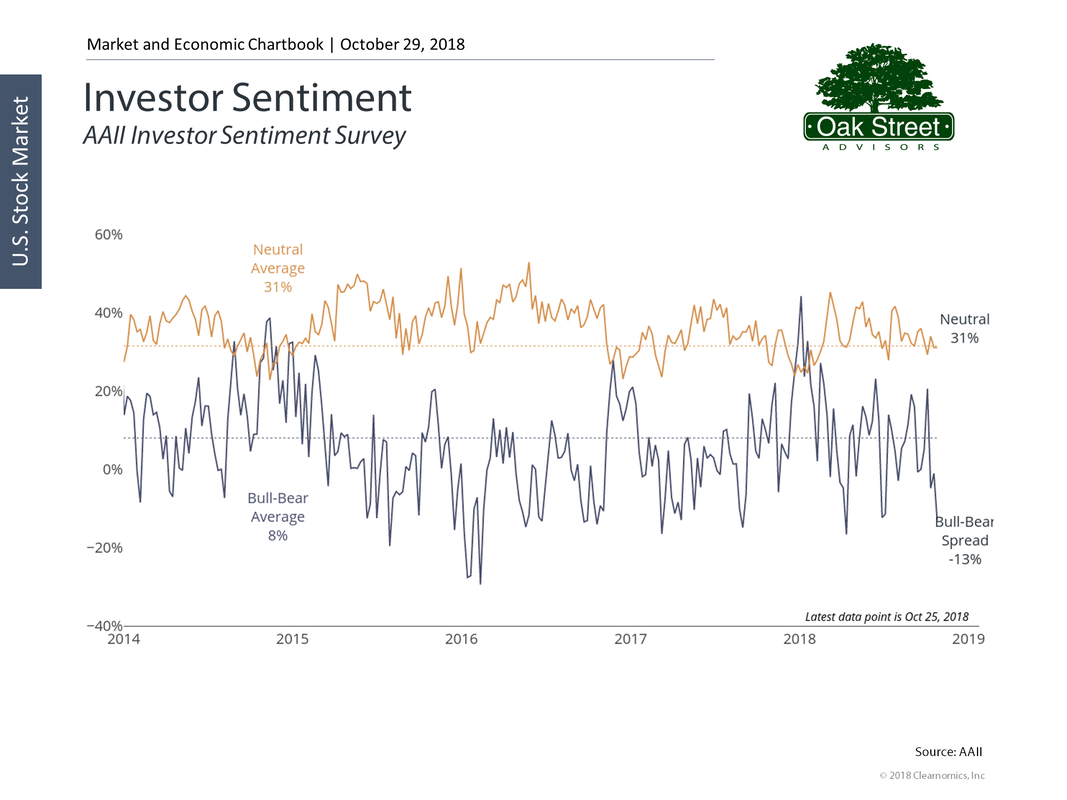

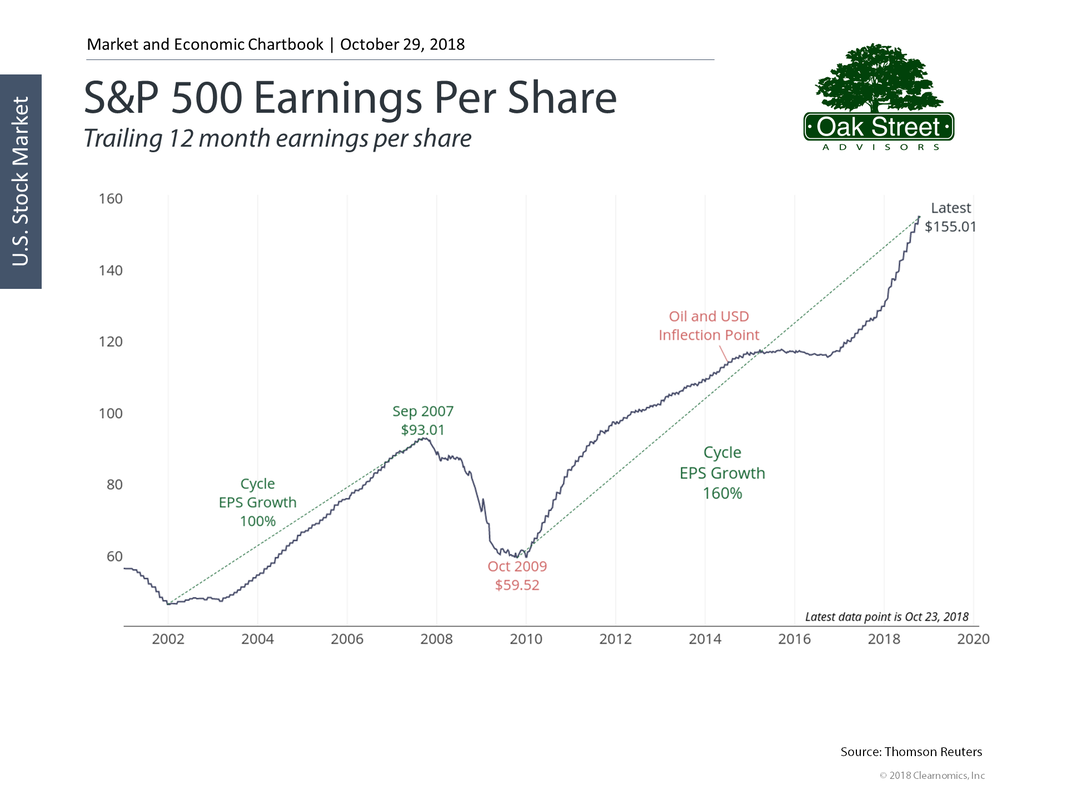

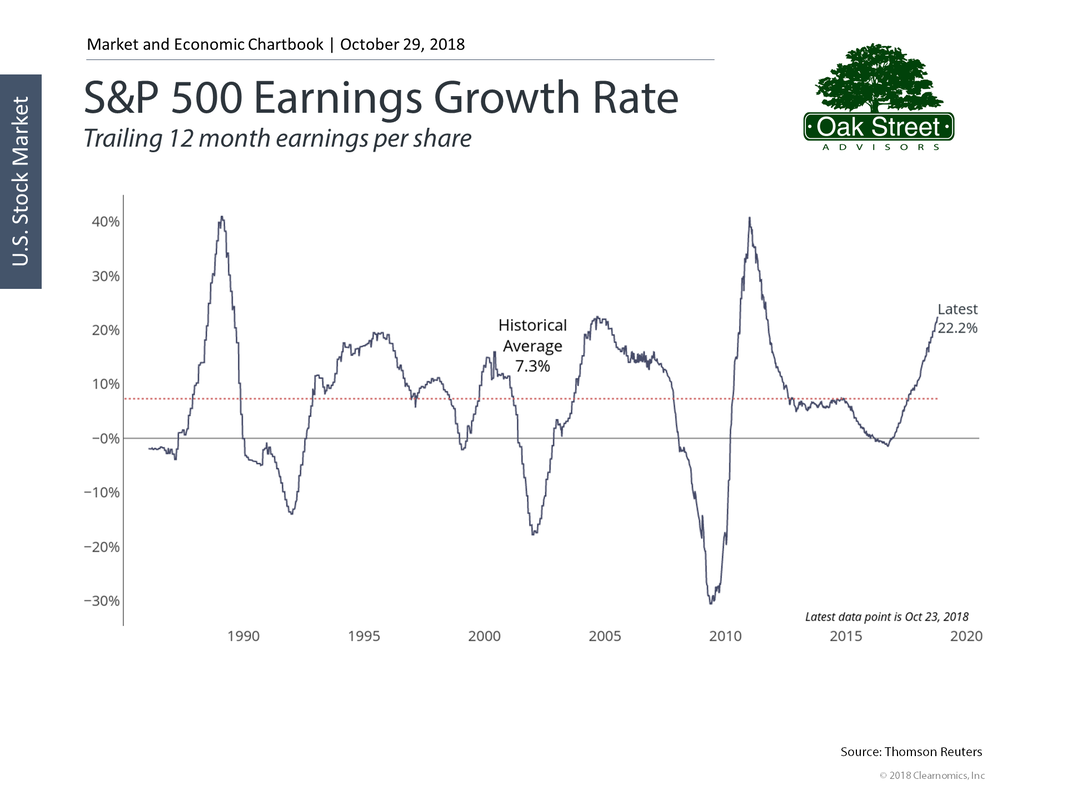

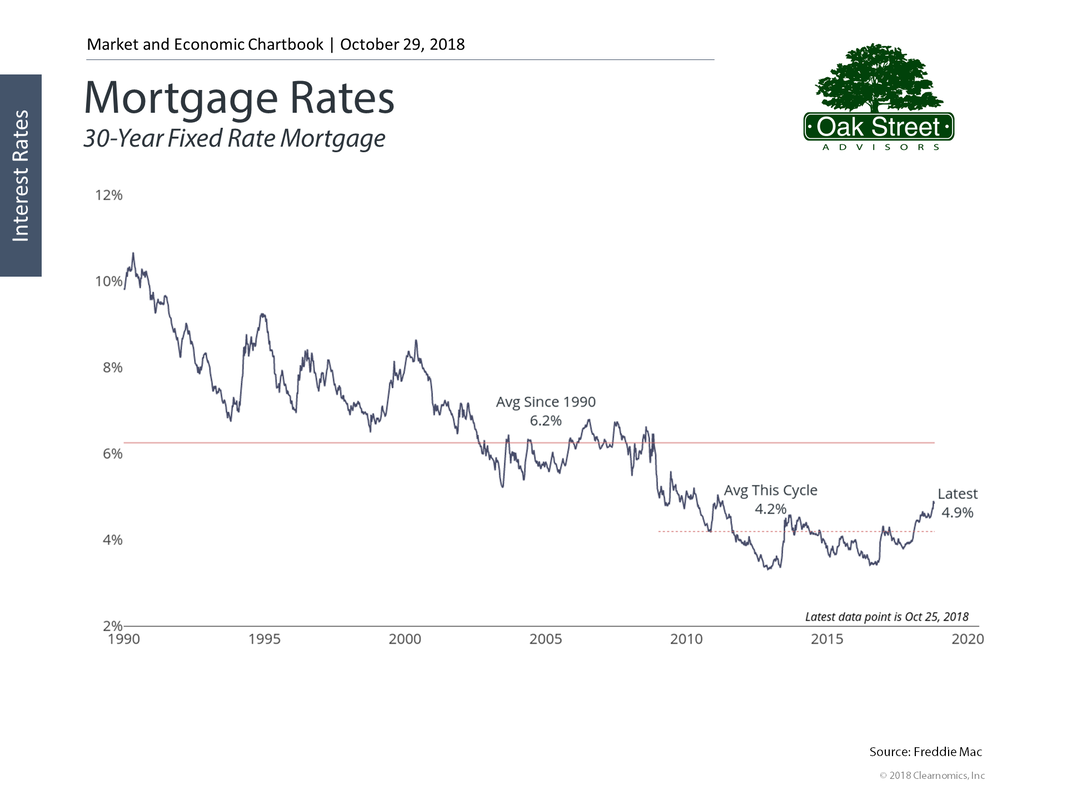

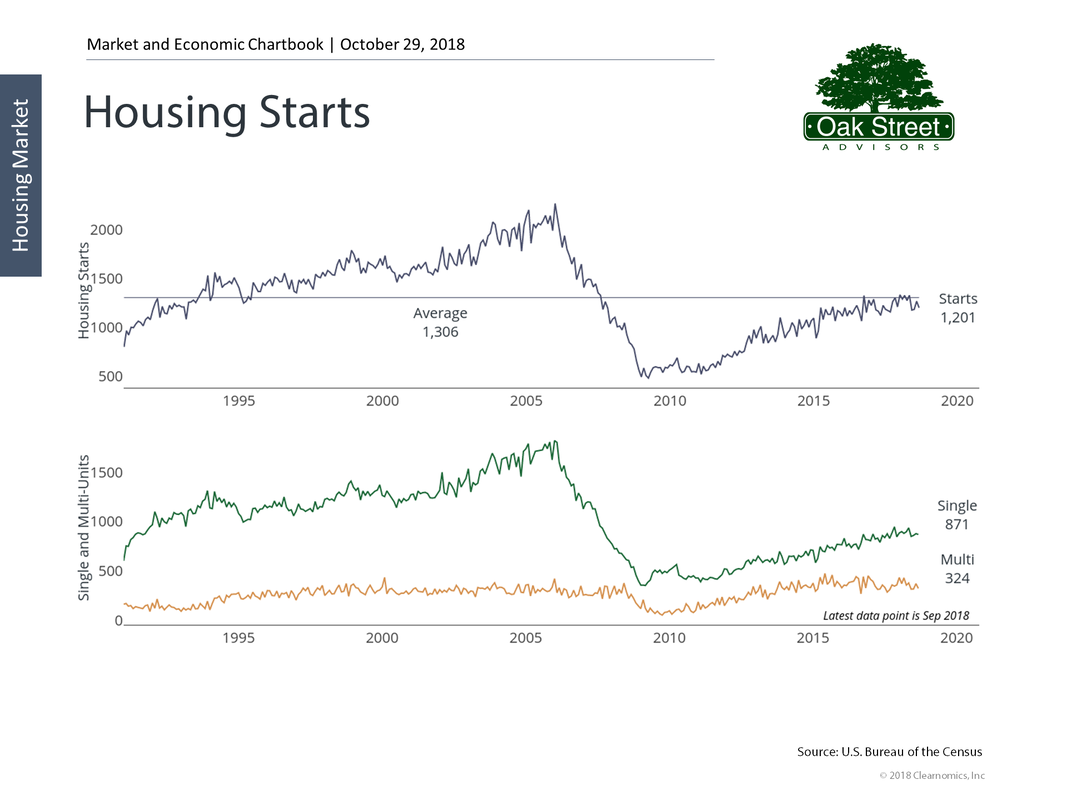

Scary Movie Part 2Just in time for Halloween the stock market has pulled back from its all-time highs and volatility has returned in the form of daily changes of more than 1%. After being up nearly 10% this year, the market- as measured by the S&P 500 index, is flat to slightly down as you read this. Accompanied by a spike in the VIX Index Pullbacks in the stock market are common with a linear regression best fit of about 7.5% each year. Looking back to 1980, even in years where the market has ended down it has rebounded from the lowest point of the year before year end. With just two months to complete 2018, it is possible that we have already seen the lows for this year. So, despite the recent pullback in stock prices this may well be a lower risk entry point for new investments. If we have in fact seen the intra-year low of -10% (with the market currently down about 1% YTD) downside risk from this point could be minimal. Investor sentiment is tilted slightly to the bearish side, indicating to contrarians that things may not really be so bad. It is unusual for markets to enter bear market territory when investors are negative. It is when you find exuberance for stocks that most of the danger lies. With that said, the earnings of S&P 500 companies have been rising at a torrid pace that is likely not sustainable. The slope of the earnings curve is steep by historical standards, the impact of lower corporate income tax rates will soon be apparent in year-over-year reporting, and rising interest rates tend to act as a brake on economic expansion. Look for S&P 500 earnings growth to continue, but for the pace to slow. We will likely enter a period when good economic news is interpreted as bad for the stock market-- as unemployment continues to fall, wages finally begin to rise, and federal reserve interest rate increases put pressure on mortgage rates and in turn the housing market. Bonds will continue to be a dangerous place to invest your money as rising rates cause bond prices to fall, and marginal borrowers have trouble issuing new debt at sustainable levels. So, as we enter the final two months of the year there are plenty of reasons to worry, but as usual, the long-term prognosis for US equities remains positive.

Like a scary movie you have seen before, conditions will look dire for the hero, but ultimately things will work out in the end. Insurance Coverage: Basic ConceptsPart of Oak Street Advisors’ 10 Financial Commandments for Millennials series, basic insurance knowledge will help you get the coverage you need and help clarify some misconceptions. Health Employer group health insurance plans are the most common option for young investors. Often, you don’t have much say in the plan, but the pricing is generally much cheaper for at least the employee, if not their entire family, than paying for private insurance through the Healthcare Marketplace. If you do have a robust menu of options in your healthcare and supplemental plans, it’s best to sit down with your advisor or HR department to discuss how you can optimize these features. If you’re paying for private health insurance, you likely have a high deductible health care plan. Using a Health Savings Account (HSA) you can reduce your taxable income, experience tax-free growth, and make tax-free purchases on qualified medical expenses. Talk with your financial planner to discuss how to set an HSA up and an appropriate strategy if investing inside the account. Auto Auto insurance coverage can often be boiler-plate, but you should understand these concepts. First, you only need personal collision coverage up to the value of your car; other vehicle collision coverage should be at least $50,000 to cover damage to a more expensive vehicle while at fault. Second, make sure you have enough “under insured motorist coverage. This is different from “uninsured motorist coverage” where you are paying for people who are driving around uninsured all together. Under insured motorist coverage makes up the gap between someone who has the bare minimum auto insurance and the actual money needed to pay for collision damage and medical bills. It is important to remember this is further protection for you, not any other motorist. Life Insurance

The basics of life insurance are broad, but we have shortened it down for you HERE. You should purchase life insurance to cover your family debts and provide income to survivors, if needed. In your life insurance calculation make sure to insure your home mortgage, kids’ college expenses, any other outstanding debts, and your final burial expenses. Often investors can self-insure some of this with their current retirement savings, but rarely all. Here’s a quick way to determine how much insurance coverage you’ll need to replace employment income for your family: Every $1,000,000 can produce $50,000 of income at a safe withdrawal rate of 5%. So add $1 million for every $50,000 of annual income you need to provide, $500,000 for every $25,000 etc. In general, if you’re not married and do not have any children- there is little reason for you to purchase life insurance. If you do need life insurance, I strongly encourage you to purchase term. Term is much cheaper and does what it’s supposed to do- insure you if you die. If you like paying an extra premium for no reason just to invest your money, you can purchase a whole life policy. These are expensive and laden with commissions and fees which are a conflict of interest to the salespeople who will try to talk you into purchasing these. Umbrella Policy An umbrella policy bridges the gap between your standard home and auto coverages and catastrophic costs. If something goes terribly wrong that you are liable for, this policy will usually cover the difference between your policy maximum coverage limits and $1 million- and can cover even more if need be. These policies are typically $150-$300 per year for the $1million coverage. For anyone building or maintaining wealth this coverage is too cheap to pass up. There is a reason on the CFP® students are taught that when in doubt regarding an insurance policy, the answer is always “recommend an umbrella policy”. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed