|

Are you staying awake at night worrying about the state of your stock investing? Our fee-only Certified Financial Planner has sound investment advice on when you should revisit your financial plan and when you should simply roll over, plump your pillow, and go back to getting some much-needed rest. It has been a truly turbulent year filled with unprecedented events and wild swings in the American economy and global financial markets. As trusted, fee-only Fiduciary financial planners, we field many calls from new clients who are suddenly very worried about their mutual funds investment, asset management, risk management, and more. There are times when reassessing your investment portfolio makes sense. But believe it or not, a stock market crash—heck, even a global pandemic—may not be one of those times. Before you call your Certified Financial Planner to pitch your current portfolio and put everything into a high yield savings account, ask yourself a few questions. Do you have a personal financial plan in place?Building wealth with assets takes smart financial planning, and a good Certified Financial Planner plans for the unexpected. At Oak Street Advisors, our long-range forecasts for our clients always assume a few years of harder times. No matter what you see on the news, if you have a good, long-term financial plan with the right level of risk management, you are probably still on track to meet your personal financial goals. And if the landscape has shifted in ways that make a difference to your asset management, you should not have to make the first call. A good financial planner will reach out to you!

If you don’t have a personalized financial plan in place, the time to reach out for fee-only investment portfolio advice is right now. Are you considering or experiencing a life-changing event?It may surprise you to hear that the most seismic events in your financial life are likely to be personal, not global. Are you thinking about getting married? Do you have a first child or a new child on the way? Are you contemplating a divorce? Have you been diagnosed with a significant illness or been in an accident? Have you been recently widowed?

Your Certified Financial Planner will most likely not hear about some of these changes in your life unless you share the news directly. Whether the news is good, we will adjust your financial plan to maximize its value. If the news is bad, we will minimize its impact on your long-term financial goals. (And no matter what, we care about you and want to know how you are doing.) Has your personal financial outlook changed? Seeing the stock market swoon or the jobless numbers rise on the news is one thing. Having your own (or your spouse’s) compensation cut or being offered an early retirement package or losing your current position is quite another. Now, it’s personal—and it will likely impact your financial plan. There are less catastrophic shifts in your finances that can also change your long-term financial forecast. Are you enrolling a child in private school? Is one of your children starting, or stepping away from, their college education? Have you decided to retire early, or buy a big boat, or invest in a second home or timeshare?

We can help! Your Certified Financial Planner has strategies to get you through short-term or long-term hardships. We can advise you on how to leverage your investment portfolio to access cash, we can let you know if you can take an early retirement, and we can show you how to adjust your personal financial plan to still meet your retirement goals. We can also show you how to roll over a 529 college savings plan to another child in your family or use it to shelter private school tuition from some taxation. Are you worried you are missing out on a big opportunity?Did one of your best friends share a tip about a hot new stock? Does your co-worker have a different investment strategy that they are sure will really pay off? It can be difficult to hear success stories at the office or the neighborhood barbecue without wondering if their advice might also be good for you. As fee-only Certified Financial Planners, we focus on long term investment strategies rather than the outlook of individual stocks. If we see a big opportunity, we will always let you know, and if you are intrigued by a particular stock, we will encourage you to speak to your investment advisor for investment portfolio advice. FOMO—or Fear of Missing Out—drives more terrible investment decisions than most people realize. By the time you are hearing about the success of a particular stock, it is likely ready to plateau or plunge, and someone else’s retirement plan is not designed around your personal financial situation and financial goals. Remember: you don’t have to take risks just to take risks. Staying on track to a comfortable retirement is a real reward. Have tax laws changed?

Has it been more than a year since you reviewed your plan with your financial advisor?Oak Street’s fee-only Certified Financial Planners build in an annual review of every single one of our client’s personal financial plans to ensure they are optimized for the coming year. And if we see trouble or opportunities ahead? We will sit down with you, share our years of experience, and reset your personal financial plan to ensure that you still reach those long-term goals.

Roth IRA accounts have been available since 1997. Unlike a Traditional IRA, Roth IRA contributions are taxed in the year of the contribution but never taxed again if certain requirements are met.

If you are a single filer with gross income of up to $52,525 or joint filers with gross income of up to $105,050 for the 2020 tax year, all of your income is taxed at 12% or less, and we strongly encourage you to make Roth IRA contributions rather than Traditional IRA contributions. The magic of compounding means, the earlier you start, the greater the tax-free growth within the account. If you are 20 when you start making contributions, you could be looking at four doubles of your original contribution by the time you retire at age 60. That means a $6,000 contribution this year could grow to $96,000, creating $90,000 of tax-free income for your retirement years. With today’s historically low income-tax rates, it would be prudent to put as much money as one can into a Roth IRA. Always consult your CPA before making this decision, but one could argue the tax-free growth and withdrawals outweigh the hurt of paying today’s top tax rates. Contribution and Income Limits For 2021 eligible individuals can contribute up to $6,000 if they are under age 50 and $7,000 over the age of 50. You can contribute 100% of any eligible income up to these limits. For single filers with Adjusted Gross Income of less than $125,000 ($124,000 for 2020) can make a full Roth IRA contribution. If the adjusted gross income is between $125,000 and $140,000 ($124,000 to $139,000 for 2020) they can make a partial Roth IRA contribution. For joint filers the threshold is below $198,000 AGI ($196,000 for 2020)and the phaseout is between AGI of $198,000 to $208,000 for 2021 ($196,000 to $206,000 for 2020). For adjusted gross incomes above these amounts, a back-door Roth IRA strategy will be needed. Back-Door Roth IRA Contributions Without income limitations for converting assets in a Traditional IRA to a Roth IRA, many who are disqualified for income resort to the back-door method for funding a Roth IRA. This works because anyone may open and contribute to a non-deductible Traditional IRA, even if you are covered by a qualified retirement plan. Once the funds are deposited into the non-deductible Traditional IRA, they can then be converted to a Roth IRA. This has the same net income-tax effect as contributing directly to a Roth IRA. The IRS recently loosened the back-door conversion rules and allow for immediate conversions, where in the past investors were recommended to wait a few months before converting to satisfy the IRS. The 5 Year Rule Another reason to open a Roth IRA is the flexibility it can provide to fund emergencies that may arise over your life. You can always withdraw any Roth IRA contributions you have made without taxes, after all, you paid income tax on the money prior to making the contribution. However, if you haven’t had the Roth IRA open for at least five years, your distribution could still be subject to a 10% tax penalty, similar to the early withdrawal penalty for Traditional IRAs. The five years for withdrawals begins on January the 1st of the year you open the account, not when you make subsequent contributions. There is also a five-year rule for Roth IRA conversions that start in January of the year you make a conversion; this prevents someone from using a Roth IRA conversion to avoid early distribution penalties from early Traditional IRA withdrawals. The Younger, The Better Tax-free growth and tax-free distributions are very enticing, especially for young investors. The more time your account grows tax-free, the better. Another point to make is that the more of your nest egg you have in a Roth IRA, the less your Required Minimum Distributions (RMDs) will be during retirement. Which inherently leads to you and your financial advisor having more ability to control/minimize income taxes during retirement years. Get Your Financials in Order, Gain Financial Freedom, and Get the Most Out of RetirementBudgeting for retirement is based on a projected retirement date. But when most people start their retirement income planning, they may not be sure exactly when they will want to step away from their job—and as they age, their planning for retirement may change. If you are thinking about accelerating your retirement plans, you are not alone. CERTIFIED FINANCIAL PLANNER™ practitioners work hard to make sure their clients are ready for retirement. When people change their minds about when they want to retire, their retirement income planning does, too. Sudden changes in fortune or lifestyle can prompt people to wonder if they can reach financial freedom sooner than they expected, like coming into a big inheritance, a generous severance package near the end of a career or a big offer to sell your company, or even a health scare or a spouse’s retirement. If you feel you may be reaching financial freedom sooner than you thought, we are always ready to explore your options for an early retirement. So, when should YOU retire? Not before you can answer “yes” to the four questions below! 1. If I retire now, is my healthcare—and that of my spouse—covered?When you think about your road to financial freedom, do you think about your personal health? You should. If you are like most working people, you have a health insurance plan that is covered or partially compensated by your work. Retiring tips don’t often talk about health care because they assume you have reached the age of 65 and are eligible for Medicare plans. If you retire today, how will you get healthcare for yourself and for your family? Depending on your retirement plans, you may need to pay for your health insurance plan out of pocket for years—and potentially for your spouse and for any children under age 26 currently on your healthcare plan as well. A high-quality healthcare plan that goes beyond catastrophic coverage can be costly, depending on your age or any pre-existing conditions. (Don’t fall for low-cost, Medishare-style junk plans that do not provide adequate coverage!) Healthcare challenges can strike at any time and turn your financial freedom into a financial disaster. At Oak Street Advisors, our fee-only financial advisors recommend strategies to protect your finances from catastrophic healthcare expenses while concurrently also minimizing taxes and potentially realizing tax-free investment growth if you choose to retire before you are eligible for Medicare. If I retire now, can I get by without my social security benefits?Most retirement strategies rely on social security benefits on some level. During your retirement income planning, your financial advisor helps you decide the optimal time to begin drawing your social security income. Most try to find ways for you to postpone taking social security until you reach at least full retirement age—as late as 67 years old, depending upon your birthdate, if not age 70. If your retirement income planning relied on receiving social security (or receiving the maximum amount of social security) and you are not yet eligible to draw payments, can you replace that income or get by without it until you reach the appropriate age? If I retire now, am I truly debt-free?Financial planning after retirement usually assumes you have paid off all of your credit cards, any outstanding medical or educational debts, and—hopefully—your home. Most CERTIFIED FINANCIAL PLANNER™ practitioners encourage all of our clients to make a debt-free retirement a high priority. You cannot retire with confidence if you are still making credit card, car, boat, student loan, or mortgage payments. Why? Peace of mind. When your home is paid off, your retirement income planning needs to cover taxes, insurance, and general home maintenance, not costly mortgage payments. If I retire now, do I have a personal or professional goal?Financial freedom tips fail to ask what, exactly, you plan to do with that newfound financial freedom. When you begin planning for your retirement, you should think about what your hopes and dreams for this incredible phase of your life might be.

Getting away from the daily grind can sound wonderful when we are in the working world. But if you do not have ideas or plans for how to spend that new free time, you may find it weighs more heavily on you than you had imagined. Your retirement plans should include more than retirement income planning. Retirement planning should include new challenges, opportunities for learning and personal growth, restorative rest and relaxation, community involvement, family connections, travel … whatever is meaningful and motivating for you. Your road to financial freedom needs a destination. Not sure how to choose a financial advisor? It’s a big decision! Our guide on how to find a good CERTIFIED FINANCIAL PLANNER™ practitioner can help you ask the right questions and select someone able to help you reach your personal financial goals and find financial freedom. Do You Need a Financial Advisor?Depending upon where you are in your life, you may not have spent much time thinking about your financial future. NOW is always the best time to start! Finding a financial planner can help you focus on personal financial goals, like buying a new home, saving for a child’s college education, or retiring at a certain age. And if you have recently received a significant pay raise, come into an inheritance or trust, or need help with tax planning, a financial advisor can help you leverage and maximize those assets. Do You Need a New Financial Advisor?Have you started to wonder if your current financial advisor is right for you? Most financial advisors receive a significant portion of their pay in commissions. When they recommend that you purchase shares of stock or mutual funds from a broker, they receive a portion of the proceeds of that sale in return. They can also make money through mark-ups of bonds, CDs, or new stock issues through a broker. And because advisors paid in by commission make the most money when you purchase financial products, they may be tempted to recommend buying things you do not really need. And their interest in your financial wellbeing may not extend beyond that sale. Many financial advisors do not assist with 529 savings plans, employer benefits packages, healthcare options, or estate planning, all critical components of a good financial plan. If you have started to wonder if your current financial advisor is truly looking out for your best interests, it is time to look for a fee-only financial advisor. What is Fee-Only Financial Advising?Fee-only is a better way to get smart financial advice you can trust. Fee-only financial advisors never make money from commissions or mark-ups. We are only paid by you to give advice that we believe will work best for you. You will never need to second-guess our motives, suggestions, or strategies. You will always know that your financial future is our highest priority. Fee-only financial advisors must meet a very strict professional fiduciary standard. Fee-only financial advisors must become Registered Investment Advisors and meet the highest fiduciary standard, while other financial advisors are held to a lower suitability standard. To be sure you are working with the best and that your financial advisor has only your best interests at heart, choose a fee-only Certified Financial Planner™ Practitioner (CFP®). Research a Financial AdvisorWord of mouth can be a great way to find a financial advisor. Asking your friends, relatives, and coworkers if they have a financial advisor they trust and would recommend can be a great place to start. Online research can also help you find and look into your options. Whenever you are given or find a name, take a moment to look them up on the broker check tools maintained by the Security and Exchange Commission or FINRA. And don’t stop with the broker name! Make sure you also plug in their firm’s name. If the firm has multiple infractions that may be an indication of poor corporate culture. What to Know Before Meeting with a Financial Advisor

Questions to Ask Your Financial Advisor

Selecting a Financial AdvisorFinding a financial planner lets you start the exciting and rewarding process of creating a financial plan calibrated just for you and your personal financial goals. Abstract ideas become an action plan. You have specific instructions and ways to mark your progress. You know how to ask for help and when to ask for changes or adjustments. And you can finally see the big picture—not only where you are today, but where you want to go.

WHAT’S A DONOR ADVISED FUND?A donor advised fund (DAF) is a relatively new tool that helps both taxpayers and charities reduce taxes now while providing planned donation strategies to continue in the future. Much like a deductible IRA, assets contributed to these donor accounts produce tax savings based on specific IRS guidelines. For taxpayers who itemize deductions every dollar donated to a donor advised fund reduces the donor’s taxable income dollar-for-dollar in the year of the gift. For high earners this is one of the few strategies to reduce taxable income outside employer retirement plans and benefit packages. Once in the account, the gifted assets grow tax-free until the donor decides to distribute the funds to the qualified charities they desire. There’s great advantage in the flexibility a donor advised fund offers. Donors make contributions now to reduce taxes now, those donations then grow via investments tax-free and those appreciated assets are then distributed at some time in the future to a qualified charity. This is a good deal for everyone involved, except Uncle Sam. For those in the highest tax bracket, every $1,000 donated to your donor advised fund results in a Federal and SC state tax savings of ~$440. Donating $100,000 would save that same taxpayer $44,000 in Federal & state income taxes; you can also use a DAF to avoid taxation on appreciated assets with low cost basis altogether. GIFTING APPRECIATED STOCK TO YOUR DONOR ADVISED FUNDTo really compound the tax savings inherent with a DAF, we recommend donating appreciated stock positions from your taxable accounts. You avoid capital gains taxes, get full value of the gifted equities in the form of the tax deduction and the assets grow tax-free until distributed to a qualified charity. Be sure you only contribute shares that you have held for at least twelve months. For any shares held less than twelve months you can only deduct your cost basis. BUNDLING CHARITABLE DONATIONS TO OFFSET INCOME WINDFALLSSome taxpayers may consider bundling annual contributions to their Donor Advised Fund into a single year to avoid wasted donation dollars that the newer and higher standard deductions produce.

For example, if you plan to give $50,000 a year for the next 10 years, and you know you have a big real estate sale, sales or performance based bonus, or generally know your taxable income will be irregularly elevated in a single tax year, you may want to bundle those annual amounts into a single, large donation that year. In this scenario, you’d donate $500,000 immediately but only distribute $50,000 each year out of the DAF while the remaining principle donations continue to grow tax-free via your investments; This strategy allows a taxpayer to continue their plan of gifting $50,000 annually while realizing a tax savings of ~$220,000 in the year of the windfall.  With the end of the year approaching, now is the time to look for opportunities to save on income taxes. Here are some items you should look for:

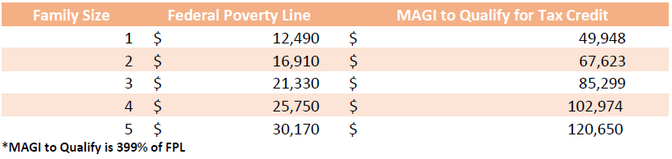

In Charleston and Myrtle Beach, clients and potential clients often assume the Affordable Care Act (ACA) only helps low earning individuals and families. This is far from the case. When using proper financial planning strategies, some families can make up to $239,000 and still qualify for the healthcare subsidy. Over 10 million Americans utilized Affordable Care Act (ACA) healthcare insurance in 2018, 87% of which received some sort of subsidy to help them pay for that insurance. Many receiving that subsidy don’t understand the how and why of the program; and many who aren’t receiving the subsidy don’t realize just how close they may be to pocketing thousands in tax relief via the Premium Tax Credit. We’re going to walk you through a broad overview, without getting into too much detail, so you may determine if you can qualify for the Premium Tax Credit and what strategies you can implement to help you qualify. Who qualifies for tax relief from the Affordable Care Act in 2020? How do you determine your Modified Gros Income (MAGI)? Start with Gross Income which, for simplicity, is any income you receive throughout the year. Next, you’ll need to determine your Adjusted Gross Income (AGI). You’ll do this by subtracting:

Finally, to determine your MAGI, add-back to your AGI:

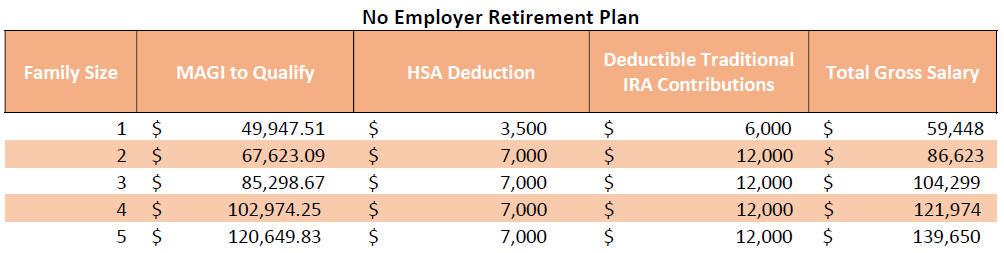

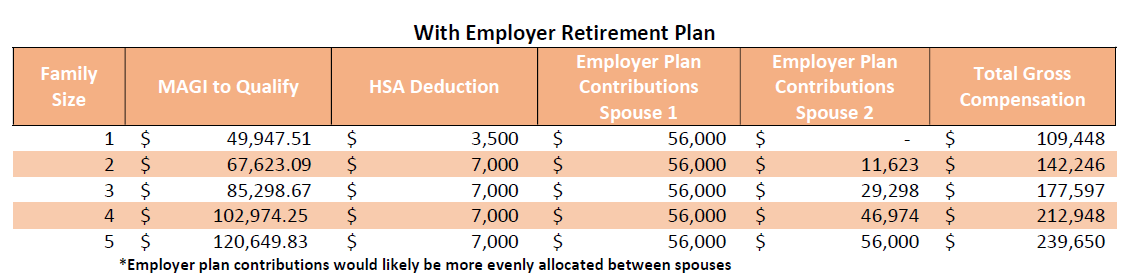

We see that for most people, the only way to lower your MAGI number is to increase the deductions that calculate your AGI, such as 401k (or any qualified employer plan), IRA (SEP, SIMPLE, Traditional) and HSA contributions—therefore we use these deductions in our general example below. Theoretically, the following gross compensations can be earned with corresponding contributions reducing overall MAGI: Often families cannot afford to, or choose not to, dedicate the maximum amounts to these accounts. We recommend establishing a strategy each year for qualifying for the Premium Tax Credit that matches your personal and financial goals.

Keep in mind, this is a general overview. There are many other rules that can change these calculations, such as non-working Spousal IRA contributions which phase out at certain income levels and the catch-up provisions afforded to anyone over the age of 50 for IRAs and 55 for HSAs; The goal of this article is to give a broad overview so you may pinpoint exactly where your family sits in reference to the Premium Tax Credit eligibility. If you’d like a CERTIFIED FINANCIAL PLANNER™ to help create and manage a tax strategy that will aims to qualify your family for the Premium Tax Credit click here. With nursing home care running north of $68,000 per year, many families who have a "comfortable retirement" could find themselves facing the prospect of spending down a large chunk of their savings and investments should the need for nursing home care arise. Without long-term care insurance some will find their only option may be to apply for Medicaid assistance.

While Medicaid rules vary from state-to-state, typically a person needing long-term care benefits must spend down their assets to $5,000. If there is a surviving spouse, they can usually keep the family home (but states can consider home equity in excess of $500,000), a prepaid burial plan, and between $50,000 and $100,000 in resources. Cost For couples aged 60, the average cost of long-term care insurance runs about $3,500 per year. For many this is expensive; some alternatives you might consider are long-term care annuities and life insurance policies with long-term care riders. Regardless of cost, you should shop for a policy from a company with the financial stability to pay a claim if it becomes needed. Limiting your coverage and extending the waiting period can help reduce costs as well. You should choose a policy that meets your needs and include in-home care and policy triggers that are reasonable. A report from the American Association for Long-Term Care Insurance suggests that for the majority of policy owners, three years of coverage is sufficient. With high cost of coverage, the primary reason for not having coverage this study suggests that some coverage is better than none, and for most, is all that is needed. What Triggers Your Long-Term Care Benefits? Most companies will pay benefits if you are unable to complete two of the six activities of daily living, which include:

Or if you have severe cognitive impairment. When Do Benefits Begin Often long-term care policies have an exclusion period before benefits will begin. There can be some flexibility here if you have the resources to pay for some expenses yourself, for a few months. The most common exclusion period is 90 days. That means you would pay the first 90 days of expenses out of your pocket. This is reasonable and ties in with Medicare, who will generally cover the first 90 days of care if you are in a nursing home for something you are expected to recover from, such as surgery or a stroke. What Long-Term Care Insurance Covers Virtually all policies are comprehensive plans, which cover care provided in many settings: at home, adult daycare centers, assisted living facilities, nursing homes, and Alzheimer’s facilities. A home care benefit will typically cover skilled nursing care and occupational, speech, physical, and rehabilitation therapy. Most importantly, it can help with personal care, such as bathing and dressing. Where to find Long-Term Care Facilities You may at some time in your life be involved in selecting a nursing home facility for a loved one. The US Department of Health and Human Services Medicare site now has a feature called Nursing Home Care Compare. You can use this site to find and compare nursing homes by state, zip code, county or name. Once you have found nursing homes in your area you can view information on the quality of care provided. Each home is compared to the state and national averages for each category; for example, the number of nursing staff per-resident, per-day; or the percentage of residents who are physically restrained. Although the grading is measured against negatives and a little confusing (it seems a lower score is better), it is an excellent resource and a good place to start should you ever need nursing home facilities. Insurance Coverage: Basic ConceptsPart of Oak Street Advisors’ 10 Financial Commandments for Millennials series, basic insurance knowledge will help you get the coverage you need and help clarify some misconceptions. Health Employer group health insurance plans are the most common option for young investors. Often, you don’t have much say in the plan, but the pricing is generally much cheaper for at least the employee, if not their entire family, than paying for private insurance through the Healthcare Marketplace. If you do have a robust menu of options in your healthcare and supplemental plans, it’s best to sit down with your advisor or HR department to discuss how you can optimize these features. If you’re paying for private health insurance, you likely have a high deductible health care plan. Using a Health Savings Account (HSA) you can reduce your taxable income, experience tax-free growth, and make tax-free purchases on qualified medical expenses. Talk with your financial planner to discuss how to set an HSA up and an appropriate strategy if investing inside the account. Auto Auto insurance coverage can often be boiler-plate, but you should understand these concepts. First, you only need personal collision coverage up to the value of your car; other vehicle collision coverage should be at least $50,000 to cover damage to a more expensive vehicle while at fault. Second, make sure you have enough “under insured motorist coverage. This is different from “uninsured motorist coverage” where you are paying for people who are driving around uninsured all together. Under insured motorist coverage makes up the gap between someone who has the bare minimum auto insurance and the actual money needed to pay for collision damage and medical bills. It is important to remember this is further protection for you, not any other motorist. Life Insurance

The basics of life insurance are broad, but we have shortened it down for you HERE. You should purchase life insurance to cover your family debts and provide income to survivors, if needed. In your life insurance calculation make sure to insure your home mortgage, kids’ college expenses, any other outstanding debts, and your final burial expenses. Often investors can self-insure some of this with their current retirement savings, but rarely all. Here’s a quick way to determine how much insurance coverage you’ll need to replace employment income for your family: Every $1,000,000 can produce $50,000 of income at a safe withdrawal rate of 5%. So add $1 million for every $50,000 of annual income you need to provide, $500,000 for every $25,000 etc. In general, if you’re not married and do not have any children- there is little reason for you to purchase life insurance. If you do need life insurance, I strongly encourage you to purchase term. Term is much cheaper and does what it’s supposed to do- insure you if you die. If you like paying an extra premium for no reason just to invest your money, you can purchase a whole life policy. These are expensive and laden with commissions and fees which are a conflict of interest to the salespeople who will try to talk you into purchasing these. Umbrella Policy An umbrella policy bridges the gap between your standard home and auto coverages and catastrophic costs. If something goes terribly wrong that you are liable for, this policy will usually cover the difference between your policy maximum coverage limits and $1 million- and can cover even more if need be. These policies are typically $150-$300 per year for the $1million coverage. For anyone building or maintaining wealth this coverage is too cheap to pass up. There is a reason on the CFP® students are taught that when in doubt regarding an insurance policy, the answer is always “recommend an umbrella policy”. The tax plan passed at the end of 2017 has a bonus for parents whose children attend private elementary and high schools. You can now use funds from a 529 savings plan to pay for these expenses, up to a maximum of $10,000. In South Carolina and other states that allow a tax deduction for 529 plan contributions, this change can mean significant savings on your state income taxes.

For example, the Charleston, SC both Porter-Gaud and Ashley Hall have high school tuition that exceeds $23,000 per year. By using the SC Future Scholar program as the funding vehicle for this tuition, families can save between $500 and $700 on their state income taxes. To take advantage of this income tax break, simply open a Future Scholar 529 plan and fund the plan with the money you will be sending to the private school anyway. Then, request the plan send the money to the students account at the school of your choice. By using the 529 plan as a middle man in the transaction you will save yourself 5% to 7% on your annual tuition expenses by lowing your state income tax liability for the year you make the contribution. It is also important to understand any sales charges associated with your 529 plan investments. In South Carolina you can open a 529 plan directly with the sponsor and avoid sales charges and loads. If you go through a broker your savings could be negated by the additional expenses. Another good reason to work with a fee-only financial advisor. While there are limits to the amount you can contribute each year to a 529 plan, you should understand that contributions are considered gifts. Contributing more than $15,000 per parent per year can be complicated but there are strategies to contribute much more in a single year and stretch the tax benefits of doing so. You should also understand how using this tax saving strategy will impact your savings goals for post high school education. College expenses will still need to be planned for and funded, so have a plan in place to address both education funding needs. Talk to your tax professional or financial advisor about not only maximizing the tax advantages of a 529 plan for college- but for private elementary and high school as well. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed