|

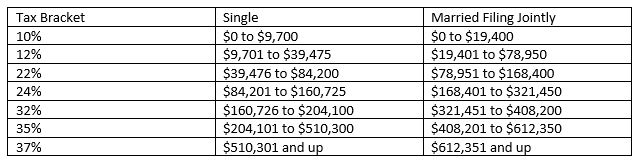

Okay-- you just completed your income tax return for last year. You want to file it away and not worry about taxes until next year, but before you do-- take a look at your completed return to identify ways you can save tax dollars next year. Income tax planning can add to your future net worth and your future income streams. Here is a line by line view of some of the things that good income tax planning can do to improve your financial life. Taxable Income Line 10 on your new 1040 return shows your taxable income after all deductions. Knowing your marginal income tax rate is the first step to efficient income tax planning. Lowering your income taxes in the current tax year is not always the best long-term strategy, lowering your lifetime income tax liability is often much more important. For 2019, the federal income tax brackets for individuals are: Your marginal income tax rate is the amount you would pay on your last dollar. For example, a single person with taxable income of $84,201 would pay a 24% rate on only one dollar of income, not their total taxable income. They would in fact pay 10% on their first $9,700 of taxable income, then 12% on the next $29,775, then 22% on the next $44,725, and finally 24% on the last dollar of taxable income. It is important to remember that the current income tax rates for individuals are scheduled to revert to the pre Tax Cuts and Jobs Act rates in 2025. Barring tax changes passed by Congress in the interim, you have six years to utilize the current brackets to your benefit. Managing Your Income Tax BracketDepending on your income level, managing the income tax bracket you fall in may mean realizing extra income to take advantage of a favorable rate; or you may want to lower your taxable income to qualify for a lower tax bracket or other income tax benefits (such as Obamacare). In my opinion the 12% bracket is extremely valuable. Married couples can have up to $78,950 of taxable income and pay no more than 12% in federal income taxes. Less than 25% of American households have taxable income above this level and I believe the odds of their marginal income tax rate falling is quite small. If you are among the many that fall into the 12% rate, you should look for ways to pay taxes on as much income as you can without moving into the 22% bracket. Some of the things you should consider are: Contribute to a Roth IRA or Roth 401k rather than a Traditional IRA or standard 401k account

Convert existing Traditional IRA funds to a Roth IRA

Higher marginal income tax payers will want to take the opposite approach. They’ll want to defer more income unless they anticipate being in an even higher bracket in future years. High bracket individuals will want to:

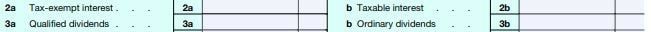

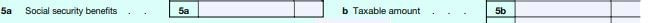

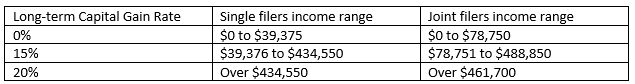

The absolute worst taxable income numbers are $200,000 for single filers and $250,000 for joint filers; along with $157,500 for single filers and $315,000 for joint filers who own their own business. The first range, $200,000 single and $250,000 joint subjects a taxpayer to the 3.8% net investment income tax. The second range for self employed filers of $157,500 for single and $315,000 for joint are the cutoff for the pass-through business income deduction. Taxpayers at those levels should take aggressive steps to lower their taxable income. Investment IncomeMoving back up your return, line 2 and line 3 deal with investment income. Note that these lines have been subdivided into an A and B column. The column on the left is better than the column on the right for income tax purposes. Tax-Exempt Interest On the left you have tax-exempt interest, which is income generated from municipal and state government entities. Municipal bond interest is generally income-tax free, although there are some taxable municipal bonds, and some municipal bond interest is subject to the Alternative Minimum Tax. Tax-exempt interest is also added to your Adjusted Gross Income (AGI) for purposes of calculating how much of your Social Security benefits are taxed. The higher your marginal income-tax rate, the more valuable tax-exempt interest is. To determine the taxable equivalent yield of a tax-exempt security, you divide the tax-exempt yield by 1 less your marginal income tax rate. For an investor in the 12% marginal income tax bracket, a municipal bond yielding 2.5% gives them the same after-tax return as a taxable security that yields 2.8% (.025/ (1-.12)). For an investor in the 32% tax bracket the same 2.5% yield from a municipal bond equates to a 3.6% taxable yield. Qualified Dividends Again, the column on the left is more valuable than the column on the right. A qualified dividend is a dividend from a company that: a) trades publicly on a US exchange and b) is incorporated in a US possession or c) is eligible for the benefits of a comprehensive income-tax treaty with the US. The advantage to generating qualified dividend income is that these payments are taxed at your capital gains rate, which is generally much lower than the rate on your ordinary income Dividends from REITs, MLPs, employee stock options, tax-exempt organizations, money market accounts, and shares used for hedging are not eligible for qualified dividend status. Make sure to also consider the treatment of preferred stock dividends. Although ranked below bondholders in the event of financial difficulty, preferred stock pay yields that are similar to long-term bonds. All taxpayers should consider these securities against table bond holdings for the tax advantages alone. IRAs, Pensions, and Annuities Income received from pensions and some annuities are absolute, in that you receive the income and you pay the taxes; however, income from an IRA and certain types of annuities are somewhat discretionary. You can plan the timing and the amount you withdraw to achieve the best income-tax outcome for your personal needs. If you are over 70 ½, you are required to take some distributions from your traditional IRA accounts (required minimum distributions/RMDs), but even then you can take advantage of the Qualified Charitable Distribution rules to lower the amount that is reported to the IRS. Income derived from variable annuities can be problematic for some. All income from variable annuities is considered ordinary income until you have spent down those assets to your cost basis. At that point, the withdrawals are deemed to be return of principal and are no longer subject to income taxes. Although we prefer to use IRA to Roth IRA conversions to manage income tax brackets for those in the 12% marginal tax bracket, you can certainly use variable annuities in a similar fashion. If you are in a higher marginal tax bracket, you can also consider exchanging your variable annuity for an immediate annuity. Doing this will change the deemed ordinary income rule to a pro-rata distribution rule, where some of your distribution is considered ordinary income and some of it is considered a return of principal. Social SecurityYou probably will pay taxes on some of your Social Security benefits. If your total income is more than $25,000 but less than $34,000 for individuals; or $32,000 but less than $44,000 for joint filers, you will pay income tax on 50% of your Social Security benefit. If you are above those ranges, you’ll pay income tax on 85% of your Social Security benefit. Sadly, I have to say I have seen cases where an individual is less than 70 years old, in a 30%+ marginal income-tax bracket, saving money, and still insists on claiming their Social Security benefit. It would be a simple fix to suspend Social Security benefits, reduce their taxable income, and accrue delayed filing credits to their future social security income. Yet some will still continue those benefits because they feel they have paid in all their life and want to see some return on their money. Yes, you could die, but throwing away money paying needless taxes is hard to understand. Additional Income and AdjustmentsIn trying to make the form 1040 look simpler, the IRS added this line. It refers to a Schedule 1 and is attached to your 1040. Alimony Under the old tax rules, alimony was deductible to the payer and taxable to the payee. No more--Congress has managed to shift the income tax burden for alimony payments to what is likely the higher earner with the higher marginal income tax rate. If you are divorcing it is important that the income tax liability of alimony payments be considered in developing an equitable settlement. Business Income/Loss This has become a much more important item than in years past, as owners of any business that uses a pass-through entity can receive a 20% reduction to taxable income generated through that business. Assuring you maximize this important benefit is essential. See our previous post ‘Big Savings for Self-Employed and Business Owners’. Capital Gains and Losses For all taxpayers, it is important to use tax-efficient strategies for taxable investment accounts. High yield stocks and bonds are more efficient being owned in tax advantaged accounts (401ks, IRAs, Roth IRAs etc), while investments that mostly appreciate in value are a better fit for taxable accounts. Still, capital gains rates are attractive relative to the tax rates on ordinary income. You can use capital losses to offset any capital gains you receive, plus $3,000 of ordinary income. Capital losses are never a good thing, but at the end of each year you should review your investments to look for opportunities to offset gains. Rental Real Estate, Royalties, Partnerships, S-Corps, trusts, etc. If you own rental properties you know how helpful depreciation can be for your income tax liability. Yes, some of the depreciation will be needed to maintain the property, but some of it will also reduce your taxable income, and if you sell, will result in more income being taxed as capital gains at currently favorable rates. If you own a property that has been fully depreciated you might consider using a tax-free exchange to like property to increase your basis and start the depreciation process all over again. Adjustments to Income Health Savings Accounts Many American’s are now covered by high-deductible health insurance plans either through their employer or purchased directly from insurers through the Affordable Care Act Marketplace. Contributing to an HSA will reduce your current income tax liability, and if the funds are used to pay for qualified medical expenses the distributions are tax-free as well. See our post on ‘Hacking Your Health Savings Account’. Self Employed SEP, SIMPLE, and Qualified Plans An easy way to reduce your current year income tax liability is to contribute to a retirement plan. IRA contributions are reported on line 32, but if you’re self-employed you can defer taxes on even more money. You can establish a SIMPLE retirement plan before October 31 of the current tax year and defer up to $13,000 ($16,000 if you are over age 50) annually. A SEP retirement plan allows an even bigger tax deferred contribution of up to $56,000, plus a catch-up contribution of $6,000 if you are over age 50. Another useful benefit is you have until your income tax filing deadline, plus any extension, to establish and fund a SEP for the previous tax year. If you’re a business owner who still needs to reduce your previous years taxable income-- this is your chance! Self Employed Health Insurance Deduction If you’re self-employed, this is where you get to reduce some of your taxable income for health insurance expenses. If you’re not self-employed and are not covered by an employer health insurance plan, this is motivation for starting a side gig.

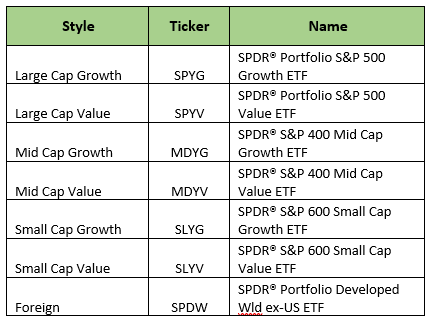

For example, the mechanic that works on cars after hours, or maybe the carpenter that does an occasional job on the side. Formalize your business to take advantage of this deduction. In Conclusion While this is far from an exhaustive list of ways to reduce your income tax liability both now and in the future, you can see there are opportunities for almost everyone to benefit from income tax planning. Take some additional time to review the tax forms you just filed or see a financial planning professional-- there is a lot at stake. Part of Oak Street Advisors’ 10 Financial Commandments for Millennials series, we discuss when to open a taxable investment account and how to strategize the location of your investment vehicles based on account taxability characteristics. Once you’ve filled up all your tax-deferred and tax-free investment accounts, it’s time to start paying Uncle Same (now) to invest. The 9th Financial Commandment for Millennials is to open a taxable investment account, while keeping tax management a key feature of this aspect of your portfolio. Investors need not worry about dividends, interest, or gains in a 401k, 403b, 457, SEP or Traditional IRAs because those will be taxed when you decide to have them taxed (or an annual portion is taxed when the government says so via Required Minimum Distributions at age 70 ½). Gains, dividends and interest in Roth IRAs are tax-free if you meet certain qualifications. For this reason, its best to have growth, dividend, and other income producing investment held inside these accounts. Now that you’re opening a taxable investment account, any growth, dividend, interest or other income is taxed in the year the gains are realized or the dividend and interest is paid (usually…i.e. phantom income). While you can use long-term capital gains tax rates to your advantage on investments held over a year, the ideal goal for a taxable account is to participate in investment growth while also not being taxed left and right for gains and income produced. To accomplish this, we recommend using a portfolio made up of Exchange Traded Funds (ETFs). ETFs offer broad diversification that reduce the need for trading, minimize taxable distributions, and provide the long-term growth you want in a tax-efficient manner. Here’s an example of Oak Street Advisors’ FatPitch ETF Portfolio investments: Even better-- our clients experience $0 trading cost because of our relationship with TD Ameritrade as custodian. However, any DIYer can implement a similar ETF strategy on their own for a minimal $5-$8 per trade.

In general, investors can see less return drag from investment and tax expenses by utilizing this strategy in their taxable investment accounts. The relationship of the taxability of an investment and the taxability of the account it is held matters, and can keep dollars in your pocket. As with any investment, making sure you’re sticking to your strategy via rebalancing and reacting to market conditions, or paying someone to do so on your behalf, is crucial. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed