|

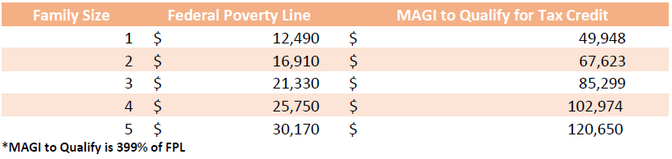

In Charleston and Myrtle Beach, clients and potential clients often assume the Affordable Care Act (ACA) only helps low earning individuals and families. This is far from the case. When using proper financial planning strategies, some families can make up to $239,000 and still qualify for the healthcare subsidy. Over 10 million Americans utilized Affordable Care Act (ACA) healthcare insurance in 2018, 87% of which received some sort of subsidy to help them pay for that insurance. Many receiving that subsidy don’t understand the how and why of the program; and many who aren’t receiving the subsidy don’t realize just how close they may be to pocketing thousands in tax relief via the Premium Tax Credit. We’re going to walk you through a broad overview, without getting into too much detail, so you may determine if you can qualify for the Premium Tax Credit and what strategies you can implement to help you qualify. Who qualifies for tax relief from the Affordable Care Act in 2020? How do you determine your Modified Gros Income (MAGI)? Start with Gross Income which, for simplicity, is any income you receive throughout the year. Next, you’ll need to determine your Adjusted Gross Income (AGI). You’ll do this by subtracting:

Finally, to determine your MAGI, add-back to your AGI:

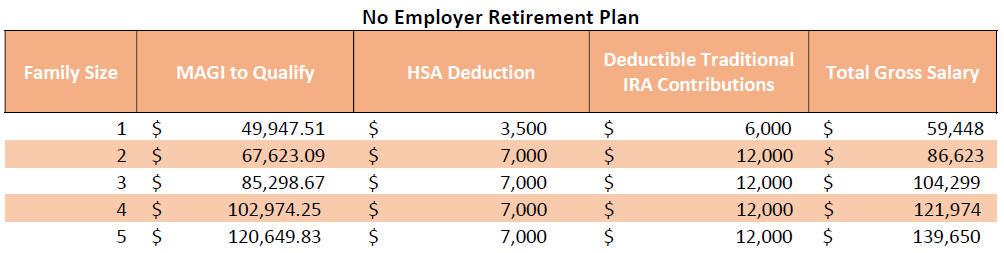

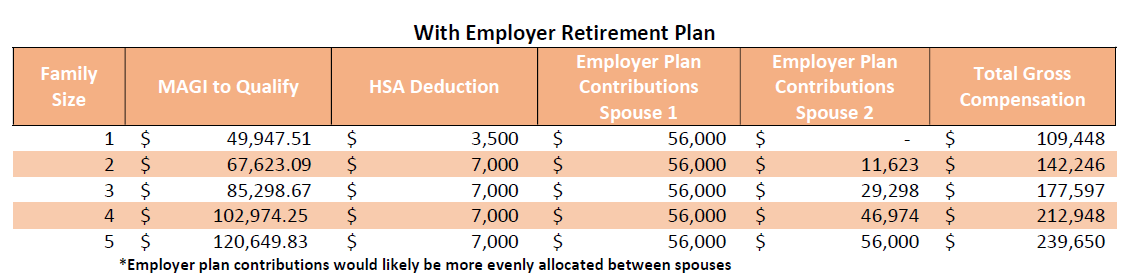

We see that for most people, the only way to lower your MAGI number is to increase the deductions that calculate your AGI, such as 401k (or any qualified employer plan), IRA (SEP, SIMPLE, Traditional) and HSA contributions—therefore we use these deductions in our general example below. Theoretically, the following gross compensations can be earned with corresponding contributions reducing overall MAGI: Often families cannot afford to, or choose not to, dedicate the maximum amounts to these accounts. We recommend establishing a strategy each year for qualifying for the Premium Tax Credit that matches your personal and financial goals.

Keep in mind, this is a general overview. There are many other rules that can change these calculations, such as non-working Spousal IRA contributions which phase out at certain income levels and the catch-up provisions afforded to anyone over the age of 50 for IRAs and 55 for HSAs; The goal of this article is to give a broad overview so you may pinpoint exactly where your family sits in reference to the Premium Tax Credit eligibility. If you’d like a CERTIFIED FINANCIAL PLANNER™ to help create and manage a tax strategy that will aims to qualify your family for the Premium Tax Credit click here. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed