|

Converting funds from a tax-deferred Rollover or Traditional IRA to a tax-free Roth IRA in retirement can be a smart move for managing your total income tax bill. Often, Roth conversions can be accomplished in lower tax brackets, protecting you from possibly higher brackets in the future and minimizing the income tax bite of Required Minimum Distributions (RMDs) from your Traditional/Rollover IRA in later years.

The earlier you can begin to efficiently convert funds to tax-free Roth assets the better. Doing so moves the growth of the converted portion of your tax-deferred accounts into income tax-free growth. The calculations can be daunting, so enlisting the aid of a CERTFIED FINANCIAL PLANNER™ professional or CPA will help. But it is often wise not to convert 100% of your tax-deferred retirement money into a Roth IRA. If you make charitable contributions on a regular basis, it would be more tax efficient to leave some money in your tax-deferred IRA to fund those contributions once you reach age 70 ½. The Qualified Charitable Distribution rules allow for income-tax free distributions to qualified charities once you reach this age. For more information on the QCD rules check out this post. The bottom line here is if used to fund your charitable giving, a Traditional/Rollover IRA gives you a very tax friendly option. Each year you can make donations that will not appear as taxable income on a 1099-R. That means you contributed the funds on a pre-tax basis, they grew without income tax consequences, and then they are distributed income tax-free. Given that, for most-- any charitable contribution over $300 per year for individual filers and $600 per year for joint filers, gets no income tax break at all-- this is a great way to save on your income taxes and support worthy causes at the same time. Another reason to avoid a 100% Roth conversion is simply that having no taxable income is not the most tax-efficient plan. There is always a level of income that is free of income taxes-- the amount of income covered by your standard deduction and/or other above the line deductions. For 2021, the standard deduction for single filers is $12,550 and for joint filers it is $25,100. This means that if you had no other sources of income, you could withdraw those amounts from a Traditional IRA income-tax free. It is unlikely you would be in this situation, but if you have a tax-efficient taxable investment account and a small pension or social security benefit, you might have some leeway to withdraw funds from a tax-deferred account at a 0% tax rate. Again, the calculations can be tricky, particularly if you are in the social security tax torpedo range, so seek out qualified help in making these decisions. Taxes are not fun to pay or to calculate. But smart income tax planning can add thousands or even hundred of thousands of dollars to your bottom line. Working with a financial expert who understands how everything fits together can be one of the best decisions you could make. Roth IRA accounts have been available since 1997. Unlike a Traditional IRA, Roth IRA contributions are taxed in the year of the contribution but never taxed again if certain requirements are met.

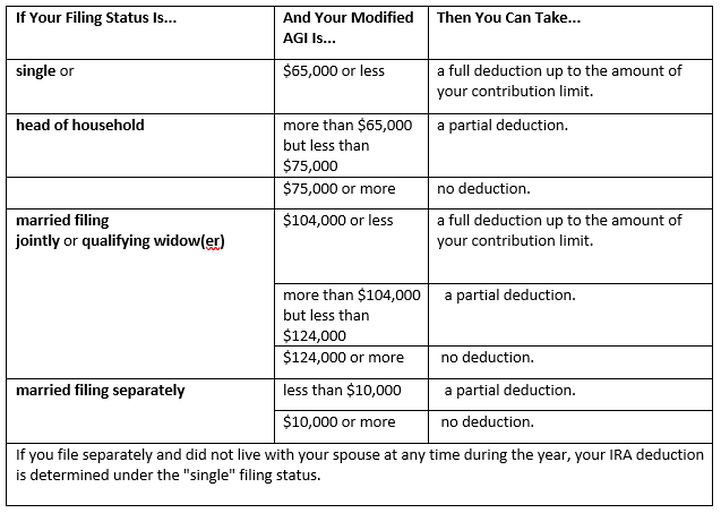

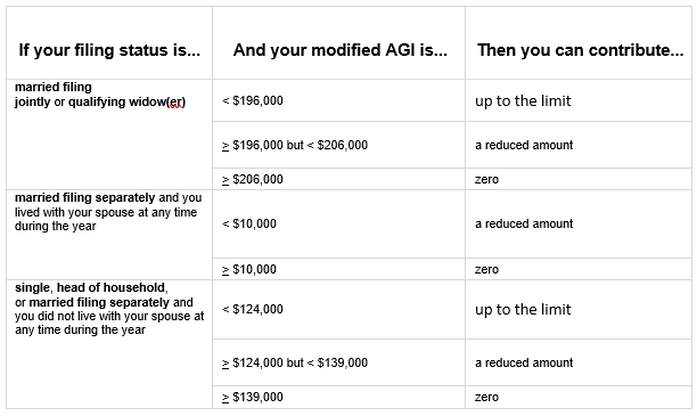

If you are a single filer with gross income of up to $52,525 or joint filers with gross income of up to $105,050 for the 2020 tax year, all of your income is taxed at 12% or less, and we strongly encourage you to make Roth IRA contributions rather than Traditional IRA contributions. The magic of compounding means, the earlier you start, the greater the tax-free growth within the account. If you are 20 when you start making contributions, you could be looking at four doubles of your original contribution by the time you retire at age 60. That means a $6,000 contribution this year could grow to $96,000, creating $90,000 of tax-free income for your retirement years. With today’s historically low income-tax rates, it would be prudent to put as much money as one can into a Roth IRA. Always consult your CPA before making this decision, but one could argue the tax-free growth and withdrawals outweigh the hurt of paying today’s top tax rates. Contribution and Income Limits For 2021 eligible individuals can contribute up to $6,000 if they are under age 50 and $7,000 over the age of 50. You can contribute 100% of any eligible income up to these limits. For single filers with Adjusted Gross Income of less than $125,000 ($124,000 for 2020) can make a full Roth IRA contribution. If the adjusted gross income is between $125,000 and $140,000 ($124,000 to $139,000 for 2020) they can make a partial Roth IRA contribution. For joint filers the threshold is below $198,000 AGI ($196,000 for 2020)and the phaseout is between AGI of $198,000 to $208,000 for 2021 ($196,000 to $206,000 for 2020). For adjusted gross incomes above these amounts, a back-door Roth IRA strategy will be needed. Back-Door Roth IRA Contributions Without income limitations for converting assets in a Traditional IRA to a Roth IRA, many who are disqualified for income resort to the back-door method for funding a Roth IRA. This works because anyone may open and contribute to a non-deductible Traditional IRA, even if you are covered by a qualified retirement plan. Once the funds are deposited into the non-deductible Traditional IRA, they can then be converted to a Roth IRA. This has the same net income-tax effect as contributing directly to a Roth IRA. The IRS recently loosened the back-door conversion rules and allow for immediate conversions, where in the past investors were recommended to wait a few months before converting to satisfy the IRS. The 5 Year Rule Another reason to open a Roth IRA is the flexibility it can provide to fund emergencies that may arise over your life. You can always withdraw any Roth IRA contributions you have made without taxes, after all, you paid income tax on the money prior to making the contribution. However, if you haven’t had the Roth IRA open for at least five years, your distribution could still be subject to a 10% tax penalty, similar to the early withdrawal penalty for Traditional IRAs. The five years for withdrawals begins on January the 1st of the year you open the account, not when you make subsequent contributions. There is also a five-year rule for Roth IRA conversions that start in January of the year you make a conversion; this prevents someone from using a Roth IRA conversion to avoid early distribution penalties from early Traditional IRA withdrawals. The Younger, The Better Tax-free growth and tax-free distributions are very enticing, especially for young investors. The more time your account grows tax-free, the better. Another point to make is that the more of your nest egg you have in a Roth IRA, the less your Required Minimum Distributions (RMDs) will be during retirement. Which inherently leads to you and your financial advisor having more ability to control/minimize income taxes during retirement years. Why you might not want to rollover that old 401k

*The rollover strategies discussed also apply to 403b, 457b, 401a and other employer sponsored qualified retirement plans For many high wage earners, making contributions up to annual Roth IRA limits (6k/$7k over 50; 2020) via the backdoor Roth IRA strategy is an appealing way to generate income tax free growth and income for future years. The backdoor Roth strategy entails making a non-deductible IRA contribution and immediately converting that contribution to a Roth IRA account. If you have no other rollover tax deferred IRA accounts when you execute this strategy, then you have simply moved money from a taxable account into a tax-free account. What If I have existing Rollover IRA and/or Traditional IRA Assets?When executing the backdoor Roth strategy, if you have any tax-deferred Rollover or Traditional IRA Assets, i.e. you haven’t paid income taxes on them yet, the Roth conversion will result in at least some of those funds being taxed in the year of the conversion. For example, let’s say you have a Traditional IRA or Rollover IRA worth $60,000 and make a non-deductible contribution of $6,000 to this IRA in accordance with your backdoor Roth IRA strategy. When you convert the same $6,000 from your Traditional or Rollover IRA to Roth IRA assets, you’ll actually be taxed on ~91% of the conversion, which creates extra taxable income of $5,460 for the tax year. This overlooked tax trap results from IRS rules which mandate, for tax calculations, your tax-deferred contributions and gains and non-deductible contributions from all IRA accounts (Rollover, Traditional & Roth) are combined into a theoretical IRA pot. From this theoretical pot, the IRS requires you to calculate the ratio of tax-deferred dollars to non-deductible dollars; the percentage of tax-deferred dollars in your theoretical account is the percentage of your Roth IRA conversion that will be taxed. In this example your non-deductible $6,000 contribution to your Traditional IRA or Rollover IRA is divided by the total account value of $66,000—just roughly 9% is not subject to income taxes at the time of conversion. The aggregation rules are one of the few reasons you should carefully think about not rolling over an old 401k or other employer plan. If the funds remain in a 401k, 401a, 403b, 457b etc. they are not subject to the aggregation rules. While there’s no avoiding taxation of previously deducted personal Traditional IRA contribution assets during a backdoor Roth IRA strategy execution or other Roth conversion, there are sometimes opportunities to clean up existing Rollover IRA accounts to avoid this unpleasant tax consequence. The Difference Between a Rollover IRA and a Traditional IRAThough they’re nearly identical, there is a subtle, but significant, difference. You can roll over a 401k to a Traditional IRA or Rollover IRA. If you choose to roll funds into a Rollover IRA, rather than a Traditional IRA, you maintain the ability to roll those funds into another current or future 401k plan, if the plan documents allow. Why Does That Matter?There are 401k plans that allow IRA roll-in contributions, but they must come from a Rollover IRA, not a Traditional IRA. If your company has such a plan, you can roll your existing Rollover IRA account into your 401k plan which eliminates the tax-deferred IRA portion of your aggregate portfolio, allowing a high earner to execute the backdoor strategy completely tax-free. Without this keen planning taxes would be paid at high income brackets on the conversion, which is counterproductive to high earner’s overall tax strategy. Don’t Commingle Rollover IRA and Traditional IRA AssetsIf you commingle “regular” Traditional IRA funds and Rollover IRA funds you lose the ability to roll-in former Rollover IRA assets. It’s important to keep the Rollover IRA and Traditional IRA accounts separate. Consider opening a stand-alone Traditional IRA for annual personal IRA contributions and a separate Rollover IRA for rollover assets.

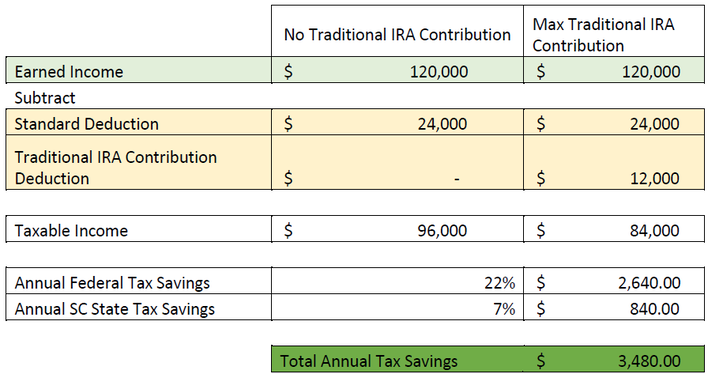

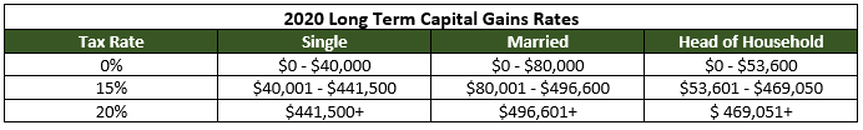

As always, things are rarely as simple as they seem. You should work with a competent Financial Planner to determine the best advice on your personal tax planning strategy. Questions about tax minimization strategies regarding your 401k rollover or rollover IRA? Click here to setup a no cost discussion with us today! How High Earners Can Diversify the Taxability of Their Retirement AssetsOur fee only financial advisors often recommend executing a backdoor Roth IRA contribution strategy for high earning clients who max out their tax-deferred and/or after-tax employer sponsored plans and are seeking additional tax favorable approaches to save and grow assets. These clients often accumulate large levels of tax-deferred dollars in their 401k, 403b, or other employer sponsored plan(s). These tax-deferred contributions help save tax dollars in high brackets now and withdrawals in retirement can be structured for tax savings in the future as well. On the other end, if we can add in Roth IRA assets to our clients’ portfolios which can be withdrawn in retirement tax-free, we add another tool in the tax-planning belt. What are Backdoor Roth IRA Contributions For most wage earners, if you contribute to a Traditional IRA you receive a dollar-for-dollar tax deduction. Here’s an overly simplified look at the tax reduction provided by the combined maximum family deductible Traditional IRA contributions of $12,000 for a married couple in 2020: Unfortunately, if you earn over a certain level of income and/or have access to an employer sponsored retirement plan (401k, 403b, 457b, etc., whether you use it or not) you lose the deductibility of your Traditional IRA contributions. **IMPORTANT: Even if you can’t deduct IRA contributions, you can still make them.** New clients are often surprised when we tell them they’ve been missing out on these tax favorable IRA contributions. Many investors assume they can’t make IRA contributions because they make too much money or already participate and max out an employer 401k or 403b plan. In each case, you can make IRA contributions, you just can’t deduct them. Unlike Traditional IRAs, when you make contributions to a Roth IRA you pay the taxes now-- or have already paid taxes on the contributions via payroll and will simply not receive a tax deduction for the contribution. The magic of a Roth IRA is that once the assets are in the account and the account has been open for 5 years—all withdrawals of principal AND earnings are tax-free. And tax-free > tax-deferred. But high earners are not allowed to make direct Roth IRA contributions, because Roth IRAs have their own income level eligibility qualifications: So-- if you’re single making more than $139,000 AGI or married and earn over $206,000 AGI you can’t make direct Roth IRA contributions AND you don’t get Traditional IRA contributions deducted. However, if you have little or no Traditional IRA assets to start with, we recommend executing a backdoor Roth contribution strategy. High earners can make non tax-deductible contributions to their Traditional IRAs, receiving no tax deduction for the contributions. Then they can immediately convert that contribution to their tax-free Roth IRA. Why would you want your investments growing tax-deferred when they could be growing tax-free? Not simple to do, but a no brainer…slam dunk. How are Backdoor Roth IRA Contributions Taxed? A key factor that must not be overlooked is the amount of previously tax-deferred Traditional IRA assets a high earner has while executing this strategy. It’s important because Roth conversions are taxed at the ratio of tax-deferred assets to after-tax, or non tax-deferred assets. For example, let’s say you’re a married high earner and want to start this backdoor Roth IRA strategy. You make the max Traditional IRA contributions of $12,000 ($6,000 each) for you and your spouse for 2020 and plan to immediately convert that to your Roth IRA to facilitate the lifetime tax-free growth mentioned above. At the same time, you already had $12,000 (again $6,000 each) of tax-deferred contributions from previous years where you qualified for the deduction. Or you could have rolled over tax-deferred assets from an old 401k into your Traditional IRA. Either way, half the assets in the Traditional IRAs were tax-deferred in prior years, and half are non-deductible from 2020’s contribution. If you convert the $12,000 of non-deferred contributions you made in 2020, it wouldn’t be a tax-free conversion— it would be taxed according to the Roth IRA pro-rata rule. This states you have to use the tax-deferred to non-tax-deferred ratio for taxing of the conversion assets. In this case the ratio is 50:50 ($12k tax-deferred to $12k tax-free), so half, or $6,000 of the $12,000 Roth IRA conversion would be taxed at your normal income tax rates for 2020. This is important-- because if you’re a high earner, you may want to avoid paying 32%+ Federal taxes this year on that $6,000 taxable portion of the Roth IRA conversion. It may be better to wait until retirement when you’ll likely be in a lower tax bracket, especially if you do some of the tax planning we mention in this article. The Roth IRA pro-rata rule should give pause to rolling over tax-deferred dollars from 401ks or 403bs into a Traditional/Rollover IRA when a backdoor Roth IRA strategy is recommended. The more assets added to your personal Traditional/Rollover IRA, the higher the taxable percentage of Roth IRA conversions. For these reasons, our financial advisors may recommend clients keep tax-deferred dollars in an old employer plan-- even if those plans have slightly elevated fees or lack diversified, cost-efficient investment offerings. We believe the tax-free savings of Roth IRA assets for a young high earner provide unmatched advantages in terms of investment returns and future tax planning strategies. Getting assets in a high earner’s Roth IRA early while avoiding unnecessary taxes at their currently high tax brackets provides great value to our clients. On the other hand, some clients prefer to fill up their brackets with Roth conversions to eventually get rid of all Traditional IRA tax-deferred assets, never having to worry about Roth conversion taxes again. Regardless—your taxable income level and tax bracket management must be thoroughly analyzed to make the right decision. Why Should I Build Roth IRA Assets?Saving on Pre-Medicare Health Insurance Premiums For example, let’s say a couple retires at age 60, with 5 years before Medicare eligibility. Our fee only advisors use taxable investment accounts and tax-free Roth IRA assets to strategically qualify millionaires for Premium Tax Credits under the Affordable Care Act that can offset some of the cost of healthcare insurance. Monthly private marketplace insurance premiums at age 60 are likely to be $1,000 per person—meaning if you and your spouse plan to retire at age 60, every year until age 65 you’ll fork over $24,000 alone on healthcare insurance premiums before you step foot in a doctor’s office. That can put a damper on early retirement plans. Our fiduciary advisors can situationally use taxable and Roth IRA assets to qualify even our most wealthy clients for Premium Tax Credits, which cover a portion or all of a family’s health insurance expenses. In the above example, that’s a potential savings of up to $120,000 in premiums from retirement at age 60 to Medicare eligibility at age 65—and a glaring reason everyone should invest in a financial plan. *Added Note: Recently, we’ve heard several current and prospective clients mention they’re going to beat high healthcare insurance costs during pre-Medicare retirement years with some sort of too-good-to-be-true Medi-Share plan. Please reconsider. These plans are not actually health insurance and leave your family’s wealth and health in jeopardy. One un-insured serious hospitalization could put your entire financial future needlessly at risk. Long Term Capital Gains Rates Saving We also use taxable and tax-free assets to manage tax brackets via favorable capital gains rates, and in some cases, help our clients pay 0% on capital gains through complex tax planning strategies. For those high earners today, as tax laws are, as is, we’d be able to structure their taxable income so they can optimize favorable capital gains rates while ensuring their assets at 12% Federally. That’s a Federal tax savings of $22,000+ for every $100,000 in their IRA. Not a bad deal for someone being taxed at 24% or 34%+ today and may even pay the 3.8% Medicare investment income surcharge. Other Uses for Roth IRA Assets Tax-free income can help manage tax brackets/income in retirement and can lead to enormous tax savings if planned correctly. If you max out your employer retirement plans and are looking for even more tax diversification of your assets, a backdoor Roth IRA strategy is a good choice. There are many factors to analyze to ensure you realize the tax savings these strategies provide.

If you could use help determining the most appropriate course of action to take with your excess savings give us a call and get started with a financial plan today.  Roth IRA accounts have been available since 1997. In a traditional IRA, you contribute pretax dollars that grow tax deferred, but are taxable upon withdrawal. Roth IRAs are for after tax contributions that provide tax free growth and distributions upon retirement. The magic of compounding means, the earlier you start, the greater the tax-free growth within the account. If you are 20 when you start making contributions, you could be looking at four doubles of your original contribution by the time you retire at age 60. That means a $6,000 contribution this year could grow to $96,000 allowing you to potentially create a constant flow of tax free income for your retirement years. Another reason to open a Roth IRA is the flexibility it can provide to fund emergencies that may arise over your lifetime. The Five-Year Rule You can always withdraw any Roth IRA contributions without taxes, after all, you paid income tax on the money prior to making the contribution. However, if you haven’t had the Roth IRA open for at least five years, your distribution could still be subject to a 10% tax penalty, similar to the early withdrawal penalty for traditional IRAs. The five years for withdrawals begins when you open the account, not when you make subsequent contributions. There is also a five-year rule for Roth IRA conversions that start in January of the year you make a conversion. This additional rule was enacted to prevent someone from using a Roth IRA conversion to avoid early distribution penalties from traditional IRA withdrawals. Who qualifies for a Roth IRA If you have a modified adjusted gross income of less than $124,000 and are single or less than $196,000 if married filing jointly, you can make Roth IRA contributions of 100% of your income up to $6,000 if younger than age 50 or $7,000 if age 50 or older. Back-door Roth IRAs Because there are no income limitations for converting traditional IRAs to a Roth IRA, many who are disqualified for income resort to the back-door method for funding a Roth IRA. This works because anyone may open and contribute to a non-deductible traditional IRA, even if you are covered by a qualified retirement plan. Once the funds are deposited into the nondeductible traditional IRA, they can then be converted to a Roth IRA. This has the same net income tax effect as contributing directly to a Roth IRA. The Early Bird Gets the Worm Tax free growth and tax free distributions are very enticing especially for those with many years until retirement, so start today. The more time your account has to grow tax free, the better. Assets can transfer to your heirs in one of two ways when you die. They can transfer by will, which includes probate court and public filing of related documents, or they can transfer by contract.

The advantages of having your assets transfer by contract include:

Examples of assets that transfer by contract include accounts or assets titled Joint Tenants with Right of Survivorship, Transfer on Death and Pay on Death accounts, Life Insurance and Annuity contracts, Trusts, and your IRA and 401k accounts if you complete the beneficiary forms correctly. When you first establish an IRA or 401k, an annuity or life insurance contract, you are provided a form to name beneficiaries. If you fail to complete these forms the assets will usually pass back into your estate and become part of the probate process. By naming a beneficiary or beneficiaries you can let these assets transfer by contract. You should also name contingent beneficiaries and choose whether you want the assets to transfer per stirpes or per capita. By filling out these beneficiary forms you are insuring that your wishes are honored after your death. Many people name only a spouse as a beneficiary. If the couple have children or grand children they wish to provide for they should consider making them contingent beneficiaries to preserve the tax benefits of an IRA (however if the children or grandchildren are minors be sure a guardian has been named or the funds will be encumbered until the courts name a guardian). Currently only surviving spouses can transfer assets from their deceased spouse's 401k to their own IRA, but the recently enacted Pension Protection Act of 2006 will extend that privilege to any beneficiary after 2007. The bottom line is beneficiary forms are an integral and important part of your estate plan. Choosing the right way to transfer these assets can save time and money, but can also be confusing. If you are unsure how to proceed choose a professional to help you, but don't delay. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed