|

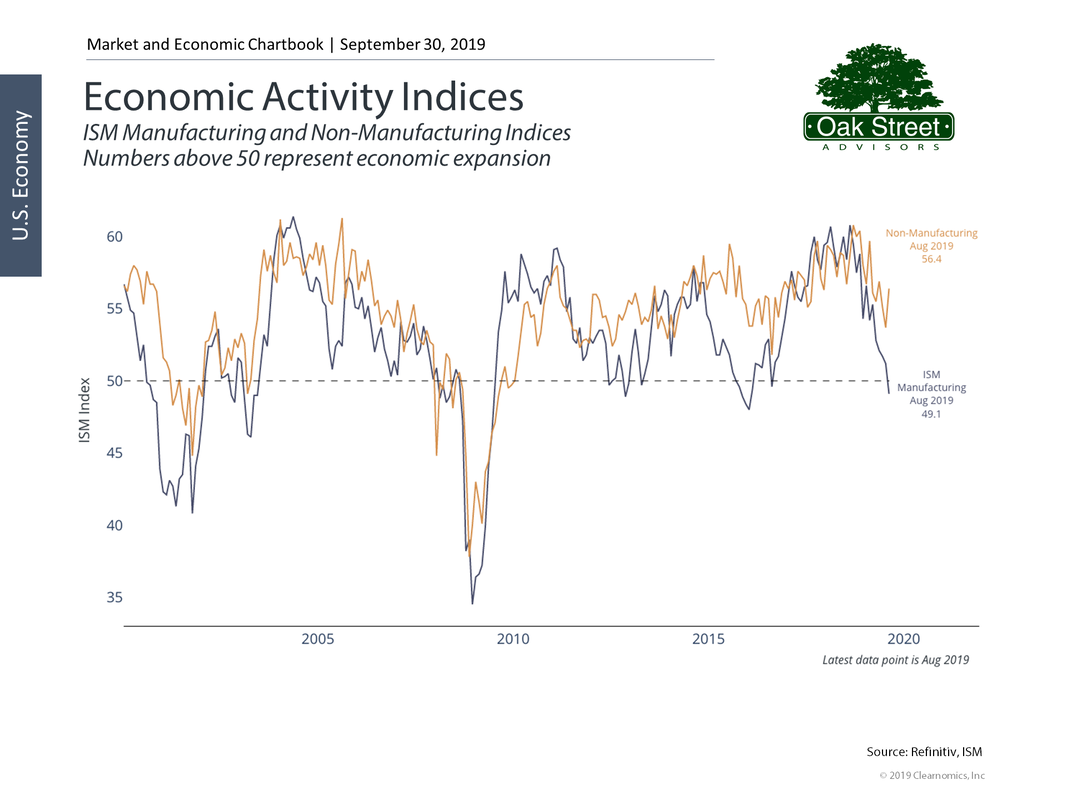

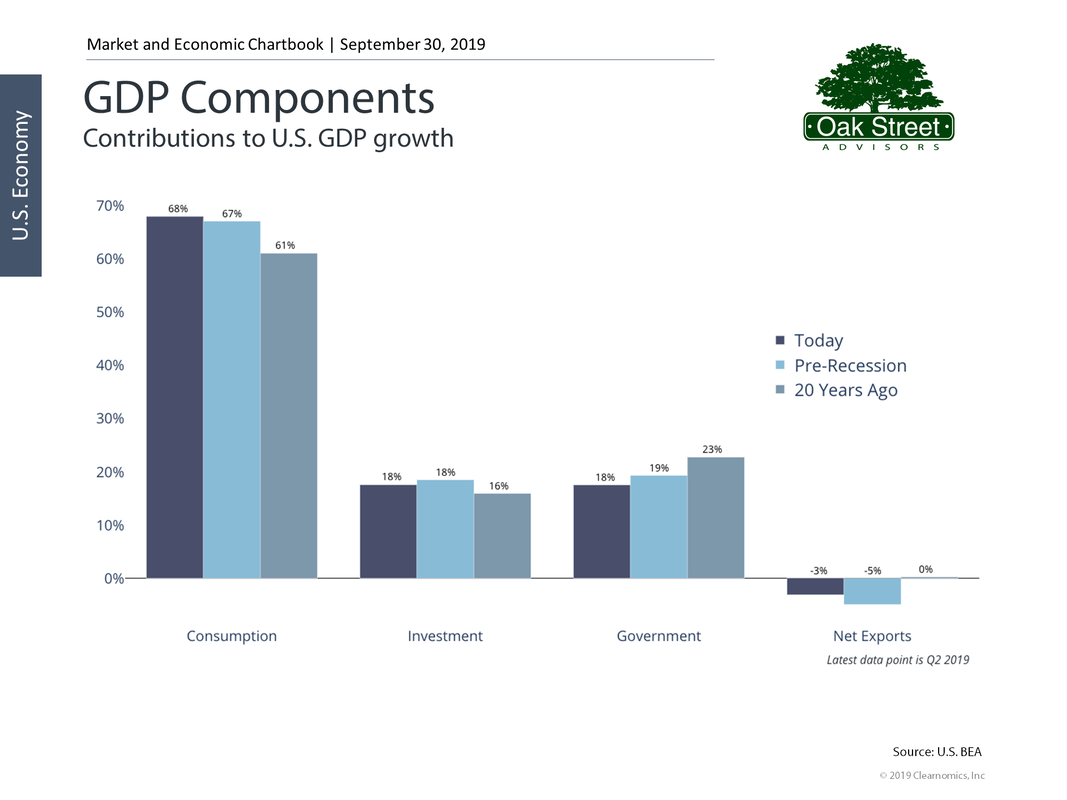

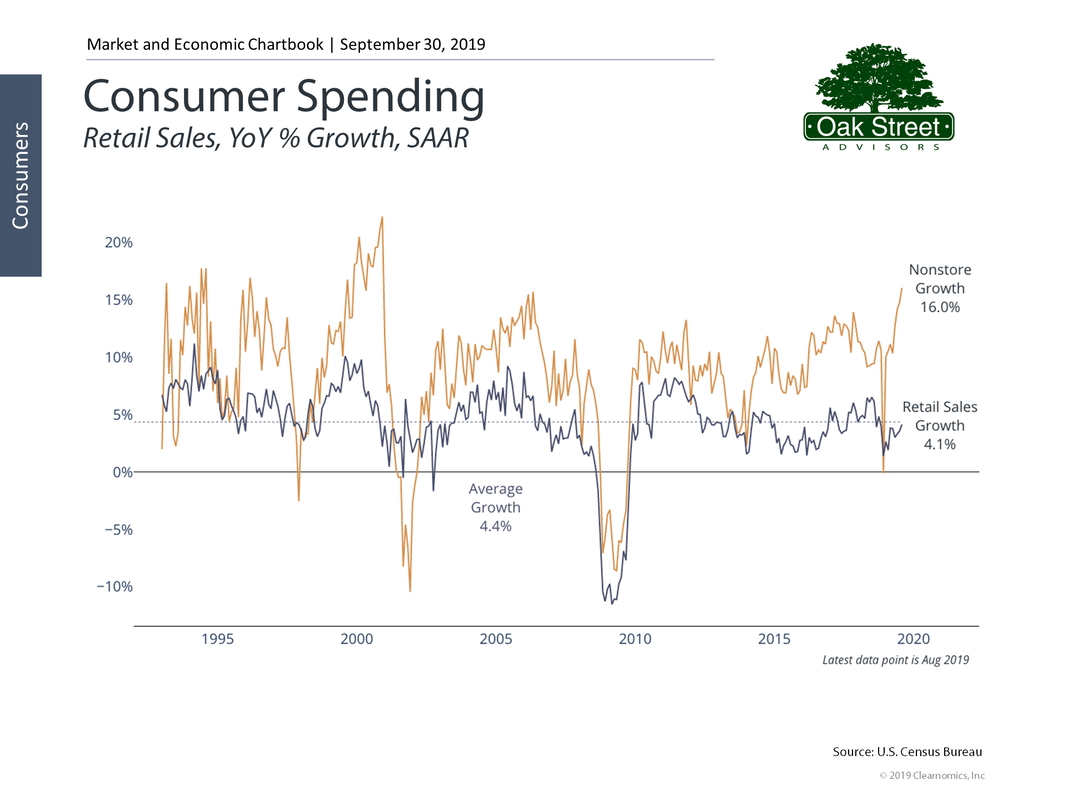

By James Liu, CFA Some investors and economists have been worried about a recession for some time. This is only natural after over a decade of steady economic growth and the spectacular rise of both stocks and bonds. On the one hand, the economy is still quite healthy by many measures, especially based consumer spending and the labor market. On the other hand, there are clear signs that industrial and corporate activity have slowed. One important measure of economic activity, the ISM manufacturing index, suggests that manufacturing activity has been slowing over the past year and actually shrank last month for the first time in three years. However, this alone is not a reason for investors to panic. First, manufacturing activity is directly affected by the on-going global trade disputes. Uncertain and reduced demand for U.S.-made goods will continue to be a drag on industrial activity until firm trade agreements are in place. Second, the corresponding non-manufacturing index has also slowed but is still expanding at a strong pace. This suggests that business activity overall would still be healthy if not for these global effects. From the perspective of GDP growth, the contribution from corporate investment has fallen since the financial crisis. This is partly because investment spending by many companies has been weaker than in past cycles. The underlying reasons for this are unclear, but they likely include slower economic growth trends compared to previous business cycles and improvements in technology. Regardless, what has increased over time is the share of GDP growth from consumer spending. Not only do consumers (on average) have strong balance sheets, with total net worth at record levels, but their spending has maintained a healthy pace. Of course, not all consumers are doing as well as they were one or two decades ago. But from the perspective of corporate profits and the stock market, the consumer is still the cornerstone of the economy. Thus, while the overall economy may be slowing, this is because we're now in the eleventh year of the business cycle and global trade disputes have created an environment of uncertainty. Manufacturing activity has decelerated but consumer spending is still strong. Here are three charts on this important topic: 1. U.S. manufacturing activity shrank last month The chart above shows the ISM manufacturing index. This is a "diffusion index" which means that values above 50 represent expansion while those below 50 imply contraction. Thus, the index shows that manufacturing activity shrank in August for the first time in three years. While this index has been slowing for over a year, on-going trade uncertainty has dragged it down further. Fortunately, the non-manufacturing index still shows healthy expansion. 2. Investment spending has fallen over the past decade GDP Components Investment spending by companies has fallen as a share of U.S. GDP growth over the past decade. This is in contrast to consumer spending which has increased. 3. However, consumer spending is still healthy Consumer Spending Consumer spending continues to be healthy despite economic uncertainty. Non-store sales (i.e. online retailers) has increased at an even more rapid pace, a sign of shifting consumer trends over the past two decades.

What's the bottom line? The economy is slowing in part due to shrinking manufacturing activity, driven in no small part by trade disputes. Despite this, other parts of the economy are still quite healthy. Investors should maintain a broader perspective on economic growth. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed