|

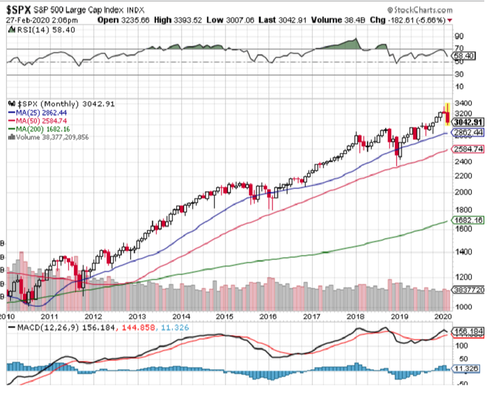

I don't want to add flames to the fire regarding the new coronavirus-- COVID-19, however, the time to have a lifeboat drill is prior to the ship sinking. Investors should contemplate what this virus can do to the markets and world economies while they are still thinking rationally, rather than waiting until widespread panic clouds their judgement. The COVID-19 is the same type of virus as the common cold, but it’s definitely not common. It is a strain that is new in humans, so we, as a species, have not developed antibodies to fight it, and there is no herd immunity to slow its contagion. Rather than turn to Facebook or the popular press for answers, we recommend you visit the Center for Disease Control web site for more detailed information on what COVID-19 is and the threat it poses. Early data shows a high fatality rate-- somewhere around 2%; but keep in mind this data could well be skewed because diagnosing those infected is rudimentary at best. We are aware of nearly 100% of the fatalities but the number of cases of infection could be vastly under-reported. A coronavirus is a cold, and except in the most serious cases, likely to pass with little notice. You’re probably aware that drug companies around the world are trying to find a vaccine. We wouldn’t hold out much hope on this front as we have been trying to find a cure for the common cold for decades with zero success. In the past week, we’ve seen the US Stock market drop by about 10% as concerns over COVID-19 have swept the globe. While markets usually do a very good job of pricing risk and opportunity, there are times when rationality tips to panic, and markets no longer function as they should. The most recent example of this was the 2008-2009 period when markets lost half of their value based on panic that the world was ending. They would eventually rebound fourfold as panic subsided and rational thought came back to the forefront. So, is the pullback, so far, a rational repricing of risk/opportunity? Or is it the beginning of a panic? We believe it is too soon to tell. Some companies have already announced that the COVID-19 is having an effect on their sales and earnings. Microsoft and Apple have noted problems with their supply chains. As market participants try to peer into the future, they’ve battered the travel and energy sectors, expecting consumers to avoid travel. As fear spreads this will work its way into the restaurant sector, fear of contagion may cause consumers to avoid crowded spaces where the virus could be easily transmitted. On a more basic level missed workdays and a drop in productivity could potentially hurt businesses of every type. S&P 500 2010-PresentThe stock market has had an incredible run over the past 14 months, reaching new highs at almost a monthly pace. The technical indicators we follow showed the market nearing overbought levels on a short-term basis prior to the recent drop. So, a pullback was not unexpected-- with or without the COVID-19 outbreak. That doesn’t mean we expect a reversal, but it does mean we would not expect a continuation of these 2%-3% per-day drops. From a technical perspective, a pullback to around 2,600 for the S&P 500 would not be overly concerning. If markets stabilize on a short-term basis, there are gaps in index price levels that will be filled. So, in fact, we could soon have a very good buying opportunity for long-term investors with cash to allocate to stocks. S&P 500 Last 6 MonthsWhat Should a Rational Investor Do?Nothing. Rational investors know that their default position should always be to remain fully invested. It is too soon to tell if this is a normal market adjustment to new information, or the beginning of a panic. For those with reasonable investment time frames, this will be a barely noticeable blip on the long-term chart of their investment history.

In the short term there will be times when investors doubt themselves. This is normal. We believe thinking about this problem now and preparing for an uncertain future can only help long-term investors achieve their long-term goals. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed