Imagine its October of 2007. You have spent the last 30-plus years of your life working and saving for this day, the day you retire. You have watched the S&P 500 Index rise steadily over the past five years, climbing from 837.37 to 1561.80, gaining over 12% a year on average. You have watched your 401k grow steadily and feel your nest egg and social security should provide you with a comfortable if not extravagant lifestyle. You work out the numbers and believe withdrawals of about 5% a year should see you through your lifetime. Then your November statement arrives, and your stock portfolio has dropped 3%. No biggie, we all know stocks fall from time to time. Now its December and your investments shrink another 3%. Okay, you don’t like it, but you have a long time horizon, and know the markets will recover. The January statement arrives, and your nest egg has shrunk another 10%. You are sweating now; a 20% drop means bear market territory. You know you shouldn’t try to time the market, but jeez! February brings another statement that shows another big drop 12%. OMG! What now? By the end of the great recession bear market in March of 2009 your stock investments have fallen a whopping 56%. Within 18 months of retiring your nest egg is already depleted by nearly 60% when you factor in distributions. Welcome to the world of sequence of return risk. Negative market events that can wreck your retirement happen more often than you might think. August 2000 to September 2002 saw the S&P 500 drop 54% over 25 months. January of 1973 to October of 1974 produced a drop of 52% over a 21 month span. December 1968 to June 1970 set you back 33% in 18 months. The greatest market crash of all began October 29, 1929 and lasted an agonizing 38 months. Stock lost 80% of their value and left the US economy in shambles. Yes, the markets recovered from all of these setbacks and went on to reach new record highs, but for those unlucky enough to retire at just the wrong moment, recovery could be forever out of their reach. The math of losses works against you. A 25% drop in market value requires a 33% gain to get back to even. A drop of 33% needs a 50% recovery to reach even, and a 50% drop in value means you need a 100% gain to be even. We all know those kinds of gains take a long time to accumulate. The risk that big market losses occur at the beginning of a withdrawal strategy is called sequence of return risk. If you experience a market return sequence of -10%, -25%, +10%, +25% the net result is you have lost over 7%, the communicative rule of multiplication gives you the same result if the returns are reversed. But! Factor in withdrawals and the picture can change dramatically. Your systematic withdrawals work like dollar cost averaging in reverse. You sell more and more shares to fund your spending at low and lower prices. So how can you protect yourself from such disasters? While there is no strategy that can protect stock investments from going down on occasion, there are some steps you can take to minimize the damage to your long term plan. The first step to avoiding irreparable harm to reaching your long-term goals is to remember that stocks go down, but they don’t stay down. Diversification Having money invested in different asset classes helps. Although the equity portion of your portfolio would have dropped precipitously, owning bonds and holding some cash would reduce the severity of sudden market corrections. Having less exposure to equities will also reduce your returns over time. Still, if you can match an asset allocation to your need for long term returns you might find a ratio that allows you to sleep at night, fund your retirement income, and let you avoid the big mistake of selling at the very bottom of the market. A Separate Bucket for Income Withdrawals- the solution to poor sequence returns Ideally you have planned well for retirement, so instead of having all your retirement nest egg invested for the long term, you have left yourself a cash cushion to fund your anticipated portfolio withdrawal needs for 36 to 48 months, allowing an extra year as a recovery period. Using this strategy your first year withdrawal needs would remain in a money market account and your spending for that first year would come from this account. Your second year of withdrawal needs would invested in one year treasuries or certificates of deposit. So, the second year rolls around and you still don’t have to sweat a bear market, Finally, the third year of anticipated spending is funded with two year treasuries or CDs and the fourth year would be invested in securities maturing in four years. This separate ‘spending bucket’ is what you use for your spending needs. This strategy would necessitate a cash allocation of 3X or 4X your estimated withdrawal rate. If you believe a 5% withdrawal rate will be safe, then 15% to 20% of your portfolio would be allocated to the ‘spending bucket’. If you believe a 4% withdrawal rate is more appropriate, then that implies a 12% to 16% allocation to the ‘spending bucket’. Using this strategy, you could have the confidence to withstand most historical bear markets and corrections. Knowing you do not have to sell stocks when markets a low could give you the edge you need to keep the remainder of your investments intact and allow your portfolio time to rebound. It could also allow the remaining portion of your portfolio to be invested more aggressively, improving the likelihood of higher long-term returns. Don’t Wait Until You Retire For those nearing retirement you should ideally begin implementing and funding this ‘withdrawal bucket’ well before the day you retire. It would be frustrating to see the stock market drop in the year before you plan to retire. Much better if you would begin shifting some of your investment, 401k, 403b, or IRA investments into a safe ‘spending bucket’ three to four years before your targeted retirement date. Four years before retirement you would move one year’s expected spending into a money market or GIC (guaranteed investment contract). Three years before retirement you move another year’s expected spending, and so forth. Then no matter what happens in the market you should be able to retire when you want and have all your withdrawal needs set aside for the four years following retirement and you could invest the remaining balance of your investment or retirement accounts in equities for long term appreciation. This seems to us a better strategy than selecting a target date fund that arbitrarily moves money out of stocks as you approach retirement age. Budget Allocation: The First Step in Personal Finance Part of Oak Street Advisors’ 10 Financial Commandments for Millennials series, budget building and understanding a general hierarchy of allocating extra income is crucial to getting a head start on retirement planning for millennials. Follow these steps and refer to the Personal Budget Template to begin. Make a budget and stick to it- seems obvious and easy right? Except for it’s not- not at all. Well, it is easy to make a budget. One that clearly has every bill, investment, savings contribution and living need covered. It looks so nice and neat when you’re done with it too! But…your budget won’t stay nice and neat. You overspend on a weekend getaway or spontaneous night out with friends and before you know it, that $300 that was supposed to be put into your IRA this month was spent on bar tabs and work lunches. Budgeting is hard work and life is expensive. Knowing that budgeting is hard is the first step to good budgeting. So, what does a decent budget look like for a young professional just starting out on the road to retirement? The answer is different from person to person but let’s start with the basics. 5 Steps in Basic Personal Budgeting

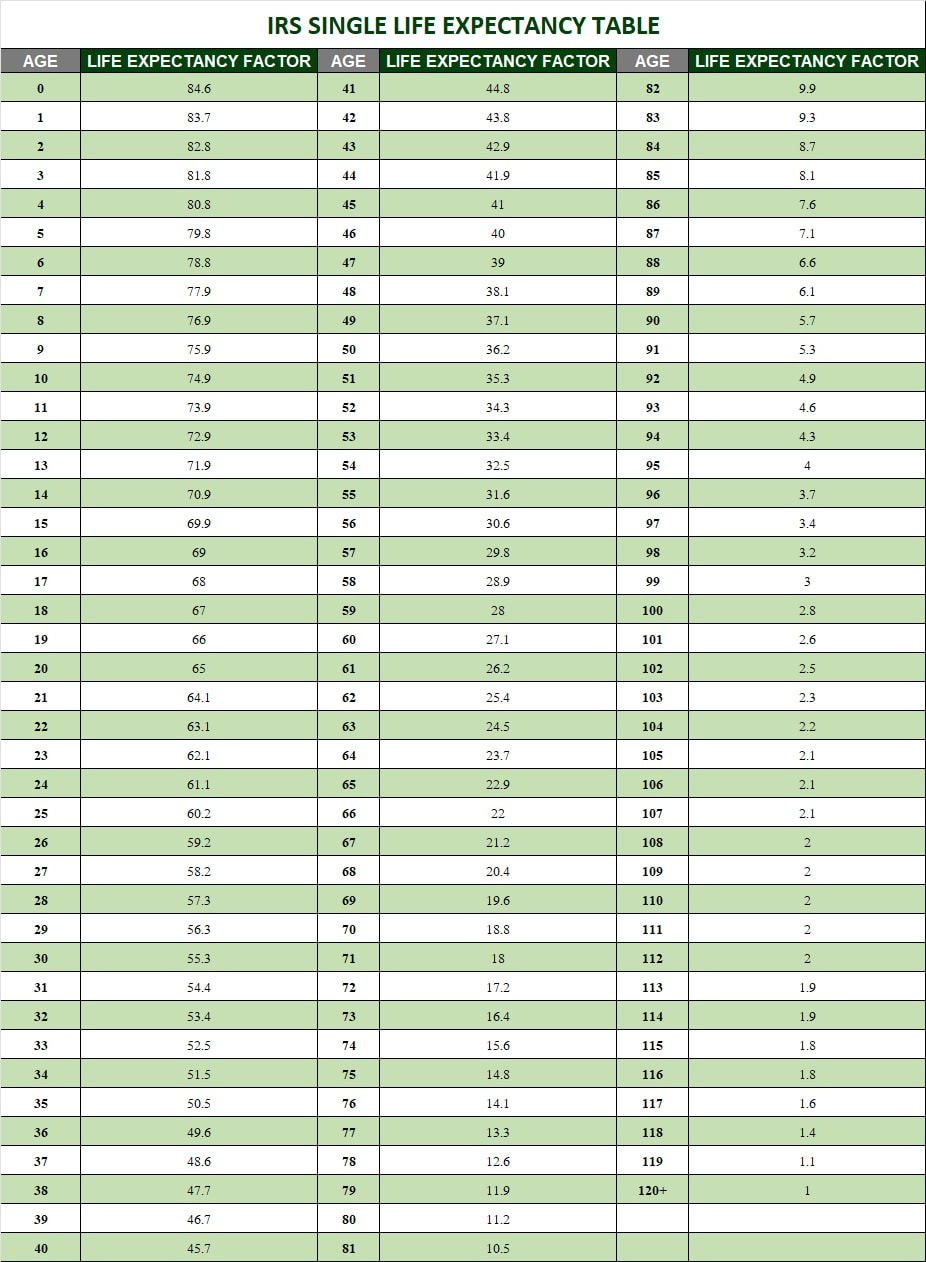

Step 1: Income – Fixed Expenses Always deduct your bills, insurance premiums, food allowance etc. directly from your paycheck. These are fixed unavoidable costs that cannot go unpaid. Now- how much is left in your checking account after you’ve paid for your next month’s existence? Step 2: Emergency Fund Savings We’re going to get into the Emergency Fund in an upcoming article, but what you need to know now is that after paying your living expenses you need to save an exact $ amount to cover your butt if any surprise expenses arise or you suffer a job loss. Step 3: Retirement Savings Once you’ve got your Emergency Fund completely funded start working on maxing out a retirement plan. Ideally, you’re participating in an employer sponsored plan like a 401(k) that will allow you to contribute up to $18,500 each year. If you’re not offered this type of plan, make sure to max out an IRA. Generally, a Roth IRA is advantageous for younger investors, however, check with your advisor or tax preparer about the implications in regard to your specific circumstances. You may consider mixing the tax-deferment of a 401(k) plan with the tax-free characteristics of a Roth IRA to play both sides of the income tax fence, so to speak. *Some young investors may consider college savings an integral part of their financial plan. Step 3 is a great place to include college savings Step 4: (Could be Step 3) Paying Down Debt Many young investors have student loans, credit cards, auto loans, mortgages etc. that can be mentally and financially draining. Depending on your situation, it may be advantageous to allocate a part of your monthly disposable income to paying down debt. It may be smart to allocate disposable income to savings, retirement, and paying down debt all at once--it truly depends on your unique circumstances. Step 5: Treat Yo’Self While allocating extra income towards improving your financial position both now and in the future is great fun-- spending your hard-earned dollars is fun as well. Ideally, you’d start saving for vacations or another ear-marked goal after the previous steps are taken care of, however, that is often not the case. We need to enjoy our money as much as we need to grow it- so don’t forget to enjoy the fruits of your labor! ----- Free Personal Budget Template Now that you have a basic guideline for creating and prioritizing your personal budget, why not take a crack at it yourself? Would a simplified Personal Budget Template help you organize your budget? Click that link to download the budget template I use personally as a CFP® practitioner and which I’ve customized to follow these budgeting steps.  You’ve inherited an IRA- so what happens next? Before we start, we need to understand some key terms: Required Minimum Distribution (RMD): The dollar amount the IRS requires one to distribute from IRAs and defined contribution plans like 401(k)s and 403(b)s. This amount is distributed from your IRA and taxed as normal income unless that distribution comes from your basis or from a Roth IRA. This dollar amount is determined by the IRS' Single Life Expectancy Table: You can always distribute more than the Required Minimum Distribution, but never any less. Failure to distribute the required amounts results in a sever 50% penalty. If your RMD was $10,000 and you took nothing, the IRS would penalize you $5,000! IRS’ Single Life Expectancy Table The table is created by the IRS to calculate how much of your IRA balance needs to be distributed each year. There are rules that govern which life expectancy age an owner or beneficiary must use in this calculation, which we will discuss. --- Starting The Process When it’s time to start the transfer process, you’ll first setup a Beneficiary IRA to hold the inherited assets. This Beneficiary IRA cannot be co-mingled with any other IRA, retirement plan, brokerage account, etc. Remember, understanding the IRS will require you to distribute some of your inheritance and knowing how that distribution is calculated is crucial in determining how to structure your Beneficiary IRA. With your Beneficiary IRA established the IRS gives you a few options on how you can distribute the assets: Cash Out Everything You can take the money- but don’t run. The lump sum distribution will be taxable income and may bump you into a higher tax bracket. When April rolls around you can expect a higher tax bill from the large distribution. Distribute Everything in 5 Years You can take withdrawals as you please, so long as the entire IRA balance has been distributed by December 31st of the 5th year after the original IRA owner’s death. Each distribution will be taxed as normal income, so again- tax planning is crucial. Take RMDs Based on Your Life Expectancy If the IRA owner has not started taking RMDs or your life expectancy is longer than the IRA owner’s, use your age in the year following the year the original IRA owner died (i.e. owner dies in 2018, you would use your age in 2019 to determine the RMDs for 2019). This is especially useful for heirs who are much younger than the original IRA owner, keeping more tax deferred income and growth in the Beneficiary IRA for a longer time. Take RMDs Based on IRA Owner’s Life Expectancy This only applies when your life expectancy is less than that of the IRA owner’s. You use the life expectancy table based on the deceased’s age rather than your own. All distributions are taxed as normal income. Take RMDs Based on the Oldest Beneficiary’s Life Expectancy Only applicable with more than one beneficiary and only if no separate Beneficiary IRA accounts are setup for said beneficiaries by December 31st of the year following the IRA owner’s death. Using the oldest beneficiary’s RMD schedule for all other beneficiaries. This could be a major negative for a younger heir. Again, all distributions are taxed as normal income. --- What’s Best for You? The best thing any IRA beneficiary can do is talk with a fee-only financial adviser who will look at their entire financial picture to determine a customized strategy. Often there are further financial and tax-related issues that should be addressed when considering how to move forward with an Inherited IRA so attention to detail is of the upmost importance. If you’re not sure what to do with an inherited IRA give us call (843.901.7778 / 843.946-9868) or shoot us an e-mail and we’ll reach out to help you navigate your Beneficiary IRA strategy. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed