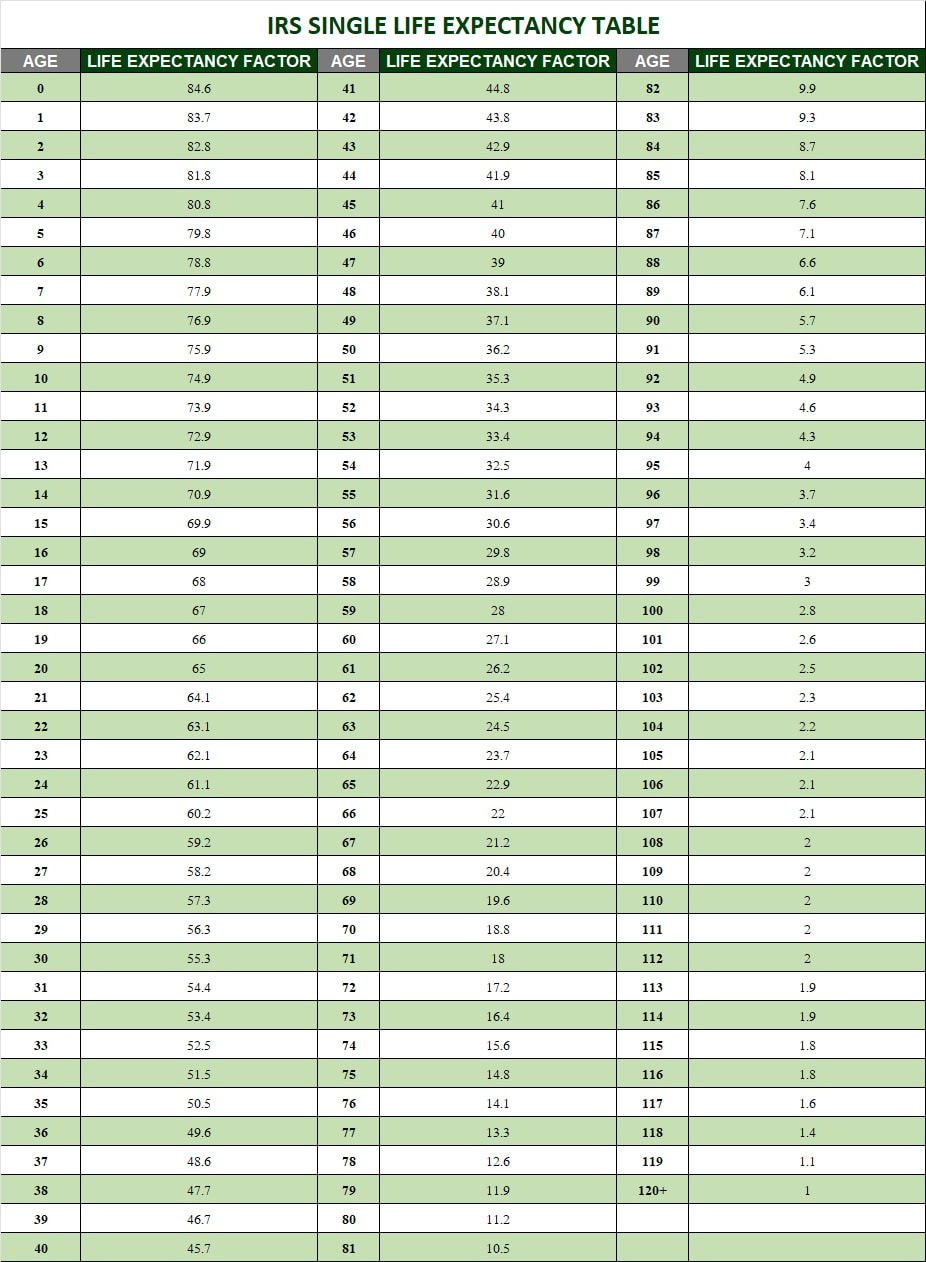

You’ve inherited an IRA- so what happens next? Before we start, we need to understand some key terms: Required Minimum Distribution (RMD): The dollar amount the IRS requires one to distribute from IRAs and defined contribution plans like 401(k)s and 403(b)s. This amount is distributed from your IRA and taxed as normal income unless that distribution comes from your basis or from a Roth IRA. This dollar amount is determined by the IRS' Single Life Expectancy Table: You can always distribute more than the Required Minimum Distribution, but never any less. Failure to distribute the required amounts results in a sever 50% penalty. If your RMD was $10,000 and you took nothing, the IRS would penalize you $5,000! IRS’ Single Life Expectancy Table The table is created by the IRS to calculate how much of your IRA balance needs to be distributed each year. There are rules that govern which life expectancy age an owner or beneficiary must use in this calculation, which we will discuss. --- Starting The Process When it’s time to start the transfer process, you’ll first setup a Beneficiary IRA to hold the inherited assets. This Beneficiary IRA cannot be co-mingled with any other IRA, retirement plan, brokerage account, etc. Remember, understanding the IRS will require you to distribute some of your inheritance and knowing how that distribution is calculated is crucial in determining how to structure your Beneficiary IRA. With your Beneficiary IRA established the IRS gives you a few options on how you can distribute the assets: Cash Out Everything You can take the money- but don’t run. The lump sum distribution will be taxable income and may bump you into a higher tax bracket. When April rolls around you can expect a higher tax bill from the large distribution. Distribute Everything in 5 Years You can take withdrawals as you please, so long as the entire IRA balance has been distributed by December 31st of the 5th year after the original IRA owner’s death. Each distribution will be taxed as normal income, so again- tax planning is crucial. Take RMDs Based on Your Life Expectancy If the IRA owner has not started taking RMDs or your life expectancy is longer than the IRA owner’s, use your age in the year following the year the original IRA owner died (i.e. owner dies in 2018, you would use your age in 2019 to determine the RMDs for 2019). This is especially useful for heirs who are much younger than the original IRA owner, keeping more tax deferred income and growth in the Beneficiary IRA for a longer time. Take RMDs Based on IRA Owner’s Life Expectancy This only applies when your life expectancy is less than that of the IRA owner’s. You use the life expectancy table based on the deceased’s age rather than your own. All distributions are taxed as normal income. Take RMDs Based on the Oldest Beneficiary’s Life Expectancy Only applicable with more than one beneficiary and only if no separate Beneficiary IRA accounts are setup for said beneficiaries by December 31st of the year following the IRA owner’s death. Using the oldest beneficiary’s RMD schedule for all other beneficiaries. This could be a major negative for a younger heir. Again, all distributions are taxed as normal income. --- What’s Best for You? The best thing any IRA beneficiary can do is talk with a fee-only financial adviser who will look at their entire financial picture to determine a customized strategy. Often there are further financial and tax-related issues that should be addressed when considering how to move forward with an Inherited IRA so attention to detail is of the upmost importance. If you’re not sure what to do with an inherited IRA give us call (843.901.7778 / 843.946-9868) or shoot us an e-mail and we’ll reach out to help you navigate your Beneficiary IRA strategy. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed