|

Asset Allocation & Risk Tolerance Part of Oak Street Advisors’ 10 Financial Commandments for Millennials series, understanding risk tolerance, asset allocation, and their relationship, is the foundation of modern portfolio theory. Implementing the proper asset allocation to minimize risk, while still achieving your long-term goals, is crucial to your success and peace of mind. Asset allocation means: how much…of what asset. What are Asset Classes? There are 3 basic Asset Classes

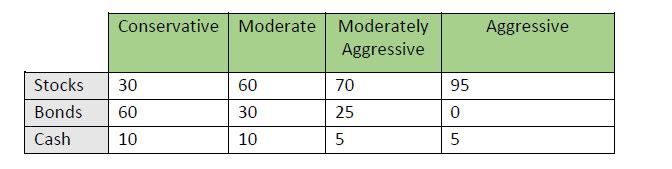

You could add real estate, commodities, alternatives, and other investments to this list, but for simplicity we’ll stick with these main 3 classes. Asset allocation refers to the weight of each of these asset classes in a portfolio. Here’s a generic look at how we currently allocate the different asset classes: For example, at Oak Street Advisors we use the following asset allocation for someone who has a Moderate Risk Tolerance: Stocks = 60% Bonds = 30% Cash = 10% This asset allocation leaves a good portion of weight to bonds and cash; which is less risky than an Aggressive Risk Tolerance: Stocks = 95% Bonds = 0% Cash = 5% As you can see, with 95% stocks, and stocks being riskier than bonds and cash positions, the latter allocation is much riskier than the former. The reason for using asset allocation is to manage risk inside your portfolio. The more stocks you own, the more volatility your portfolio will experience. The more stock you own, the higher your return has historically been. We add bonds and cash to the mix to make the short-term swings in the overall portfolio value smaller, but in doing this we also reduce the potential returns provided by the portfolio as well. We use asset allocation to allow ourselves to stay invested for the long-term gains while sleeping well at night during times when stocks temporarily fall. Your personal asset allocation will reflect your Risk Tolerance, which can be viewed as the point where you can stay invested for the long-term gains, without making the big mistake of selling in a panic. For some of our clients, we provide them with a short Risk Tolerance Scorecard. While brief and simplified, it gives investors a start on their comfort with investment risk. Once a risk tolerance score is determined, investors can select the appropriate asset allocation based on their individual or combined familial results. While you’re here, why don’t you determine a base-line risk tolerance by answering the following:  Grading Your Risk Tolerance: Starting from the top down, assign the number of points from 5 to 1. EXAMPLE: What is your current age? Less Than 45 = 5 Points 45 to 55 = 4 Points 56 to 65 = 3 Points 66 to 75 = 2 Points Older than 75 = 1 Point Each question is graded the same, 5 points for the first answer, 4 points for the second answer, 3 points for the third, 2 points for the fourth, and 1 point for the last. Write all your points down, then add them together. An idea of your risk tolerance is estimated from the sum of your points as follows: 1-14 = Conservative 15-21 = Moderate 22-28 = Moderately Aggressive 29-35 = Aggressive Remembering the asset allocations from above, you can select the corresponding allocation. Inside those asset classes is an investment manager’s secret sauce, but any investor can achieve these general allocations via indexed ETFs. One last point I want to present is the fact that yes, you can determine a proper asset allocation based on your personal risk tolerance; however, is that level of risk going to produce the returns necessary to meet your long-term goals? Sometimes investors must take more risk than they may be quantifiably comfortable with in order to achieve the desired outcome. The 10 Financial Commandments for Millennials 4th Commandment: Establishing an Emergency Fund12/4/2018

The Emergency Fund: Why, How Much, & Where

Part of Oak Street Advisors’ 10 Financial Commandments for Millennials series, determining the correct amount, picking a high-yield account, and saving for an Emergency Fund is critical in establishing a solid financial foundation for millennial investors. Before you start investing, you still need to complete one other, vital, step; and that’s saving enough for a properly funded emergency fund. An emergency fund is a savings account dedicated to bailing you out when unforeseen financial troubles arise. This fund is for repairing your HVAC unit, fixing your car, unexpected medical bills, and loss of wages. Your emergency fund shouldn’t be so small that you aren’t able to cover a financial crisis without going into debt; but not so large that you have too much capital allocated in cash. General savings guidelines call for 3 months of expenses for two incomes, 6 months of expenses with one income- for both single and married investors. This is a baseline, but your Emergency Fund should be dictated by your individual circumstances. You and your financial planner should collaborate to determine the amount that is right for you. Or, you can head back over to our Personal Budget Template to calculate a personal number. Once the proper amount is determined, your emergency fund should be moved into a high yield savings account. Most of us keep our savings at a big bank and receive terrible interest rates for parking our money there. While it may not seem like a lot of extra money, going from an account producing 0.01% interest vs. 2.0% interest just makes sense. Why not let your money earn the most it can for you? For example, say you have $10,000 in your Emergency Fund: Bank A Bank B Interest Rate 0.01% 2.0% Amount You Earn/Year $10 $200 |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed