|

The old prayer goes…”God grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference.”

You cannot change the markets; they have a life of their own. But you can change the way you see them and the way you react to them. Enter with caution, have the courage to stay. Know that your fear is usually irrational and have the wisdom to overcome your panic. Patience will bring the serenity. Sometimes it happens. Someone comes into my office wanting to know about their investments and how we manage money but doesn't want to go through the financial planning process. The have done their own planning or don't want to do the work to build a real plan.

That's like going to the doctors office and saying, "Write me a scrip". It won't happen. That is not how medicine is practiced or how financial planning is done.  It is always amazing how stock market tops attract so many investor dollars. Just when things are at their riskiest point flows of funds into stocks skyrockets. We convince ourselves that the part will last forever and we hate being left out. The flip side is the head scratcher of a down market, where no one wants to buy even though prices are marked down 10%, 25% or even 50% on rare occasions. If this were a department store the aisle would be overflowing with bargain hunters. Yet when it comes to investments no one wants to shop the markdown rack. If you are feeling confident you should stop and think deeply about why. If you are feeling scared, then it is likely time to go shopping.

Why is it when we get stuck in traffic the other lane always seems to be moving faster? It is sometimes like that with investments we own. Ours is merely creeping while the other guy’s is moving right along…until we switch lanes. Then we seem to be stuck again in the wrong lane  Sometimes I get a question about investing in gold. Usually it is after a tumultuous time in the stock market or a geopolitical crisis de jour. But thinking of gold as an investment to my mind is wrong. Gold is not an investment it is something to speculate in. An investment grows apart from any need for price appreciation, although price appreciation is often a consequence of a good investment. An investment might pay you interest or dividends. Gold does neither. An investment could be converted into an income stream at some future date, like your house if you were to rent it out. Gold cannot be converted to an income stream. The only thing positive about gold is the hope that someday someone else will pay you more for it than you purchased it for. Maybe, Maybe not. In the meantime, you have to store gold in a secure location, which will likely cost your money. The difference in the bid (what someone will pay you for your gold) and the ask (what someone will be willing to sell their gold to you for) can be substantial for small investors. Most small investors are better off owning a bind or CD that will pay them income or a common stock of a company that is growing and will one day pay a dividend or generate rising net income to justify a higher market price. Warren Buffet, the legendary investor, had this to say about gold. “"I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side…Now for that same cube of gold, it would be worth at today's market prices about $7 trillion – that's probably about a third of the value of all the stocks in the United States…For $7 trillion…you could have all the farmland in the United States, you could have about seven Exxon Mobils and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67 foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I'll take the farmland and the Exxon Mobils." If you read any of the financial press aimed at the individual investor you have likely run across the active investor passive investor debate. The majority of financial writers today will lead you to think that you should be very passive in your investment approach, buy an index fund and never sell. If you are in the mutual fund business, you want to convince investors to pay for your fund managers expertise, so you advocate an approach that is active in seeking opportunities in the markets.

Each side would have you believe theirs is the only way to go and that charlatans and quacks make up the other side. Maybe neither side is right. After all they are trying to prove a future event and that is impossible. Perhaps you might want to take a passively active approach. Select a portfolio of companies you believe will provide superior return over the long run and hold on to those companies through thick and thin for a very long time. That is what Warren Buffet does after all. Or maybe you should consider being actively passive as your strategy. That would be like buying a diversified portfolio of exchange traded index funds and rebalancing them periodically or maybe even adjusting the portfolio weightings to reflect anticipated changes in world economics. Sometimes you might overweight growth and other times overweight value, or dozens of variations in themes while always remaining fully invested in various indices. Investing is not a black or white affair. It is a continuum of choices. Find what works for you and stick to it. If you have known someone who suffered a heart attack and survived you might also have witnessed a quick lifestyle change in the survivor. Diet improves remarkably, even couch potatoes suddenly become more active. In general the Heath choices of the survivors improve markedly.

That is usually how it happens with money too. We experience the financial equivalent of a heart attack before we are jolted into making wise choices with our money. Surely an ounce of prevention is worth a pound of cure in financial matters as well as in health matters A volatile stock market closed 2015 with a small loss of 0.70% on the S&P 500 index and 1.0% for the Dow. The US Dollar gained about 9% against other major currencies resulting in a 1% loss in the EFA Index for dollar denominated investors.

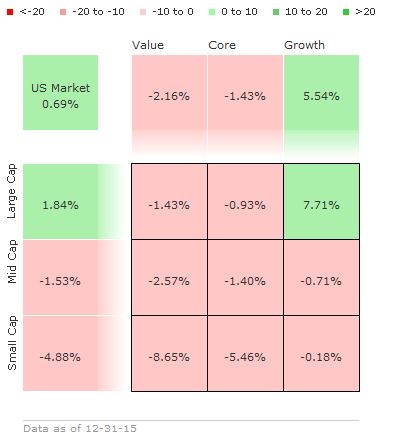

The Federal Reserve finally began raising rates at the end of 2015. The Barclays Aggregate Bond Index ended 2015 with a small 0.48% gain for the year. Yet trouble in the oil patch resulted in a 4.47% loss in the High Yield Index and a 0.77% loss for the Corporate Credit Bond Index. As the Morningstar Stock Heat Map shows Large Cap Growth stocks were the only bright spot for 2015. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed