|

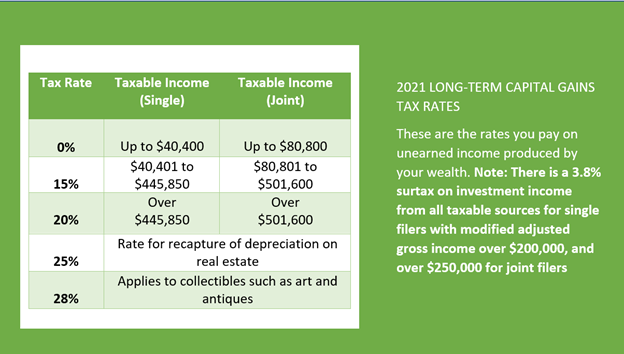

Recently, a report by Propublica revealed that the richest Americans do not pay federal income tax at nearly the same rate average Americans do. How does this happen? What legal pathways do these ultra-wealthy Americans take advantage of to ultimately pay so little in taxes? These are the questions many ordinary Americans are asking. This works because the United States tax code favors wealth over work. The highest capital gains rate is the 28%, that is assessed on collectibles. Because the majority of wealth in America is created by owning or investing in businesses, a capital gains rate of 23.8% is what most wealthy Americans pay on most of their income, 20% capital gains rate and a 3.8% surcharge for gains over $250,000. Qualified dividends are taxed at capital gains rates, so, yes, all the dividends Bill Gates receives are only taxed at 23.8%. For a working class American, the marginal income tax rate on $250,000 is 24%, for married filers, not including Medicare taxes of 1.45% and another 6.2% in Social Security taxes on the first $142,800 of earned income. If you have earned income of over $628,300 as a married filer, your marginal income tax rate jumps to 40.3%. That is 69% more than the top rate for long-term capital gains on stock investments.

Or even better, if you are like Jeff Bezos, and own a lot of shares of a high growth company, why pay any taxes at all. You can borrow against the stock you own (margin) at less than a 1% interest rate, use the investment interest expense to offset some other income (for being CEO), and as long as your stock appreciates more than the 1% each year, you never have to sell, never have to realize a gain, and never have to pay any income taxes. Plus, when your kids inherit the stock from you, they get a stepped-up cost basis that can reduce their taxes on any sales to zero. The ultra-wealthy can afford to hire some of the best advisors in the world to help them use these and many other tricks to minimize their income tax liability. For regular folks like you and me, smart tax planning is required to build wealth in the first place. If you want to learn strategies you can use to minimize your income taxes and grow your wealth faster, then download a free copy of our “Tax Planning Basics” e-book. It is full of things you can do to keep more of what you earn. Things like asset location, Roth IRA conversion strategies, and income shifting strategies. It’s not an army of accountants, but it’s a start. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed