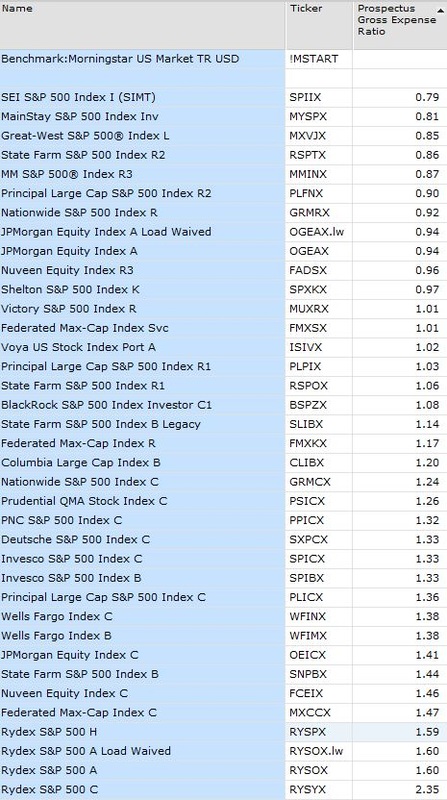

This is a real phone call. Caller: Can you help develop residual income? Make the right investments etc.? Me: Sure, but first you need to develop a plan so we will know what steps to take to reach your long term financial goals. Caller: Well, I wasn’t sure if I have enough money to work with your firm. Me: Well if you look at our web site, you’ll see we offer a Fiscal Checkup™ to get you started in the right direction at a minimal cost. We want to help you grow into a very good client. Caller: I’m not sure. What kinds of investments can I make? Me: Look, investments are neither good nor bad. What matters is that they help you reach your long term goals. You need to know where you’re going before we can talk about investments. How old are you? Caller: I’m 33. Me: I guess you have a job? Caller: Yes, I work at xxxxx Me: Do you have a 401k? Caller: Yes Me: Have you maxed out your contributions to your 401k plan? Caller: No. Me: Well at least you are contributing enough to get all the matching funds, right? Caller: No. Me: Well that’s someplace to start. Caller: Look I know I should be contributing more to my 401k to capture that free money. Me: And yet you are not doing it. Caller: Yeah Me: You have a wife and two kids. Do you have life insurance? Caller: Yeah, I get all that through work. Me: Do you know if it’s enough? Caller: I have $300,000 of protection. Me: Well that will replace about $15,000 of income. Do you make more than $15,000 a year? Caller: Oh yes! I got enough to pay off the mortgage. Me: Wow, two kids, college, that is not enough. How about your 401k plan? How did you choose those investments? Caller: Just a guess. Me: You know college is expensive. How do you plan to pay for that? Caller: I guess I’ll just have to tell the kids they are on their own there. Okay, you should be able to see where this is going. Most of the people I work with do not have a plan when they begin working with me. They call thinking this is about investments. It is not! It is about achieving the important financial goals in your life. It is about identifying your needs, prioritizing those needs, and developing a strategy to meet those needs. Investing comes in at the very end. Many younger people need financial coaching to help them pay off debts, develop a budget, learn to save, understand their employee benefits, and protect their family. They really don’t need “investments”. If you see yourself here, I encourage you to seek help. Sure there are financial firms that don’t care about planning and will be happy to sell you an investment and there are firms that have high minimums to open an account, but there are also firms that believe in growing their own great clients who will be happy to help you get started the right way. Find one that will help you!  Where do you draw the line for ethical behavior and corporate greed? This weekend I saw an online article about expense ratios and index funds that claimed there were funds that do nothing more than track the S&P 500 Index, yet charge investors fees greater than 1% to do so. I have a license for the Morningstar database so I checked for myself today. I was amazed. A scan for S&P tracking funds returned 160 funds, now Morningstar counts each share class as a separate fund so the real number is a bit less, but the spread of gross prospectus expense ratios was eye opening. The expense ratios ranged from a low of .01% (that is one basis point) for the Vanguard 500 Index Institutional Select to a high of 2.35% for the Rydex S&P 500 Class C share. Now you should know that managing an index fund is a no brainer. The stocks you own should be the same stock in the same weightings as the index that is published by Standard and Poor. It should be easy enough for a computer program to handle without much human input. And other than expenses all these funds are the same. It is a commodity and one index fund should logically be a perfect replacement for any other index fund, just as one bushel of wheat should be a perfect replacement for any other bushel of wheat. So how can Rydex justify those charges? And although Rydex is the most expensive I see Nuveen Equity Index C at 1.46% State Farm S&P 500 Index B at 1.44%, Wells Fargo Index B at 1.38%. This is nuts. If you own any of these funds you should fire your broker. The SPY SPDR S&P 500 Exchange Traded Fund is available for all brokerage firms to purchase and has a gross expense ratio of just 0.11% (11 basis points). How can anyone justify paying 10 times that for what should be an identical product? But where do you draw the line? Or is there no line because no one is looking?  “If Johnny jumped off a bridge would you jump too?”, said every mother ever. Just shows how pervasive the herding or follow the crowd instinct is. Like bison on the prairie we seem to move as a herd. While there is safety in numbers, sometimes the herd mentality is detrimental to us and our finances. Native Americans took advantage of the herd mentality by starting a stampede among the herd of bison and driving them off a cliff as the herd panicked. So it goes with stock market investors sometimes. We all get spooked and run for the exit at the same time and some of us invariably end up at the bottom of a precipice. Or, just as dangerously, we all sense the opportunity to make a fortune and pile into the same stocks at the same time until, the last fool climbs on board. Then when there are no more fools to jump into the boat it sinks from the weight of the herd. Cognitive biases are mental shortcuts that helped our ancestors survive in a hostile environment. In the modern world these deeply ingrained shortcuts can be dangerous to our financial wellbeing. Although it is impossible to purge your psyche of these biases, if you are aware they exist you have a better chance of overcoming the urges they bring and making more rational and profitable decisions.  If you haven’t heard of Bill Ackman before then good for you! You’re out living your life and are not too plugged into CNBC. Bill Ackman is a hedge fund manager, he is a really smart guy and made a lot of money for his investors…until recently. His big bet on pharmaceutical company Valeant has become an epic fail, with the stock price cratering from a high of $261 in August of 2015 to around $34 per share less than a year later. That is shedding over 85% of the company’s value. So how can such a smart guy turn so wrong so fast? And, what can individual investors learn from Mr. Ackman’s fail? 1) Don’t own enough of any one thing that you can make a killing or be killed by it. Diversification is the investor’s best friend. You do not have to be a stock picking genius like Bill Ackman to grow your wealth, you just need to have a properly diversified portfolio that you can stick with through thick and thin. The magic of compound interest and the inexorable march of the stock market will do the rest. 2) Don’t announce to the world that you own stock in a company that you see as a big winner. Bill Ackman was often in the financial media, talking up the positives of Valeant. Maybe it started by Ackman being a little greedy and talking up a holding, but over time it seems to have morphed into a story he believed. If you publicly say XYZ is the best thing since sliced bread, you will paint yourself into a corner of having to admit you were wrong if things don’t work out, and people hate to admit they were wrong about anything! So Bill sees that Valiant stock is cratering, but rather than admit to being wrong he stubbornly refused to sell until most of his money has disappeared. From here it will take a gain of over 600% for him to get back to a valuation equal to the August of 2015 level. How many years of stellar returns does it take to gain over 600%? Not even Bill Ackman is that good. 3) Don’t invest in companies that are built on shady dealings. Like the banks that derive too much of their profit from the fees they charge their small customers, Valeant Pharmaceuticals didn’t have a legitimate economic model. They bought companies and drug rights with the sole intent of price gouging their customers. If they would do that are you really surprised they would cook their books too? Companies that understand they are also citizens of the places they do business tend to build the best business model for the long run. Companies that are shady like the Pharma Bro i.e. Enron, Lehman Brothers, Arthur Anderson, eventually are rewarded appropriately for their behavior. There are too many good companies available to choose one built on cheating. Sorry, Bill Ackman. We are only human.  I’m not one to pay buckets of money for custom tailored clothing. Just like many of you, I go to a store, pick out my general size and buy the nearest fitting clothes available. I would enjoy having my shoulders, waist, neck etc. measured to the quarter inch, then have my clothes fit perfectly, but that just isn’t practical in my mind. However, when it comes to investing, you should always have a plan tailored to your lifestyle and financial standing. While any vehicle could fit you, it may not be appropriate for you. Age, health, income, lifestyle, and risk appetite are some of the many factors that determine how you should invest. There are rarely situations where a single investment is appropriate for a wide range of demographics. Unlike that large sweatshirt that virtually anyone can throw on, investment vehicles are not one size fits all. It takes meticulous understanding and measuring of each individual’s unique situation to find the most fitting investments. So when it comes to your investments, make sure you’re not just following this quarter's fashionable trends and investing in a one-size-fits-all vehicle. Talk to an advisor who will take into account all the various factors of your situation and then tailor a plan that fits you perfectly.  If it seems too good to be true, then it probably is. Don’t be fooled by get rich quick schemes. Don’t be fooled by over optimistic return on investment pitches. Don’t make an uneducated commitment to a little known product or fund that promises too much too fast. Don’t be pushed around by salesmen who throw incomprehensible products and jargon at you. Make smart, thoughtful, and rational financial decisions. Talk with an advisor who shoots it straight, understands your unique situation, and tailors a strategy completely around your needs- not a product’s characteristics. Don’t be fooled today, or any other day out of the year when it comes to your money. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed