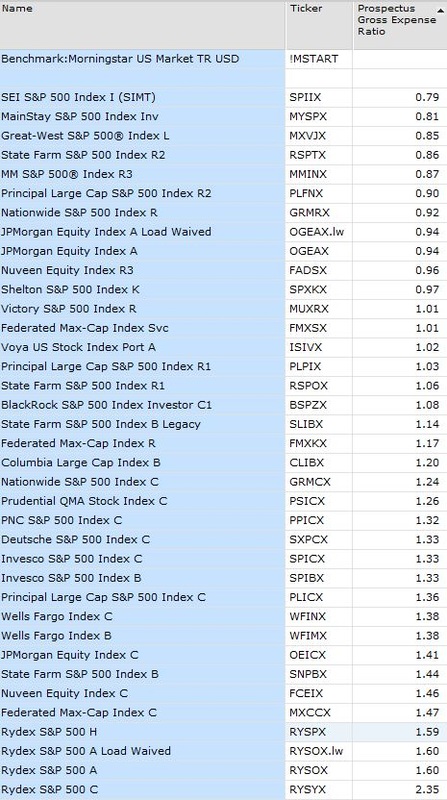

Where do you draw the line for ethical behavior and corporate greed? This weekend I saw an online article about expense ratios and index funds that claimed there were funds that do nothing more than track the S&P 500 Index, yet charge investors fees greater than 1% to do so. I have a license for the Morningstar database so I checked for myself today. I was amazed. A scan for S&P tracking funds returned 160 funds, now Morningstar counts each share class as a separate fund so the real number is a bit less, but the spread of gross prospectus expense ratios was eye opening. The expense ratios ranged from a low of .01% (that is one basis point) for the Vanguard 500 Index Institutional Select to a high of 2.35% for the Rydex S&P 500 Class C share. Now you should know that managing an index fund is a no brainer. The stocks you own should be the same stock in the same weightings as the index that is published by Standard and Poor. It should be easy enough for a computer program to handle without much human input. And other than expenses all these funds are the same. It is a commodity and one index fund should logically be a perfect replacement for any other index fund, just as one bushel of wheat should be a perfect replacement for any other bushel of wheat. So how can Rydex justify those charges? And although Rydex is the most expensive I see Nuveen Equity Index C at 1.46% State Farm S&P 500 Index B at 1.44%, Wells Fargo Index B at 1.38%. This is nuts. If you own any of these funds you should fire your broker. The SPY SPDR S&P 500 Exchange Traded Fund is available for all brokerage firms to purchase and has a gross expense ratio of just 0.11% (11 basis points). How can anyone justify paying 10 times that for what should be an identical product? But where do you draw the line? Or is there no line because no one is looking? Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed