|

Not sure how to choose a financial advisor? It’s a big decision! Our guide on how to find a good CERTIFIED FINANCIAL PLANNER™ practitioner can help you ask the right questions and select someone able to help you reach your personal financial goals and find financial freedom. Do You Need a Financial Advisor?Depending upon where you are in your life, you may not have spent much time thinking about your financial future. NOW is always the best time to start! Finding a financial planner can help you focus on personal financial goals, like buying a new home, saving for a child’s college education, or retiring at a certain age. And if you have recently received a significant pay raise, come into an inheritance or trust, or need help with tax planning, a financial advisor can help you leverage and maximize those assets. Do You Need a New Financial Advisor?Have you started to wonder if your current financial advisor is right for you? Most financial advisors receive a significant portion of their pay in commissions. When they recommend that you purchase shares of stock or mutual funds from a broker, they receive a portion of the proceeds of that sale in return. They can also make money through mark-ups of bonds, CDs, or new stock issues through a broker. And because advisors paid in by commission make the most money when you purchase financial products, they may be tempted to recommend buying things you do not really need. And their interest in your financial wellbeing may not extend beyond that sale. Many financial advisors do not assist with 529 savings plans, employer benefits packages, healthcare options, or estate planning, all critical components of a good financial plan. If you have started to wonder if your current financial advisor is truly looking out for your best interests, it is time to look for a fee-only financial advisor. What is Fee-Only Financial Advising?Fee-only is a better way to get smart financial advice you can trust. Fee-only financial advisors never make money from commissions or mark-ups. We are only paid by you to give advice that we believe will work best for you. You will never need to second-guess our motives, suggestions, or strategies. You will always know that your financial future is our highest priority. Fee-only financial advisors must meet a very strict professional fiduciary standard. Fee-only financial advisors must become Registered Investment Advisors and meet the highest fiduciary standard, while other financial advisors are held to a lower suitability standard. To be sure you are working with the best and that your financial advisor has only your best interests at heart, choose a fee-only Certified Financial Planner™ Practitioner (CFP®). Research a Financial AdvisorWord of mouth can be a great way to find a financial advisor. Asking your friends, relatives, and coworkers if they have a financial advisor they trust and would recommend can be a great place to start. Online research can also help you find and look into your options. Whenever you are given or find a name, take a moment to look them up on the broker check tools maintained by the Security and Exchange Commission or FINRA. And don’t stop with the broker name! Make sure you also plug in their firm’s name. If the firm has multiple infractions that may be an indication of poor corporate culture. What to Know Before Meeting with a Financial Advisor

Questions to Ask Your Financial Advisor

Selecting a Financial AdvisorFinding a financial planner lets you start the exciting and rewarding process of creating a financial plan calibrated just for you and your personal financial goals. Abstract ideas become an action plan. You have specific instructions and ways to mark your progress. You know how to ask for help and when to ask for changes or adjustments. And you can finally see the big picture—not only where you are today, but where you want to go.

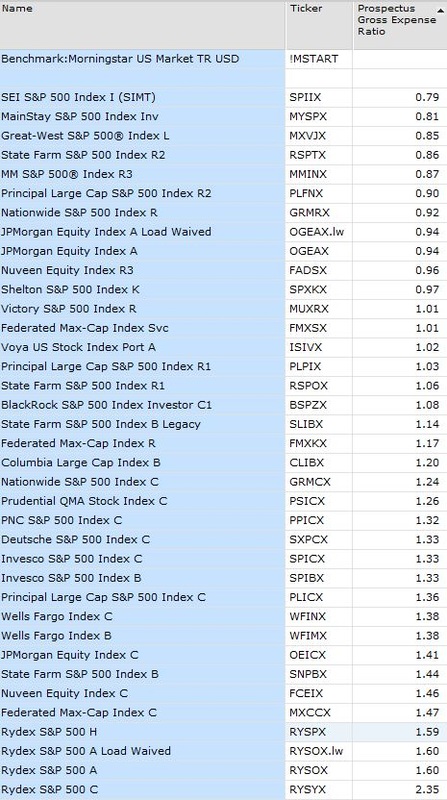

The Department of Labor’s fiduciary rule has died in the courtroom. The Insured Retirement Institute and the Securities Industry and Financial Markets Association along with the Chamber of Commerce brought suit to protect the financial service companies who would prefer not to act as your fiduciary partner. After a three-judge panel ruled the DOL had exceeded their authority the DOL chose not to appeal the ruling. Despite 17 states and the AARP’s pleas to be allowed to continue the case the 5th circuit court denied their request, leaving investors once again on their own to determine who they can trust with their life savings. To make matters worse, the SEC has proposed new rules that provides cover to those not willing to act as a fiduciary. They call it the “Regulation” Best Interest rule. Best interest sounds much like fiduciary to most folks, but as with many things written by attorneys it might not mean what you think it means. While the Regulation Best Interest is an improvement over the suitability standard, the name alone is deceptive. Unlike the fiduciary standard that has a long history of common law and case law definition, ‘best interest’ is undefined and subject to future court rulings to grow the teeth needed to provide needed protections. The SEC proposal also requires both brokers and advisors to provide a four-page disclosure document to help define how they will behave in the client relationship. It seems to me a simple check a box form would be clearer and simpler for all parties. One box would say, “yes, I will always act as a fiduciary in our relationship” and the other would simply say “No, I will not act as a fiduciary at all times”. A rose is a rose is a rose, unless we are talking about your retirement nest egg, then it’s more “buyer beware”.  Here are the people who do not think advisors should be held to a fiduciary standard: SIFMA – Securities Industry and Financial Markets Association. View their members here. FSI – Financial Service Institute. FSI is comprised of financial advisor members and broker-dealers. You can learn more about this group here. IRI – Insured Retirement Institute. IRI is the only association that represents the entire supply chain of insured retirement strategies (read annuities). On the web at http://www.irionline.org/home Financial Services Roundtable - FSR members include the leading banking, insurance, asset management, finance and credit card companies in America. You can view their membership here. Like the meatpacking industry depicted in Upton Sinclair’s novel The Jungle, these trade associations would have your retirement left open to Wall Street greed rather than cleaned up with the financial services version of the Meat Inspection Act. They believe putting you, the client’s interest first would not be a good idea. Hmm...  Where do you draw the line for ethical behavior and corporate greed? This weekend I saw an online article about expense ratios and index funds that claimed there were funds that do nothing more than track the S&P 500 Index, yet charge investors fees greater than 1% to do so. I have a license for the Morningstar database so I checked for myself today. I was amazed. A scan for S&P tracking funds returned 160 funds, now Morningstar counts each share class as a separate fund so the real number is a bit less, but the spread of gross prospectus expense ratios was eye opening. The expense ratios ranged from a low of .01% (that is one basis point) for the Vanguard 500 Index Institutional Select to a high of 2.35% for the Rydex S&P 500 Class C share. Now you should know that managing an index fund is a no brainer. The stocks you own should be the same stock in the same weightings as the index that is published by Standard and Poor. It should be easy enough for a computer program to handle without much human input. And other than expenses all these funds are the same. It is a commodity and one index fund should logically be a perfect replacement for any other index fund, just as one bushel of wheat should be a perfect replacement for any other bushel of wheat. So how can Rydex justify those charges? And although Rydex is the most expensive I see Nuveen Equity Index C at 1.46% State Farm S&P 500 Index B at 1.44%, Wells Fargo Index B at 1.38%. This is nuts. If you own any of these funds you should fire your broker. The SPY SPDR S&P 500 Exchange Traded Fund is available for all brokerage firms to purchase and has a gross expense ratio of just 0.11% (11 basis points). How can anyone justify paying 10 times that for what should be an identical product? But where do you draw the line? Or is there no line because no one is looking? NAPFA - the National Association of Personal Financial Advisors has a straightforward look at accepting the mantle of a fiduciary advisor. This pledge applies to all members. How about your advisor?

The advisor shall exercise his/her best efforts to act in good faith and in the best interests of the client. The advisor shall provide written disclosure to the client prior to the engagement of the advisor, and thereafter throughout the term of the engagement, of any conflicts of interest, which will or reasonably may compromise the impartiality or independence of the advisor. The advisor, or any party in which the advisor has a financial interest, does not receive any compensation or other remuneration that is contingent on any client's purchase or sale of a financial product. The advisor does not receive a fee or other compensation from another party based on the referral of a client or the client's business. Following the NAPFA Fiduciary Oath means I shall: * Always act in good faith and with candor. * Be proactive in disclosing any conflicts of interest that may impact a client. * Not accept any referral fees or compensation contingent upon the purchase or sale of a financial product. Signed this _____ of ________________ ________________________________ NAPFA-Registered Financial Advisor Seldom have I read a blog post that I wish I could share with the entire world, but Tara Siegel Bernard, writing on 'Bucks' over at the New York Times just laid one down that I have to share with you. Her post titled 'Will You Be My Fiduciary' and the article that she wrote to go along with it deserve your attention. Tara posts a simple fiduciary pledge that you can at least use to start an important conversation with your advisor. While many wont sign it and some have legitimate reasons for not signing, it gives you a chance to learn why and have a hard conversation about what is in your best interests. I've posted the pledge below, but please read Tara's entire post here.

The Fiduciary Pledge I, the undersigned, pledge to exercise my best efforts to always act in good faith and in the best interests of my client, _______, and will act as a fiduciary. I will provide written disclosure, in advance, of any conflicts of interest, which could reasonably compromise the impartiality of my advice. Moreover, in advance, I will disclose any and all fees I will receive as a result of this transaction and I will disclose any and all fees I pay to others for referring this client transaction to me. This pledge covers all services provided. X________________________________ Date______________________________ |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed