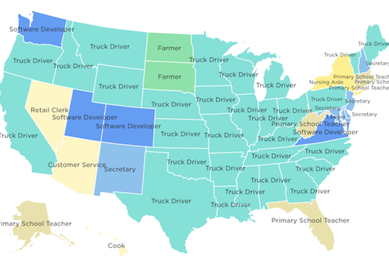

This image shows the damage that can be done to employees when new technology transforms the way work is done. Self driving vehicles are coming. We are not there yet, but five years ago a self driving car wasn't even a thing. The most common job in America, the truck driver, is about to go the way of the horse and buggy. Yes there will be new jobs created servicing and manufacturing these new self driving vehicles, but the skill set needed for those jobs do not intersect with the skill set of a truck driver. And along with the truck driver, what happens to the waitresses and cooks at truck stops across America? What happens to the landlords who lease the buildings for the truck stop? What happens to the CB radio manufacturer? Technology is wonderful, globalization is wonderful in the long run, but society must find a way to ease the economic pain of those displaced by technology or geography in the short run.  It was about three weeks ago, June 23rd to be exact, that the fears of the Brexit flooded the markets and it seemed as if everything was going down, way down. Now look at what has come to fruition over the past two weeks. Almost all global markets are trending upwards, especially the US markets, which have seen the Dow Jones and S&P 500 hit record intraday highs over the past 2 days alone. Throughout all of this chaotic market volatility, we come back to the same recurring theme. Yes, markets will go down, yes, markets will go up. Both sides of this coin are unpredictable, so we look again towards the long run where the markets have continuously trended up over time. When another scare comes around, stand firm, and if you can't, reach out to an advisor who will help you do so.  I turned on CNBC this morning to the news that the Brits had voted to leave the EU. The S&P futures showed a loss of nearly 4%. The British Pound dropping by nearly 8%. The announcers are interviewing anyone that will talk about the doom to come. In other words the sky is falling...again. Except that it is not. This is another example of the crisis du jour that causes too many investors to think like day traders. The long term effects may be substantial, but they will not be deadly. The markets will fall today, but they will not go to zero. If anything, this will be a chance to buy some stocks for long term gain. Remember, the price of the permanent ups of the stock market are these short term downs.  Stealing a page from Elliott Management, the $27 billion hedge fund founded by Paul E. Singer, who successfully sued Argentina for payment of defaulted bond issues, other hedge fund managers have been buying distressed Puerto Rican debt hoping for a similar payout. The strategy works like this: Puerto Rico is known to be in dire financial straits. With the tax free debt of this US territory trading at large discounts hedge funds have been buying these bonds in the secondary market and hoping to convince congress to bail out Puerto Rico. Essentially they want the U.S. taxpayers to pay the full price for the bonds they bought for pennies on the dollar. Fortunately, legislation has just passed out of a house committee that would set up an oversight board to restructure Puerto Rican debt. Seeing that their gambit is slipping, the hedgies have resorted to buying ads that protest this restructuring and warning that states like Michigan could be the next to restructure their debt and pay less than 100% of bond obligations. These hedge funds conveniently forget that Puerto Rico is not a state. By remaining quietly in the shadows and using their political contributions to convince your congressional representatives to argue for them, they hope to turn your money into their money by political fiat. CNBC was on in the background, I wasn’t really paying attention, but then I heard it.

“No bear market has ever occurred in the US stock market without a recession” There it was a blinding insight into the obvious. Who was that masked man? I may never know. He was gone before I could focus my attention, but he left behind something so true it forced me to rethink all the fears that market corrections cause. If you want proof then you can follow this link to a chart that is easy to understand. There has been one exception: October of 1987’s infamous Black Monday when the Dow plunged 22% in one day. Could we have another day like that? Maybe, but remember the Dow closed that day at 1,738.74. The Dow closed at 16,102.38 on 9/4/2015. The moral of this story is sometimes we get so caught up in the day to day worries of markets and headlines that the obvious is often overlooked. It’s obvious that equity markets go down. It’s obvious that markets don’t stay down. It’s obvious we are fearful and it’s obvious we should be bold. It’s obvious we should have a long term view of our investments yet it’s obvious we succumb to short term fears. What's up with Greece? It's in the news a lot these days and keeps getting blamed for every dip in the Dow or drop in the Euro. Why is Greece such a big deal?

The easy answer is Greece really isn't that important. It has a population of just over 11 million which is a bit smaller than Pennsylvania. It has GDP of 242 billion making it a little smaller than Louisiana. Greece's biggest exports are refined petroleum, aluminum, electronic equipment, pharmaceutical products, plastics, vegetables, fruits, iron and steel products. None of this makes Greece indispensable to the world economy. The real answer is harder and will require you to learn a little about history and a little about how currencies work. First let's look at a map of Europe pre 1999. It was filled with different currencies including the Franc, the Peso, the Deutschmark, and of course, the Greek Drachma. Back then Greece was one of the poorer Euro countries and had one of the weakest currencies in the region. So currencies act a bit like a governor on a motor, they can slow down or speed up of the economic engine. Take Greece--if the Greeks spend too much money or print too much money, markets would make the Drachma worth less, so to Greeks foreign goods become more expensive. This would naturally cause the Greeks to spend less on imports because they became more expensive, and in turn encouraged Greeks to spend more money at home which created more domestic demand. Now if you were, say, a German, your Deutschmark could buy more stuff made by the Greeks. To a German it was cheaper to buy Greek goods, so they would. This would lead to still higher demand. This flexibility would cause the Greek economy to grow and currencies would then readjust to fit the new situation. But fast forward to 1999, when the Euro is issued as a single continental currency. At first this is great for the Greeks. It artificially gave their 'currency' more buying power. Suddenly those BMWs and Mercedes the Germans made were a little cheaper. So instead of spending money at home, the Greeks sent all their Euros to Germany in exchange for shiny new cars and maybe some beer. It worked well for the Germans too. By making their currency artificially cheap they sold more stuff to the rest of Europe. The German economy picked up steam and German citizens enjoyed low unemployment and rising incomes. But the global credit crunch that began in 2007 exposed chinks in the European currency armor. Because Europe used a single currency, bond investors had considered all bond issuers to be equal. The credit crunch made them reassess this assumption. Well, guess what, the credit quality of Greece wasn't as strong as the credit quality of Germany. Now what? You can't devalue just the Euros in Greece- so how do you rebalance the system? That is the problem with Greece. The single currency nullifies the usual check and balances of free markets. That is why it is such a big deal. Because no one knows the answer. The European Central Bank has made Greece swallow a crapburger of austerity measures meant to keep Greece from spending, just like a currency devaluation would. However, this does nothing to encourage domestic growth or to stimulate exports. The effect is just more pain for the Greek people. With no other answers, the European Central Bank calls for ever more austerity--that won't work. From a Greek perspective leaving the EU, while bad, is no worse than more austerity. If they leave, the Drachma is reborn, and foreign goods are immediately more expensive and domestic goods are more attractive. Market forces take over and eventually things get better for the Greeks. Problem solved. Or is it? If Greece leaves the Euro, that opens the door for others in a similar situation to follow suit. Portugal, Spain, and Italy are all caught in the same sink hole. Will they leave too? Can they afford to stay? If they leave, how long can the Euro last? This could be a huge drag on all the European economies as trade dries up and recessions follow. Even Germany, who has been the primary beneficiary of all this currency wrangling will see its economy shrink as their products quickly become too expensive for others in the region. Politics comes into play too. Greece is already being courted by Russia. Russia has oil production capability while Greece has refining capacity. Putin would love to spread his influence. Can Europe and NATO not be concerned about spreading Russian influence? The only real answer I can see is that Greece defaults in some shape or form. Either they exit the Euro and pay back creditors in devalued currency, while opening the door for future defections, or they stay in the Euro and the other countries bail them out, opening the door for future bailouts of other weak members. Either way, it is not good for Europe or European trading partners. And this is what the heck is going on with Greece and why it matters. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed