|

Many investors love the Federally tax-free income they receive from municipal bonds. Municipal bonds are debt securities issued by state and local governments to fund operations or special projects. Because the income an investor receives is not taxed, the after-tax return of municipal debt is often higher than the after-tax income provided by corporate bonds and bank CDs. For example, the yield on the iShares Core US Aggregate Bond ETF (AGG) currently stands at about 2.3%. For a taxpayer subject to a 22% marginal income tax rate, the after-tax return drops to just 1.8% and is even lower as you climb into higher marginal tax brackets. Compare this to the Vanguard Tax-Exempt Bond Index Fund ETF (VTEB) which yields 2.1% federally income tax free. An often-underappreciated item in the US income tax code deals with qualified dividends. A qualified dividend is a dividend from a common stock or a preferred stock that the filer owns for a specified minimum time period. The beauty of qualified dividends is that they are taxed at the filer's long-term capital gains rate rather than as ordinary income. The following table compares ordinary income rates and long-term capital gains rates for married filing jointly returns for the tax year 2021

*Includes 3.8% net investment income surcharge.

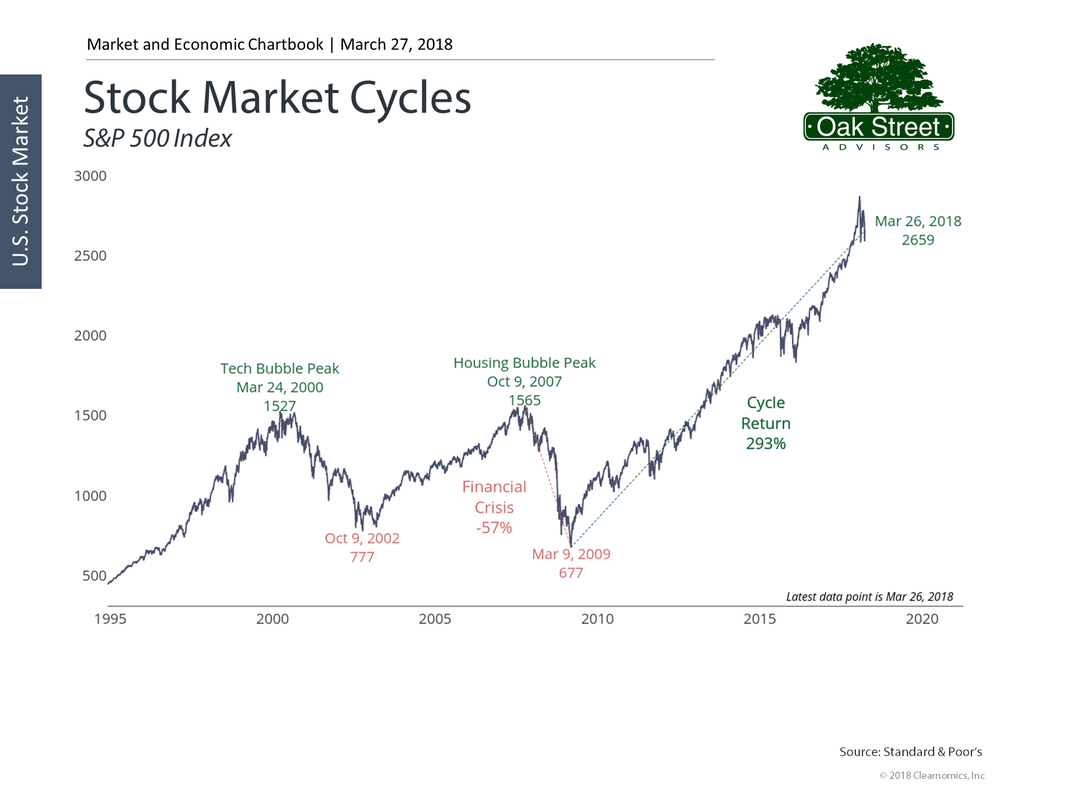

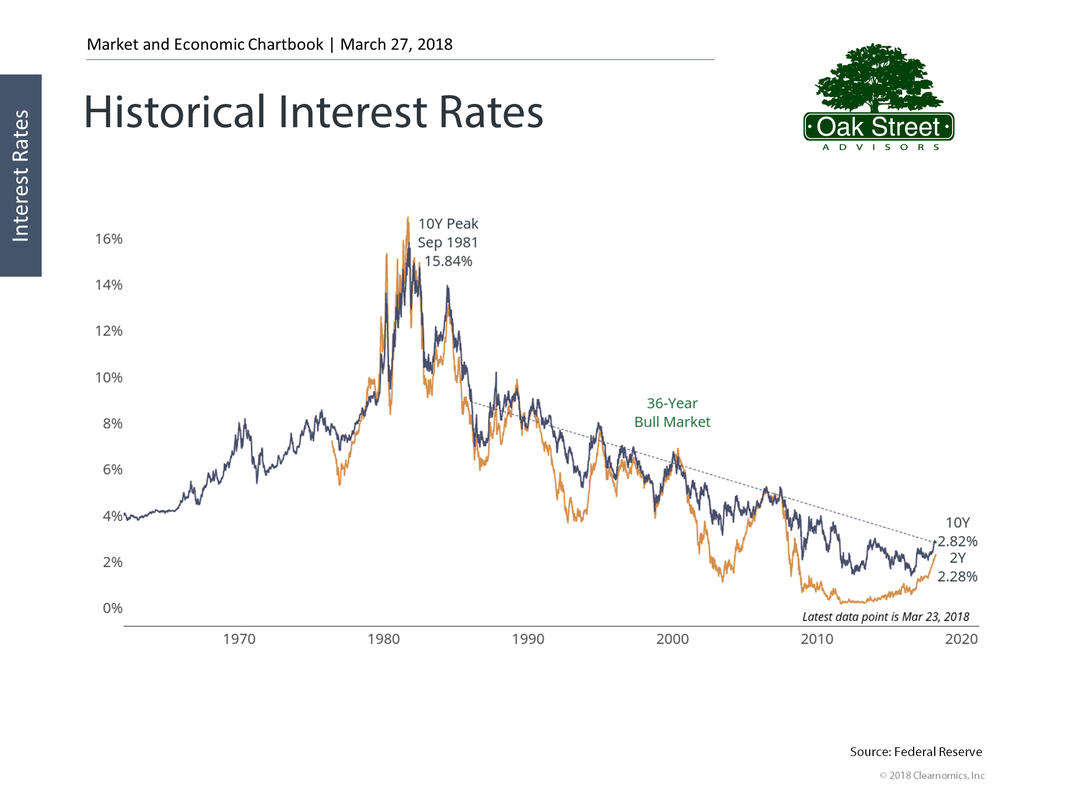

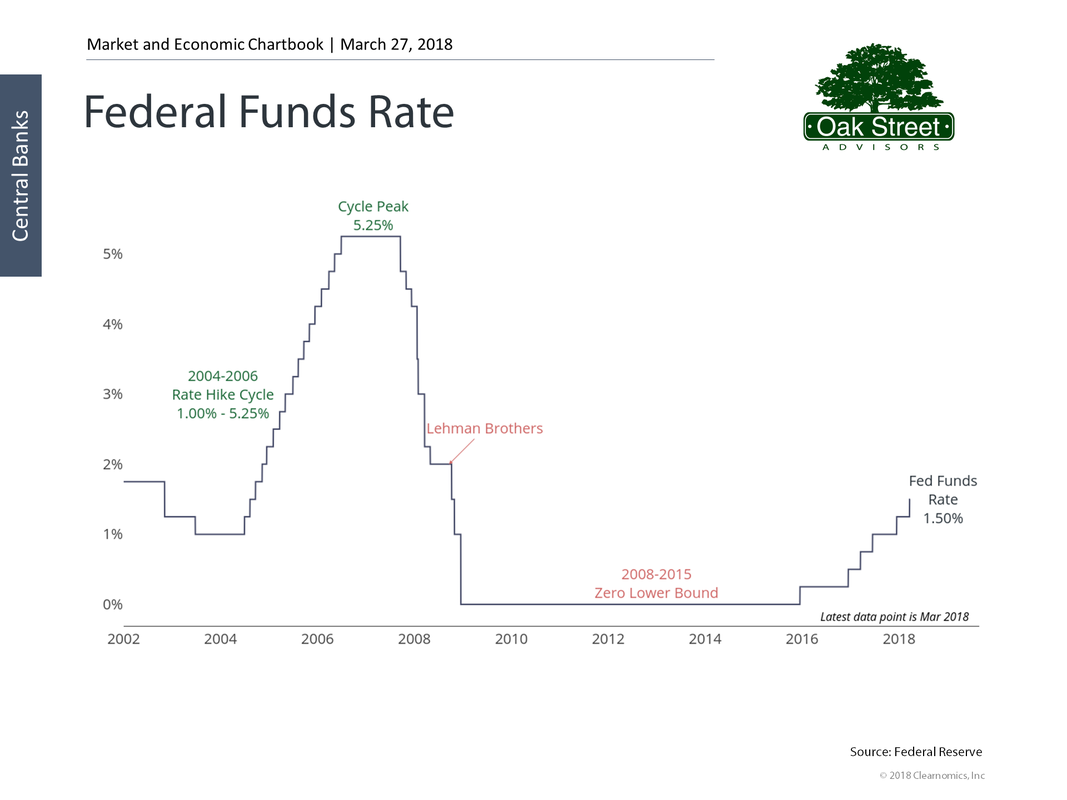

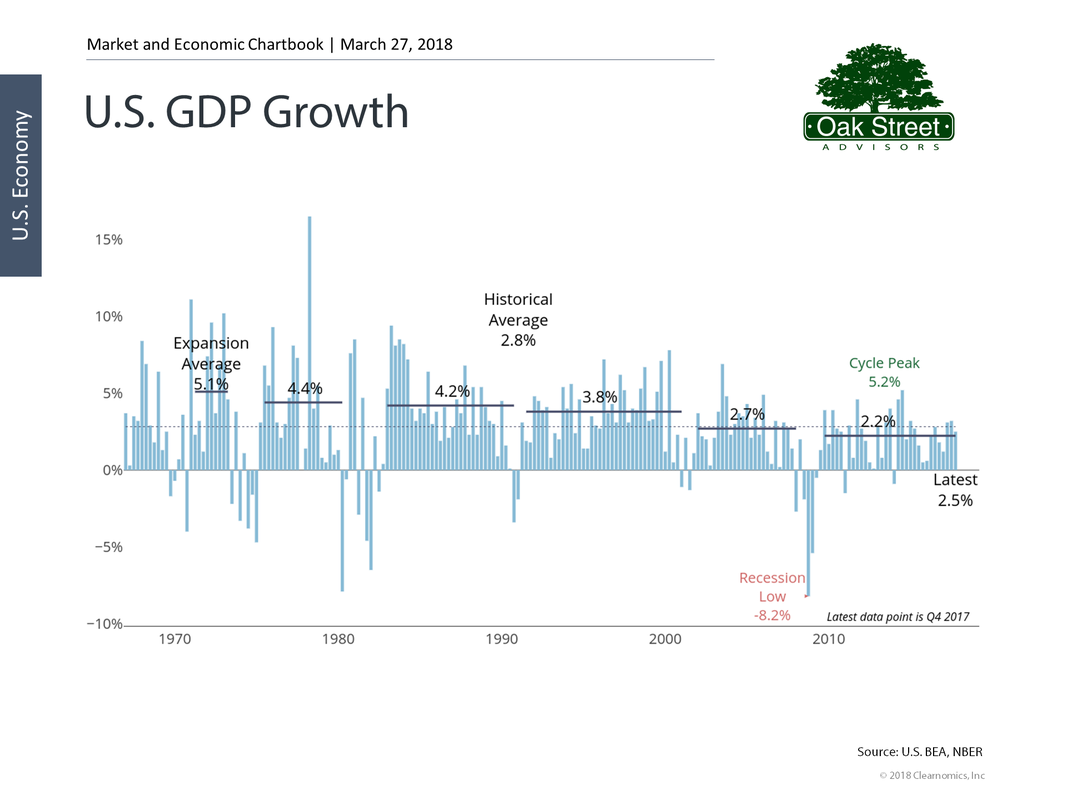

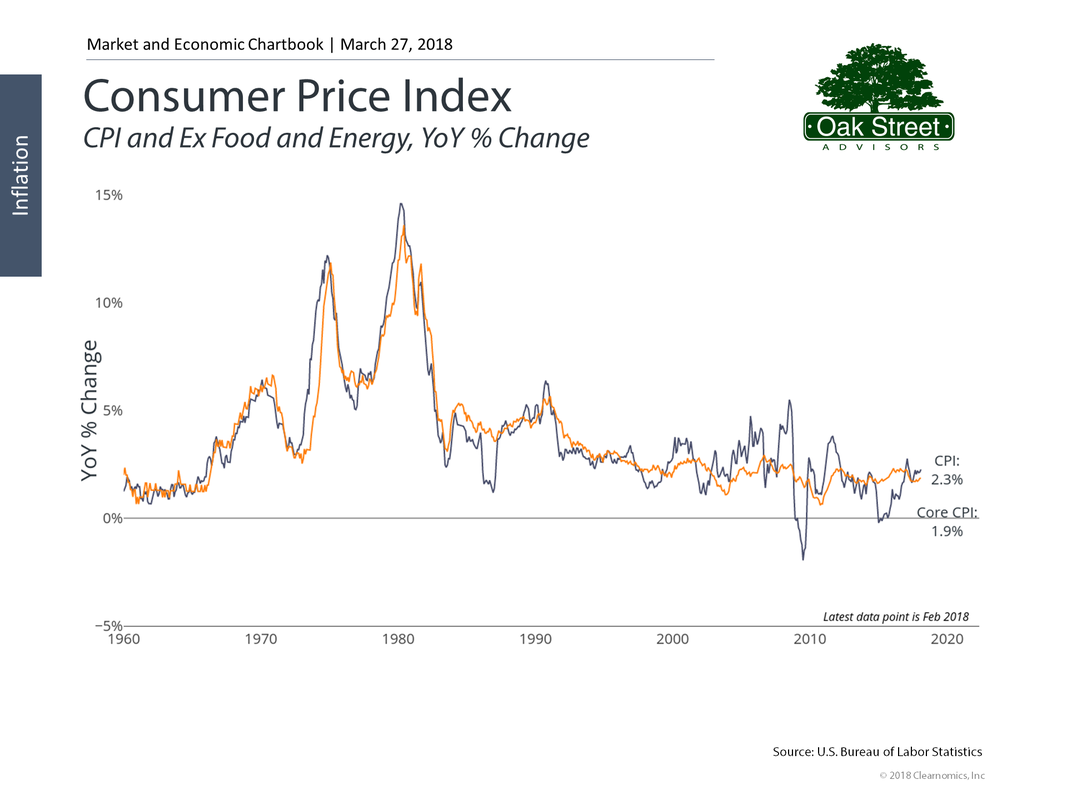

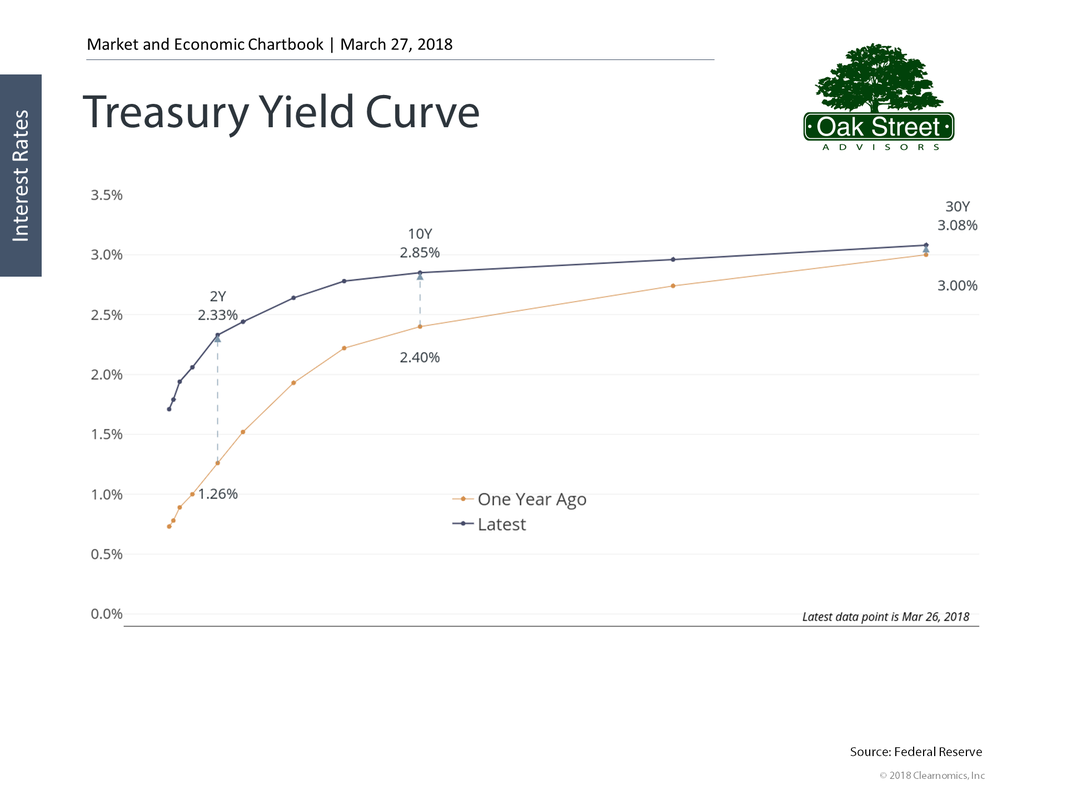

Which brings us to the value of qualified dividend income (QDI). QDI extends to income received from preferred securities. Preferred stocks are debt-like securities issued by corporations that rank below the bond holders-- but above the stockholders-- in the event of a liquidation. The term preferred is used because the dividends on these shares must be paid in preference to dividends paid to common stock shareholders. To learn more about preferred stocks you can view the Wikipedia entry here. The importance of this is the after-tax returns of many preferred securities held long enough to receive QDI tax treatment, are higher than rates generally available in the municipal bond market. Take the Bank of America preferred series A (BAC-PA) for example. This security has a current dividend yield of 5.8%, even at the highest capital gain rate of 20% and add in the 3.8% net investment income surcharge the after-tax net on this income is 4.4% or more than double the tax-free rate of 2.1% from VTEB. There are some details to keep in mind; to qualify for QDI status, the security must be held for 91 days out of the 181-day period, beginning 90 days before the ex-dividend date. Because most preferred securities pay quarterly dividends, you would generally need to make your purchase the day of the preferred trade’s ex-dividend to ensure you receive favorable tax treatment. Also, preferred issues are highly concentrated in the financial and utility sectors of the market which could lead to poor diversification. You could use exchange traded funds (ETFs) like the iShares Preferred and Income Securities ETF (PFF) or an open-end mutual fund like the Nuveen Preferred Securities and Income Fund; but be aware that not all the distributions from funds like these are considered Qualified Dividend Income. Only 62% of the distributions from PFF were eligible for QDI treatment in 2018 and usually about 60% of the Nuveen funds distributions were QDI eligible. Still, for investors concerned with building a tax-efficient portfolio, preferred securities are certainly worth consideration. The popular press is fond of pointing out how old the bull market for stocks is. After bottoming in 2009 we have seen stocks march upward for for nearly a decade. Many of today’s younger investors, say those in their thirties, have seen the stock market fall, but never felt the pain in their own portfolio.  Yet for another class of investor, those who have invested in bonds, the bull market run has been even longer. Going back to the days of President Jimmy Carter in 1981, bond yields have fallen, year after year. Because bond prices move inversely to interest rates, bond prices have been rising for the last 36 years. That means someone who entered the workforce in the early eighties, bond prices have always gone up. For some perspective the Certified Financial Planner Board of Standards was formed in 1985. As a group, CFP® practitioners have never experienced a true bear market in fixed income securities. Although the credit freeze that coincided with the great recession bear market for stocks, had a short, sharp panic in the fixed income markets; a long drawn out bear market for fixed income has been an experience the profession will for the most part find alien. The closest thing to the pain of a bear market in bonds experienced by this group was the 2004 to 2006 Chinese water torture of the Greenspan/Bernanke Fed. During the thirteen months that spanned June of 2005 to July of 2006, the Federal Reserve raised rates 25 basis points every time they met. Although the aggregate bond index only fell in price by about 5%, the constant barrage of interest rate increases was hard to live through. That pain was nothing compared to the Burns/Miller/Volker era where we saw the Fed raise rates from 4.75% in November of 1976 to the 20% Fed Funds rate of May 1981. That was the last true bear market for fixed income products in the United States. Although your grandfather might wistfully talk about getting 18% on his CDs, the path that led to those astronomical rates was littered with bond investors who saw the value of longer term bonds fall by 50% or more. When I hear today’s press ask what will happen if the 10-year Treasury bond breaches 4% I am astonished. It is not a question of if, but a question of when. If we can avoid creating a trade war with the rest of the world, there are some very expansive monetary policies recently enacted by congress and the Trump administration investors can benefit from. The tax overhaul will provide a good measure of impetus to the economy, and the budget bill recently signed into law gets us away from the restrictive spending of the sequestration agreement and into a more expansive government spending era. Yet, the Federal Reserve must walk a fine line between economic growth and containing inflation. GDP growth has entered a more normal territory. Inflation, while still subdued, has shown signs of rebounding. The uptick in inflation is related to a small increase in wage growth, which is in turn related to the continued implosion of our unemployment rate. You also will note a similar uptick in mortgage rates. As investors search for yield in a low rate world, we have seen a compression in the interest rate spreads between high quality bonds and low quality (junk) bonds. With rates as low as they are today and with the economy growing it is inevitable that interest rates will rise. The end of the 36-year bond bull market is likely upon us. A flattish yield curve where the difference in a two-year treasury and a ten-year treasury is a mere 52 basis points, puts bond investors in a peculiar spot where an interest rate increase of just 1% could potentially wipe out three to five years of interest income. The take away from all this is bonds are a minefield for investors today. A small misstep can be very costly and the rewards for investment are very small. Many advisors are ill-prepared for a world of falling bond prices.

Unless you or your advisor are true experts with fixed income investments, your best option in today's environment is to keep your maturities very short. That means you should be selling any bonds or bond mutual funds that have long durations. You should direct those allocations to short term treasuries, certificates of deposit, and bonds in the 1 to 3 year maturity range. Hopefully you will ladder those investments so you have new money available to invest at progressively higher rates throughout this interest rate cycle.  Think Janet Yellen has an easy job? The San Francisco federal reserve has published a web game to let you see how smart you really are. In the game your job is to keep inflation in check and unemployment low by adjusting short term interest rates. The game can help you understand the basics of monetary policy and explore some of the correlations of our economy. It will not present you with the challenges of dealing with government shutdowns, poor tax policies, or financial meltdowns, but it will provide you some entertainment as you learn the basics.  Well, we just had another FedWatch orchestrated by the financial media. Did you miss it. I hope so. The fed did not raise interest rates today in spite of all the speculation by the TV talking heads. I cannot guess the man hours that are wasted pontificating about what the fed should or should not do. If your investment time horizon is Fed meeting to Fed meeting, you are not an investor at all. You are a speculator. Yes, the Fed will likely raise interest rates again at some point. Will it matter? Sure, for about six months. If you expect to live beyond the next six months – keep calm and carry on. Duration has a special meaning in the investment world. It is a measure of interest rate sensitivity in bond portfolios. You can calculate the duration for an individual bond or for a portfolio of individual bonds and you can derive an average duration. Why is this important? Because in a rising rate environment, like the one we are just entering, the duration will give you an idea of how much your principle will decline for a given increase in interest rates.

If your bond portfolio or your bond fund has an average duration of 6 years then you can expect the value of the portfolio to drop by about 6% for every 1% increase in interest rates. The Pimco Total Return Bond Fund with assets of around $246 billion dollars is one of the largest bond mutual funds in the United States. With an average duration of 5.26 years you could expect about a 5% drop in the funds value if interest rates rose by 1 percentage point. Or you could expect a 1.25% drop in value if interest rates rose by just 0.25%. Given that most bond funds have a yield of around 3% you can see that even small changes in interest rates can wipe out months of dividend income. So you should be aware of the duration of any bonds or bond mutual funds you own. Then ask yourself if the risk is worth the reward at this point |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed