|

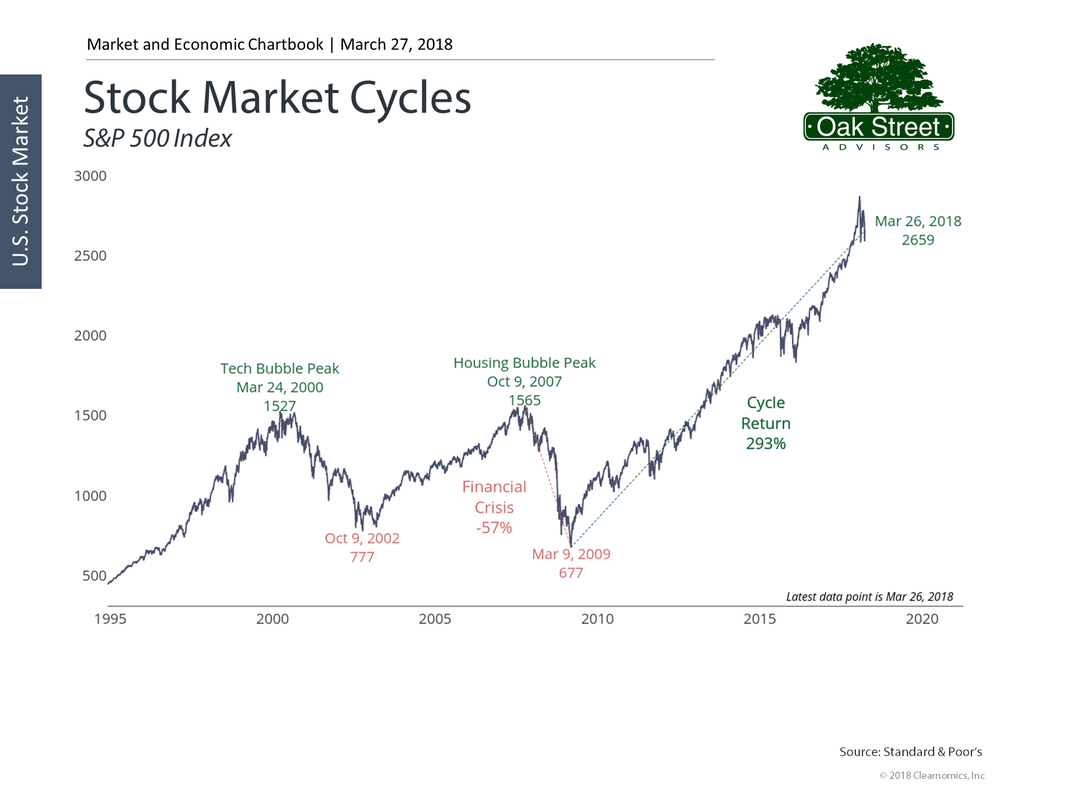

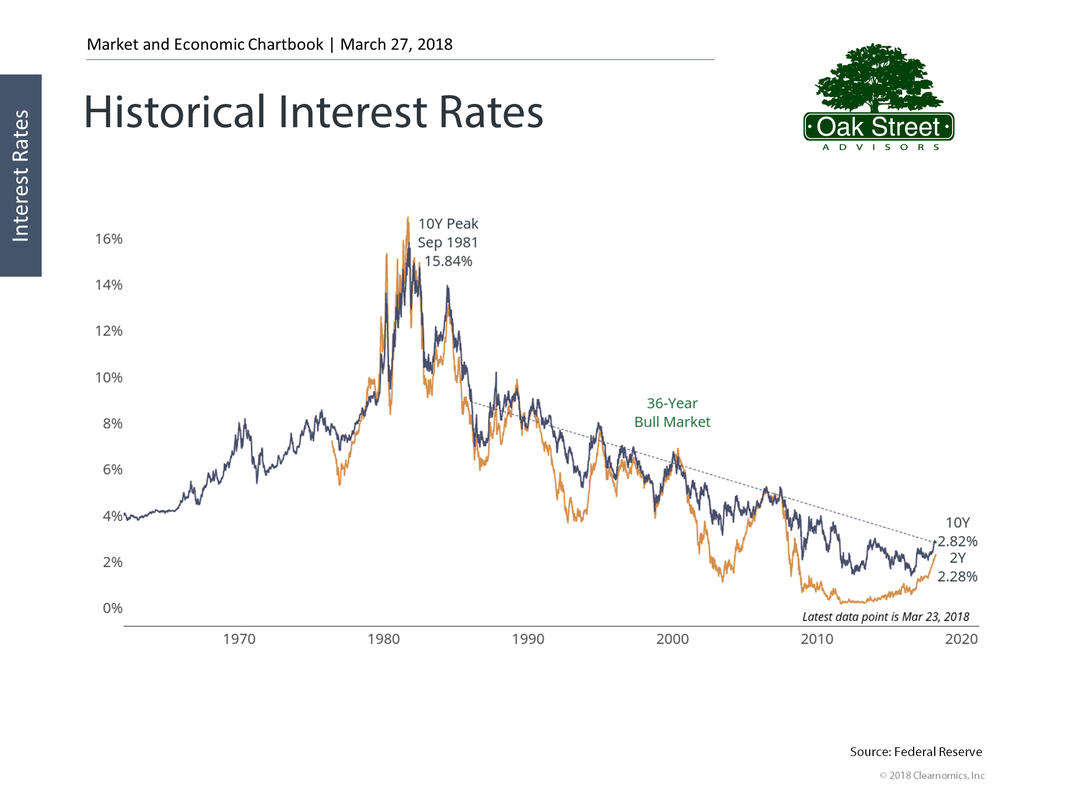

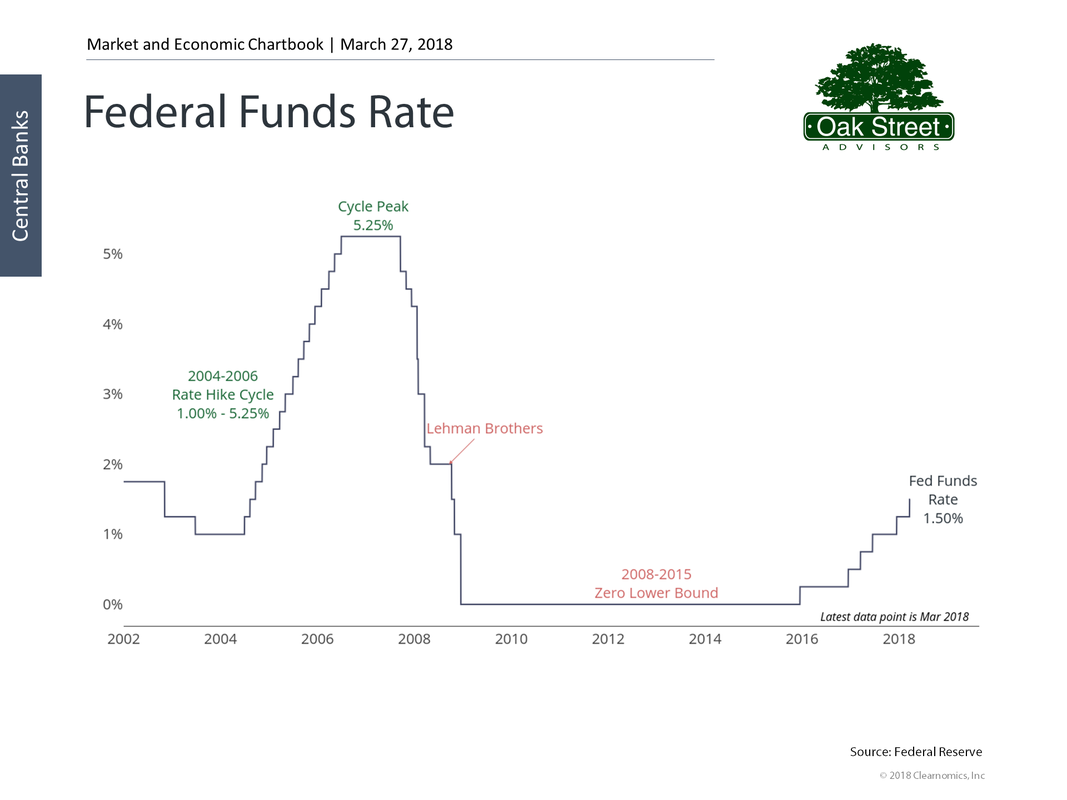

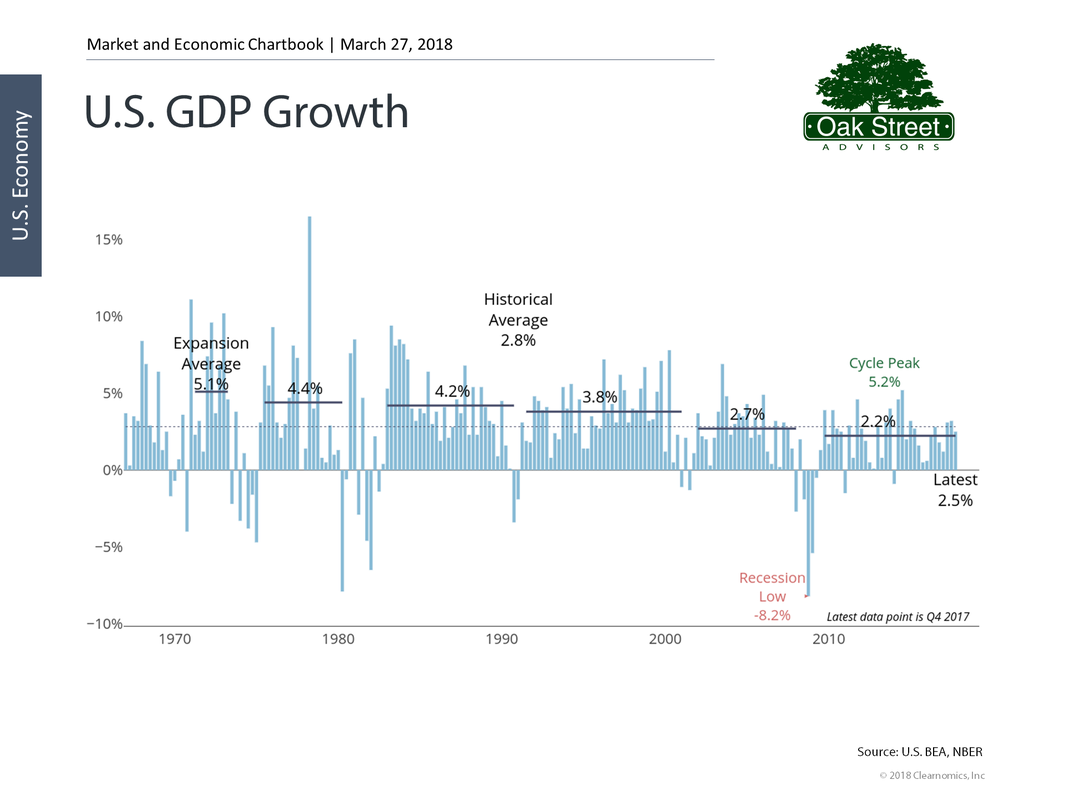

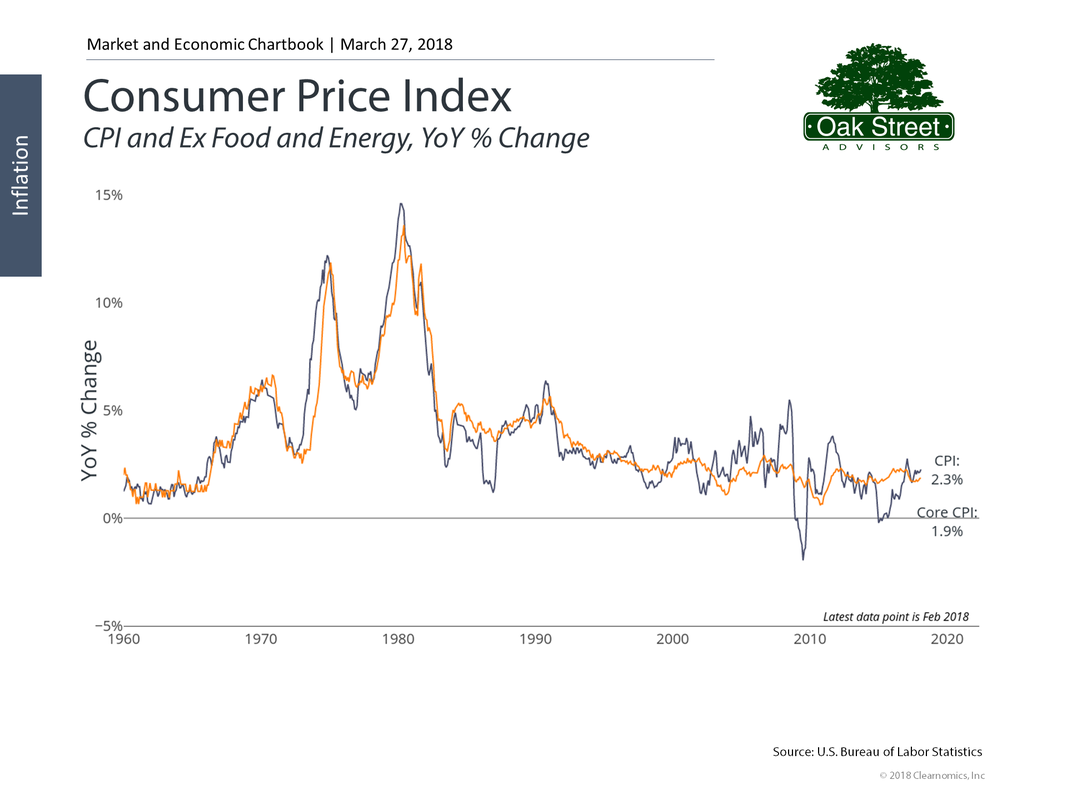

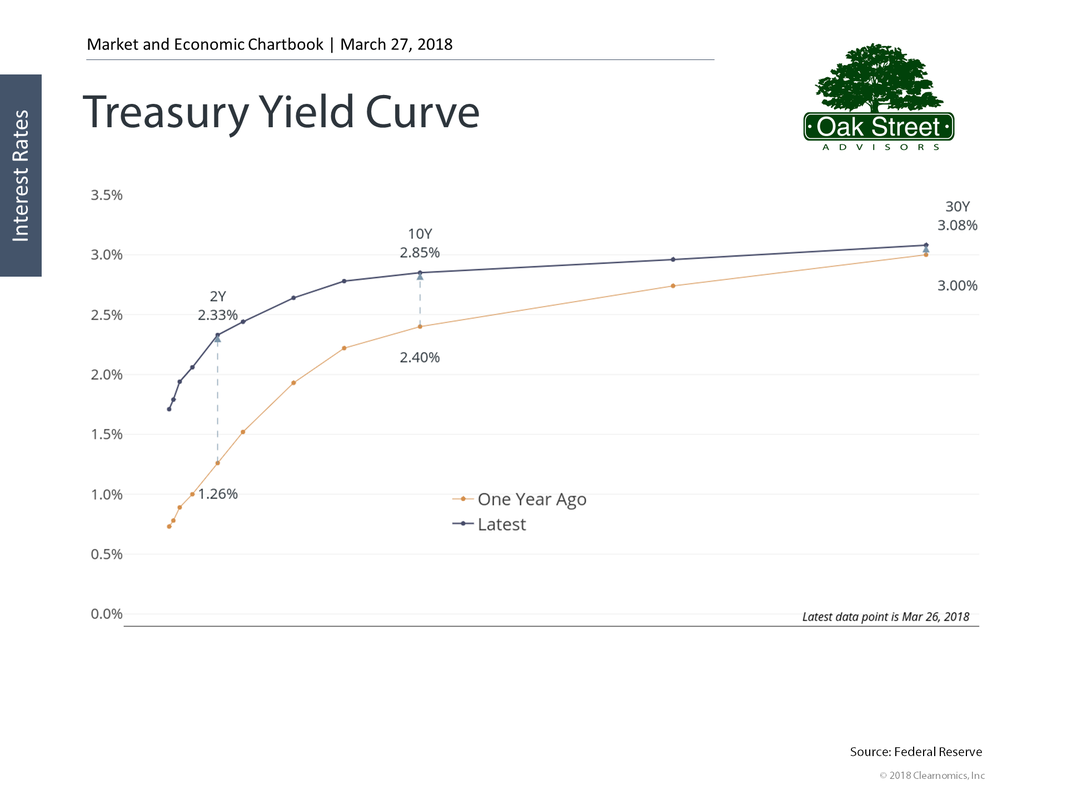

The popular press is fond of pointing out how old the bull market for stocks is. After bottoming in 2009 we have seen stocks march upward for for nearly a decade. Many of today’s younger investors, say those in their thirties, have seen the stock market fall, but never felt the pain in their own portfolio.  Yet for another class of investor, those who have invested in bonds, the bull market run has been even longer. Going back to the days of President Jimmy Carter in 1981, bond yields have fallen, year after year. Because bond prices move inversely to interest rates, bond prices have been rising for the last 36 years. That means someone who entered the workforce in the early eighties, bond prices have always gone up. For some perspective the Certified Financial Planner Board of Standards was formed in 1985. As a group, CFP® practitioners have never experienced a true bear market in fixed income securities. Although the credit freeze that coincided with the great recession bear market for stocks, had a short, sharp panic in the fixed income markets; a long drawn out bear market for fixed income has been an experience the profession will for the most part find alien. The closest thing to the pain of a bear market in bonds experienced by this group was the 2004 to 2006 Chinese water torture of the Greenspan/Bernanke Fed. During the thirteen months that spanned June of 2005 to July of 2006, the Federal Reserve raised rates 25 basis points every time they met. Although the aggregate bond index only fell in price by about 5%, the constant barrage of interest rate increases was hard to live through. That pain was nothing compared to the Burns/Miller/Volker era where we saw the Fed raise rates from 4.75% in November of 1976 to the 20% Fed Funds rate of May 1981. That was the last true bear market for fixed income products in the United States. Although your grandfather might wistfully talk about getting 18% on his CDs, the path that led to those astronomical rates was littered with bond investors who saw the value of longer term bonds fall by 50% or more. When I hear today’s press ask what will happen if the 10-year Treasury bond breaches 4% I am astonished. It is not a question of if, but a question of when. If we can avoid creating a trade war with the rest of the world, there are some very expansive monetary policies recently enacted by congress and the Trump administration investors can benefit from. The tax overhaul will provide a good measure of impetus to the economy, and the budget bill recently signed into law gets us away from the restrictive spending of the sequestration agreement and into a more expansive government spending era. Yet, the Federal Reserve must walk a fine line between economic growth and containing inflation. GDP growth has entered a more normal territory. Inflation, while still subdued, has shown signs of rebounding. The uptick in inflation is related to a small increase in wage growth, which is in turn related to the continued implosion of our unemployment rate. You also will note a similar uptick in mortgage rates. As investors search for yield in a low rate world, we have seen a compression in the interest rate spreads between high quality bonds and low quality (junk) bonds. With rates as low as they are today and with the economy growing it is inevitable that interest rates will rise. The end of the 36-year bond bull market is likely upon us. A flattish yield curve where the difference in a two-year treasury and a ten-year treasury is a mere 52 basis points, puts bond investors in a peculiar spot where an interest rate increase of just 1% could potentially wipe out three to five years of interest income. The take away from all this is bonds are a minefield for investors today. A small misstep can be very costly and the rewards for investment are very small. Many advisors are ill-prepared for a world of falling bond prices.

Unless you or your advisor are true experts with fixed income investments, your best option in today's environment is to keep your maturities very short. That means you should be selling any bonds or bond mutual funds that have long durations. You should direct those allocations to short term treasuries, certificates of deposit, and bonds in the 1 to 3 year maturity range. Hopefully you will ladder those investments so you have new money available to invest at progressively higher rates throughout this interest rate cycle. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed