The 6th Financial Commandment for Millennials: When it's (Not) Smart to Max Out Your Retirement Plan1/17/2019

Whether you’re enrolled in an employer retirement plan like a 401k, are self-employed and can utilize a SEP or Solo 401k, or are forced to brave it alone and contribute to a personal IRA – and you’ve completed the previous Financial Commandments for Millennials it's time to start making the maximum contributions to these plans. First things first, regardless of how your 401k or other employer plan’s investments and fees are structured, investors should always contribute enough to their employer retirement plans to receive the full employer matching…aka the free money. After that, don’t max out your contributions blindly. There are a number of factors that should be considered when determining where your savings should be invested, and an employer retirement plan should be analyzed just as thoroughly as any other investment vehicle. For example, a low earner with access to a poorly constructed and expensive 401k plan may find it more advantageous to only contribute enough to receive the full employer matching (free money), while making the remainder of their contributions to a Traditional or Roth IRA that offers full diversification with lower fees; at least until they reach maximum IRA contributions. If the same investor is a high earner, eating those high expenses might be worth it. Inherently, these investors have more excess income to be deferred in the first place. If they’re in the 32% tax bracket currently, they may want to defer income until they retire in a few years and their tax bracket drops to 22%. In this scenario, the tax savings may outweigh the high costs of the 401k plan. The bottom line is that everyone’s circumstances are different and investors need to be aware that just because they have access to a 401k plan doesn’t mean it’s always the best investment option.

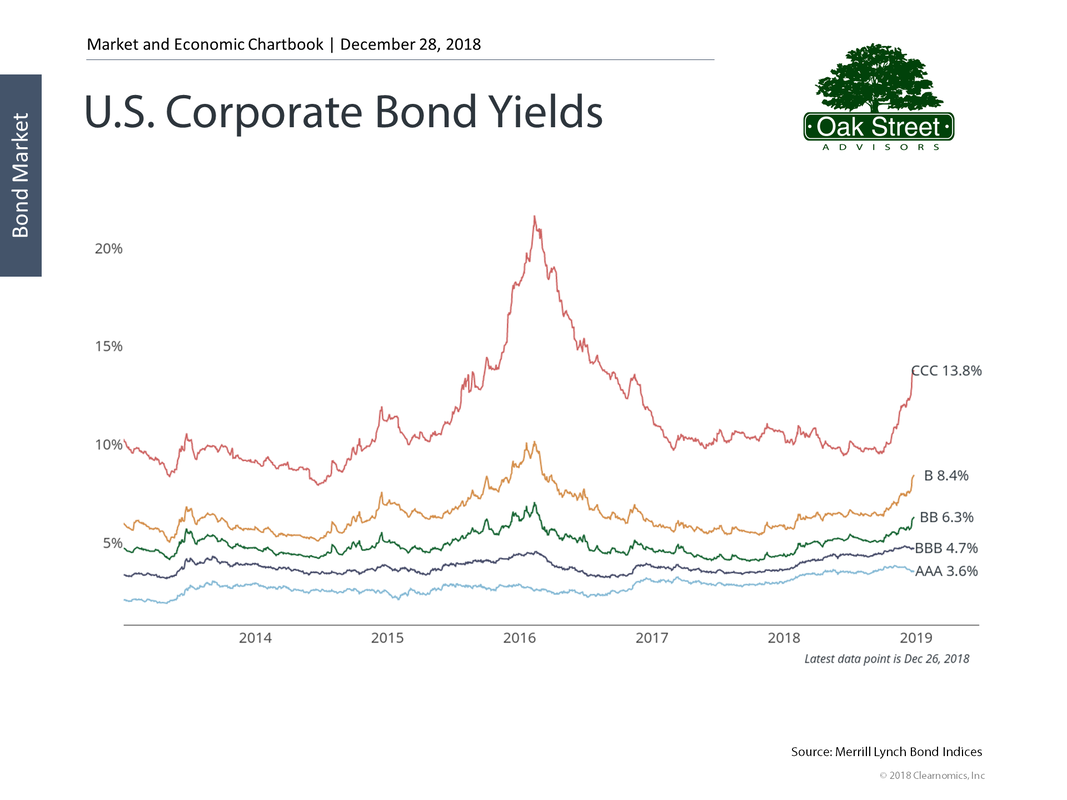

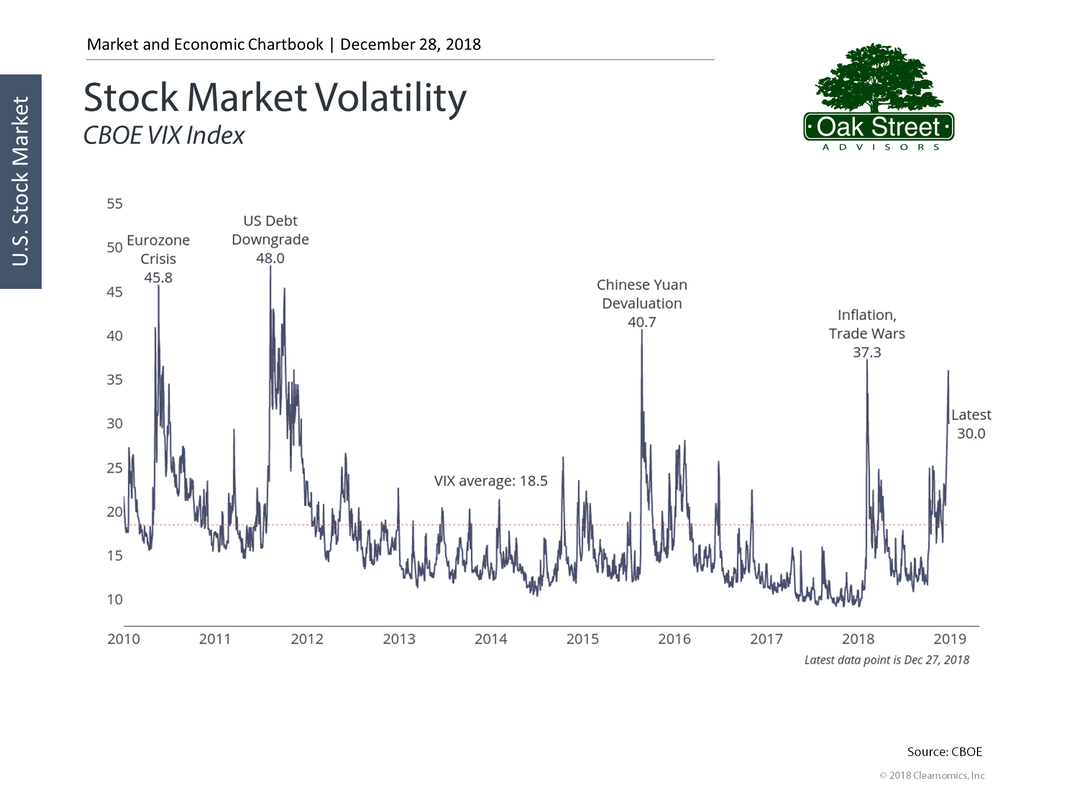

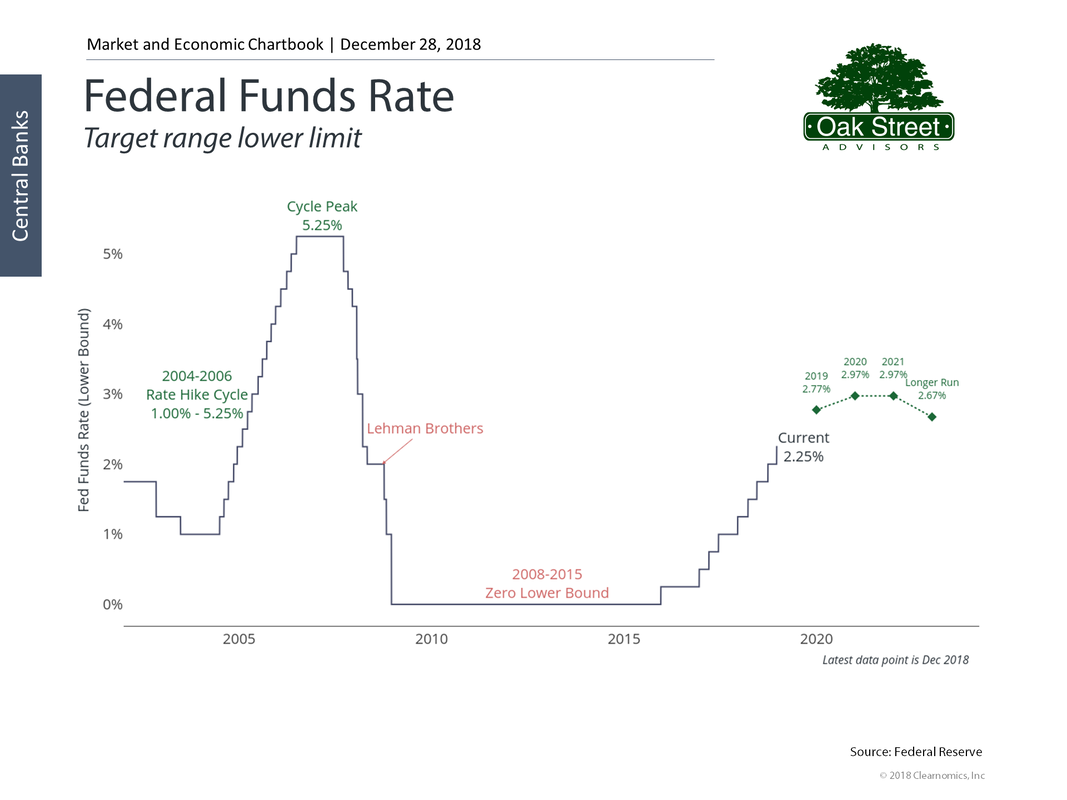

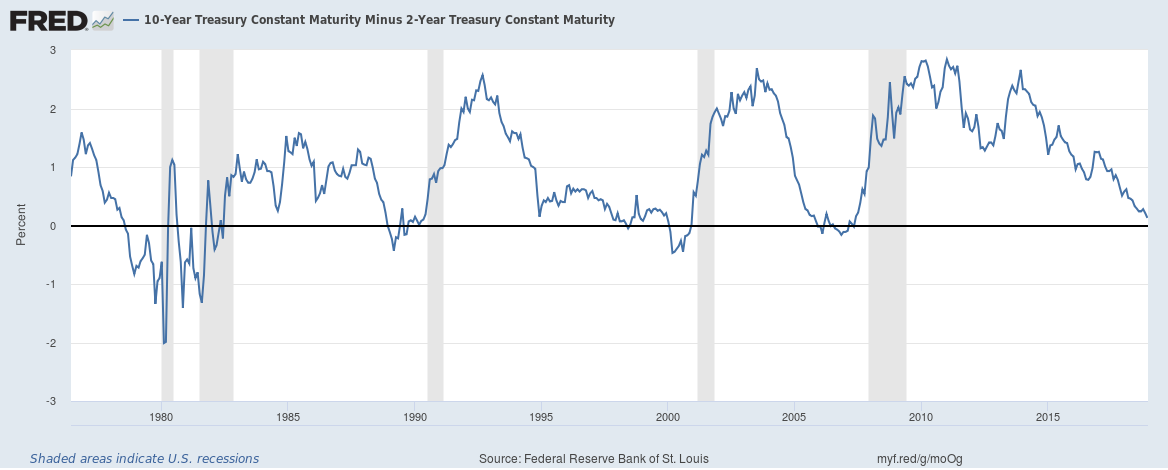

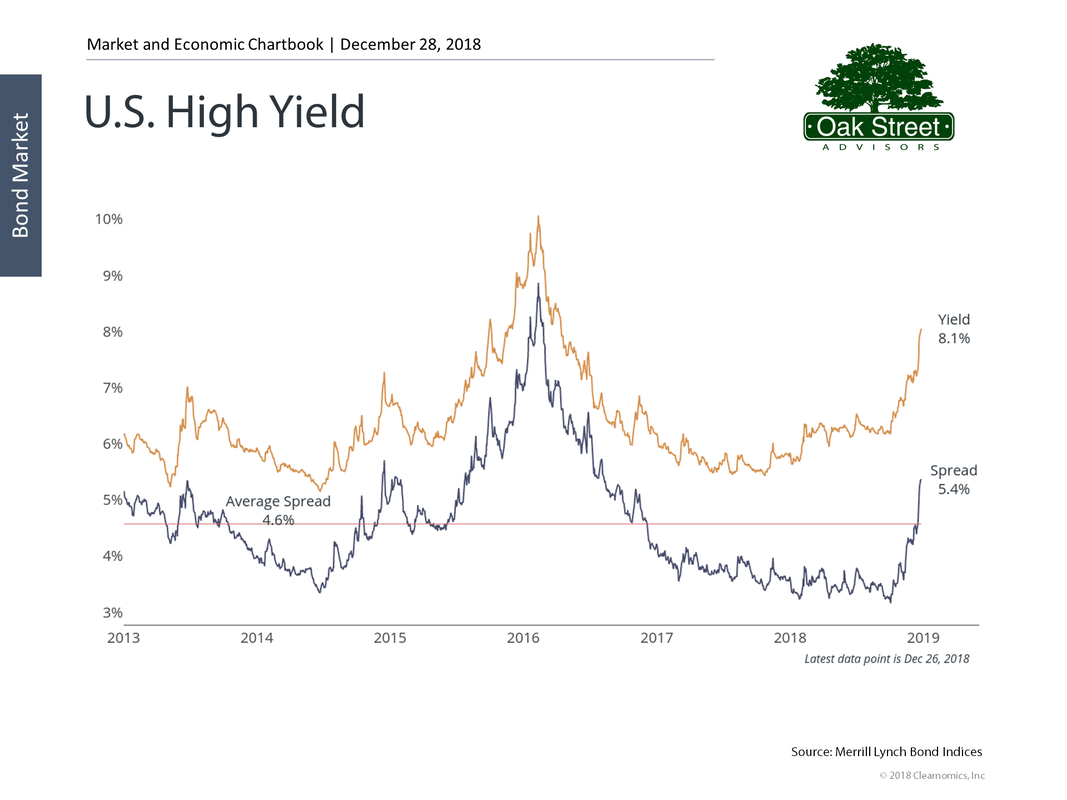

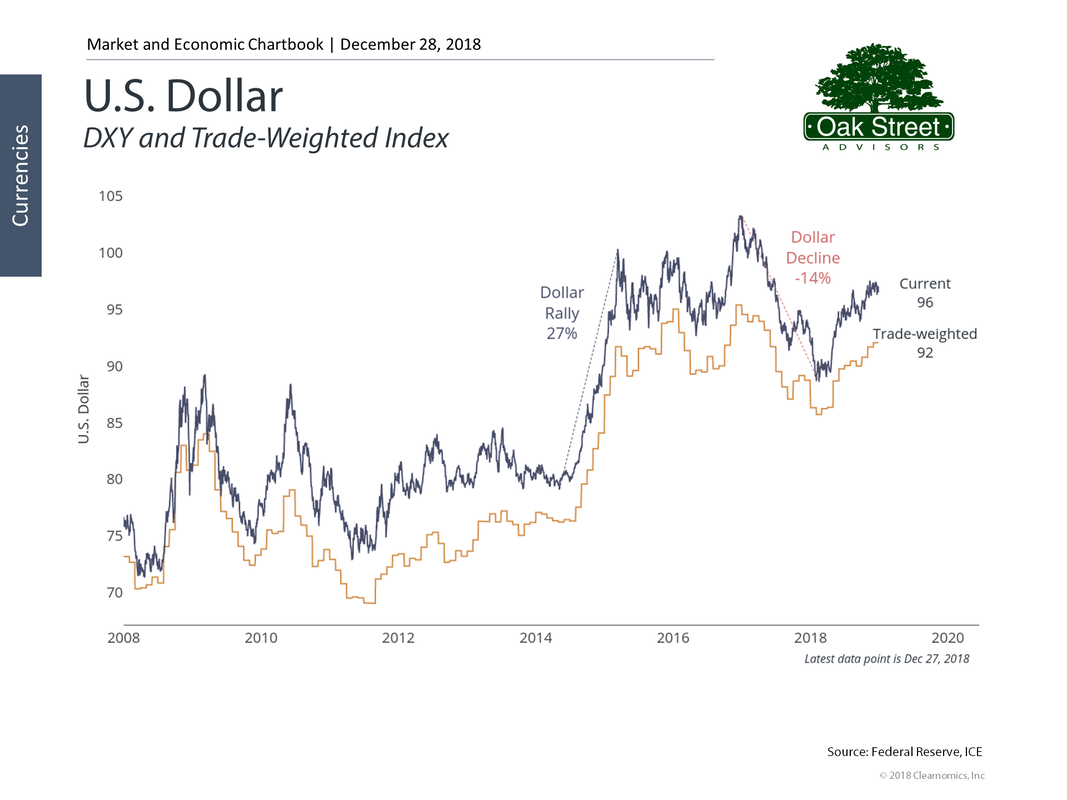

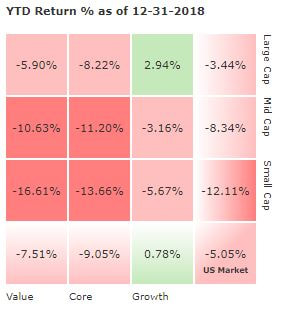

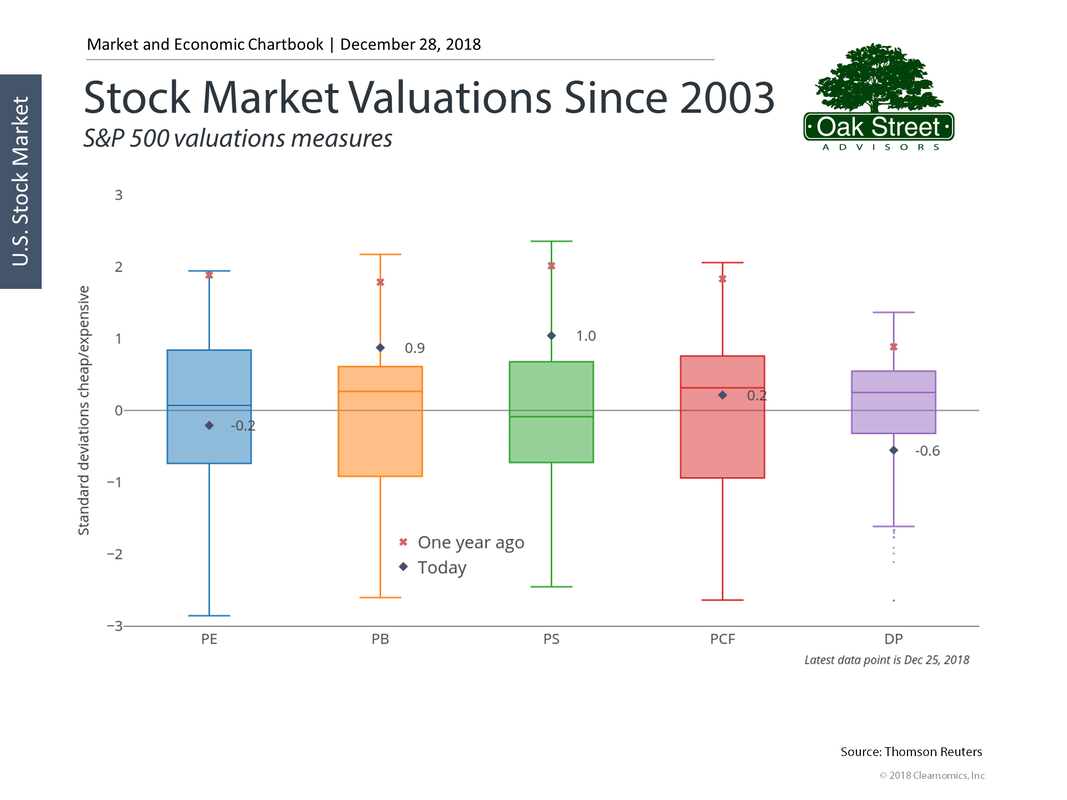

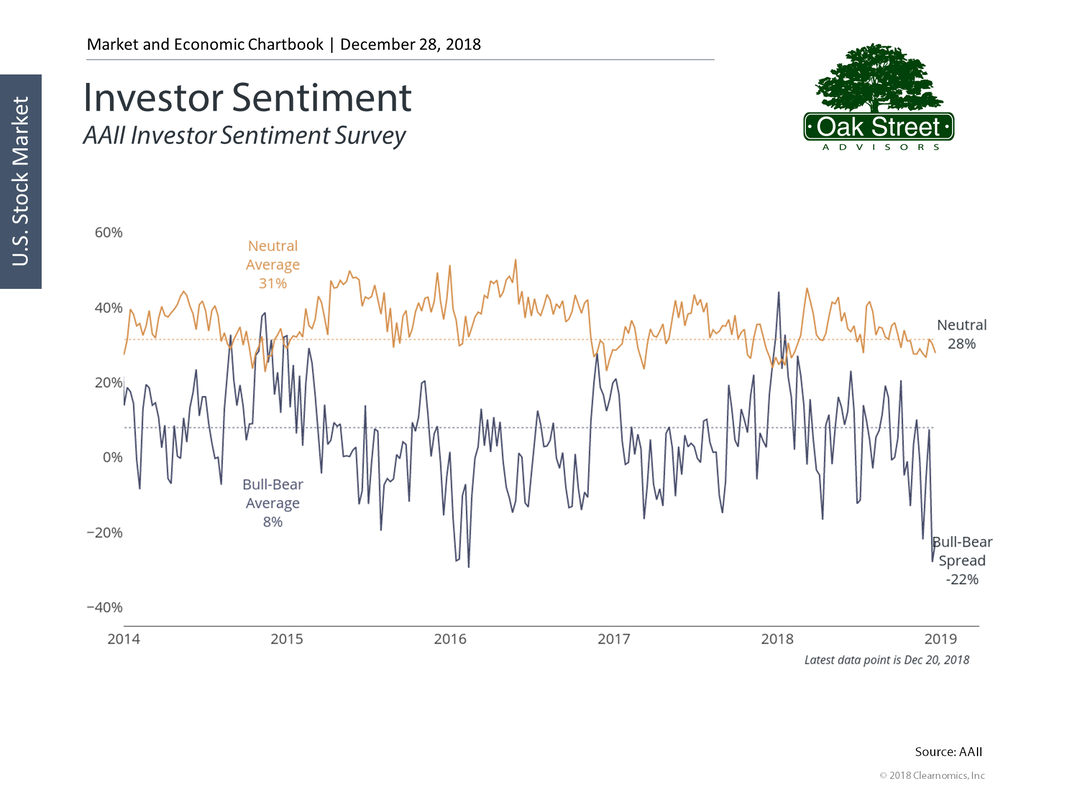

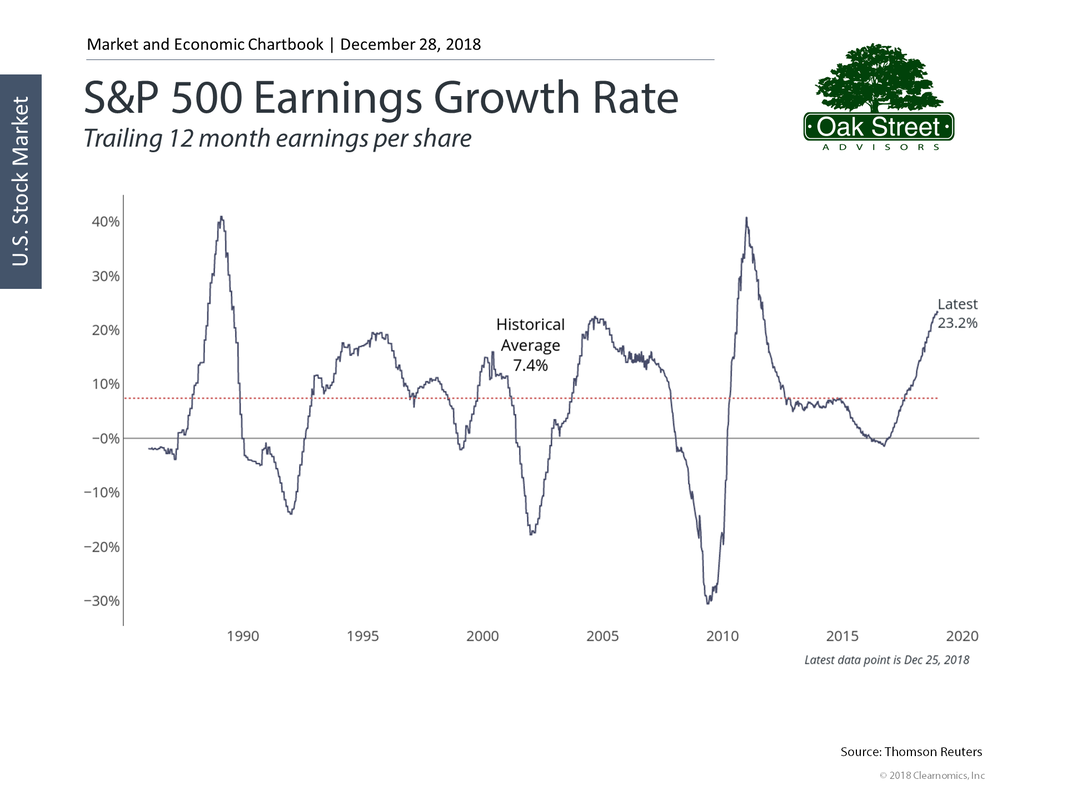

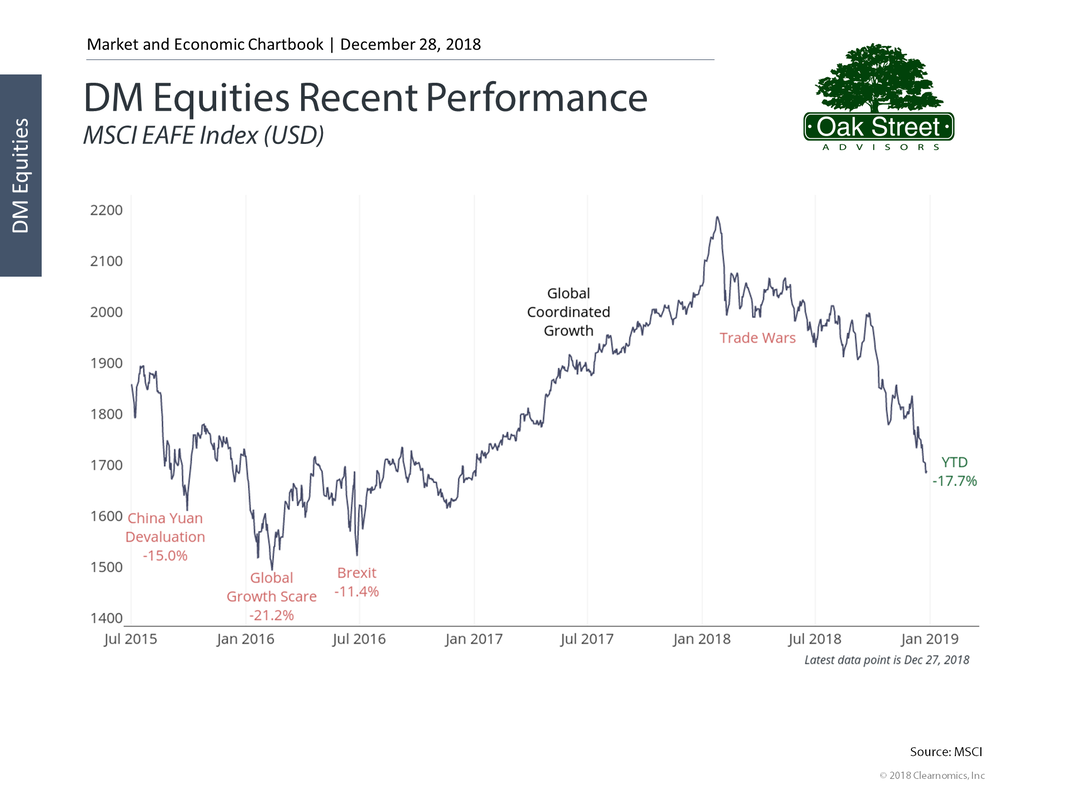

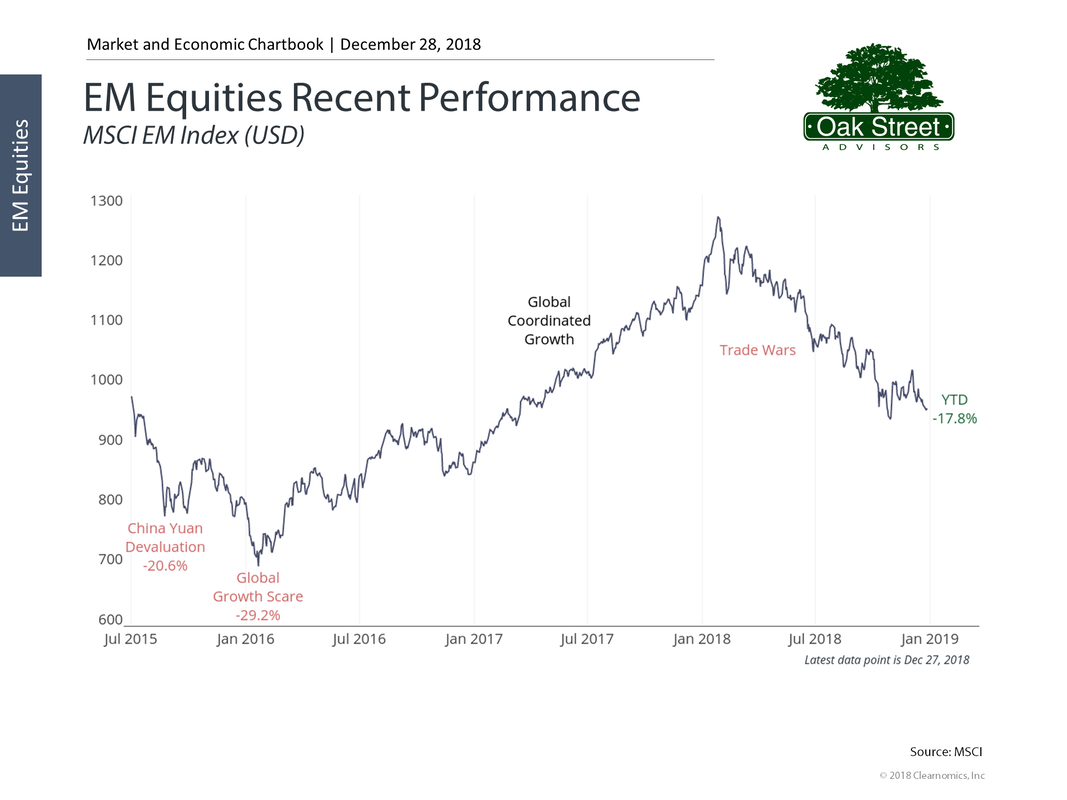

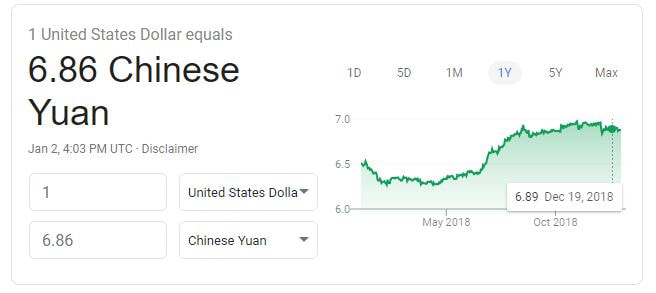

Ideally, you’d want to see total expenses equal to or less than 1%; anything near or above 1.5% should give you cause for concern. You can also reach out to a fee-only financial advisor who can help you determine your plan’s fees and the best investment strategy for your personal situation. You could also ask for a copy of your plan’s 408(b)(2) and 405(a)5 fee disclosures and fund expense breakdown to find out. Once you determine the best vehicle(s) to make your contributions, how should you invest it? You can refer to last month’s article Asset Allocation and Risk Tolerance or you can access Oak Street Advisors’ 401k Like a Boss employer plan investment strategy workbook as a starting point. Volatility Wow! 2018 went out with a huge rise in volatility as stocks swung from a small gain for the year to nearly reaching bear market territory, before rebounding yet again to end the year down 4.38% as measured by the S&P 500 index For 2019, you should expect volatility to remain high. Markets will continue to gyrate as we face increasing political uncertainty. The government shutdown will likely become an extended event, as neither side is likely to move much, and negotiating with the executive branch is like trying to eat Jell-O with chopsticks; it wiggles all over the place. While some may find these tactics a refreshing change to the way our government usually works, the markets are likely to be confused by the new normal and react with wild swings based on the latest news cycle. The unpredictability of the current administration will continue to promote volatility as markets react to a constant barrage of headlines and unconventional political tactics. Interest Rates The Federal Reserve raised rates 4 times in 2018, moving the benchmark short-term rate from 1.25% to 2.25%. This resulted in a difficult year for bond investors as fixed income indices fell for the first time since 2013. There is also concern about the yield curve. While the yield curve has not inverted yet, it is dangerously close to doing so. The chart below shows the 10-year treasury yield minus the 2-year treasury yield, going back to the 1970s. The shaded areas represent recessions. Historically, an inverted yield curve has presaged recessions and Fed economist David Andolfatto recently argued that an inverted yield curve could actually cause recessions. Regardless of whether an inverted yield curve is a leading indicator or a contributing factor to recessions, being on the cliff’s edge as we are now adds to the uncertainty surrounding markets going into 2019. With worries about a possible recession on investors minds, credit quality spreads are finally normalizing after years of compression following the credit crunch of 2008-2009.  2019 may be the year we finally find some value in high-yield bonds after nearly a decade of tightened credit quality spreads. Rising interest rates also leads to a stronger dollar. This makes US produced goods more expensive for foreign buyers and can dampen the earnings of US exporters. Equity Markets After a fast start in early 2018, the equity markets fell hard in the 4th quarter of the year. Nearly every subcategory of the market ended 2018 in the red. But compared to one year ago, equity valuations have fallen, based on many metrics. Have equity valuations fallen enough to make stocks a compelling value? No one knows for sure, but investors should keep in mind that their default position should always be to remain fully invested. Remember, the price of the long-term gains historically inherent in the equity markets is the short-term pain caused by corrections along the way. Investor sentiment remains muted, offering more good news for contrarian investors. Earnings among the companies in the S&P 500 continues to grow at a torrid pace. Lower corporate tax rates have fueled stock buyback programs that allow corporate earnings per share to grow faster than the economic growth generated by normal business operations. I would expect to see a slowdown in the rate of earnings growth later in 2019, as year over year comparisons get tougher, and interest rate increases continue to take a toll on earnings growth. That does not mean we expect earnings to fall, just that the rate of growth will moderate as 2019 progresses. 2018 was also something of a dud for foreign stock investors. Developed markets produced even lower returns for US investors than did the domestic market. And emerging markets were equally as disappointing. For 2019, we expect both trends to continue. Higher interest rates will generally lead to a stronger dollar and a stronger headwind for non-dollar denominated investments. In 2018, the dollar rose by about 3.5% versus the Euro and about 5% versus the Chinese Yuan. That means investors in the Eurozone needed a 3.5% gain to remain even when they convert their Euro based investments back to US dollars and investors in Chinese companies had a 5% hurdle to clear. Conclusions At this point we believe investors should focus on US based companies and remain fully invested. Bond durations should remain short, at least for the first half of 2019, as Fed policy is still unclear. If the yield curve does invert, we would take that as a sign to lengthen bond maturities and perhaps reduce our equity holding a bit. You should expect volatility to remain elevated and look at dips as an opportunity. Important: This is not intended as investment advice. We share this so that our clients and prospective clients can understand some of the factors we consider as we implement their investment strategy. Any predictions of future events should be viewed with a skeptical eye. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed