|

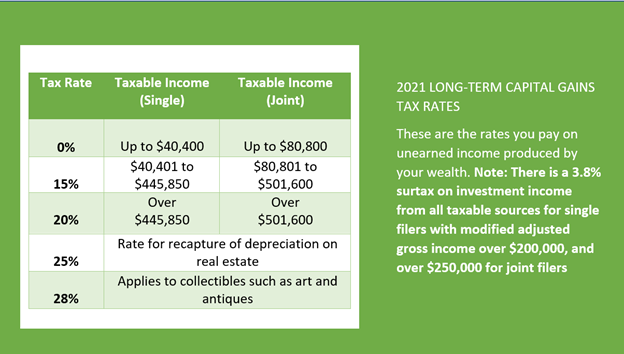

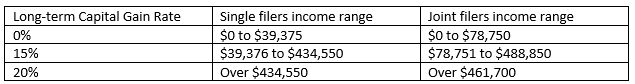

Recently, a report by Propublica revealed that the richest Americans do not pay federal income tax at nearly the same rate average Americans do. How does this happen? What legal pathways do these ultra-wealthy Americans take advantage of to ultimately pay so little in taxes? These are the questions many ordinary Americans are asking. This works because the United States tax code favors wealth over work. The highest capital gains rate is the 28%, that is assessed on collectibles. Because the majority of wealth in America is created by owning or investing in businesses, a capital gains rate of 23.8% is what most wealthy Americans pay on most of their income, 20% capital gains rate and a 3.8% surcharge for gains over $250,000. Qualified dividends are taxed at capital gains rates, so, yes, all the dividends Bill Gates receives are only taxed at 23.8%. For a working class American, the marginal income tax rate on $250,000 is 24%, for married filers, not including Medicare taxes of 1.45% and another 6.2% in Social Security taxes on the first $142,800 of earned income. If you have earned income of over $628,300 as a married filer, your marginal income tax rate jumps to 40.3%. That is 69% more than the top rate for long-term capital gains on stock investments.

Or even better, if you are like Jeff Bezos, and own a lot of shares of a high growth company, why pay any taxes at all. You can borrow against the stock you own (margin) at less than a 1% interest rate, use the investment interest expense to offset some other income (for being CEO), and as long as your stock appreciates more than the 1% each year, you never have to sell, never have to realize a gain, and never have to pay any income taxes. Plus, when your kids inherit the stock from you, they get a stepped-up cost basis that can reduce their taxes on any sales to zero. The ultra-wealthy can afford to hire some of the best advisors in the world to help them use these and many other tricks to minimize their income tax liability. For regular folks like you and me, smart tax planning is required to build wealth in the first place. If you want to learn strategies you can use to minimize your income taxes and grow your wealth faster, then download a free copy of our “Tax Planning Basics” e-book. It is full of things you can do to keep more of what you earn. Things like asset location, Roth IRA conversion strategies, and income shifting strategies. It’s not an army of accountants, but it’s a start. A health savings account is a tax-deductible savings plan for individuals covered by a qualified High-Deductible Health Plan (HDHP). This program allows for tax deductible contributions to a special account that allows you to pay for expenses your insurance plan does not cover with pretax and tax-free dollars.

Eligibility A high deductible plan for 2021 requires a minimum deductible of $1,400 for individuals and/or $2,800 for a family. These plans must have a maximum out-of-pocket expense of at least $7,000 for an individual and $14,000 for a family. If you’re covered by a spouse’s workplace policy, Tricare, the Veterans Administration, or Medicare you are not eligible. If you are a dependent on someone else’s tax return or covered by a Flexible spending account or Health reimbursement account, you are not eligible. How an HSA Works The beauty of an HSA is you make contributions that are deducted from your taxable income, yet when you spend the money for qualified expenses, the distribution is tax-free as well. Any growth within the HSA account is also tax-free. So, the contributions are deductible like a Traditional IRA, but earnings and distributions are tax-free, like a Roth IRA – you get the best of both worlds! Contributions Contributions to an HSA are deductible from your taxable income in the years you contribute, and like a Traditional IRA, you can make contributions until April the 15th or your normal tax filing deadline of the following year. For 2021, the maximum HSA contribution is $3,600 for and individual and $7,200 for a family, with an additional $1,000 per year “catch-up” contribution for those over age 55. It is important to know that for married couples the $1,000 catch-up provision applies to each spouse. If you and your spouse are each over 55 your HSA contribution limit for 2021 would be $9,200. If you contribute to an HSA plan through your employer, your annual contributions are reduced dollar-for-dollar by any contributions your employer makes on your behalf. For example, if you and your spouse are under age 55 and your employer makes a $1,200 annual contribution on your behalf, you would only be allowed to contribute and deduct from your taxable income $6,000 for 2021 ($7,200 contribution limit minus $1,200 employer contribution). If you drop out of a high deductible plan before the end of any calendar year, say you become eligible for Medicare, or you change employers and the new coverage does not qualify as a high deductible plan, your contributions for that year are simply pro-rated. Meaning if you participate for three months then changed to a plan that is not eligible for HSA contributions, you would be eligible for a 3/12ths deduction in that calendar year. On the other hand, if you become eligible for HSA contributions during a calendar year, you can make contributions as if you were covered by a high-deductible plan for the full year. So, if you moved from an employer plan that was not HSA compliant to another employer plan that was HSA eligible in October you would be allowed to contribute as if you were eligible for the entire year. This is known as the last month rule. The contribution rules for HSA accounts also allow others to contribute to the account on your behalf. For example, if you have a working child who is covered by an HSA compliant insurance policy, you can contribute directly to the account for them. The contribution is considered a gift so you will not receive an income tax deduction, but it may be an important step to helping your child become financially stable. Qualified HSA Funding Distribution An important funding technique is the ability to make a trustee to trustee transfer from an IRA into your HSA account. Each taxpayer may only do one qualified transfer in their lifetime and the amount of your HSA contribution will be reduced dollar-for-dollar in the year you make a conversion. This is an outstanding opportunity to convert dollars that are potentially taxable in the future to dollars that can be tax-free. If you are young and make a conversion, the potential for tax free growth can’t be beat. Even if you’re just shy of Medicare eligibility, the income tax savings of this strategy make it worthy of consideration. An important note for couples is that only one person can own an HSA account. To maximize the Qualified HSA funding distribution benefit, one spouse will open a family HSA for a calendar year and use their qualified funding distribution. In the following year the other spouse will open a separate HSA account and use their own once in a lifetime qualified funding distribution to fund that account. This would allow a couple to convert up to $18,000 from IRAs where distributions are likely to be taxable--into HSA accounts that compound tax-free and provide tax-free future benefits. Rollovers You are allowed to rollover funds, via a trustee-to-trustee transfer, from one HSA account to another without triggering a taxable event. This means if you leave an employer’s plan and wish to establish an HSA account through a different provider, you can consolidate your account with the new provider and simplify your finances. Or if you wish you can change HSA account custodians anytime. Beneficiaries If you name your spouse as the beneficiary of your HSA account, the account will be treated as the spouse’s HSA upon your death. For other beneficiaries, the fair market value becomes a taxable distribution to the beneficiary. Household Individuals Funds from your HSA account can be used for qualified medical expenses for you and your family. The IRS is a bit liberal in their definition of family. Anyone who qualifies as a dependent on your income tax return can have medical expenses paid from your HSA account. You, your spouse, your children under age 19 or under age 24 if a full-time student, grandchildren, parents, and foster children are all included. Qualified Expenses Medically necessary expenses not covered by insurance can be paid from your HSA account without taxation. Even things like drug and alcohol rehab, home modifications for disabilities, acupuncture, dental and vision care, and over the counter drugs prescribed by your doctor, are all allowed expenses. Although your current insurance premiums cannot be paid from you HSA account, you can use those funds to pay for Long-Term Care insurance and Medicare Part B and Part D premiums. For a complete listing of eligible expenses see IRS publication 502. Look Back Provision If you have an HSA account open during any tax year and do not have enough money contributed to cover all the allowed reimbursements, you can use future years contributions to pay yourself back. For example; In 2020 you had an HSA balance of $4,000 but in December you had a large unexpected $5,000 medical expense. You would be able to make 2021 contributions and then reimburse yourself for the extra $1,000 expense you incurred in 2020. Prohibited Transactions Like IRA accounts, there are certain transactions that are prohibited inside your HSA account. You cannot have any self-dealing transactions such as sale leasing or exchange of property between yourself and your HSA account, you cannot charge your HSA account for services you provide, and you cannot use your HSA account as collateral for any loans. A violation of these rules will trigger a deemed distribution from your HSA account and subject all the funds to taxation in the year the violation occurs. For more information on prohibited transactions see section 4975 of the tax code. For the full IRS guidance on Health Savings Accounts see Publication 969. How Business Owners Can Save On Their Income Taxes With the Qualified Business Income Deduction11/24/2020

The recent income tax revamp has made income tax planning early in the year a must for many self-employed professionals. The ability to take a 20% deduction of business income, available for single filers with income below $164,900 for 2021 and married filers with income below $329,800, is too good to pass up. Filers with taxable income at these levels will be in the 24% marginal tax bracket, so being able to qualify for the business income deduction is worth thousands, particularly when proper tax planning can prevent many from reaching the next 32% bracket. There are a number of ways to game your reported income, allowing many filers with reportable income well above these limits to qualify for the 20% exclusion. First, the exclusion counts toward reducing your income below the phaseout thresholds. A married couple with employment income of $175,000 and a like amount received as business income would see their total income of $350,000 reduced by 20% of the business income or $35,000 allowing them to remain within the proscribed income limits. Contributions made to an Health Savings Accounts will also reduce your taxable income. For 2021 single filers can deduct up to $3,450 and couples up to $6,900. A real biggie for high earners looking to qualify for the 20% exclusion is retirement plan contributions. Money contributed to your qualified retirement plans can make a huge difference. For 2021 those under age 50 can contribute $19,500 to a 401k and those 50 and above can contribute up to $26,000. Presumably as a business owner you can also be sure to offer a generous match. Matching contributions are a deductible business expense that benefits you the owner directly yet reduces your reported profits and thus your total income for purposes of qualifying for the 20% deduction. And for very high earners, adding a defined benefit plan to your existing defined contribution plan might be a smart move, depending on the demographics and size of your workforce. Don’t overlook simple things like using tax free municipal bonds for your savings versus taxable bonds and CDs. Going beyond the basics, some business owners could benefit from reimagining their business ownership. Suppose you are a professional who owns your place of business. Setting up a separate company to own the real estate could be a smart move. You lease the building back from the owner at a fair market rate creating business income that is not subject to the target income limits. Busy professionals have little time to devote to income tax planning and their CPAs are busy during tax season, but the difference between qualifying for the deduction and not qualifying could hinge on how soon you begin a given strategy. This is being written as the bill is still in progress. Edits may be required as more information becomes available. Please check back for updates and be sure to consult a financial professional before implementing any of the strategies suggested in this post. The Senate has passed an emergency relief bill that is expected to pass the House later this week. The package is over $2 trillion in scope, $6 trillion if you include loan provisions, and is the largest relief bill in the history of the United States. Relief Payments Made Directly to TaxpayersLet’s start with the direct payment checks you have probably heard about. In general, individuals will receive payments of $1,200 and joint filers $2,400, plus $500 for each qualifying child. The definition of a qualifying child is already in the current Child Tax Credit Guidelines i.e. if you claim someone as a dependent child on your tax return in 2020 then they’ll qualify for the additional $500 per child payment. High income taxpayers will see these amount reduced as income exceeds $150,000 for joint filers, $112,500 for head of household, and $75,000 for single filers. For every $100 over those limits the payment is reduced by $5 until you reach zero. That means joint filers earning $198,000 or more, heads of households earning $136,500 or more and single filers earning $99,000 or more will receive nothing. The payments will be based on the most recent tax return filed. So, if you have already filed for 2019 you are stuck with those earnings. If you have not filed for 2019, then your payment will be based on 2018 return information. If your income is higher in 2019 than 2018 DO NOT FILE YOUR TAXES UNTIL LATER. On the other hand, if your 2019 income is lower than 2018 IT IS IMPORTANT TO FILE YOUR TAXES NOW. The payments will be direct deposited for taxpayers who elected to have direct deposit on their income tax forms. This could be a problem if the direct deposit instructions you provided in 2018 are to an account that has since been closed, or if you have divorced or separated since your 2018 tax filing. Within 15 days of the money being released, the IRS will send a letter informing you of the amount and where it was sent. If there is an issue with your payment, like it never arrived or went to a divorced spouse, the letter will include a phone number where you can call to resolve the issue, but unfortunately, the IRS is difficult to communicate with in general. Required Minimum Distributions from IRA Accounts SuspendedFor the tax year 2020, there are no required minimum distributions (RMDS) from IRA accounts. If you have already withdrawn your RMDs for 2020, you cannot undo that. If you haven't taken your RMD yet, consider how delaying or withdrawing your RMD will affect your income tax brackets. For inherited IRA accounts required withdrawals are also eliminated for the 2020 tax year. Corona Virus Distributions from Qualified Retirement PlansDistributions of up to $100,000 from any IRA, 401k, 403b, or other qualified plan will not be subject to the usual 10% early withdrawal penalty for those who are infected with the COVID virus, have a family member infected by the virus, or were laid off or lost wages due to the virus. The distribution is still taxable, but the income, by default, will be spread over a 3-year period. This can help you access funds without bumping yourself into a much higher income tax bracket. It could potentially be used to advance fund Roth IRA conversions. More on that as we have time to digest all the ins and outs of the legislation. The law also allows for repayment of any qualified plan distributions over a 3-year period as a qualified rollover contribution. So, if you need the funds now and are re-employed later, you will be able to replace the funds, offsetting any potential tax bracket increase in the future. Allowable loans from qualified plans, such as a 401ks, are also increased to $100,000 or 100% of the vested account balance, whichever is lower. Repayment of any loan taken in 2020 can be delayed for up to one year. Charitable Contribution DeductionAfter the recent Tax Cuts and Jobs Act (TCJA), many taxpayers found themselves using the increased standard deduction and no longer itemizing on their income tax return. That eliminated the charitable contribution deduction. One of the permanent changes the relief bill provides is a new above the line deduction for up to $300 of cash contributions to a qualified charity. This does not include contributions to donor advised funds. *Again, this is a preliminary look at the relief bill, we will provide updates and corrections as new information becomes available

With the end of the year approaching, now is the time to look for opportunities to save on income taxes. Here are some items you should look for:

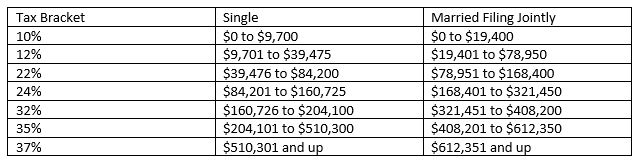

Okay-- you just completed your income tax return for last year. You want to file it away and not worry about taxes until next year, but before you do-- take a look at your completed return to identify ways you can save tax dollars next year. Income tax planning can add to your future net worth and your future income streams. Here is a line by line view of some of the things that good income tax planning can do to improve your financial life. Taxable Income Line 10 on your new 1040 return shows your taxable income after all deductions. Knowing your marginal income tax rate is the first step to efficient income tax planning. Lowering your income taxes in the current tax year is not always the best long-term strategy, lowering your lifetime income tax liability is often much more important. For 2019, the federal income tax brackets for individuals are: Your marginal income tax rate is the amount you would pay on your last dollar. For example, a single person with taxable income of $84,201 would pay a 24% rate on only one dollar of income, not their total taxable income. They would in fact pay 10% on their first $9,700 of taxable income, then 12% on the next $29,775, then 22% on the next $44,725, and finally 24% on the last dollar of taxable income. It is important to remember that the current income tax rates for individuals are scheduled to revert to the pre Tax Cuts and Jobs Act rates in 2025. Barring tax changes passed by Congress in the interim, you have six years to utilize the current brackets to your benefit. Managing Your Income Tax BracketDepending on your income level, managing the income tax bracket you fall in may mean realizing extra income to take advantage of a favorable rate; or you may want to lower your taxable income to qualify for a lower tax bracket or other income tax benefits (such as Obamacare). In my opinion the 12% bracket is extremely valuable. Married couples can have up to $78,950 of taxable income and pay no more than 12% in federal income taxes. Less than 25% of American households have taxable income above this level and I believe the odds of their marginal income tax rate falling is quite small. If you are among the many that fall into the 12% rate, you should look for ways to pay taxes on as much income as you can without moving into the 22% bracket. Some of the things you should consider are: Contribute to a Roth IRA or Roth 401k rather than a Traditional IRA or standard 401k account

Convert existing Traditional IRA funds to a Roth IRA

Higher marginal income tax payers will want to take the opposite approach. They’ll want to defer more income unless they anticipate being in an even higher bracket in future years. High bracket individuals will want to:

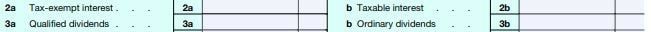

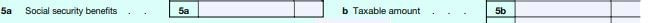

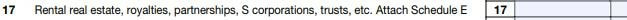

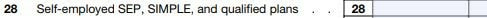

The absolute worst taxable income numbers are $200,000 for single filers and $250,000 for joint filers; along with $157,500 for single filers and $315,000 for joint filers who own their own business. The first range, $200,000 single and $250,000 joint subjects a taxpayer to the 3.8% net investment income tax. The second range for self employed filers of $157,500 for single and $315,000 for joint are the cutoff for the pass-through business income deduction. Taxpayers at those levels should take aggressive steps to lower their taxable income. Investment IncomeMoving back up your return, line 2 and line 3 deal with investment income. Note that these lines have been subdivided into an A and B column. The column on the left is better than the column on the right for income tax purposes. Tax-Exempt Interest On the left you have tax-exempt interest, which is income generated from municipal and state government entities. Municipal bond interest is generally income-tax free, although there are some taxable municipal bonds, and some municipal bond interest is subject to the Alternative Minimum Tax. Tax-exempt interest is also added to your Adjusted Gross Income (AGI) for purposes of calculating how much of your Social Security benefits are taxed. The higher your marginal income-tax rate, the more valuable tax-exempt interest is. To determine the taxable equivalent yield of a tax-exempt security, you divide the tax-exempt yield by 1 less your marginal income tax rate. For an investor in the 12% marginal income tax bracket, a municipal bond yielding 2.5% gives them the same after-tax return as a taxable security that yields 2.8% (.025/ (1-.12)). For an investor in the 32% tax bracket the same 2.5% yield from a municipal bond equates to a 3.6% taxable yield. Qualified Dividends Again, the column on the left is more valuable than the column on the right. A qualified dividend is a dividend from a company that: a) trades publicly on a US exchange and b) is incorporated in a US possession or c) is eligible for the benefits of a comprehensive income-tax treaty with the US. The advantage to generating qualified dividend income is that these payments are taxed at your capital gains rate, which is generally much lower than the rate on your ordinary income Dividends from REITs, MLPs, employee stock options, tax-exempt organizations, money market accounts, and shares used for hedging are not eligible for qualified dividend status. Make sure to also consider the treatment of preferred stock dividends. Although ranked below bondholders in the event of financial difficulty, preferred stock pay yields that are similar to long-term bonds. All taxpayers should consider these securities against table bond holdings for the tax advantages alone. IRAs, Pensions, and Annuities Income received from pensions and some annuities are absolute, in that you receive the income and you pay the taxes; however, income from an IRA and certain types of annuities are somewhat discretionary. You can plan the timing and the amount you withdraw to achieve the best income-tax outcome for your personal needs. If you are over 70 ½, you are required to take some distributions from your traditional IRA accounts (required minimum distributions/RMDs), but even then you can take advantage of the Qualified Charitable Distribution rules to lower the amount that is reported to the IRS. Income derived from variable annuities can be problematic for some. All income from variable annuities is considered ordinary income until you have spent down those assets to your cost basis. At that point, the withdrawals are deemed to be return of principal and are no longer subject to income taxes. Although we prefer to use IRA to Roth IRA conversions to manage income tax brackets for those in the 12% marginal tax bracket, you can certainly use variable annuities in a similar fashion. If you are in a higher marginal tax bracket, you can also consider exchanging your variable annuity for an immediate annuity. Doing this will change the deemed ordinary income rule to a pro-rata distribution rule, where some of your distribution is considered ordinary income and some of it is considered a return of principal. Social SecurityYou probably will pay taxes on some of your Social Security benefits. If your total income is more than $25,000 but less than $34,000 for individuals; or $32,000 but less than $44,000 for joint filers, you will pay income tax on 50% of your Social Security benefit. If you are above those ranges, you’ll pay income tax on 85% of your Social Security benefit. Sadly, I have to say I have seen cases where an individual is less than 70 years old, in a 30%+ marginal income-tax bracket, saving money, and still insists on claiming their Social Security benefit. It would be a simple fix to suspend Social Security benefits, reduce their taxable income, and accrue delayed filing credits to their future social security income. Yet some will still continue those benefits because they feel they have paid in all their life and want to see some return on their money. Yes, you could die, but throwing away money paying needless taxes is hard to understand. Additional Income and AdjustmentsIn trying to make the form 1040 look simpler, the IRS added this line. It refers to a Schedule 1 and is attached to your 1040. Alimony Under the old tax rules, alimony was deductible to the payer and taxable to the payee. No more--Congress has managed to shift the income tax burden for alimony payments to what is likely the higher earner with the higher marginal income tax rate. If you are divorcing it is important that the income tax liability of alimony payments be considered in developing an equitable settlement. Business Income/Loss This has become a much more important item than in years past, as owners of any business that uses a pass-through entity can receive a 20% reduction to taxable income generated through that business. Assuring you maximize this important benefit is essential. See our previous post ‘Big Savings for Self-Employed and Business Owners’. Capital Gains and Losses For all taxpayers, it is important to use tax-efficient strategies for taxable investment accounts. High yield stocks and bonds are more efficient being owned in tax advantaged accounts (401ks, IRAs, Roth IRAs etc), while investments that mostly appreciate in value are a better fit for taxable accounts. Still, capital gains rates are attractive relative to the tax rates on ordinary income. You can use capital losses to offset any capital gains you receive, plus $3,000 of ordinary income. Capital losses are never a good thing, but at the end of each year you should review your investments to look for opportunities to offset gains. Rental Real Estate, Royalties, Partnerships, S-Corps, trusts, etc. If you own rental properties you know how helpful depreciation can be for your income tax liability. Yes, some of the depreciation will be needed to maintain the property, but some of it will also reduce your taxable income, and if you sell, will result in more income being taxed as capital gains at currently favorable rates. If you own a property that has been fully depreciated you might consider using a tax-free exchange to like property to increase your basis and start the depreciation process all over again. Adjustments to Income Health Savings Accounts Many American’s are now covered by high-deductible health insurance plans either through their employer or purchased directly from insurers through the Affordable Care Act Marketplace. Contributing to an HSA will reduce your current income tax liability, and if the funds are used to pay for qualified medical expenses the distributions are tax-free as well. See our post on ‘Hacking Your Health Savings Account’. Self Employed SEP, SIMPLE, and Qualified Plans An easy way to reduce your current year income tax liability is to contribute to a retirement plan. IRA contributions are reported on line 32, but if you’re self-employed you can defer taxes on even more money. You can establish a SIMPLE retirement plan before October 31 of the current tax year and defer up to $13,000 ($16,000 if you are over age 50) annually. A SEP retirement plan allows an even bigger tax deferred contribution of up to $56,000, plus a catch-up contribution of $6,000 if you are over age 50. Another useful benefit is you have until your income tax filing deadline, plus any extension, to establish and fund a SEP for the previous tax year. If you’re a business owner who still needs to reduce your previous years taxable income-- this is your chance! Self Employed Health Insurance Deduction If you’re self-employed, this is where you get to reduce some of your taxable income for health insurance expenses. If you’re not self-employed and are not covered by an employer health insurance plan, this is motivation for starting a side gig.

For example, the mechanic that works on cars after hours, or maybe the carpenter that does an occasional job on the side. Formalize your business to take advantage of this deduction. In Conclusion While this is far from an exhaustive list of ways to reduce your income tax liability both now and in the future, you can see there are opportunities for almost everyone to benefit from income tax planning. Take some additional time to review the tax forms you just filed or see a financial planning professional-- there is a lot at stake. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed