|

Often, navigating the Social Security Administration’s rules can be complex and confusing. None more so than trying to determine a surviving spouse’s social security benefit. Nearly every couple will face this problem at some point.

Timing is everything regarding social security surviving spouse benefits. The filing date alone—when you decide to claim social security and when your spouse does—ultimately determines how much you both will receive in Widow or Widowers benefit. Getting your initial claiming strategy right is paramount to maximizing this important benefit. If the deceased spouse has not begun receiving social security income at the time of death, the survivor’s benefit is based upon the decedent’s primary insurance amount (their social security income at Normal Retirement Age) plus any delayed retirement credits up to the date of death. Delayed retirement credits add about 8% to the social security income received for each year you delay taking your social security benefit beyond your normal retirement date, up to age 70. If this is the case the surviving spouse’s decision to claim social security benefits will be based on their age at the time they file. What this means is if the survivor decides to receive social security income before they reach their normal retirement date, there will be a reduction in income for each year of early filing, even if the deceased spouse had earned delayed retirement credits. If the deceased spouse had been receiving social security income before their normal retirement date, their benefit and the widow(er)’s benefits are reduced forever, depending on when the initial benefit claim was filed. Generally, you would lose about 8% of social security income for each year you receive social security payments prior to reaching your Normal Retirement Age (NRA). A widow(er)’s benefit is limited to the larger of 82.5% of the deceased spouse’s death primary insurance amount or the reduced income benefit the deceased would have been eligible for if they had lived. The Social Security Administration provides the following example: “Mr. B, age 64 on August 3, received reduced retirement income benefit of $350 (primary insurance amount $374.90) for August and September. He died in October. Mrs. B, age 66, comes in, to file for widow's benefits. The retirement income benefit if Mr. B were alive would be $350. 82 1/2 percent of the death primary insurance amount is $309.20 ($374.90 X .825). The life and death primary insurance amounts are the same. The widow’s income benefit will be the higher of the two, $350 in this example.” Your widow or widower can get benefits at any age if they take care of your child younger than age 16 or disabled, who’s receiving Social Security benefits. If the surviving spouse is disabled, benefits can begin as early as age 50. Unmarried children, younger than age 18 (or up to age 19 if they’re attending elementary or secondary school full time), can also get benefits. Children can get benefits at any age if they were disabled before age 22. Under certain circumstances stepchildren, grandchildren, step-grandchildren, or adopted children may also be eligible for benefits. These circumstances are exempt from the deemed filing rules and do not affect future claims made under their own work record. There is a family maximum to survivor benefits that will vary between 150% and 180% of the deceased worker’s benefit amount. For divorcees who had been married for ten years or longer, the survivor benefit is available if they have not remarried before age 60. An ex-spouse’s survivor benefit has no effect on the family maximum benefit, so a new spouse and any children can still be eligible to receive survivor benefits based on the same wage earner. Although a widow may be eligible for benefits based on their own work record, if they file for social security benefits, they will receive the highest benefit they qualify for at the time they file. Some benefits are calculated independently with the larger benefit being paid or the smaller benefit being paid plus the excess amount of the larger one. Other types of benefits are calculated with a carry-over reduction amount from the first benefit to the second. Although the loss of a loved one is a terrible time to assess and compare your social security filing options, it is important that you choose wisely. If possible, delay the decision until you have had the time to be emotionally ready to face the problem and consult with a trusted financial planner. If you are at least 62 by the end of 2015 you are a winner! Everyone else, not so much.

As part of the budget agreement passed by the Senate and House of Representatives and signed by President Obama “loopholes” in Social Security rules were closed. These “loopholes” included the ability to file and suspend and the ability to file restricted claims for spousal benefits only were eliminated for those of us younger than 62. By extending the concept of ‘deemed’, younger workers who file for benefits will receive the larger of their spousal benefit or their benefit based on their own earnings record at the time of filing. You will still be able to delay claiming your Social Security benefit beyond your normal retirement age and accrue addition credits, but the ability to draw a spousal benefit while allowing your own benefit to accrue delayed credits was nixed for the vast majority of Americans. If you are among the winners in this legislative lottery be sure you think carefully about your Social Security claiming strategy. You could increase your lifetime benefits by many thousands of dollars. You can still use the ‘restricted application’ to collect benefits based on your spouse’s earnings record while allowing your own benefit to earn delayed payment credits of about 8% per year. The rules are complex, but they are certainly worth learning. For the losers, the rules are simpler and less generous, but there are still choices that can mean more money for married couples in some circumstances. File and suspend is a strategy available only to those who elect to wait until at least their normal retirement age to begin receiving Social Security benefits. It is a tool that allows the coordination of benefits between spouses and is a bit like an insurance policy for anyone deferring benefits. It works like this.

Once you reach your normal retirement age you apply for Social Security benefits, but have your payment suspended before any check are issued. This accomplishes two things. One, if you have a spouse who is eligible for spousal benefits it is a signal to the Social Security Administration that they can now claim those benefits. Two, it provides some protection in case you learn you have a medical condition that will limit your lifespan. If, for example, you are diagnosed with cancer when you are age 69 and not expected to live much longer, you can go back to the Social Security Administration and tell them you want to receive benefits retroactively to the day you had your benefits suspended. You will receive a lump sum check for any benefits accrued up to that point. If you do not retroactively claim your benefits you will continue to earn delayed retirement credits and boost your monthly check by 8% a year until you reach age 70. Many times folks get in such a big rush to claim their Social Security benefit that they lock in reduced benefits without considering how this decision fits in with their long term needs and other sources of retirement income.

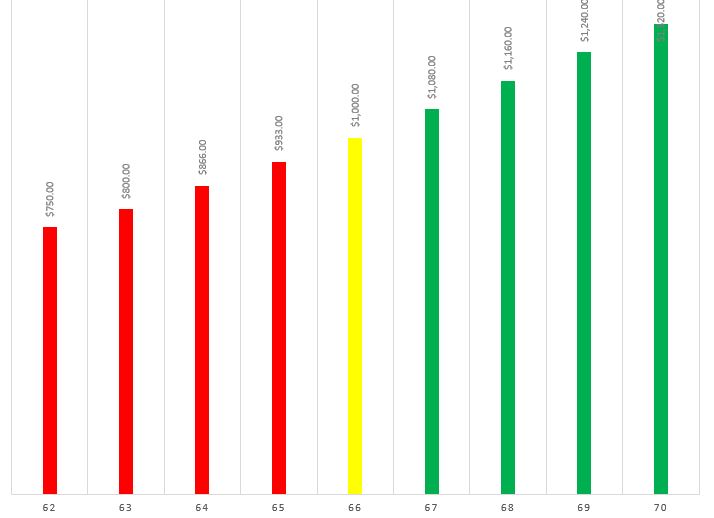

Just because you can claim Social Security benefits at age 62 doesn’t mean that you should. If fact depending on when you were born, your annual income will be reduced by 25% if you start taking your checks at age 62. That means if you have earned a $1,000 per month benefit at your normal retirement age you will only receive $750 per month if you start at age 62. Multiply that reduction by the many years you will live in retirement and you’ll find you could be leaving tens of thousands of dollars on the table! On the other end of the scale you can receive increased payments if you delay receiving benefits beyond your normal retirement age. For each year up to age 70 that you delay receiving Social Security benefits your monthly check will increase by 8%. So I you were expecting to receive $1,000 per month at your normal retirement age you could boost your monthly check to $1,320 per month just by waiting until age 70 to start receiving benefits. So for someone with the same work history the monthly Social Security retirement benefit could range from a low of $750 to a high of $1,320. That is more than an 75% difference in monthly income! And it is a difference you will likely live with all your life. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed