|

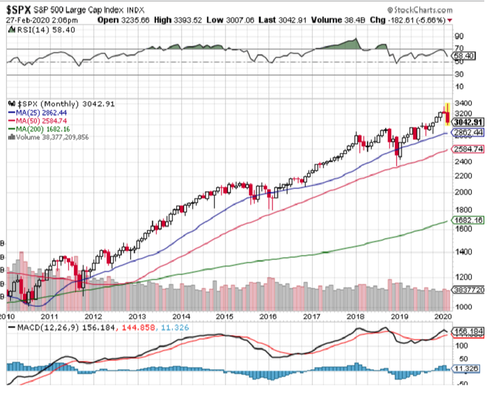

I don't want to add flames to the fire regarding the new coronavirus-- COVID-19, however, the time to have a lifeboat drill is prior to the ship sinking. Investors should contemplate what this virus can do to the markets and world economies while they are still thinking rationally, rather than waiting until widespread panic clouds their judgement. The COVID-19 is the same type of virus as the common cold, but it’s definitely not common. It is a strain that is new in humans, so we, as a species, have not developed antibodies to fight it, and there is no herd immunity to slow its contagion. Rather than turn to Facebook or the popular press for answers, we recommend you visit the Center for Disease Control web site for more detailed information on what COVID-19 is and the threat it poses. Early data shows a high fatality rate-- somewhere around 2%; but keep in mind this data could well be skewed because diagnosing those infected is rudimentary at best. We are aware of nearly 100% of the fatalities but the number of cases of infection could be vastly under-reported. A coronavirus is a cold, and except in the most serious cases, likely to pass with little notice. You’re probably aware that drug companies around the world are trying to find a vaccine. We wouldn’t hold out much hope on this front as we have been trying to find a cure for the common cold for decades with zero success. In the past week, we’ve seen the US Stock market drop by about 10% as concerns over COVID-19 have swept the globe. While markets usually do a very good job of pricing risk and opportunity, there are times when rationality tips to panic, and markets no longer function as they should. The most recent example of this was the 2008-2009 period when markets lost half of their value based on panic that the world was ending. They would eventually rebound fourfold as panic subsided and rational thought came back to the forefront. So, is the pullback, so far, a rational repricing of risk/opportunity? Or is it the beginning of a panic? We believe it is too soon to tell. Some companies have already announced that the COVID-19 is having an effect on their sales and earnings. Microsoft and Apple have noted problems with their supply chains. As market participants try to peer into the future, they’ve battered the travel and energy sectors, expecting consumers to avoid travel. As fear spreads this will work its way into the restaurant sector, fear of contagion may cause consumers to avoid crowded spaces where the virus could be easily transmitted. On a more basic level missed workdays and a drop in productivity could potentially hurt businesses of every type. S&P 500 2010-PresentThe stock market has had an incredible run over the past 14 months, reaching new highs at almost a monthly pace. The technical indicators we follow showed the market nearing overbought levels on a short-term basis prior to the recent drop. So, a pullback was not unexpected-- with or without the COVID-19 outbreak. That doesn’t mean we expect a reversal, but it does mean we would not expect a continuation of these 2%-3% per-day drops. From a technical perspective, a pullback to around 2,600 for the S&P 500 would not be overly concerning. If markets stabilize on a short-term basis, there are gaps in index price levels that will be filled. So, in fact, we could soon have a very good buying opportunity for long-term investors with cash to allocate to stocks. S&P 500 Last 6 MonthsWhat Should a Rational Investor Do?Nothing. Rational investors know that their default position should always be to remain fully invested. It is too soon to tell if this is a normal market adjustment to new information, or the beginning of a panic. For those with reasonable investment time frames, this will be a barely noticeable blip on the long-term chart of their investment history.

In the short term there will be times when investors doubt themselves. This is normal. We believe thinking about this problem now and preparing for an uncertain future can only help long-term investors achieve their long-term goals.  Every year about this time, the popular press comes out with predictions for the new year. We all know that no one has a crystal ball but we read them anyway. Happily, Google never forgets. Here are some of the predictions made for 2016.

So, read the predictions for 2017 with a healthy dose of skepticism, it’s just for fun.

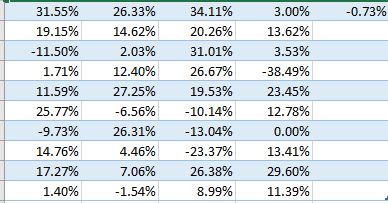

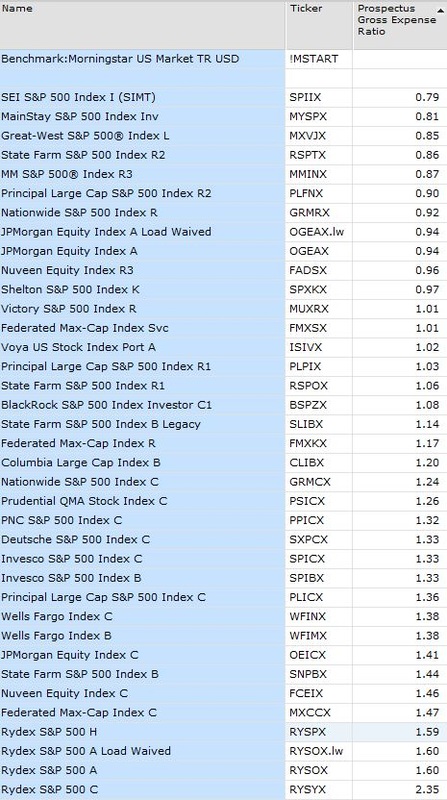

Over the last 80 years the stock market has advanced an average of 10% each year, but average is not normal when it comes to the stock market. The table pictured on the left shows the actual returns for the S&P 500 each year since 1975. How many of those returns were 10%? How many fell between 9% an 11%? Not many were even close to average.  So while you may be hoping for your investments to look like this.  You will likely experience something like this.  Bob Clark, a columnist for Investment Advisor magazine, recently said, "...the role of advisors is to protect their clients from the financial services industry". Many times the products pushed by the large financial service firms do more harm to investors than good. The "hot" product du jour is currently the Equity Index Annuity. While the equity index Annuity itself is not an evil thing, the way they are presented to investors is many times misleading, and they are often pushed to be a much larger part of a portfolio than prudence would justify. In brief, an equity index annuity, provides returns that a related to some stock market index. As such they can be viewed as an equity derivative (remember those?). Investors typically receive a return that is some portion of the return of an index like the S&P 500 (for example 90% of the point to point return of the price increase of the index, not including dividends), the average monthly return of the index over a predetermined period (again not including dividends), or the monthly gain of the index with a predetermined cap (often 2-3% per month cap). The big draw is that you receive a guarantee that your account will not have a negative return over some period of time. Often touted as "heads you win, tails you don't loose". On the face that sounds enticing. It is only if you kick the tires that problems become apparent. First, like most annuities there is a long period of time where you a charged a surrender charge if you want or need to withdraw more funds than allowed in the contract (I have even seen instances where the surrender charge is applied to any withdrawal except in the case of annuitization). Second, any gain from annuities is considered to be distributed first, and taxed as ordinary income (you do not get favorable dividend of capital gain rate when you file your taxes), and any distribution before age 59 1/2 could be subject to a 10% premature distribution tax penalty. Worst of all the returns investors receive will likely not measure up to expectations. The pitfalls of monthly caps and averaging returns requires some contemplation to understand. Let's say you are credited with any market gains up to 2% each month. That means if the index you participate in goes up by 2% you are credited with the full 2%, if the index goes up 3%, sorry, you are still only credited with 2%. Okay, you say, that's not so bad, I can still earn a whopping 24% in a year! In theory yes, in practice, no. See sometimes, even in a very good year, markets will fall back some months. And you equity indexed annuity lets you participate fully in the monthly market drops, as long as the account moves no further than 0% in a year. If the index you participate in rises by 3% one month, the 1% the next month, but falls by 3% the following month, your account earns zero, nada, zilch. You were credited with 2% the first month, then 1% the second month, but got dinged for the full minus 3% in the third month. It's all very confusing, and people hear what they want to hear. That is what the insurance companies and agents who sell equity index annuities are counting on. Heads the insurance company wins, tails, you lose.  Warren Buffett is the man. The Oracle of Omaha just seems to make the right move almost all of the time. One of my favorite Buffett moves has been 8 years in the making…so far. About 8 years ago Warren made a $1 million bet with a hedge fund company that a simple S&P Index Fund would outperform a group of hedge funds over a 10-year span. The winnings will go to a charity of the victor’s choice and right now, Buffett’s less managed and much more affordable Index Fund is crushing its competition. Of course, we can learn yet another vital lesson from Warren. It’s not always the flashy, trendy, and often times much more expensive investments that perform the best. Often times, as history has proven to us over and over, a simple index fund and the stock market’s consistent rise over time can turn out to be the strongest investment of all. It may not be a flashy way of investing, but it sure pays off in the end.  Stole that headline from Twitter. Originated with someone named Allen Kuhn. I don’t know Allen but that is a catchy snippet. One hundred and forty characters doesn’t tell much of a story so I will just guess what Allen was thinking. These were all on Yahoo finance today. This could send gold tumbling below $1,000 again, Citi says – Citi doesn’t know which way gold will trade next, but they know you are scared. Hedge funds dumped Apple, and bought this stock instead – Hmm Apple was a great investment for a long time and now these guys have found a replacement for Apple in my portfolio! Holy iWatch, Batman! Jump on it! Top 3 American Century Investments Asset Allocation Mutual Funds (TWSAX, TWSMX) – Wait, what? You said three, this is only two and they both have above average fees. A brutal remark from a high-speed trader tells you everything you need to know about where Wall Street is headed – and my crystal ball says they are all wet.  Wow! Can you believe it? What in the world is going on now? No one understands this, it just makes no sense. Has the world gone mad? All of these sentences could be uttered every week if you have a conversation about the stock market. It never seems to change, there is always something nutty happening. If it’s not the Fed, it’s congress. If it’s not interest rates, it’s PE ratios. If it’s not earnings, it’s IPOs. All of this reminds me of an old Saturday Night Live skit that featured Gilda Radner as Roseanne Roseannadanna. After going off on a rambling rant loosely related to some topic, Rosanna would be interrupted by the news anchor played by Jane Curtin and then Roseanna would end the segment with the line, “Well, Jane, it just goes to show you, it's always something — if it ain't one thing, it's another." And that’s the problem and opportunity with the stock market!  Where do you draw the line for ethical behavior and corporate greed? This weekend I saw an online article about expense ratios and index funds that claimed there were funds that do nothing more than track the S&P 500 Index, yet charge investors fees greater than 1% to do so. I have a license for the Morningstar database so I checked for myself today. I was amazed. A scan for S&P tracking funds returned 160 funds, now Morningstar counts each share class as a separate fund so the real number is a bit less, but the spread of gross prospectus expense ratios was eye opening. The expense ratios ranged from a low of .01% (that is one basis point) for the Vanguard 500 Index Institutional Select to a high of 2.35% for the Rydex S&P 500 Class C share. Now you should know that managing an index fund is a no brainer. The stocks you own should be the same stock in the same weightings as the index that is published by Standard and Poor. It should be easy enough for a computer program to handle without much human input. And other than expenses all these funds are the same. It is a commodity and one index fund should logically be a perfect replacement for any other index fund, just as one bushel of wheat should be a perfect replacement for any other bushel of wheat. So how can Rydex justify those charges? And although Rydex is the most expensive I see Nuveen Equity Index C at 1.46% State Farm S&P 500 Index B at 1.44%, Wells Fargo Index B at 1.38%. This is nuts. If you own any of these funds you should fire your broker. The SPY SPDR S&P 500 Exchange Traded Fund is available for all brokerage firms to purchase and has a gross expense ratio of just 0.11% (11 basis points). How can anyone justify paying 10 times that for what should be an identical product? But where do you draw the line? Or is there no line because no one is looking?  If you haven’t heard of Bill Ackman before then good for you! You’re out living your life and are not too plugged into CNBC. Bill Ackman is a hedge fund manager, he is a really smart guy and made a lot of money for his investors…until recently. His big bet on pharmaceutical company Valeant has become an epic fail, with the stock price cratering from a high of $261 in August of 2015 to around $34 per share less than a year later. That is shedding over 85% of the company’s value. So how can such a smart guy turn so wrong so fast? And, what can individual investors learn from Mr. Ackman’s fail? 1) Don’t own enough of any one thing that you can make a killing or be killed by it. Diversification is the investor’s best friend. You do not have to be a stock picking genius like Bill Ackman to grow your wealth, you just need to have a properly diversified portfolio that you can stick with through thick and thin. The magic of compound interest and the inexorable march of the stock market will do the rest. 2) Don’t announce to the world that you own stock in a company that you see as a big winner. Bill Ackman was often in the financial media, talking up the positives of Valeant. Maybe it started by Ackman being a little greedy and talking up a holding, but over time it seems to have morphed into a story he believed. If you publicly say XYZ is the best thing since sliced bread, you will paint yourself into a corner of having to admit you were wrong if things don’t work out, and people hate to admit they were wrong about anything! So Bill sees that Valiant stock is cratering, but rather than admit to being wrong he stubbornly refused to sell until most of his money has disappeared. From here it will take a gain of over 600% for him to get back to a valuation equal to the August of 2015 level. How many years of stellar returns does it take to gain over 600%? Not even Bill Ackman is that good. 3) Don’t invest in companies that are built on shady dealings. Like the banks that derive too much of their profit from the fees they charge their small customers, Valeant Pharmaceuticals didn’t have a legitimate economic model. They bought companies and drug rights with the sole intent of price gouging their customers. If they would do that are you really surprised they would cook their books too? Companies that understand they are also citizens of the places they do business tend to build the best business model for the long run. Companies that are shady like the Pharma Bro i.e. Enron, Lehman Brothers, Arthur Anderson, eventually are rewarded appropriately for their behavior. There are too many good companies available to choose one built on cheating. Sorry, Bill Ackman. We are only human. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed