Get Your Financials in Order, Gain Financial Freedom, and Get the Most Out of RetirementBudgeting for retirement is based on a projected retirement date. But when most people start their retirement income planning, they may not be sure exactly when they will want to step away from their job—and as they age, their planning for retirement may change. If you are thinking about accelerating your retirement plans, you are not alone. CERTIFIED FINANCIAL PLANNER™ practitioners work hard to make sure their clients are ready for retirement. When people change their minds about when they want to retire, their retirement income planning does, too. Sudden changes in fortune or lifestyle can prompt people to wonder if they can reach financial freedom sooner than they expected, like coming into a big inheritance, a generous severance package near the end of a career or a big offer to sell your company, or even a health scare or a spouse’s retirement. If you feel you may be reaching financial freedom sooner than you thought, we are always ready to explore your options for an early retirement. So, when should YOU retire? Not before you can answer “yes” to the four questions below! 1. If I retire now, is my healthcare—and that of my spouse—covered?When you think about your road to financial freedom, do you think about your personal health? You should. If you are like most working people, you have a health insurance plan that is covered or partially compensated by your work. Retiring tips don’t often talk about health care because they assume you have reached the age of 65 and are eligible for Medicare plans. If you retire today, how will you get healthcare for yourself and for your family? Depending on your retirement plans, you may need to pay for your health insurance plan out of pocket for years—and potentially for your spouse and for any children under age 26 currently on your healthcare plan as well. A high-quality healthcare plan that goes beyond catastrophic coverage can be costly, depending on your age or any pre-existing conditions. (Don’t fall for low-cost, Medishare-style junk plans that do not provide adequate coverage!) Healthcare challenges can strike at any time and turn your financial freedom into a financial disaster. At Oak Street Advisors, our fee-only financial advisors recommend strategies to protect your finances from catastrophic healthcare expenses while concurrently also minimizing taxes and potentially realizing tax-free investment growth if you choose to retire before you are eligible for Medicare. If I retire now, can I get by without my social security benefits?Most retirement strategies rely on social security benefits on some level. During your retirement income planning, your financial advisor helps you decide the optimal time to begin drawing your social security income. Most try to find ways for you to postpone taking social security until you reach at least full retirement age—as late as 67 years old, depending upon your birthdate, if not age 70. If your retirement income planning relied on receiving social security (or receiving the maximum amount of social security) and you are not yet eligible to draw payments, can you replace that income or get by without it until you reach the appropriate age? If I retire now, am I truly debt-free?Financial planning after retirement usually assumes you have paid off all of your credit cards, any outstanding medical or educational debts, and—hopefully—your home. Most CERTIFIED FINANCIAL PLANNER™ practitioners encourage all of our clients to make a debt-free retirement a high priority. You cannot retire with confidence if you are still making credit card, car, boat, student loan, or mortgage payments. Why? Peace of mind. When your home is paid off, your retirement income planning needs to cover taxes, insurance, and general home maintenance, not costly mortgage payments. If I retire now, do I have a personal or professional goal?Financial freedom tips fail to ask what, exactly, you plan to do with that newfound financial freedom. When you begin planning for your retirement, you should think about what your hopes and dreams for this incredible phase of your life might be.

Getting away from the daily grind can sound wonderful when we are in the working world. But if you do not have ideas or plans for how to spend that new free time, you may find it weighs more heavily on you than you had imagined. Your retirement plans should include more than retirement income planning. Retirement planning should include new challenges, opportunities for learning and personal growth, restorative rest and relaxation, community involvement, family connections, travel … whatever is meaningful and motivating for you. Your road to financial freedom needs a destination. Often, navigating the Social Security Administration’s rules can be complex and confusing. None more so than trying to determine a surviving spouse’s social security benefit. Nearly every couple will face this problem at some point.

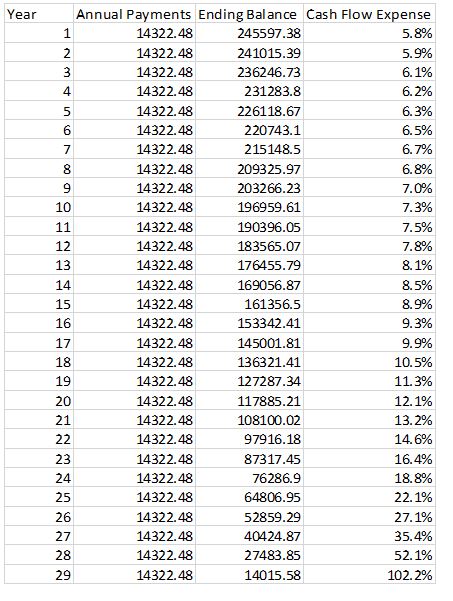

Timing is everything regarding social security surviving spouse benefits. The filing date alone—when you decide to claim social security and when your spouse does—ultimately determines how much you both will receive in Widow or Widowers benefit. Getting your initial claiming strategy right is paramount to maximizing this important benefit. If the deceased spouse has not begun receiving social security income at the time of death, the survivor’s benefit is based upon the decedent’s primary insurance amount (their social security income at Normal Retirement Age) plus any delayed retirement credits up to the date of death. Delayed retirement credits add about 8% to the social security income received for each year you delay taking your social security benefit beyond your normal retirement date, up to age 70. If this is the case the surviving spouse’s decision to claim social security benefits will be based on their age at the time they file. What this means is if the survivor decides to receive social security income before they reach their normal retirement date, there will be a reduction in income for each year of early filing, even if the deceased spouse had earned delayed retirement credits. If the deceased spouse had been receiving social security income before their normal retirement date, their benefit and the widow(er)’s benefits are reduced forever, depending on when the initial benefit claim was filed. Generally, you would lose about 8% of social security income for each year you receive social security payments prior to reaching your Normal Retirement Age (NRA). A widow(er)’s benefit is limited to the larger of 82.5% of the deceased spouse’s death primary insurance amount or the reduced income benefit the deceased would have been eligible for if they had lived. The Social Security Administration provides the following example: “Mr. B, age 64 on August 3, received reduced retirement income benefit of $350 (primary insurance amount $374.90) for August and September. He died in October. Mrs. B, age 66, comes in, to file for widow's benefits. The retirement income benefit if Mr. B were alive would be $350. 82 1/2 percent of the death primary insurance amount is $309.20 ($374.90 X .825). The life and death primary insurance amounts are the same. The widow’s income benefit will be the higher of the two, $350 in this example.” Your widow or widower can get benefits at any age if they take care of your child younger than age 16 or disabled, who’s receiving Social Security benefits. If the surviving spouse is disabled, benefits can begin as early as age 50. Unmarried children, younger than age 18 (or up to age 19 if they’re attending elementary or secondary school full time), can also get benefits. Children can get benefits at any age if they were disabled before age 22. Under certain circumstances stepchildren, grandchildren, step-grandchildren, or adopted children may also be eligible for benefits. These circumstances are exempt from the deemed filing rules and do not affect future claims made under their own work record. There is a family maximum to survivor benefits that will vary between 150% and 180% of the deceased worker’s benefit amount. For divorcees who had been married for ten years or longer, the survivor benefit is available if they have not remarried before age 60. An ex-spouse’s survivor benefit has no effect on the family maximum benefit, so a new spouse and any children can still be eligible to receive survivor benefits based on the same wage earner. Although a widow may be eligible for benefits based on their own work record, if they file for social security benefits, they will receive the highest benefit they qualify for at the time they file. Some benefits are calculated independently with the larger benefit being paid or the smaller benefit being paid plus the excess amount of the larger one. Other types of benefits are calculated with a carry-over reduction amount from the first benefit to the second. Although the loss of a loved one is a terrible time to assess and compare your social security filing options, it is important that you choose wisely. If possible, delay the decision until you have had the time to be emotionally ready to face the problem and consult with a trusted financial planner.  I have heard debt defined as work you have yet to do. Thinking of debt in this way highlights the need to be debt free in retirement. If retirement is to be a time when you no longer exchange labor for a paycheck, then you do not want ‘work you haven’t done yet’ to be in the equation. Carrying consumer debt like credit cards and home equity loans is the biggest no-no. It is important to remember that the safest and easiest way to earn 12% to 18% on your money is to not pay 12% to 18% for your money. Home mortgages are not as bad as consumer debt since you are financing an asset that will likely appreciate, or at least keep even with inflation. However, if you can eliminate that monthly payment you will find you can sleep better when you reach your retirement years. The two most common objections I have run into when recommending clients pay off a mortgage are: 1) They like the mortgage interest deduction when they file their income tax return 2) They like the security of having a large balance in their savings accounts. To which I explain: 1) The mortgage interest deduction only reduces the effective interest rate you pay, it does not eliminate it. Plus, your marginal income tax rate is likely to be lower during your retirement years anyway. 2) You are likely earning less on your savings than you are paying in mortgage interest, and even if you invested the money, you then end up with more assets at risk to market fluctuations during a part of your life when lowering your exposure to risk makes sense. Having a reasonable budget and the discipline to live within it is equally critical to your happiness and peace of mind during both accumulation and retirement phases. Having no mortgage keeps your monthly expenses low and which makes living within your means during retirement much easier. If all you really have to worry about is paying taxes, insurance, utilities, and for food you will find less stress in your life. So, based on your anticipated retirement date, you should develop a plan to eliminate as much debt and monthly payments as possible. It is much easier to develop and implement a plan in the years leading up to retirement than it is to address these needs after you have retired. If you need help developing a debt elimination plan, then reach out to us here at Oak Street Advisors, we have decades of experience helping pre-retirees fine tune their finances to make retirement less stressful and more enjoyable. Carrying mortgage debt can be a contentious subject among financial planners. Some look at the leverage as an opportunity to build net worth. Others see mortgage debt as merely a necessary evil. Often clients believe the mortgage interest deduction is valuable, but with the new income tax rules effective January 1, the deduction is limited for some and worth less for others. So when should you try to be mortgage free? Certainly, by the time you plan to retire. I have given this advice to everyone who has the means to do so, and to a person, they have always commented that it was the best advice they ever received. The reason has little to do with money, but everything to do with peace of mind. Not having the expense of a mortgage often reduces your need for significant cash flows. Being mortgage free also means that if push comes to shove, how much does it really take to live each month? Your basic expenses are then whittled down to food, energy, medical, and insurance expenses. Retirement is also the point in your life where growing your net worth takes a back seat to generating income. I explain to clients that the easiest and safest way to earn 4% on your money is to avoid paying 4% for your money. Paying off a mortgage can be compared to purchasing a bond with a yield equal to your mortgage interest rate. I like to illustrate the value of paying off your mortgage in a very simple way. Below is a chart of the annual payments for a $250,000 mortgage at 4% interest. We can ignore escrow amounts, because that covers expenses that will continue regardless of whether or not you pay off the mortgage debt. Cash flow expense is simply the mortgage payments for the year divided by the payoff amount, or if you had the cash available to pay off the mortgage how much cash flow that money would have to produce to cover your mortgage payment.

You can see in this example that by year 15 the amount of money needed to pay off your mortgage would need to produce returns close to the historical equity market rates to be an even trade-off. By year 20 of a 30-year mortgage, or around the time many people are reaching retirement, the return on cash needed to make your mortgage payments has reached double digits. If you were retiring at that point and had $117,886 available in a taxable account I would encourage you to use that money to pay off your mortgage. With a cash on cash return of over 12% the odds of earning a higher return on that money is slim, and it gives you an extra ten years of a less stressful retirement. I once had a planning client come to me complaining that low CD rates were cutting into their lifestyle. The client felt they needed more income, but they were very risk averse. For them using the $100,000 to pay off their mortgage saved them from having $9,000 in annual expenses and did so without exposing them to any investment risk at all. Every situation is a bit different, but you should challenge your assumption that carrying mortgage debt in always a good strategy. If you are at least 62 by the end of 2015 you are a winner! Everyone else, not so much.

As part of the budget agreement passed by the Senate and House of Representatives and signed by President Obama “loopholes” in Social Security rules were closed. These “loopholes” included the ability to file and suspend and the ability to file restricted claims for spousal benefits only were eliminated for those of us younger than 62. By extending the concept of ‘deemed’, younger workers who file for benefits will receive the larger of their spousal benefit or their benefit based on their own earnings record at the time of filing. You will still be able to delay claiming your Social Security benefit beyond your normal retirement age and accrue addition credits, but the ability to draw a spousal benefit while allowing your own benefit to accrue delayed credits was nixed for the vast majority of Americans. If you are among the winners in this legislative lottery be sure you think carefully about your Social Security claiming strategy. You could increase your lifetime benefits by many thousands of dollars. You can still use the ‘restricted application’ to collect benefits based on your spouse’s earnings record while allowing your own benefit to earn delayed payment credits of about 8% per year. The rules are complex, but they are certainly worth learning. For the losers, the rules are simpler and less generous, but there are still choices that can mean more money for married couples in some circumstances. File and suspend is a strategy available only to those who elect to wait until at least their normal retirement age to begin receiving Social Security benefits. It is a tool that allows the coordination of benefits between spouses and is a bit like an insurance policy for anyone deferring benefits. It works like this.

Once you reach your normal retirement age you apply for Social Security benefits, but have your payment suspended before any check are issued. This accomplishes two things. One, if you have a spouse who is eligible for spousal benefits it is a signal to the Social Security Administration that they can now claim those benefits. Two, it provides some protection in case you learn you have a medical condition that will limit your lifespan. If, for example, you are diagnosed with cancer when you are age 69 and not expected to live much longer, you can go back to the Social Security Administration and tell them you want to receive benefits retroactively to the day you had your benefits suspended. You will receive a lump sum check for any benefits accrued up to that point. If you do not retroactively claim your benefits you will continue to earn delayed retirement credits and boost your monthly check by 8% a year until you reach age 70. Many times folks get in such a big rush to claim their Social Security benefit that they lock in reduced benefits without considering how this decision fits in with their long term needs and other sources of retirement income.

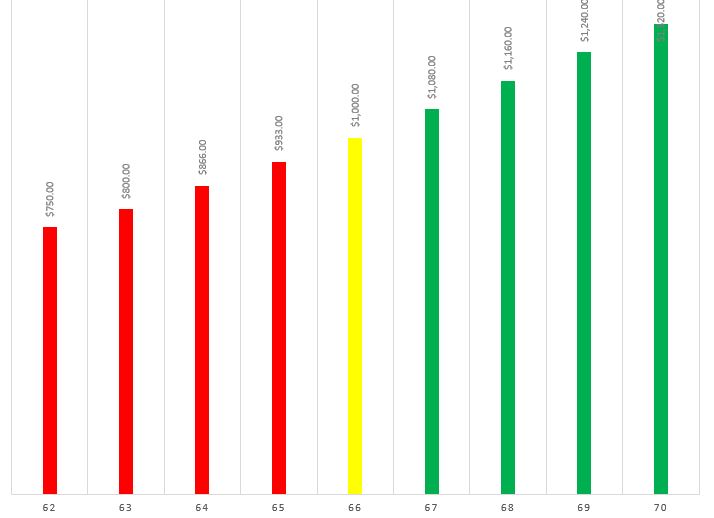

Just because you can claim Social Security benefits at age 62 doesn’t mean that you should. If fact depending on when you were born, your annual income will be reduced by 25% if you start taking your checks at age 62. That means if you have earned a $1,000 per month benefit at your normal retirement age you will only receive $750 per month if you start at age 62. Multiply that reduction by the many years you will live in retirement and you’ll find you could be leaving tens of thousands of dollars on the table! On the other end of the scale you can receive increased payments if you delay receiving benefits beyond your normal retirement age. For each year up to age 70 that you delay receiving Social Security benefits your monthly check will increase by 8%. So I you were expecting to receive $1,000 per month at your normal retirement age you could boost your monthly check to $1,320 per month just by waiting until age 70 to start receiving benefits. So for someone with the same work history the monthly Social Security retirement benefit could range from a low of $750 to a high of $1,320. That is more than an 75% difference in monthly income! And it is a difference you will likely live with all your life. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed