|

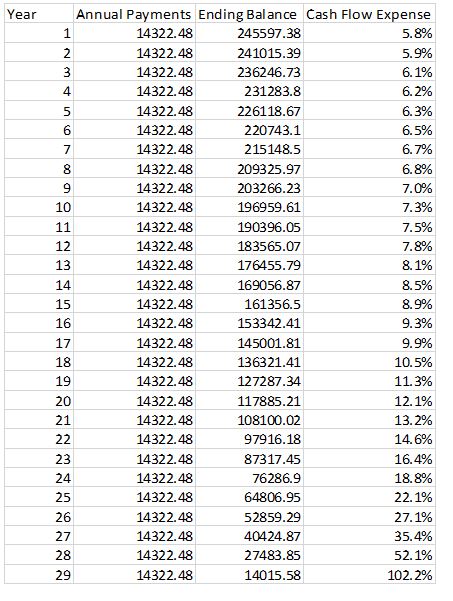

Carrying mortgage debt can be a contentious subject among financial planners. Some look at the leverage as an opportunity to build net worth. Others see mortgage debt as merely a necessary evil. Often clients believe the mortgage interest deduction is valuable, but with the new income tax rules effective January 1, the deduction is limited for some and worth less for others. So when should you try to be mortgage free? Certainly, by the time you plan to retire. I have given this advice to everyone who has the means to do so, and to a person, they have always commented that it was the best advice they ever received. The reason has little to do with money, but everything to do with peace of mind. Not having the expense of a mortgage often reduces your need for significant cash flows. Being mortgage free also means that if push comes to shove, how much does it really take to live each month? Your basic expenses are then whittled down to food, energy, medical, and insurance expenses. Retirement is also the point in your life where growing your net worth takes a back seat to generating income. I explain to clients that the easiest and safest way to earn 4% on your money is to avoid paying 4% for your money. Paying off a mortgage can be compared to purchasing a bond with a yield equal to your mortgage interest rate. I like to illustrate the value of paying off your mortgage in a very simple way. Below is a chart of the annual payments for a $250,000 mortgage at 4% interest. We can ignore escrow amounts, because that covers expenses that will continue regardless of whether or not you pay off the mortgage debt. Cash flow expense is simply the mortgage payments for the year divided by the payoff amount, or if you had the cash available to pay off the mortgage how much cash flow that money would have to produce to cover your mortgage payment.

You can see in this example that by year 15 the amount of money needed to pay off your mortgage would need to produce returns close to the historical equity market rates to be an even trade-off. By year 20 of a 30-year mortgage, or around the time many people are reaching retirement, the return on cash needed to make your mortgage payments has reached double digits. If you were retiring at that point and had $117,886 available in a taxable account I would encourage you to use that money to pay off your mortgage. With a cash on cash return of over 12% the odds of earning a higher return on that money is slim, and it gives you an extra ten years of a less stressful retirement. I once had a planning client come to me complaining that low CD rates were cutting into their lifestyle. The client felt they needed more income, but they were very risk averse. For them using the $100,000 to pay off their mortgage saved them from having $9,000 in annual expenses and did so without exposing them to any investment risk at all. Every situation is a bit different, but you should challenge your assumption that carrying mortgage debt in always a good strategy. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed