|

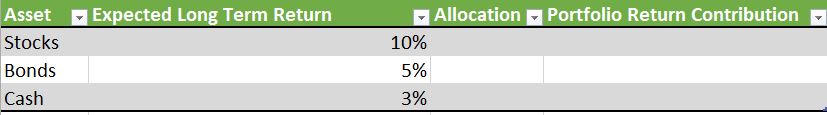

Many people do 'kitchen table' financial planning from time to time. They have a goal and make a guess about how much money they will need to pay for it. Next they will assume some rate of return on their capital and off they go, pounding on the calculator keys until they arrive at an answer. I am in fact a fan of 'kitchen table' planning, so I would like to offer some ideas on how to do it better. I'll start with estimating your rate of return. Here is a method that will give you an idea about what sort of long term return you can expect from a portfolio using the three major assets classes available in the capital markets. Remember it is an estimate not a guarantee, but it is better than just pulling a number out of the air and it also illustrates the relationship between risk and reward. To use this tool you should know that I am speaking of gross returns, that is returns before the effect of inflation. From 1925 to present the stock markets has produced and average annual return of 10%. Some years are higher, some are lower. Different periods have produced different result but I have more confidence in over eighty years of observations than any shorter period. Bonds have averaged around 5% and cash somewhere around 3%. You can use your own guesses of course but at least this gives you a starting point. Next you must determine your asset allocation. That's just the fancy word for what percent of your portfolio is invested in each asset class. Just divide each component by the total. Now you can use the form below to estimate your long term return. For example if you have 70% of your money in stocks, 25% in bonds, and 5 % in cash you would multiply .7 by.1 and put .07 in the contribution column, multiply .25 by .05 and put .0125 in the contribution column, and multiply .05 by .03 and put .0015 in the contribution column. Total the contribution column and you will get an 8.4% expected long term return from this portfolio.

Try changing the allocations to see how risk and reward can affect your expected returns. If you like you can add other asset classes such as real estate and commodities to see how they might affect your expected return. How much money you can take out of your investments without running out of money is a critical question when building any financial plan. As a member of the Financial Planning Association I hear from other members and read in the financial press many theories on how to calculate a safe withdrawal rate. Some of the ideas put forth are elegant, some are complicated, and all ultimately fail because they attempt to do the impossible, which is to predict a future event. The future is unknowable, so having any degree of confidence in any method of projecting historic calculations on future events is dubious at best. There is a reason the SEC requires the disclaimer that past results are not indicative of future returns.

The uncertainty of safe withdrawal rates is one of the reasons I advise clients to try to be debt free when they reach retirement age. If your house is paid for and you have no consumer debt, your living expenses can be managed much more easily. You can adjust your lifestyle without too much pain to cope with unexpected events, and adjust withdrawal rates to protect your nest egg. That said, I do believe having a financial plan gives you a much greater chance of success than not having a plan, and you must select some withdrawal rate that you believe (or maybe hope) to be safe to complete any retirement planning calculations. So here I go with what I believe is as good a way of calculating your safe withdrawal rate as any. If you've been reading this blog a while you know about estimating your rate of return for a diversified portfolio, and you know how to calculate your real rate of return. My simple if imperfect suggestion for calculating your personal safe withdrawal rate is to use the expected real rate of return of your portfolio. This amount is already adjusted for inflation and you will probably have to make some adjustments along the way anyway. If you can afford to take less, great! Your odds of success are probably improved. Oh, and one other thing, when you reach retirement try to keep one years living expenses allocated to cash, this will help if things get really dismal. Having a large cash reserve will preclude you from having to sell other securities at in opportune times. At least for a year. If you were planning a vacation you would start with a desired destination, select the dates you can go, determine your budget, and then tweak your plans to fit your budget. It is the same with financial planning. You have to determine where you want to go (how much income or how big a nest egg you need), set a target date for getting there, determine how much you need to save and invest, and then tweak your plan for the realities of your situation.

If you are planning for a down payment on a home you will have to amass a lump sum that you will be spending all at once. So calculating your need is pretty straight forward. If you want to buy a $300,000 house, you will need to save at least a 10% down payment, or $30,000. If you are planning to send a child to college you can look up the cost of tuition, books, and living expenses at the schools web site. But unless your child is starting school this year you will have to estimate what future expenses might be, or you will surely come up short due to likely increases in costs between now and the time your student enrolls. So how do you plan for such price increases? Well, if you do a little snooping around you will learn that college costs have been increasing at about twice the level of general inflation. Armed with that and the number of years until your student enters college, you can make an educated estimate of how much you will need in the future to pay for this expense, by using one of the 'secret' formulas of financial planning. It is called the Future Value formula. It is, like the name implies, a formula to calculate the compound interest future value of something. Here's the 'secret' formula: FV = PV * ( 1 + i )N PV = present value FV = future value (maturity value) i = interest rate in percent per period N = number of periods When estimating the future cost of something the i represents the rate you expect that something to go up in real terms. To learn about real rates of return see this previous post. So lets work through an example. I have a daughter who will enter college in 12 years. The cost of attending a university in my state is currently about $17,000 per year, so in todays dollars I would need $68,000 to pay for her education. PV = $68,000 FV = future value = ? i = interest rate in percent per period = 6% (nominal college inflation)-3%(expected general inflation rate) =3% N = number of periods = 12 years FV = $68,000 * ( 1 + .03)12 If you are like me you don't have one of those fancy TI calculators you kids use, but that is okay. to solve the ( 1 + .03)12 part you just add 1 and .03 then enter 1.03 times 1.03 into your basic calculator and hit the enter button twelve times. That gives you 1.4685. Now multiply $68,000 by the 1.4685, and presto, you find you will need about $99,860 (lets call it an even $100,000) in inflation adjusted dollars to send little Debbie off to college when the time comes. Finally, when you are planning for retirement the 'how much will I need?' question is usually answered with a per year income figure. Here you have to estimate what you would need if you retired today. You don't need to adjust this amount for inflation because we will be adjusting investment returns for inflation as we go. So just figure what you would need today (you should make adjustments for children that are grown and gone, and any debts like your mortgage that you expect to be paid off.) From this income need you should subtract any pension, social security, or annuity income you will receive during retirement. This leaves you with the annual income needs you will have to pay for yourself. For example; I need $50,000 in retirement income. I expect to receive $1,400 a month or $16,800 in social security benefits and a company pension of $12,000 per year. That leaves me with a shortfall of $21,200 per year that will have to come from my investments. If you have read my post on safe withdrawal rates, you'll remember that the estimated real rate of return on your investments is your maximum withdrawal rate. Let's say my expected real rate of return is 5%. To estimate how much I would have to have in savings and investments to fund the $21,200 per year shortfall in retirement income I would simply divide $21,200 by .05. This tells me I need to have $424,000 in investments to fund the balance of my retirement income needs. Sixty five million Americans now invest for retirement through 401(k)s and similar plans. Defined contribution plans have become the centerpiece of many American’s retirement savings. How can you determine if your plan makes the grade? Here are some of the components to look at when judging your company’s 401k.

Fees Low fees and expenses are important to getting the most benefit from your 401k.Unfortunately it is often hard to determine how much you are paying in investment, administrative, legal, record keeping, and accounting expenses. Now the various fees are not secrets, but are typically hidden in the fine print of multiple documents available in multiple places, so it's very hard for individual investors to figure out what has been subtracted from their individual accounts. Fortunately, under a proposed Labor Department regulation, scheduled to go into effect January 1 of 2009, your employer may be required to tell you these fees, and disclose in dollar terms each quarter how much you are being charges for these various fees. What levels of expenses are appropriate for your plan? It depends on the size of your plan.But for all but the smallest plans (plans with less than $500,000 in total assets) total expenses of 1% to 1.5% is reasonable. The total expenses include investment management, record keeping and accounting, legal, and administrative expenses. If your plan charges more you should question those in charge of the plan. The company sponsoring the plan has a fiduciary duty to plan participants and they may be just as much in the dark as you about the fees being charged. Matching Matching is a key feature of 401(k)s participation rates increase when an employer matches a participant's contribution in one form or another. Most large employers realize that and many small companies have matching programs under the ‘safe harbor’ rules, that allow highly compensated employees and business owners to maximize their 401k deferrals. No restrictions on sales of employer stock In the wake of such high profile corporate bankruptcies such as Enron and more recently Bear Stearns the importance of not having too much of your retirement money invested in employer stock is evident. The best plans, at least of those that use employer stock funds, have no barriers to immediate diversification. Automatic Enrollment The best 401(k) plans automatically enroll workers into qualified default investment option and automatically increase their contributions over time. With auto enrollment more employees end up saving for retirement, and they start saving earlier, making their chance of reaching their retirement goals higher. Investment Options The best plans offer enough investment options to allow you to build a well diversified portfolio. They often include large cap, mid cap, small cap, and international stock funds, as well as bond funds and money market or guaranteed income options. Many of the best plans now offer target date or risk based portfolios to simplify your selections. The best plans also offer automatic rebalancing of your investments at regular intervals. Education Employee communications and education is an important piece of keeping you informed of the changes that could affect your retirement plans. The best plans offer ongoing investment education and financial planning information. Pricing Some of the best 401(k) plans tend to invest in funds that have what's called institutional pricing. Most mutual funds come in many classes, with some classes having higher fees than others. Plans that use funds with institutional pricing typically have the lowest fees, but in any event your plan should be using the share class with the lowest expenses available to the plan based on the plan size. Seldom have I read a blog post that I wish I could share with the entire world, but Tara Siegel Bernard, writing on 'Bucks' over at the New York Times just laid one down that I have to share with you. Her post titled 'Will You Be My Fiduciary' and the article that she wrote to go along with it deserve your attention. Tara posts a simple fiduciary pledge that you can at least use to start an important conversation with your advisor. While many wont sign it and some have legitimate reasons for not signing, it gives you a chance to learn why and have a hard conversation about what is in your best interests. I've posted the pledge below, but please read Tara's entire post here.

The Fiduciary Pledge I, the undersigned, pledge to exercise my best efforts to always act in good faith and in the best interests of my client, _______, and will act as a fiduciary. I will provide written disclosure, in advance, of any conflicts of interest, which could reasonably compromise the impartiality of my advice. Moreover, in advance, I will disclose any and all fees I will receive as a result of this transaction and I will disclose any and all fees I pay to others for referring this client transaction to me. This pledge covers all services provided. X________________________________ Date______________________________ In the sector of charitable giving a new trend is emerging. This trend pools together the resources of the middle income class and has become for the second largest recipient of charitable funds in the United States behind only the Red Cross. Since the mid 1990's Donor Advised Funds have flourished into a dominant force in philanthropy and continue to grow as more money managers and investors become aware of their simplicity, flexibility, and low cost.

Donor Advised Funds (DAFs) are just that, individuals give money or assets to a charity or sponsorship organization who sets up a Donor Advised Fund account. That account is then invested in options offered by the specific organization that the donor has chosen. From this account, donors can make grants of $50 or more to specific organizations or causes that are important to them. While this seems basic, there are many choices to be made in creating, investing, and continuing this charitable account. But first, I will explain WHY you should consider setting up a DAF if you're looking to make charitable donations. Simplicity The first major advantage DAFs have over private foundations is the simplicity of setting up the fund. For donor advised funds, a simple agreement between the sponsoring organization and the donor is all that is needed to create the account. This method is much easier than applying for IRS tax-exempt status, filing all required tax reports, and maintaining compliance with all the rules that apply to charitable foundations. Low Cost Another positive aspect of the Donor Advised Fund is the low cost to create it. Needing as little as a $5,000 in initial contributions those who wish to donate even on a modest scale can get involved in charitable giving. Further, grants to individual charities can be made in increments of as little as $50. Flexibility Flexibility is the foundation of the Donor Advised Fund. When choosing a specific plan with a sponsorship organization there are many various investment options to select from. The plans range from broad investment choices, where donors are allowed to choose their own investment portfolios- to basic mutual fund choices offered by the sponsor, and finally to the option of pooling together mutual funds to invest. Only rarely are donors offered no investment choice at all but in these situations the sponsoring organization chooses and manages the investment options for the donor. In the past most donors have contributed through private foundations often set up by the individuals themselves or through a third party. There are many benefits in doing so: up to 30% of cash contributions can be deducted and 20% of all other assets can be written off as well. However, the up and coming DAF has joined the race and offers even more bang for your buck as well as less hassle than is involved in giving through private foundations. Offering a write off of 50% of initial cash contributions and a 30% write off of other assets contributed, the Donor Advised Fund trumps the private foundation in terms of tax breaks, as well as potentially reducing estate taxes since more of your assets are donated to the fund. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed