|

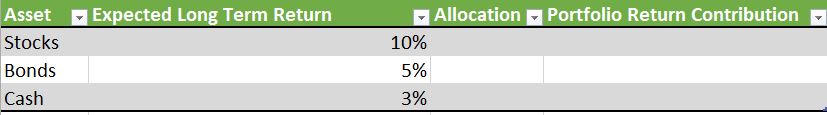

Many people do 'kitchen table' financial planning from time to time. They have a goal and make a guess about how much money they will need to pay for it. Next they will assume some rate of return on their capital and off they go, pounding on the calculator keys until they arrive at an answer. I am in fact a fan of 'kitchen table' planning, so I would like to offer some ideas on how to do it better. I'll start with estimating your rate of return. Here is a method that will give you an idea about what sort of long term return you can expect from a portfolio using the three major assets classes available in the capital markets. Remember it is an estimate not a guarantee, but it is better than just pulling a number out of the air and it also illustrates the relationship between risk and reward. To use this tool you should know that I am speaking of gross returns, that is returns before the effect of inflation. From 1925 to present the stock markets has produced and average annual return of 10%. Some years are higher, some are lower. Different periods have produced different result but I have more confidence in over eighty years of observations than any shorter period. Bonds have averaged around 5% and cash somewhere around 3%. You can use your own guesses of course but at least this gives you a starting point. Next you must determine your asset allocation. That's just the fancy word for what percent of your portfolio is invested in each asset class. Just divide each component by the total. Now you can use the form below to estimate your long term return. For example if you have 70% of your money in stocks, 25% in bonds, and 5 % in cash you would multiply .7 by.1 and put .07 in the contribution column, multiply .25 by .05 and put .0125 in the contribution column, and multiply .05 by .03 and put .0015 in the contribution column. Total the contribution column and you will get an 8.4% expected long term return from this portfolio.

Try changing the allocations to see how risk and reward can affect your expected returns. If you like you can add other asset classes such as real estate and commodities to see how they might affect your expected return. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed