|

File and suspend is a strategy available only to those who elect to wait until at least their normal retirement age to begin receiving Social Security benefits. It is a tool that allows the coordination of benefits between spouses and is a bit like an insurance policy for anyone deferring benefits. It works like this.

Once you reach your normal retirement age you apply for Social Security benefits, but have your payment suspended before any check are issued. This accomplishes two things. One, if you have a spouse who is eligible for spousal benefits it is a signal to the Social Security Administration that they can now claim those benefits. Two, it provides some protection in case you learn you have a medical condition that will limit your lifespan. If, for example, you are diagnosed with cancer when you are age 69 and not expected to live much longer, you can go back to the Social Security Administration and tell them you want to receive benefits retroactively to the day you had your benefits suspended. You will receive a lump sum check for any benefits accrued up to that point. If you do not retroactively claim your benefits you will continue to earn delayed retirement credits and boost your monthly check by 8% a year until you reach age 70. Many times folks get in such a big rush to claim their Social Security benefit that they lock in reduced benefits without considering how this decision fits in with their long term needs and other sources of retirement income.

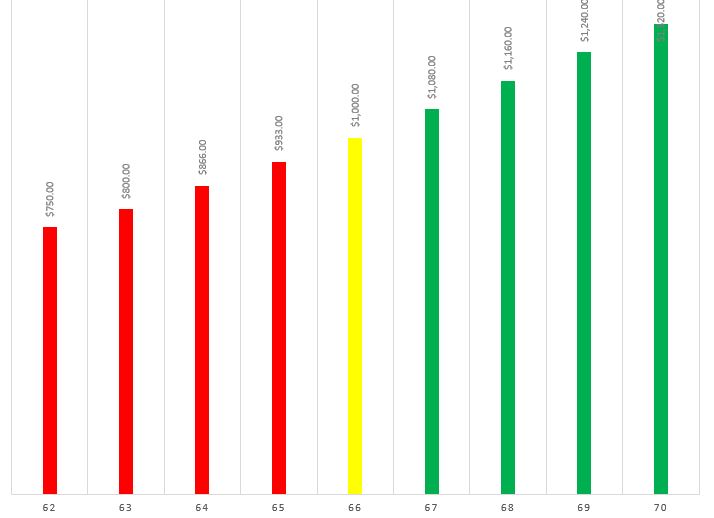

Just because you can claim Social Security benefits at age 62 doesn’t mean that you should. If fact depending on when you were born, your annual income will be reduced by 25% if you start taking your checks at age 62. That means if you have earned a $1,000 per month benefit at your normal retirement age you will only receive $750 per month if you start at age 62. Multiply that reduction by the many years you will live in retirement and you’ll find you could be leaving tens of thousands of dollars on the table! On the other end of the scale you can receive increased payments if you delay receiving benefits beyond your normal retirement age. For each year up to age 70 that you delay receiving Social Security benefits your monthly check will increase by 8%. So I you were expecting to receive $1,000 per month at your normal retirement age you could boost your monthly check to $1,320 per month just by waiting until age 70 to start receiving benefits. So for someone with the same work history the monthly Social Security retirement benefit could range from a low of $750 to a high of $1,320. That is more than an 75% difference in monthly income! And it is a difference you will likely live with all your life. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed