|

Every year thousands of generous people leave a part of their final estate to worthy charities, leaving a legacy that will continue to help others after they have passed. Having taken care of their families, these Good Samaritans also help those less fortunate and in need of help and care.

But what if there were a way to be generous and receive a benefit while still living? There is—it’s an old estate planning tool called a Charitable Remainder Trust. A Charitable Remainder Trust (CRT) is an irrevocable trust that pays the grantor or heirs an income for a specified period of time, with any remaining balance going to one or more qualified charities. A CRT can be funded with cash, stocks, bonds, real estate, private company interests, and non-traded stock. The trust retains a carry-over basis for all assets donated to the trust and the remainder cannot be less than 10% of net fair market value of the assets donated to trust. Additionally, the time period is limited to 20 years or the life of one or more of the non-charitable beneficiaries. For their future generosity, the grantor receives a current tax-year charitable deduction that is based on the IRS section 7520 interest rate, among other factors. The interest rate used to calculate the remainder value is based on the rate in effect in the month the trust is funded. Generally, the higher the interest rate, the higher the charitable deduction created by a CRT. As interest rates have moved up, so has the IRS section 7520 interest rate, and thus has the remainder value calculation and the current year deduction. There are a couple of variations of CRTs. A Charitable Remainder Annuity Trust (CRAT) pays a fixed dollar income to the non-charitable beneficiary(ies). The dollar amount must be no less than 5% of the initial trust value and no more than 50% of the initial trust value. Generally, the present value of the annual income stream is determined and subtracted from the value of the property transferred to the trust to arrive at the value of the remainder interest. The factors for determining the present value of an income stream payable for the life of the noncharitable beneficiary are in Publication 1457, Table S, Single Life Factors and the present value of an income stream payable for a term of years are in Publication 1457, Table B, Term Certain Factors. There are slight adjustments that must be made for payments that occur other than annually at the end of the year, but your CPA should have software that can do those calculations for you. The other CRT variation is a Charitable Remainder Unitrust (CRUT). In a unitrust, the percentage of the trust assets is fixed at between 5% and 50% of the initial trust balance, but the dollar amount of the distributions can fluctuate from year-to-year. Generally, the present value of the remainder interest (i.e., the charitable deduction) in a CRUT is determined by finding the present-value factor that corresponds to the trust’s adjusted payout rate. The present-value factor for a CRUT with an income interest payable for a term of years is in Table D, Term Certain Factors, of Publication 1458. The present-value factor for a CRUT with an income interest payable for the life of the noncharitable beneficiary is in Table U(1), Single Life Factors, of Publication 1458. If the income interest is payable for the lives of two individuals, use Table U(2), Last-to-Die Factors, in Publication 1458. You can use an online calculator to get a ballpark idea of the current tax deduction you could be entitled to, but your CPA will provide the final numbers for your income tax filing. If you plan to leave any property to a charitable organization at your death, you should consider using a CRT now instead. It can reduce your income tax bill and provide additional funds for you to be even more charitable. Using a see-through trust as a tax-deferred Traditional IRA beneficiary has steadily risen among estate planning attorneys. The benefits of using a trust as the IRA beneficiary includes:

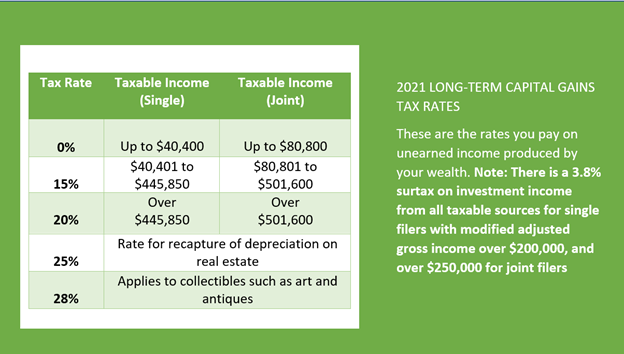

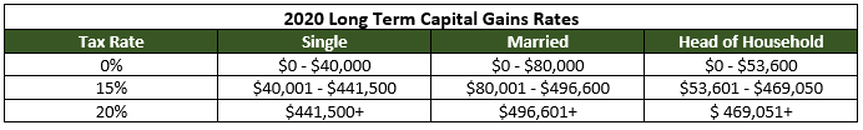

Usually, a single trust is named, and the beneficiaries' share of the assets are spelled out in the trust. One trust, one trustee, nice and simple. Perhaps not. Under the new SECURE Act rules for IRA beneficiaries, all IRA assets must be distributed within 10 years of the year following the date of death of the original IRA owner, with some exemptions for spouses, disabled and minor beneficiaries, and beneficiaries who are less than 10 years younger than the decedent. This dramatically shortens the time that a trust can protect heirs and introduces income tax planning problems for the beneficiaries. Although there are steps a beneficiary can take to minimize the income tax bite of inheriting an IRA, having the IRA assets co-mingled with a single trust as the beneficiary will severely limit these options. Each individual beneficiary will have different tax planning opportunities and needs. Using a single trust to receive and distribute IRA assets will make income tax planning for the individual beneficiaries nearly impossible. Here's a simple solution. Ask your attorney to draw up your trust documents so that upon your death, a pass-through trust is established for each individual heir, and use the beneficiary designation form provided by your IRA custodian to enumerate the share each trust receives. This way the money is not comingled, and the trustee can work with each end beneficiary to select the times and amount of the distributions that will minimize the income tax bite for that beneficiary. There are a lot of IRA beneficiary trusts out there. Many will need to be updated for the added complexities of the SECURE Act. Recently, a report by Propublica revealed that the richest Americans do not pay federal income tax at nearly the same rate average Americans do. How does this happen? What legal pathways do these ultra-wealthy Americans take advantage of to ultimately pay so little in taxes? These are the questions many ordinary Americans are asking. This works because the United States tax code favors wealth over work. The highest capital gains rate is the 28%, that is assessed on collectibles. Because the majority of wealth in America is created by owning or investing in businesses, a capital gains rate of 23.8% is what most wealthy Americans pay on most of their income, 20% capital gains rate and a 3.8% surcharge for gains over $250,000. Qualified dividends are taxed at capital gains rates, so, yes, all the dividends Bill Gates receives are only taxed at 23.8%. For a working class American, the marginal income tax rate on $250,000 is 24%, for married filers, not including Medicare taxes of 1.45% and another 6.2% in Social Security taxes on the first $142,800 of earned income. If you have earned income of over $628,300 as a married filer, your marginal income tax rate jumps to 40.3%. That is 69% more than the top rate for long-term capital gains on stock investments.

Or even better, if you are like Jeff Bezos, and own a lot of shares of a high growth company, why pay any taxes at all. You can borrow against the stock you own (margin) at less than a 1% interest rate, use the investment interest expense to offset some other income (for being CEO), and as long as your stock appreciates more than the 1% each year, you never have to sell, never have to realize a gain, and never have to pay any income taxes. Plus, when your kids inherit the stock from you, they get a stepped-up cost basis that can reduce their taxes on any sales to zero. The ultra-wealthy can afford to hire some of the best advisors in the world to help them use these and many other tricks to minimize their income tax liability. For regular folks like you and me, smart tax planning is required to build wealth in the first place. If you want to learn strategies you can use to minimize your income taxes and grow your wealth faster, then download a free copy of our “Tax Planning Basics” e-book. It is full of things you can do to keep more of what you earn. Things like asset location, Roth IRA conversion strategies, and income shifting strategies. It’s not an army of accountants, but it’s a start. Converting funds from a tax-deferred Rollover or Traditional IRA to a tax-free Roth IRA in retirement can be a smart move for managing your total income tax bill. Often, Roth conversions can be accomplished in lower tax brackets, protecting you from possibly higher brackets in the future and minimizing the income tax bite of Required Minimum Distributions (RMDs) from your Traditional/Rollover IRA in later years.

The earlier you can begin to efficiently convert funds to tax-free Roth assets the better. Doing so moves the growth of the converted portion of your tax-deferred accounts into income tax-free growth. The calculations can be daunting, so enlisting the aid of a CERTFIED FINANCIAL PLANNER™ professional or CPA will help. But it is often wise not to convert 100% of your tax-deferred retirement money into a Roth IRA. If you make charitable contributions on a regular basis, it would be more tax efficient to leave some money in your tax-deferred IRA to fund those contributions once you reach age 70 ½. The Qualified Charitable Distribution rules allow for income-tax free distributions to qualified charities once you reach this age. For more information on the QCD rules check out this post. The bottom line here is if used to fund your charitable giving, a Traditional/Rollover IRA gives you a very tax friendly option. Each year you can make donations that will not appear as taxable income on a 1099-R. That means you contributed the funds on a pre-tax basis, they grew without income tax consequences, and then they are distributed income tax-free. Given that, for most-- any charitable contribution over $300 per year for individual filers and $600 per year for joint filers, gets no income tax break at all-- this is a great way to save on your income taxes and support worthy causes at the same time. Another reason to avoid a 100% Roth conversion is simply that having no taxable income is not the most tax-efficient plan. There is always a level of income that is free of income taxes-- the amount of income covered by your standard deduction and/or other above the line deductions. For 2021, the standard deduction for single filers is $12,550 and for joint filers it is $25,100. This means that if you had no other sources of income, you could withdraw those amounts from a Traditional IRA income-tax free. It is unlikely you would be in this situation, but if you have a tax-efficient taxable investment account and a small pension or social security benefit, you might have some leeway to withdraw funds from a tax-deferred account at a 0% tax rate. Again, the calculations can be tricky, particularly if you are in the social security tax torpedo range, so seek out qualified help in making these decisions. Taxes are not fun to pay or to calculate. But smart income tax planning can add thousands or even hundred of thousands of dollars to your bottom line. Working with a financial expert who understands how everything fits together can be one of the best decisions you could make. Many investors love the Federally tax-free income they receive from municipal bonds. Municipal bonds are debt securities issued by state and local governments to fund operations or special projects. Because the income an investor receives is not taxed, the after-tax return of municipal debt is often higher than the after-tax income provided by corporate bonds and bank CDs. For example, the yield on the iShares Core US Aggregate Bond ETF (AGG) currently stands at about 2.3%. For a taxpayer subject to a 22% marginal income tax rate, the after-tax return drops to just 1.8% and is even lower as you climb into higher marginal tax brackets. Compare this to the Vanguard Tax-Exempt Bond Index Fund ETF (VTEB) which yields 2.1% federally income tax free. An often-underappreciated item in the US income tax code deals with qualified dividends. A qualified dividend is a dividend from a common stock or a preferred stock that the filer owns for a specified minimum time period. The beauty of qualified dividends is that they are taxed at the filer's long-term capital gains rate rather than as ordinary income. The following table compares ordinary income rates and long-term capital gains rates for married filing jointly returns for the tax year 2021

*Includes 3.8% net investment income surcharge.

Which brings us to the value of qualified dividend income (QDI). QDI extends to income received from preferred securities. Preferred stocks are debt-like securities issued by corporations that rank below the bond holders-- but above the stockholders-- in the event of a liquidation. The term preferred is used because the dividends on these shares must be paid in preference to dividends paid to common stock shareholders. To learn more about preferred stocks you can view the Wikipedia entry here. The importance of this is the after-tax returns of many preferred securities held long enough to receive QDI tax treatment, are higher than rates generally available in the municipal bond market. Take the Bank of America preferred series A (BAC-PA) for example. This security has a current dividend yield of 5.8%, even at the highest capital gain rate of 20% and add in the 3.8% net investment income surcharge the after-tax net on this income is 4.4% or more than double the tax-free rate of 2.1% from VTEB. There are some details to keep in mind; to qualify for QDI status, the security must be held for 91 days out of the 181-day period, beginning 90 days before the ex-dividend date. Because most preferred securities pay quarterly dividends, you would generally need to make your purchase the day of the preferred trade’s ex-dividend to ensure you receive favorable tax treatment. Also, preferred issues are highly concentrated in the financial and utility sectors of the market which could lead to poor diversification. You could use exchange traded funds (ETFs) like the iShares Preferred and Income Securities ETF (PFF) or an open-end mutual fund like the Nuveen Preferred Securities and Income Fund; but be aware that not all the distributions from funds like these are considered Qualified Dividend Income. Only 62% of the distributions from PFF were eligible for QDI treatment in 2018 and usually about 60% of the Nuveen funds distributions were QDI eligible. Still, for investors concerned with building a tax-efficient portfolio, preferred securities are certainly worth consideration. A health savings account is a tax-deductible savings plan for individuals covered by a qualified High-Deductible Health Plan (HDHP). This program allows for tax deductible contributions to a special account that allows you to pay for expenses your insurance plan does not cover with pretax and tax-free dollars.

Eligibility A high deductible plan for 2021 requires a minimum deductible of $1,400 for individuals and/or $2,800 for a family. These plans must have a maximum out-of-pocket expense of at least $7,000 for an individual and $14,000 for a family. If you’re covered by a spouse’s workplace policy, Tricare, the Veterans Administration, or Medicare you are not eligible. If you are a dependent on someone else’s tax return or covered by a Flexible spending account or Health reimbursement account, you are not eligible. How an HSA Works The beauty of an HSA is you make contributions that are deducted from your taxable income, yet when you spend the money for qualified expenses, the distribution is tax-free as well. Any growth within the HSA account is also tax-free. So, the contributions are deductible like a Traditional IRA, but earnings and distributions are tax-free, like a Roth IRA – you get the best of both worlds! Contributions Contributions to an HSA are deductible from your taxable income in the years you contribute, and like a Traditional IRA, you can make contributions until April the 15th or your normal tax filing deadline of the following year. For 2021, the maximum HSA contribution is $3,600 for and individual and $7,200 for a family, with an additional $1,000 per year “catch-up” contribution for those over age 55. It is important to know that for married couples the $1,000 catch-up provision applies to each spouse. If you and your spouse are each over 55 your HSA contribution limit for 2021 would be $9,200. If you contribute to an HSA plan through your employer, your annual contributions are reduced dollar-for-dollar by any contributions your employer makes on your behalf. For example, if you and your spouse are under age 55 and your employer makes a $1,200 annual contribution on your behalf, you would only be allowed to contribute and deduct from your taxable income $6,000 for 2021 ($7,200 contribution limit minus $1,200 employer contribution). If you drop out of a high deductible plan before the end of any calendar year, say you become eligible for Medicare, or you change employers and the new coverage does not qualify as a high deductible plan, your contributions for that year are simply pro-rated. Meaning if you participate for three months then changed to a plan that is not eligible for HSA contributions, you would be eligible for a 3/12ths deduction in that calendar year. On the other hand, if you become eligible for HSA contributions during a calendar year, you can make contributions as if you were covered by a high-deductible plan for the full year. So, if you moved from an employer plan that was not HSA compliant to another employer plan that was HSA eligible in October you would be allowed to contribute as if you were eligible for the entire year. This is known as the last month rule. The contribution rules for HSA accounts also allow others to contribute to the account on your behalf. For example, if you have a working child who is covered by an HSA compliant insurance policy, you can contribute directly to the account for them. The contribution is considered a gift so you will not receive an income tax deduction, but it may be an important step to helping your child become financially stable. Qualified HSA Funding Distribution An important funding technique is the ability to make a trustee to trustee transfer from an IRA into your HSA account. Each taxpayer may only do one qualified transfer in their lifetime and the amount of your HSA contribution will be reduced dollar-for-dollar in the year you make a conversion. This is an outstanding opportunity to convert dollars that are potentially taxable in the future to dollars that can be tax-free. If you are young and make a conversion, the potential for tax free growth can’t be beat. Even if you’re just shy of Medicare eligibility, the income tax savings of this strategy make it worthy of consideration. An important note for couples is that only one person can own an HSA account. To maximize the Qualified HSA funding distribution benefit, one spouse will open a family HSA for a calendar year and use their qualified funding distribution. In the following year the other spouse will open a separate HSA account and use their own once in a lifetime qualified funding distribution to fund that account. This would allow a couple to convert up to $18,000 from IRAs where distributions are likely to be taxable--into HSA accounts that compound tax-free and provide tax-free future benefits. Rollovers You are allowed to rollover funds, via a trustee-to-trustee transfer, from one HSA account to another without triggering a taxable event. This means if you leave an employer’s plan and wish to establish an HSA account through a different provider, you can consolidate your account with the new provider and simplify your finances. Or if you wish you can change HSA account custodians anytime. Beneficiaries If you name your spouse as the beneficiary of your HSA account, the account will be treated as the spouse’s HSA upon your death. For other beneficiaries, the fair market value becomes a taxable distribution to the beneficiary. Household Individuals Funds from your HSA account can be used for qualified medical expenses for you and your family. The IRS is a bit liberal in their definition of family. Anyone who qualifies as a dependent on your income tax return can have medical expenses paid from your HSA account. You, your spouse, your children under age 19 or under age 24 if a full-time student, grandchildren, parents, and foster children are all included. Qualified Expenses Medically necessary expenses not covered by insurance can be paid from your HSA account without taxation. Even things like drug and alcohol rehab, home modifications for disabilities, acupuncture, dental and vision care, and over the counter drugs prescribed by your doctor, are all allowed expenses. Although your current insurance premiums cannot be paid from you HSA account, you can use those funds to pay for Long-Term Care insurance and Medicare Part B and Part D premiums. For a complete listing of eligible expenses see IRS publication 502. Look Back Provision If you have an HSA account open during any tax year and do not have enough money contributed to cover all the allowed reimbursements, you can use future years contributions to pay yourself back. For example; In 2020 you had an HSA balance of $4,000 but in December you had a large unexpected $5,000 medical expense. You would be able to make 2021 contributions and then reimburse yourself for the extra $1,000 expense you incurred in 2020. Prohibited Transactions Like IRA accounts, there are certain transactions that are prohibited inside your HSA account. You cannot have any self-dealing transactions such as sale leasing or exchange of property between yourself and your HSA account, you cannot charge your HSA account for services you provide, and you cannot use your HSA account as collateral for any loans. A violation of these rules will trigger a deemed distribution from your HSA account and subject all the funds to taxation in the year the violation occurs. For more information on prohibited transactions see section 4975 of the tax code. For the full IRS guidance on Health Savings Accounts see Publication 969. How Business Owners Can Save On Their Income Taxes With the Qualified Business Income Deduction11/24/2020

The recent income tax revamp has made income tax planning early in the year a must for many self-employed professionals. The ability to take a 20% deduction of business income, available for single filers with income below $164,900 for 2021 and married filers with income below $329,800, is too good to pass up. Filers with taxable income at these levels will be in the 24% marginal tax bracket, so being able to qualify for the business income deduction is worth thousands, particularly when proper tax planning can prevent many from reaching the next 32% bracket. There are a number of ways to game your reported income, allowing many filers with reportable income well above these limits to qualify for the 20% exclusion. First, the exclusion counts toward reducing your income below the phaseout thresholds. A married couple with employment income of $175,000 and a like amount received as business income would see their total income of $350,000 reduced by 20% of the business income or $35,000 allowing them to remain within the proscribed income limits. Contributions made to an Health Savings Accounts will also reduce your taxable income. For 2021 single filers can deduct up to $3,450 and couples up to $6,900. A real biggie for high earners looking to qualify for the 20% exclusion is retirement plan contributions. Money contributed to your qualified retirement plans can make a huge difference. For 2021 those under age 50 can contribute $19,500 to a 401k and those 50 and above can contribute up to $26,000. Presumably as a business owner you can also be sure to offer a generous match. Matching contributions are a deductible business expense that benefits you the owner directly yet reduces your reported profits and thus your total income for purposes of qualifying for the 20% deduction. And for very high earners, adding a defined benefit plan to your existing defined contribution plan might be a smart move, depending on the demographics and size of your workforce. Don’t overlook simple things like using tax free municipal bonds for your savings versus taxable bonds and CDs. Going beyond the basics, some business owners could benefit from reimagining their business ownership. Suppose you are a professional who owns your place of business. Setting up a separate company to own the real estate could be a smart move. You lease the building back from the owner at a fair market rate creating business income that is not subject to the target income limits. Busy professionals have little time to devote to income tax planning and their CPAs are busy during tax season, but the difference between qualifying for the deduction and not qualifying could hinge on how soon you begin a given strategy.  If you're age 72 or older you probably know you must begin taking distributions from your IRA -- whether you want to or not. The IRS life expectancy tables determine your Required Minimum Distribution (RMD) based on the previous years ending balance for your IRA and your attained age for the tax year. The Qualified Charitable Distribution (QCD) rules provide those subject to RMDs an option that can help them reduce their income tax liability by having certain charitable contributions made directly to a qualified charity. Given the changes to itemized deductions and the standard deduction in the 2017 tax law update, the Qualified Charitable Distribution rules for your IRA account becomes even more important. If you make charitable contributions throughout the year, it would be wise to consider making those contributions directly from your IRA. Up to $100,000 of charitable distributions from each IRA owner's accounts can be excluded from your taxable income each year. Say you plan to give $10,000 to your church or another qualified charity and you're receiving taxable distributions from your IRA. If you make the contribution to the charity directly from your IRA, your $10,000 gift will not be reported as income on your income tax return. If you instead receive these funds as income from your IRA distribution and then send the same $10,000 to the charity, it is included in your taxable income and could result in higher Medicare premiums and a higher percentage of your Social Security income being taxable. If you don't have itemized deductions that exceed the new $24,000 per couple or $12,000 per individual standard deduction, you could lose all the tax benefits of your generosity. By having the distributions sent directly to the qualified charity from your IRA, you will exclude the amount from your taxable income, potentially lowering your Medicare premiums, the taxable portion of your social security benefits, and your overall income tax rate at both the federal and state level. If you follow this strategy, be sure to let your income tax preparer know. There may be no indicator on the 1099R you receive at the end of the year that shows that part of your distribution is non-taxable, so there is a chance many people using this strategy are over-paying their income taxes each year. Why you might not want to rollover that old 401k

*The rollover strategies discussed also apply to 403b, 457b, 401a and other employer sponsored qualified retirement plans For many high wage earners, making contributions up to annual Roth IRA limits (6k/$7k over 50; 2020) via the backdoor Roth IRA strategy is an appealing way to generate income tax free growth and income for future years. The backdoor Roth strategy entails making a non-deductible IRA contribution and immediately converting that contribution to a Roth IRA account. If you have no other rollover tax deferred IRA accounts when you execute this strategy, then you have simply moved money from a taxable account into a tax-free account. What If I have existing Rollover IRA and/or Traditional IRA Assets?When executing the backdoor Roth strategy, if you have any tax-deferred Rollover or Traditional IRA Assets, i.e. you haven’t paid income taxes on them yet, the Roth conversion will result in at least some of those funds being taxed in the year of the conversion. For example, let’s say you have a Traditional IRA or Rollover IRA worth $60,000 and make a non-deductible contribution of $6,000 to this IRA in accordance with your backdoor Roth IRA strategy. When you convert the same $6,000 from your Traditional or Rollover IRA to Roth IRA assets, you’ll actually be taxed on ~91% of the conversion, which creates extra taxable income of $5,460 for the tax year. This overlooked tax trap results from IRS rules which mandate, for tax calculations, your tax-deferred contributions and gains and non-deductible contributions from all IRA accounts (Rollover, Traditional & Roth) are combined into a theoretical IRA pot. From this theoretical pot, the IRS requires you to calculate the ratio of tax-deferred dollars to non-deductible dollars; the percentage of tax-deferred dollars in your theoretical account is the percentage of your Roth IRA conversion that will be taxed. In this example your non-deductible $6,000 contribution to your Traditional IRA or Rollover IRA is divided by the total account value of $66,000—just roughly 9% is not subject to income taxes at the time of conversion. The aggregation rules are one of the few reasons you should carefully think about not rolling over an old 401k or other employer plan. If the funds remain in a 401k, 401a, 403b, 457b etc. they are not subject to the aggregation rules. While there’s no avoiding taxation of previously deducted personal Traditional IRA contribution assets during a backdoor Roth IRA strategy execution or other Roth conversion, there are sometimes opportunities to clean up existing Rollover IRA accounts to avoid this unpleasant tax consequence. The Difference Between a Rollover IRA and a Traditional IRAThough they’re nearly identical, there is a subtle, but significant, difference. You can roll over a 401k to a Traditional IRA or Rollover IRA. If you choose to roll funds into a Rollover IRA, rather than a Traditional IRA, you maintain the ability to roll those funds into another current or future 401k plan, if the plan documents allow. Why Does That Matter?There are 401k plans that allow IRA roll-in contributions, but they must come from a Rollover IRA, not a Traditional IRA. If your company has such a plan, you can roll your existing Rollover IRA account into your 401k plan which eliminates the tax-deferred IRA portion of your aggregate portfolio, allowing a high earner to execute the backdoor strategy completely tax-free. Without this keen planning taxes would be paid at high income brackets on the conversion, which is counterproductive to high earner’s overall tax strategy. Don’t Commingle Rollover IRA and Traditional IRA AssetsIf you commingle “regular” Traditional IRA funds and Rollover IRA funds you lose the ability to roll-in former Rollover IRA assets. It’s important to keep the Rollover IRA and Traditional IRA accounts separate. Consider opening a stand-alone Traditional IRA for annual personal IRA contributions and a separate Rollover IRA for rollover assets.

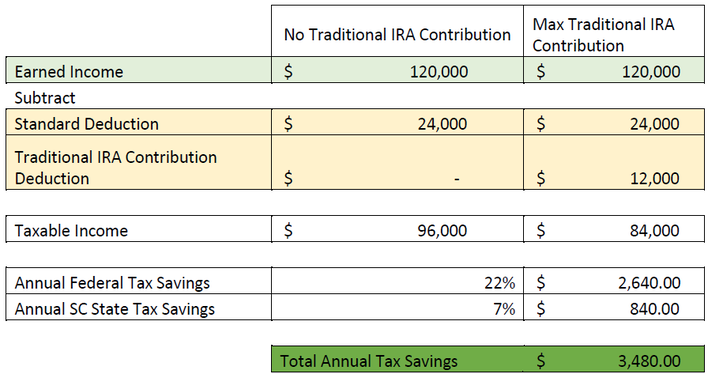

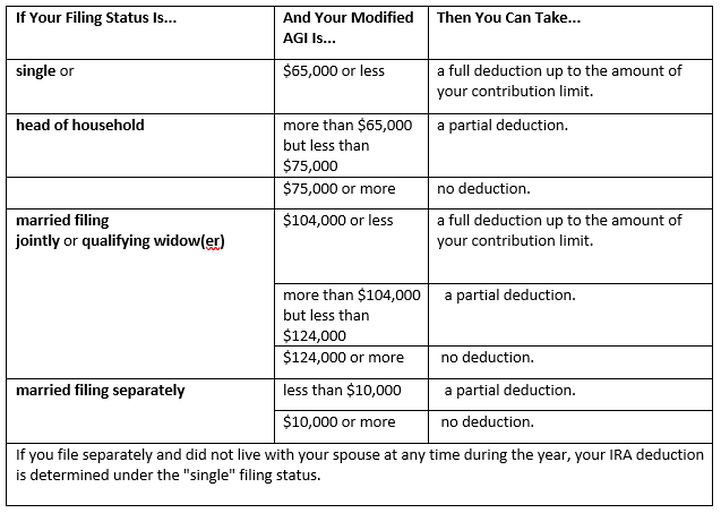

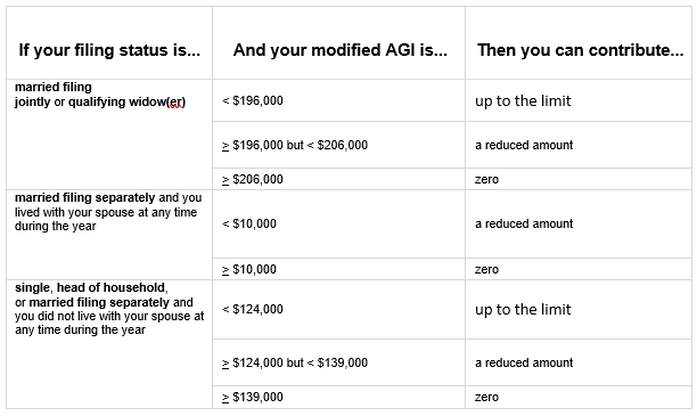

As always, things are rarely as simple as they seem. You should work with a competent Financial Planner to determine the best advice on your personal tax planning strategy. Questions about tax minimization strategies regarding your 401k rollover or rollover IRA? Click here to setup a no cost discussion with us today! How High Earners Can Diversify the Taxability of Their Retirement AssetsOur fee only financial advisors often recommend executing a backdoor Roth IRA contribution strategy for high earning clients who max out their tax-deferred and/or after-tax employer sponsored plans and are seeking additional tax favorable approaches to save and grow assets. These clients often accumulate large levels of tax-deferred dollars in their 401k, 403b, or other employer sponsored plan(s). These tax-deferred contributions help save tax dollars in high brackets now and withdrawals in retirement can be structured for tax savings in the future as well. On the other end, if we can add in Roth IRA assets to our clients’ portfolios which can be withdrawn in retirement tax-free, we add another tool in the tax-planning belt. What are Backdoor Roth IRA Contributions For most wage earners, if you contribute to a Traditional IRA you receive a dollar-for-dollar tax deduction. Here’s an overly simplified look at the tax reduction provided by the combined maximum family deductible Traditional IRA contributions of $12,000 for a married couple in 2020: Unfortunately, if you earn over a certain level of income and/or have access to an employer sponsored retirement plan (401k, 403b, 457b, etc., whether you use it or not) you lose the deductibility of your Traditional IRA contributions. **IMPORTANT: Even if you can’t deduct IRA contributions, you can still make them.** New clients are often surprised when we tell them they’ve been missing out on these tax favorable IRA contributions. Many investors assume they can’t make IRA contributions because they make too much money or already participate and max out an employer 401k or 403b plan. In each case, you can make IRA contributions, you just can’t deduct them. Unlike Traditional IRAs, when you make contributions to a Roth IRA you pay the taxes now-- or have already paid taxes on the contributions via payroll and will simply not receive a tax deduction for the contribution. The magic of a Roth IRA is that once the assets are in the account and the account has been open for 5 years—all withdrawals of principal AND earnings are tax-free. And tax-free > tax-deferred. But high earners are not allowed to make direct Roth IRA contributions, because Roth IRAs have their own income level eligibility qualifications: So-- if you’re single making more than $139,000 AGI or married and earn over $206,000 AGI you can’t make direct Roth IRA contributions AND you don’t get Traditional IRA contributions deducted. However, if you have little or no Traditional IRA assets to start with, we recommend executing a backdoor Roth contribution strategy. High earners can make non tax-deductible contributions to their Traditional IRAs, receiving no tax deduction for the contributions. Then they can immediately convert that contribution to their tax-free Roth IRA. Why would you want your investments growing tax-deferred when they could be growing tax-free? Not simple to do, but a no brainer…slam dunk. How are Backdoor Roth IRA Contributions Taxed? A key factor that must not be overlooked is the amount of previously tax-deferred Traditional IRA assets a high earner has while executing this strategy. It’s important because Roth conversions are taxed at the ratio of tax-deferred assets to after-tax, or non tax-deferred assets. For example, let’s say you’re a married high earner and want to start this backdoor Roth IRA strategy. You make the max Traditional IRA contributions of $12,000 ($6,000 each) for you and your spouse for 2020 and plan to immediately convert that to your Roth IRA to facilitate the lifetime tax-free growth mentioned above. At the same time, you already had $12,000 (again $6,000 each) of tax-deferred contributions from previous years where you qualified for the deduction. Or you could have rolled over tax-deferred assets from an old 401k into your Traditional IRA. Either way, half the assets in the Traditional IRAs were tax-deferred in prior years, and half are non-deductible from 2020’s contribution. If you convert the $12,000 of non-deferred contributions you made in 2020, it wouldn’t be a tax-free conversion— it would be taxed according to the Roth IRA pro-rata rule. This states you have to use the tax-deferred to non-tax-deferred ratio for taxing of the conversion assets. In this case the ratio is 50:50 ($12k tax-deferred to $12k tax-free), so half, or $6,000 of the $12,000 Roth IRA conversion would be taxed at your normal income tax rates for 2020. This is important-- because if you’re a high earner, you may want to avoid paying 32%+ Federal taxes this year on that $6,000 taxable portion of the Roth IRA conversion. It may be better to wait until retirement when you’ll likely be in a lower tax bracket, especially if you do some of the tax planning we mention in this article. The Roth IRA pro-rata rule should give pause to rolling over tax-deferred dollars from 401ks or 403bs into a Traditional/Rollover IRA when a backdoor Roth IRA strategy is recommended. The more assets added to your personal Traditional/Rollover IRA, the higher the taxable percentage of Roth IRA conversions. For these reasons, our financial advisors may recommend clients keep tax-deferred dollars in an old employer plan-- even if those plans have slightly elevated fees or lack diversified, cost-efficient investment offerings. We believe the tax-free savings of Roth IRA assets for a young high earner provide unmatched advantages in terms of investment returns and future tax planning strategies. Getting assets in a high earner’s Roth IRA early while avoiding unnecessary taxes at their currently high tax brackets provides great value to our clients. On the other hand, some clients prefer to fill up their brackets with Roth conversions to eventually get rid of all Traditional IRA tax-deferred assets, never having to worry about Roth conversion taxes again. Regardless—your taxable income level and tax bracket management must be thoroughly analyzed to make the right decision. Why Should I Build Roth IRA Assets?Saving on Pre-Medicare Health Insurance Premiums For example, let’s say a couple retires at age 60, with 5 years before Medicare eligibility. Our fee only advisors use taxable investment accounts and tax-free Roth IRA assets to strategically qualify millionaires for Premium Tax Credits under the Affordable Care Act that can offset some of the cost of healthcare insurance. Monthly private marketplace insurance premiums at age 60 are likely to be $1,000 per person—meaning if you and your spouse plan to retire at age 60, every year until age 65 you’ll fork over $24,000 alone on healthcare insurance premiums before you step foot in a doctor’s office. That can put a damper on early retirement plans. Our fiduciary advisors can situationally use taxable and Roth IRA assets to qualify even our most wealthy clients for Premium Tax Credits, which cover a portion or all of a family’s health insurance expenses. In the above example, that’s a potential savings of up to $120,000 in premiums from retirement at age 60 to Medicare eligibility at age 65—and a glaring reason everyone should invest in a financial plan. *Added Note: Recently, we’ve heard several current and prospective clients mention they’re going to beat high healthcare insurance costs during pre-Medicare retirement years with some sort of too-good-to-be-true Medi-Share plan. Please reconsider. These plans are not actually health insurance and leave your family’s wealth and health in jeopardy. One un-insured serious hospitalization could put your entire financial future needlessly at risk. Long Term Capital Gains Rates Saving We also use taxable and tax-free assets to manage tax brackets via favorable capital gains rates, and in some cases, help our clients pay 0% on capital gains through complex tax planning strategies. For those high earners today, as tax laws are, as is, we’d be able to structure their taxable income so they can optimize favorable capital gains rates while ensuring their assets at 12% Federally. That’s a Federal tax savings of $22,000+ for every $100,000 in their IRA. Not a bad deal for someone being taxed at 24% or 34%+ today and may even pay the 3.8% Medicare investment income surcharge. Other Uses for Roth IRA Assets Tax-free income can help manage tax brackets/income in retirement and can lead to enormous tax savings if planned correctly. If you max out your employer retirement plans and are looking for even more tax diversification of your assets, a backdoor Roth IRA strategy is a good choice. There are many factors to analyze to ensure you realize the tax savings these strategies provide.

If you could use help determining the most appropriate course of action to take with your excess savings give us a call and get started with a financial plan today. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed