|

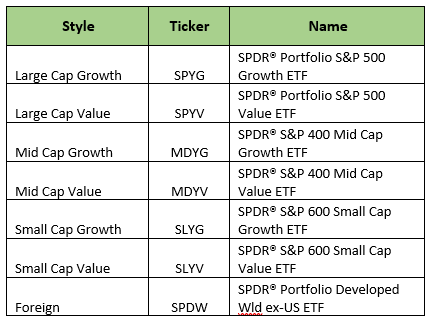

Part of Oak Street Advisors’ 10 Financial Commandments for Millennials series, we discuss when to open a taxable investment account and how to strategize the location of your investment vehicles based on account taxability characteristics. Once you’ve filled up all your tax-deferred and tax-free investment accounts, it’s time to start paying Uncle Same (now) to invest. The 9th Financial Commandment for Millennials is to open a taxable investment account, while keeping tax management a key feature of this aspect of your portfolio. Investors need not worry about dividends, interest, or gains in a 401k, 403b, 457, SEP or Traditional IRAs because those will be taxed when you decide to have them taxed (or an annual portion is taxed when the government says so via Required Minimum Distributions at age 70 ½). Gains, dividends and interest in Roth IRAs are tax-free if you meet certain qualifications. For this reason, its best to have growth, dividend, and other income producing investment held inside these accounts. Now that you’re opening a taxable investment account, any growth, dividend, interest or other income is taxed in the year the gains are realized or the dividend and interest is paid (usually…i.e. phantom income). While you can use long-term capital gains tax rates to your advantage on investments held over a year, the ideal goal for a taxable account is to participate in investment growth while also not being taxed left and right for gains and income produced. To accomplish this, we recommend using a portfolio made up of Exchange Traded Funds (ETFs). ETFs offer broad diversification that reduce the need for trading, minimize taxable distributions, and provide the long-term growth you want in a tax-efficient manner. Here’s an example of Oak Street Advisors’ FatPitch ETF Portfolio investments: Even better-- our clients experience $0 trading cost because of our relationship with TD Ameritrade as custodian. However, any DIYer can implement a similar ETF strategy on their own for a minimal $5-$8 per trade.

In general, investors can see less return drag from investment and tax expenses by utilizing this strategy in their taxable investment accounts. The relationship of the taxability of an investment and the taxability of the account it is held matters, and can keep dollars in your pocket. As with any investment, making sure you’re sticking to your strategy via rebalancing and reacting to market conditions, or paying someone to do so on your behalf, is crucial. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed