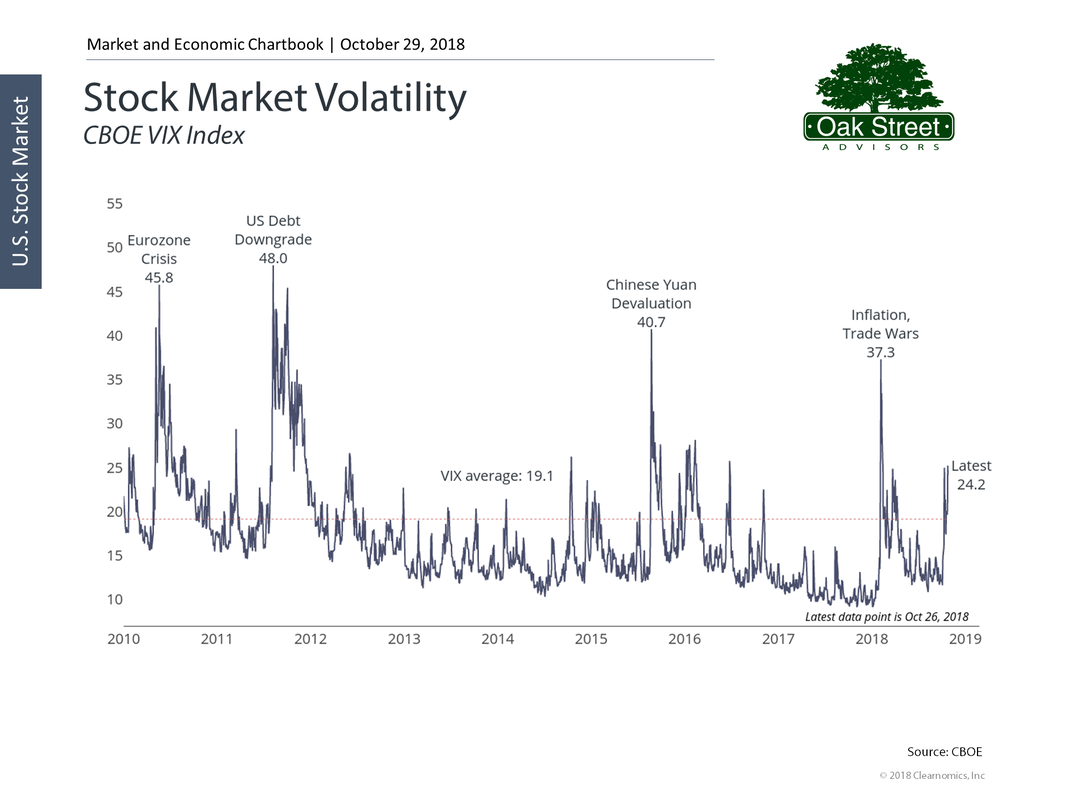

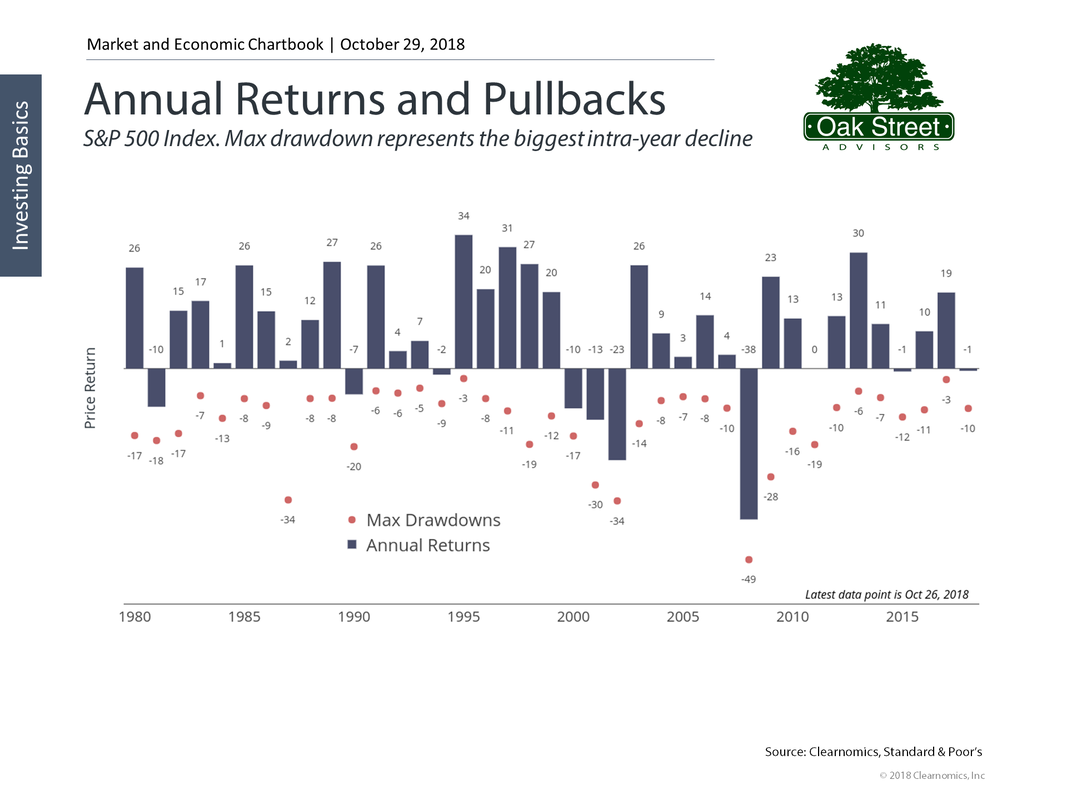

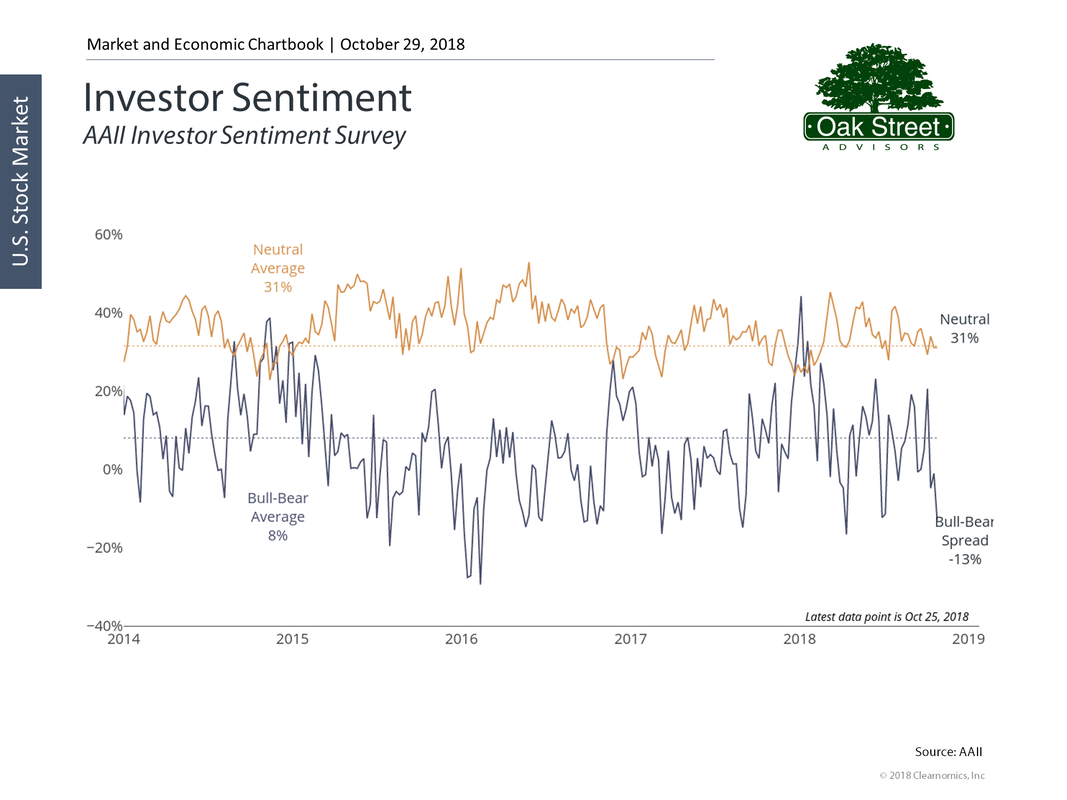

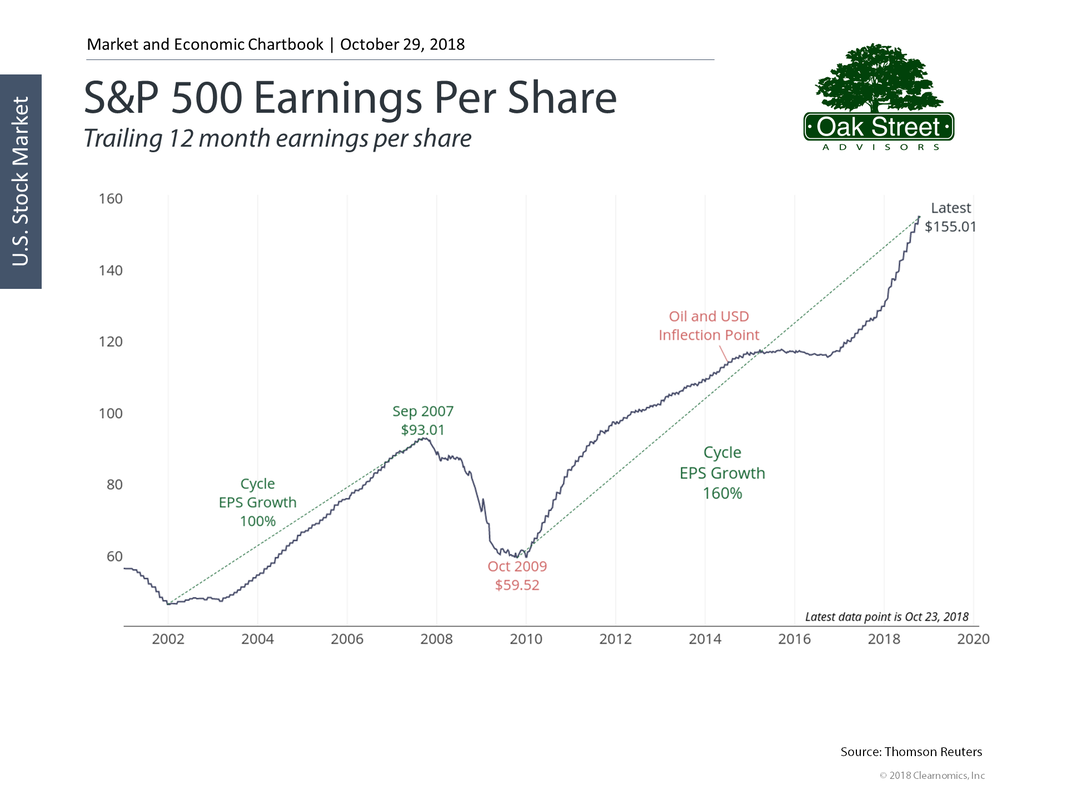

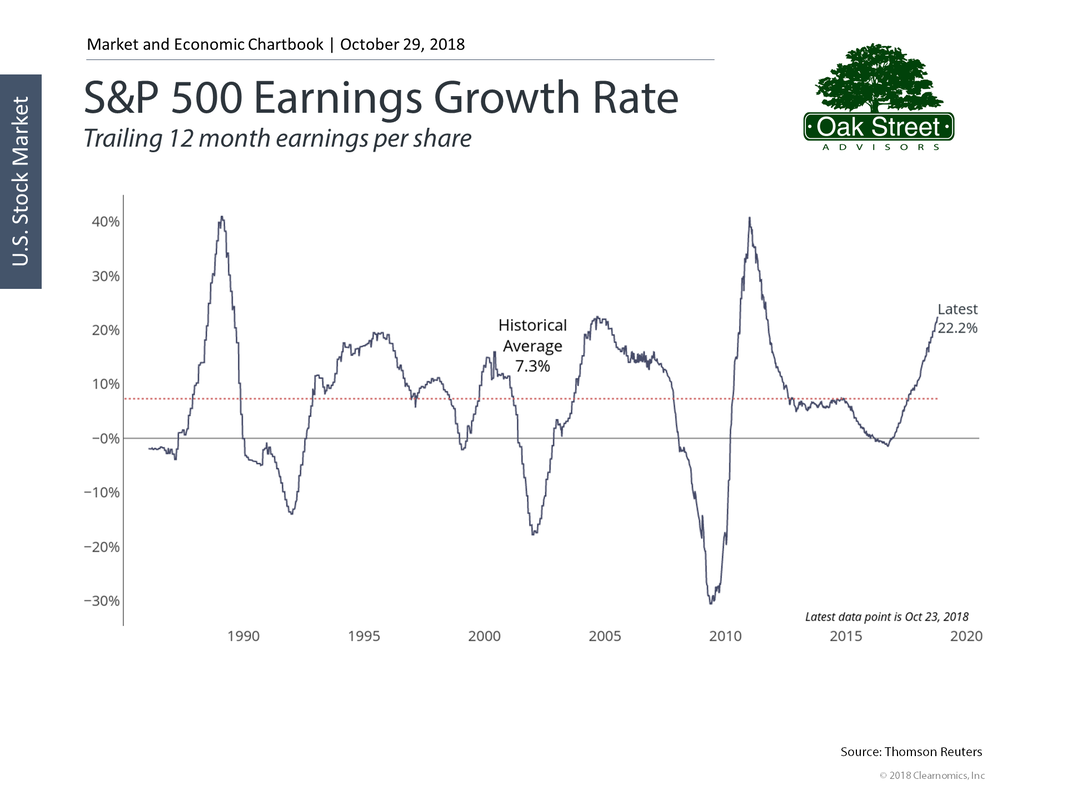

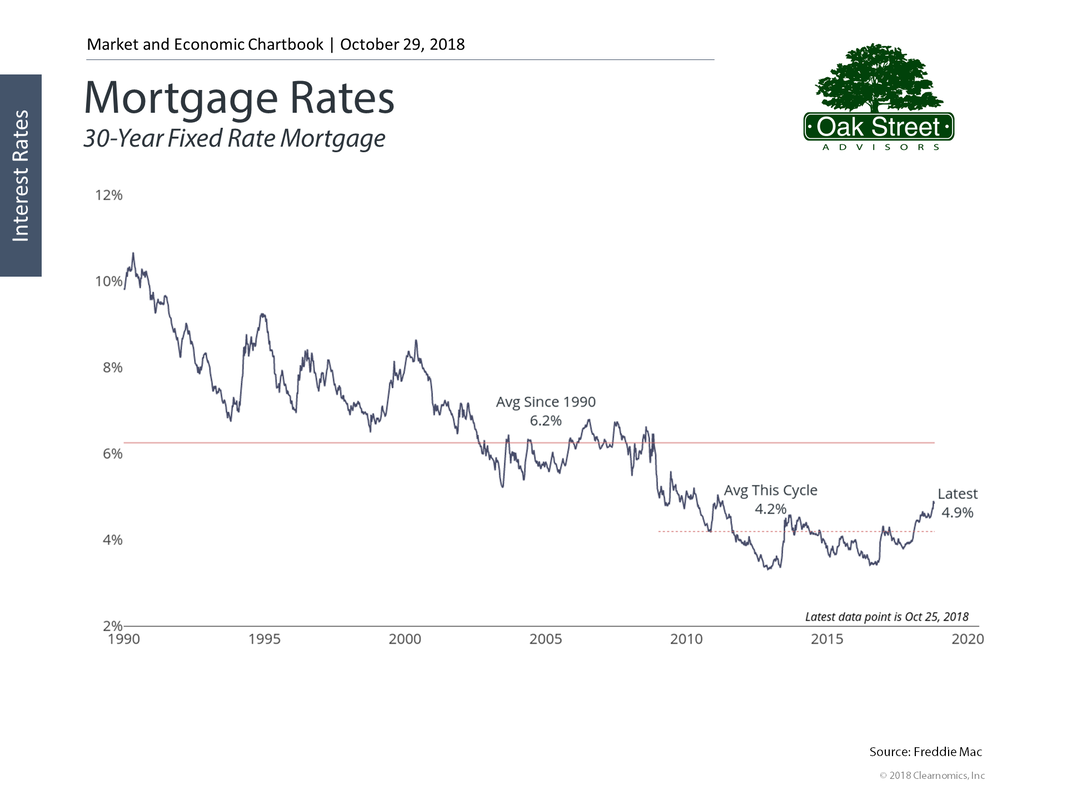

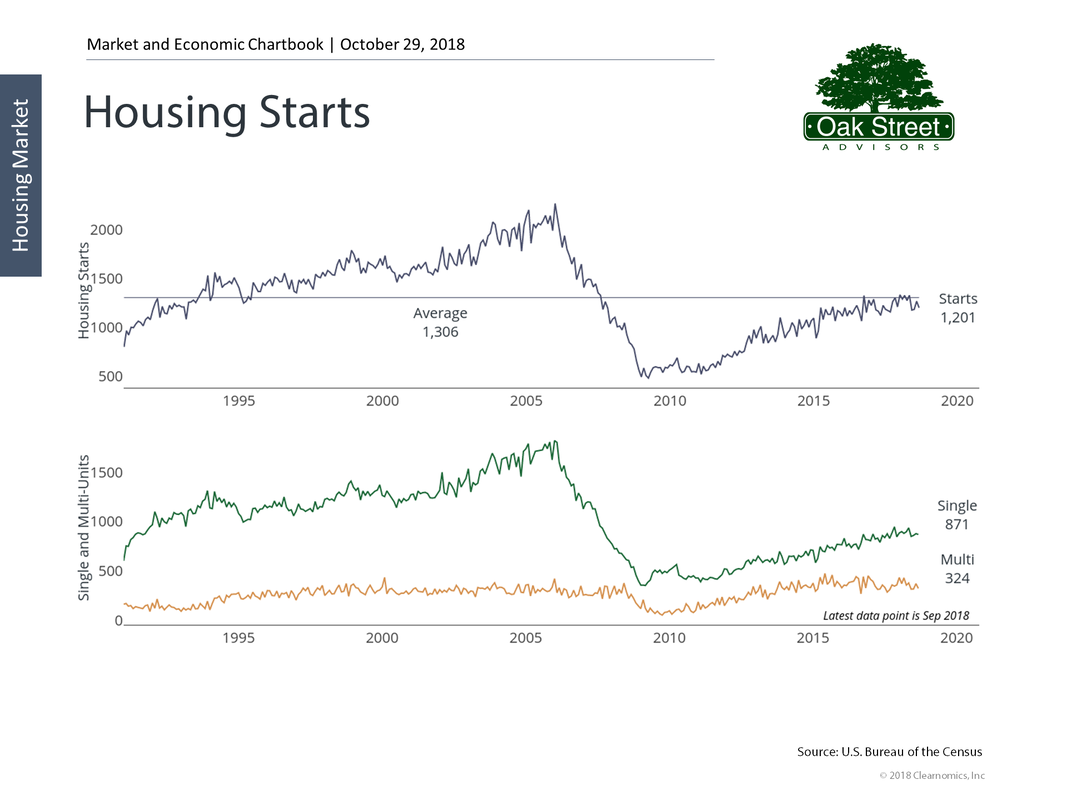

Scary Movie Part 2Just in time for Halloween the stock market has pulled back from its all-time highs and volatility has returned in the form of daily changes of more than 1%. After being up nearly 10% this year, the market- as measured by the S&P 500 index, is flat to slightly down as you read this. Accompanied by a spike in the VIX Index Pullbacks in the stock market are common with a linear regression best fit of about 7.5% each year. Looking back to 1980, even in years where the market has ended down it has rebounded from the lowest point of the year before year end. With just two months to complete 2018, it is possible that we have already seen the lows for this year. So, despite the recent pullback in stock prices this may well be a lower risk entry point for new investments. If we have in fact seen the intra-year low of -10% (with the market currently down about 1% YTD) downside risk from this point could be minimal. Investor sentiment is tilted slightly to the bearish side, indicating to contrarians that things may not really be so bad. It is unusual for markets to enter bear market territory when investors are negative. It is when you find exuberance for stocks that most of the danger lies. With that said, the earnings of S&P 500 companies have been rising at a torrid pace that is likely not sustainable. The slope of the earnings curve is steep by historical standards, the impact of lower corporate income tax rates will soon be apparent in year-over-year reporting, and rising interest rates tend to act as a brake on economic expansion. Look for S&P 500 earnings growth to continue, but for the pace to slow. We will likely enter a period when good economic news is interpreted as bad for the stock market-- as unemployment continues to fall, wages finally begin to rise, and federal reserve interest rate increases put pressure on mortgage rates and in turn the housing market. Bonds will continue to be a dangerous place to invest your money as rising rates cause bond prices to fall, and marginal borrowers have trouble issuing new debt at sustainable levels. So, as we enter the final two months of the year there are plenty of reasons to worry, but as usual, the long-term prognosis for US equities remains positive.

Like a scary movie you have seen before, conditions will look dire for the hero, but ultimately things will work out in the end. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed