|

What if you could transfer assets from your taxable individual or joint accounts into tax-advantaged retirement plans, Traditional IRAs, and Roth IRAs—all while saving taxes now and in the future?

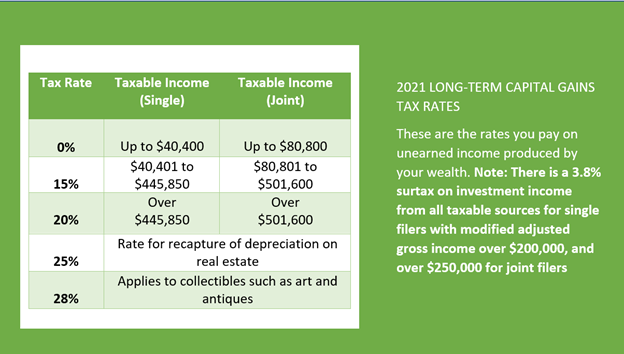

We help clients do just that. Over the past few years, we’ve had several clients with large taxable investment accounts that received major tax reductions while realizing ongoing investment tax-savings through savvy cash flow management and use of employer retirement plans and other tax-advantaged accounts. To execute this strategy, we build a tax and cash flow planning strategy that maximizes current year tax savings and takes advantage of tax-deferred and/or tax-free growth—all while keeping the same current spending plan in place. This is done by increasing (often maximizing) employer or self-employed retirement plan contributions for the household and making maximum IRA contributions in the same tax year. Further, for clients with access to after-tax accounts within their employer retirement plans, we move assets that would normally be invested in a taxable account, and eventually taxed at some point in the future, to their Roth IRAs well above the normal $6,000 or $7,000 annual contribution limits based on their age. To illustrate this planning technique, let’s use a married couple in the 22% Federal tax bracket who both have 401k plans through their employers and $500,000 in taxable investments in their joint account as an example. Both are age 52—allowing them to contribute $26,000 to their 401ks annually with age-based catch-up contribution limits, but they are only contributing $16,000 each because of monthly cash flow needs. Additionally, one of the spouses has an after-tax account in their employer 401k and is not a Highly Compensated Employee. If the couple were to both increase their monthly contributions, they would soon run into debt as their spending would outpace their earnings. When building their plan, we’d recommend they increase their 401k contributions to their maximum limits of $26,000 each. This increase of $20,000 in 401k contributions project to produce an annual Federal tax savings of $4,400 while also allowing the assets to grow tax-deferred. Tax-deferred accounts can then be managed in future years, often during retirement, to potentially be received at the 12% or another lower tax bracket. For investors with large Roth balances, they may be able to receive some of these assets in the 0% tax bracket. With the addition of $20,000 total from their paychecks, their monthly spending deficit is now $1,667. We recommend simply replacing this income with assets from their taxable joint investment account. This strategy essentially transfers assets from their taxable account into their tax-deferred accounts. In addition, the spouse with the after-tax account in their 401k can add another $32,000 (assuming no employer matching contributions for simplicity) into their Roth IRA by converting the after-tax accounts to their Roth IRA immediately, with no tax consequences. This spouse would need to have no tax-deferred IRA assets (SEP, SIMPLE, Traditional, Rollover, etc.) or would be subject to IRA pro-rata aggregation rules which make a portion, or all of the conversion taxable at current normal tax rates. In the event they do have tax-deferred IRA assets, we recommend rolling those assets into their current employer’s 401k plan, which eliminates the taxation from IRA aggregation rules mentioned above. We then recommend replacing the reduced income from those extra after-tax contributions with taxable assets in their joint account. Lastly, we recommend they make Traditional, Roth or backdoor Roth contributions up to the annual maximum IRS limits to get even more of the taxable assets into tax-advantaged accounts. In the end, this couple in our example have taken $66,000 of assets that would eventually be taxed, even if at favorable long-term capital gains rates, and transferred those assets to tax-sheltered or tax-free accounts which will be used in future tax planning to control their tax bracket via qualified distribution, qualified charitable distribution, and Roth conversion strategies. Lastly, there is the possibility of using the large Roth IRA balance prior to taking Social Security to realize long-term capital gains inside their joint taxable account at 0% and/or IRA distributions at the 0% or 12% Federal tax rate during early retirement years—saving another projected 10% in taxes on the same assets. This tax and cash flow strategy can produce thousands, if not tens- or hundreds-of-thousands, in lifetime tax savings for your family. If tax rates rise in the future from their current historically low levels, this strategy will pay off even more. If you’re in a similar situation, setup a no-cost initial planning consultation with Oak Street Advisors today to discuss creating a financial plan that will incorporate this strategy and many others in order to optimize your finances and minimize your current and future taxes. Recently, a report by Propublica revealed that the richest Americans do not pay federal income tax at nearly the same rate average Americans do. How does this happen? What legal pathways do these ultra-wealthy Americans take advantage of to ultimately pay so little in taxes? These are the questions many ordinary Americans are asking. This works because the United States tax code favors wealth over work. The highest capital gains rate is the 28%, that is assessed on collectibles. Because the majority of wealth in America is created by owning or investing in businesses, a capital gains rate of 23.8% is what most wealthy Americans pay on most of their income, 20% capital gains rate and a 3.8% surcharge for gains over $250,000. Qualified dividends are taxed at capital gains rates, so, yes, all the dividends Bill Gates receives are only taxed at 23.8%. For a working class American, the marginal income tax rate on $250,000 is 24%, for married filers, not including Medicare taxes of 1.45% and another 6.2% in Social Security taxes on the first $142,800 of earned income. If you have earned income of over $628,300 as a married filer, your marginal income tax rate jumps to 40.3%. That is 69% more than the top rate for long-term capital gains on stock investments.

Or even better, if you are like Jeff Bezos, and own a lot of shares of a high growth company, why pay any taxes at all. You can borrow against the stock you own (margin) at less than a 1% interest rate, use the investment interest expense to offset some other income (for being CEO), and as long as your stock appreciates more than the 1% each year, you never have to sell, never have to realize a gain, and never have to pay any income taxes. Plus, when your kids inherit the stock from you, they get a stepped-up cost basis that can reduce their taxes on any sales to zero. The ultra-wealthy can afford to hire some of the best advisors in the world to help them use these and many other tricks to minimize their income tax liability. For regular folks like you and me, smart tax planning is required to build wealth in the first place. If you want to learn strategies you can use to minimize your income taxes and grow your wealth faster, then download a free copy of our “Tax Planning Basics” e-book. It is full of things you can do to keep more of what you earn. Things like asset location, Roth IRA conversion strategies, and income shifting strategies. It’s not an army of accountants, but it’s a start. To choose the best South Carolina state retirement plan our CERTIFIED FINANCIAL PLANNER™ practitioners analyze your goals, retirement horizon, appetite for risk, cashflow and many other factors while constructing your personalized financial plan. If you would like to learn more about developing a comprehensive financial plan, reach out to Oak Street Advisors today Employees of the state of South Carolina, which includes full time employees of state school districts, full time employees of state supported colleges, universities and technical colleges, full-time employees of the state of South Carolina or any of its departments, agencies, bureaus, commissions, and institutions, are eligible to participate in the South Carolina retirement plans.

There are two main types of plans offered by the state of South Carolina. The SC Public Employees Benefit Authority (PEBA) offers the South Carolina State Retirement System (SRS) plan, which is a traditional defined benefit pension plan; and the SC Optional Retirement Plan (ORP), which works like a 401k defined contribution plan. Under both plans you contribute 9% of your gross pay on a tax-deferred basis. Selecting the best plan for your family is one of the most important decisions you’ll make in your life. If you do not specify a selection within thirty days of your hire date you will automatically be assigned to the State Retirement System plan. Because the choice is so crucial to your retirement, we will go into depth on each plan and list the positives and negatives associated with each choice. SC STATE RETIREMENT SYSTEM (SRS) The retirement system divides employees into two classes of participants. To try and be clear and save you some time we will separate this section by employee class. Read the sub-section that is important to you. SC PEBA Employee Classes: Class Two - those employed before July 1st, 2012 Class Three - those employed on or after July 1st, 2012 are considered Class Three participants CLASS TWO EMPLOYEES The benefits under this plan are based on your attained age and years of service. The monthly benefit you receive is calculated by multiplying your Average Final Compensation (12 highest consecutive quarters of earnable compensation in which you made regular member contributions and were earning service credit. An amount up to and including 45 days’ termination pay for unused annual leave at retirement may be included in your AFC calculation) by 1.82%, then multiplied by your years of service. For example, if your AFC were $60,000 and you were an employee for 30 years, your benefit would be: .0182 x 30 (years) = .546 Average Final Compensation $60,000 divided by 12 = $5,000 Monthly benefit = $5,000 X .546 = $2,730 CLASS TWO: EARLY RETIREMENT AND REDUCTIONS TO YOUR BENEFITS Important Notes About Early Retirement: 1. Class Two participants can retire with full benefits after 28 years of service or at age 65. 2. Class Two participants can also receive reduced benefits at age 60 or at age 55 with 25 years of service. This is an area most employees need help with. Similar to the Social Security system, early retirement from the SC PEBA has a dramatic and permanent effect on your monthly benefit. Class Two participants can retire at age 60, but your benefit is reduced by 5% for each year you receive a benefit before age 65. For example, using the benefits from the example above, if you retire and elect to receive benefits at age 60, your monthly pension check would be reduced by 25%! The amount you would receive would be permanently reduced by $682.50 per month, leaving you with income of just $2,047.50 of monthly pension income. Multiply that reduction by the 20 years or more most retirees will live after employment and you’ve cost yourself over $200,000 in lifetime income. Class Two participants can also begin receiving benefits as early as age 55 if they have 25 years of service. The reduction is even more onerous at 4% for each year before they achieve age 65. Taking our above example would result in a 40% reduction of monthly income. That results in a pension check of just $1,638 and forgone lifetime earnings of more than $300,000 for someone living to age 80. CLASS THREE EMPLOYEES You must be a participant for no less than 8 years to receive a pension. Class Three participant calculation of AFC (Average Final Compensation) is a slightly different than Class Two’s calculation. Take the 20 highest consecutive quarters of earnable compensation in which you made regular member contributions and were earning service credit. * *Termination pay for unused annual leave at retirement is not included in the AFC calculation. Then you use the same calculation as Class Two above: .0182 x 30 (years) = .546 Average Final Compensation $60,000 divided by 12 = $5,000 Monthly benefit = $5,000 X .546 = $2,730 CLASS THREE: EARLY RETIREMENT AND REDUCTIONS TO YOUR BENEFITS

HOW BOTH CLASS EMPLOYEES CAN AVOID EARLY RETIREMENT BENEFIT REDUCTIONS Because the reductions to your monthly pension are both permanent and severe, you should usually try to avoid taking your pension prematurely. You’ve probably noticed that people are living longer-- the life expectancy for American males who reach age 60 is currently another 21 years and for females another 24 years. Therefore, deciding to take your pension early and suffering a substantial reduction in your benefits must make sense from a break-even analysis. In the examples we used above, a retiree who chooses to receive benefits early would receive monthly benefits of $2,047.50 for 60 months before their Normal Retirement Age. Essentially starting with a $122,850 lead over a participant who waits until 65 to begin their benefit. But the participant who delays receiving their benefit earns $682.50 more each month. If you divide the $122,850 by the amount of additional income received from delaying pension benefits, you see that after 180 months both participants have received the same dollars in total retirement income. The longer you live, the better the decision to delay benefits becomes. If you have health issues that could impact your longevity, taking an early benefit could make sense. If you’re healthy, and particularly if you’re female, delaying benefits is likely to be a better deal. You can find a good life expectancy calculator at LivingTo100.com. HOW TO RETIRE EARLY AND AVOID REDUCED BENEFITS One way to retire before your normal retirement date and also avoid taking reduced benefits is to utilize the state’s additional 457b Deferred Compensation Plan. With this plan, you can contribute extra funds to build a bridge between your planned retirement date and age 65 when you receive full retirement benefits. How much you need to accumulate in this “bridge” account is fairly straightforward to calculate. Multiply your annual pension income by the number of years you expect to retire before reaching age 65. That becomes your saving target. Working with a CERTIFIED FINANCIAL PLANNER™ will help you determine the exact amount your “bridge” should be, and the monthly savings needed to build it. With this bridge in place, you can replace any income shortfall while you still delay claiming your benefit in order maximize your future pension income. ADDITIONAL CONSIDERATIONS SURVIVING SPOUSE ELECTIONS When selecting your retirement benefit you can choose to receive benefits that end when you die, remains the same for a surviving spouse, or provides a lower benefit for a surviving spouse. The best choice for you will depend on a variety of factors including you and your spouse’s life expectancy and family retirement assets. It usually will make sense to choose an option that provides some income for a surviving spouse. What makes this plan great is the option to change the survivor election if the non-participating spouse predeceases you. In this scenario, participants can revert to the single life option, increasing their current monthly pension benefit. Before making this irrevocable choice, it would be wise to consult with a CERTIFIED FINANCIAL PLANNER™. INFLATION PROTECTION The SC State Retirement System Plan also includes some protection against inflation in the form of a 1% annually cost of living increase, subject to a $500 annual cap. This limited inflation protection means you should have additional retirement savings to protect the purchasing power of your retirement income. OPTIONAL RETIREMENT PROGRAM The Optional Retirement Program is a Defined Contribution plan. This means the funds going into your plan are defined, but the outcome of those invested funds is not. Participants contribute 9% of their gross income into the plan and the State of South Carolina contributes another 5% on their behalf. The retirement benefit you receive when you separate from service depends on how well the investments inside of your plan perform. Your outcome could be better or worse than the traditional SRS pension plan. The money in your ORP is always yours and you are 100% vested in the account balance from day one. There is an annual open enrollment from January 1st to March 1st each year when you may change providers, or switch to the SRS pension plan if you have been a participant for less than 5 years. There are currently four providers of the Optional Retirement Program:

Each provider charges administrative fees that are in addition to the fund expense ratios.

For a quick comparison of providers, click here. All of these are reasonable fees. You should compare the fees charged by the individual mutual funds within the plan to compare total fees and expenses. WHICH PLAN IS BEST FOR YOU? Determining the best option for you is a big decision. We recommend you give this a lot of thought. A good place to start can be found on page six of the “Select Your Retirement Plan” booklet available online. Want a CERTIFIED FINANCIAL PLANNER™ practitioner to help you make this decision? Reach out to Oak Street Advisors today. Converting funds from a tax-deferred Rollover or Traditional IRA to a tax-free Roth IRA in retirement can be a smart move for managing your total income tax bill. Often, Roth conversions can be accomplished in lower tax brackets, protecting you from possibly higher brackets in the future and minimizing the income tax bite of Required Minimum Distributions (RMDs) from your Traditional/Rollover IRA in later years.

The earlier you can begin to efficiently convert funds to tax-free Roth assets the better. Doing so moves the growth of the converted portion of your tax-deferred accounts into income tax-free growth. The calculations can be daunting, so enlisting the aid of a CERTFIED FINANCIAL PLANNER™ professional or CPA will help. But it is often wise not to convert 100% of your tax-deferred retirement money into a Roth IRA. If you make charitable contributions on a regular basis, it would be more tax efficient to leave some money in your tax-deferred IRA to fund those contributions once you reach age 70 ½. The Qualified Charitable Distribution rules allow for income-tax free distributions to qualified charities once you reach this age. For more information on the QCD rules check out this post. The bottom line here is if used to fund your charitable giving, a Traditional/Rollover IRA gives you a very tax friendly option. Each year you can make donations that will not appear as taxable income on a 1099-R. That means you contributed the funds on a pre-tax basis, they grew without income tax consequences, and then they are distributed income tax-free. Given that, for most-- any charitable contribution over $300 per year for individual filers and $600 per year for joint filers, gets no income tax break at all-- this is a great way to save on your income taxes and support worthy causes at the same time. Another reason to avoid a 100% Roth conversion is simply that having no taxable income is not the most tax-efficient plan. There is always a level of income that is free of income taxes-- the amount of income covered by your standard deduction and/or other above the line deductions. For 2021, the standard deduction for single filers is $12,550 and for joint filers it is $25,100. This means that if you had no other sources of income, you could withdraw those amounts from a Traditional IRA income-tax free. It is unlikely you would be in this situation, but if you have a tax-efficient taxable investment account and a small pension or social security benefit, you might have some leeway to withdraw funds from a tax-deferred account at a 0% tax rate. Again, the calculations can be tricky, particularly if you are in the social security tax torpedo range, so seek out qualified help in making these decisions. Taxes are not fun to pay or to calculate. But smart income tax planning can add thousands or even hundred of thousands of dollars to your bottom line. Working with a financial expert who understands how everything fits together can be one of the best decisions you could make. Are you staying awake at night worrying about the state of your stock investing? Our fee-only Certified Financial Planner has sound investment advice on when you should revisit your financial plan and when you should simply roll over, plump your pillow, and go back to getting some much-needed rest. It has been a truly turbulent year filled with unprecedented events and wild swings in the American economy and global financial markets. As trusted, fee-only Fiduciary financial planners, we field many calls from new clients who are suddenly very worried about their mutual funds investment, asset management, risk management, and more. There are times when reassessing your investment portfolio makes sense. But believe it or not, a stock market crash—heck, even a global pandemic—may not be one of those times. Before you call your Certified Financial Planner to pitch your current portfolio and put everything into a high yield savings account, ask yourself a few questions. Do you have a personal financial plan in place?Building wealth with assets takes smart financial planning, and a good Certified Financial Planner plans for the unexpected. At Oak Street Advisors, our long-range forecasts for our clients always assume a few years of harder times. No matter what you see on the news, if you have a good, long-term financial plan with the right level of risk management, you are probably still on track to meet your personal financial goals. And if the landscape has shifted in ways that make a difference to your asset management, you should not have to make the first call. A good financial planner will reach out to you!

If you don’t have a personalized financial plan in place, the time to reach out for fee-only investment portfolio advice is right now. Are you considering or experiencing a life-changing event?It may surprise you to hear that the most seismic events in your financial life are likely to be personal, not global. Are you thinking about getting married? Do you have a first child or a new child on the way? Are you contemplating a divorce? Have you been diagnosed with a significant illness or been in an accident? Have you been recently widowed?

Your Certified Financial Planner will most likely not hear about some of these changes in your life unless you share the news directly. Whether the news is good, we will adjust your financial plan to maximize its value. If the news is bad, we will minimize its impact on your long-term financial goals. (And no matter what, we care about you and want to know how you are doing.) Has your personal financial outlook changed? Seeing the stock market swoon or the jobless numbers rise on the news is one thing. Having your own (or your spouse’s) compensation cut or being offered an early retirement package or losing your current position is quite another. Now, it’s personal—and it will likely impact your financial plan. There are less catastrophic shifts in your finances that can also change your long-term financial forecast. Are you enrolling a child in private school? Is one of your children starting, or stepping away from, their college education? Have you decided to retire early, or buy a big boat, or invest in a second home or timeshare?

We can help! Your Certified Financial Planner has strategies to get you through short-term or long-term hardships. We can advise you on how to leverage your investment portfolio to access cash, we can let you know if you can take an early retirement, and we can show you how to adjust your personal financial plan to still meet your retirement goals. We can also show you how to roll over a 529 college savings plan to another child in your family or use it to shelter private school tuition from some taxation. Are you worried you are missing out on a big opportunity?Did one of your best friends share a tip about a hot new stock? Does your co-worker have a different investment strategy that they are sure will really pay off? It can be difficult to hear success stories at the office or the neighborhood barbecue without wondering if their advice might also be good for you. As fee-only Certified Financial Planners, we focus on long term investment strategies rather than the outlook of individual stocks. If we see a big opportunity, we will always let you know, and if you are intrigued by a particular stock, we will encourage you to speak to your investment advisor for investment portfolio advice. FOMO—or Fear of Missing Out—drives more terrible investment decisions than most people realize. By the time you are hearing about the success of a particular stock, it is likely ready to plateau or plunge, and someone else’s retirement plan is not designed around your personal financial situation and financial goals. Remember: you don’t have to take risks just to take risks. Staying on track to a comfortable retirement is a real reward. Have tax laws changed?

Has it been more than a year since you reviewed your plan with your financial advisor?Oak Street’s fee-only Certified Financial Planners build in an annual review of every single one of our client’s personal financial plans to ensure they are optimized for the coming year. And if we see trouble or opportunities ahead? We will sit down with you, share our years of experience, and reset your personal financial plan to ensure that you still reach those long-term goals.

Many investors love the Federally tax-free income they receive from municipal bonds. Municipal bonds are debt securities issued by state and local governments to fund operations or special projects. Because the income an investor receives is not taxed, the after-tax return of municipal debt is often higher than the after-tax income provided by corporate bonds and bank CDs. For example, the yield on the iShares Core US Aggregate Bond ETF (AGG) currently stands at about 2.3%. For a taxpayer subject to a 22% marginal income tax rate, the after-tax return drops to just 1.8% and is even lower as you climb into higher marginal tax brackets. Compare this to the Vanguard Tax-Exempt Bond Index Fund ETF (VTEB) which yields 2.1% federally income tax free. An often-underappreciated item in the US income tax code deals with qualified dividends. A qualified dividend is a dividend from a common stock or a preferred stock that the filer owns for a specified minimum time period. The beauty of qualified dividends is that they are taxed at the filer's long-term capital gains rate rather than as ordinary income. The following table compares ordinary income rates and long-term capital gains rates for married filing jointly returns for the tax year 2021

*Includes 3.8% net investment income surcharge.

Which brings us to the value of qualified dividend income (QDI). QDI extends to income received from preferred securities. Preferred stocks are debt-like securities issued by corporations that rank below the bond holders-- but above the stockholders-- in the event of a liquidation. The term preferred is used because the dividends on these shares must be paid in preference to dividends paid to common stock shareholders. To learn more about preferred stocks you can view the Wikipedia entry here. The importance of this is the after-tax returns of many preferred securities held long enough to receive QDI tax treatment, are higher than rates generally available in the municipal bond market. Take the Bank of America preferred series A (BAC-PA) for example. This security has a current dividend yield of 5.8%, even at the highest capital gain rate of 20% and add in the 3.8% net investment income surcharge the after-tax net on this income is 4.4% or more than double the tax-free rate of 2.1% from VTEB. There are some details to keep in mind; to qualify for QDI status, the security must be held for 91 days out of the 181-day period, beginning 90 days before the ex-dividend date. Because most preferred securities pay quarterly dividends, you would generally need to make your purchase the day of the preferred trade’s ex-dividend to ensure you receive favorable tax treatment. Also, preferred issues are highly concentrated in the financial and utility sectors of the market which could lead to poor diversification. You could use exchange traded funds (ETFs) like the iShares Preferred and Income Securities ETF (PFF) or an open-end mutual fund like the Nuveen Preferred Securities and Income Fund; but be aware that not all the distributions from funds like these are considered Qualified Dividend Income. Only 62% of the distributions from PFF were eligible for QDI treatment in 2018 and usually about 60% of the Nuveen funds distributions were QDI eligible. Still, for investors concerned with building a tax-efficient portfolio, preferred securities are certainly worth consideration. A health savings account is a tax-deductible savings plan for individuals covered by a qualified High-Deductible Health Plan (HDHP). This program allows for tax deductible contributions to a special account that allows you to pay for expenses your insurance plan does not cover with pretax and tax-free dollars.

Eligibility A high deductible plan for 2021 requires a minimum deductible of $1,400 for individuals and/or $2,800 for a family. These plans must have a maximum out-of-pocket expense of at least $7,000 for an individual and $14,000 for a family. If you’re covered by a spouse’s workplace policy, Tricare, the Veterans Administration, or Medicare you are not eligible. If you are a dependent on someone else’s tax return or covered by a Flexible spending account or Health reimbursement account, you are not eligible. How an HSA Works The beauty of an HSA is you make contributions that are deducted from your taxable income, yet when you spend the money for qualified expenses, the distribution is tax-free as well. Any growth within the HSA account is also tax-free. So, the contributions are deductible like a Traditional IRA, but earnings and distributions are tax-free, like a Roth IRA – you get the best of both worlds! Contributions Contributions to an HSA are deductible from your taxable income in the years you contribute, and like a Traditional IRA, you can make contributions until April the 15th or your normal tax filing deadline of the following year. For 2021, the maximum HSA contribution is $3,600 for and individual and $7,200 for a family, with an additional $1,000 per year “catch-up” contribution for those over age 55. It is important to know that for married couples the $1,000 catch-up provision applies to each spouse. If you and your spouse are each over 55 your HSA contribution limit for 2021 would be $9,200. If you contribute to an HSA plan through your employer, your annual contributions are reduced dollar-for-dollar by any contributions your employer makes on your behalf. For example, if you and your spouse are under age 55 and your employer makes a $1,200 annual contribution on your behalf, you would only be allowed to contribute and deduct from your taxable income $6,000 for 2021 ($7,200 contribution limit minus $1,200 employer contribution). If you drop out of a high deductible plan before the end of any calendar year, say you become eligible for Medicare, or you change employers and the new coverage does not qualify as a high deductible plan, your contributions for that year are simply pro-rated. Meaning if you participate for three months then changed to a plan that is not eligible for HSA contributions, you would be eligible for a 3/12ths deduction in that calendar year. On the other hand, if you become eligible for HSA contributions during a calendar year, you can make contributions as if you were covered by a high-deductible plan for the full year. So, if you moved from an employer plan that was not HSA compliant to another employer plan that was HSA eligible in October you would be allowed to contribute as if you were eligible for the entire year. This is known as the last month rule. The contribution rules for HSA accounts also allow others to contribute to the account on your behalf. For example, if you have a working child who is covered by an HSA compliant insurance policy, you can contribute directly to the account for them. The contribution is considered a gift so you will not receive an income tax deduction, but it may be an important step to helping your child become financially stable. Qualified HSA Funding Distribution An important funding technique is the ability to make a trustee to trustee transfer from an IRA into your HSA account. Each taxpayer may only do one qualified transfer in their lifetime and the amount of your HSA contribution will be reduced dollar-for-dollar in the year you make a conversion. This is an outstanding opportunity to convert dollars that are potentially taxable in the future to dollars that can be tax-free. If you are young and make a conversion, the potential for tax free growth can’t be beat. Even if you’re just shy of Medicare eligibility, the income tax savings of this strategy make it worthy of consideration. An important note for couples is that only one person can own an HSA account. To maximize the Qualified HSA funding distribution benefit, one spouse will open a family HSA for a calendar year and use their qualified funding distribution. In the following year the other spouse will open a separate HSA account and use their own once in a lifetime qualified funding distribution to fund that account. This would allow a couple to convert up to $18,000 from IRAs where distributions are likely to be taxable--into HSA accounts that compound tax-free and provide tax-free future benefits. Rollovers You are allowed to rollover funds, via a trustee-to-trustee transfer, from one HSA account to another without triggering a taxable event. This means if you leave an employer’s plan and wish to establish an HSA account through a different provider, you can consolidate your account with the new provider and simplify your finances. Or if you wish you can change HSA account custodians anytime. Beneficiaries If you name your spouse as the beneficiary of your HSA account, the account will be treated as the spouse’s HSA upon your death. For other beneficiaries, the fair market value becomes a taxable distribution to the beneficiary. Household Individuals Funds from your HSA account can be used for qualified medical expenses for you and your family. The IRS is a bit liberal in their definition of family. Anyone who qualifies as a dependent on your income tax return can have medical expenses paid from your HSA account. You, your spouse, your children under age 19 or under age 24 if a full-time student, grandchildren, parents, and foster children are all included. Qualified Expenses Medically necessary expenses not covered by insurance can be paid from your HSA account without taxation. Even things like drug and alcohol rehab, home modifications for disabilities, acupuncture, dental and vision care, and over the counter drugs prescribed by your doctor, are all allowed expenses. Although your current insurance premiums cannot be paid from you HSA account, you can use those funds to pay for Long-Term Care insurance and Medicare Part B and Part D premiums. For a complete listing of eligible expenses see IRS publication 502. Look Back Provision If you have an HSA account open during any tax year and do not have enough money contributed to cover all the allowed reimbursements, you can use future years contributions to pay yourself back. For example; In 2020 you had an HSA balance of $4,000 but in December you had a large unexpected $5,000 medical expense. You would be able to make 2021 contributions and then reimburse yourself for the extra $1,000 expense you incurred in 2020. Prohibited Transactions Like IRA accounts, there are certain transactions that are prohibited inside your HSA account. You cannot have any self-dealing transactions such as sale leasing or exchange of property between yourself and your HSA account, you cannot charge your HSA account for services you provide, and you cannot use your HSA account as collateral for any loans. A violation of these rules will trigger a deemed distribution from your HSA account and subject all the funds to taxation in the year the violation occurs. For more information on prohibited transactions see section 4975 of the tax code. For the full IRS guidance on Health Savings Accounts see Publication 969. How Business Owners Can Save On Their Income Taxes With the Qualified Business Income Deduction11/24/2020

The recent income tax revamp has made income tax planning early in the year a must for many self-employed professionals. The ability to take a 20% deduction of business income, available for single filers with income below $164,900 for 2021 and married filers with income below $329,800, is too good to pass up. Filers with taxable income at these levels will be in the 24% marginal tax bracket, so being able to qualify for the business income deduction is worth thousands, particularly when proper tax planning can prevent many from reaching the next 32% bracket. There are a number of ways to game your reported income, allowing many filers with reportable income well above these limits to qualify for the 20% exclusion. First, the exclusion counts toward reducing your income below the phaseout thresholds. A married couple with employment income of $175,000 and a like amount received as business income would see their total income of $350,000 reduced by 20% of the business income or $35,000 allowing them to remain within the proscribed income limits. Contributions made to an Health Savings Accounts will also reduce your taxable income. For 2021 single filers can deduct up to $3,450 and couples up to $6,900. A real biggie for high earners looking to qualify for the 20% exclusion is retirement plan contributions. Money contributed to your qualified retirement plans can make a huge difference. For 2021 those under age 50 can contribute $19,500 to a 401k and those 50 and above can contribute up to $26,000. Presumably as a business owner you can also be sure to offer a generous match. Matching contributions are a deductible business expense that benefits you the owner directly yet reduces your reported profits and thus your total income for purposes of qualifying for the 20% deduction. And for very high earners, adding a defined benefit plan to your existing defined contribution plan might be a smart move, depending on the demographics and size of your workforce. Don’t overlook simple things like using tax free municipal bonds for your savings versus taxable bonds and CDs. Going beyond the basics, some business owners could benefit from reimagining their business ownership. Suppose you are a professional who owns your place of business. Setting up a separate company to own the real estate could be a smart move. You lease the building back from the owner at a fair market rate creating business income that is not subject to the target income limits. Busy professionals have little time to devote to income tax planning and their CPAs are busy during tax season, but the difference between qualifying for the deduction and not qualifying could hinge on how soon you begin a given strategy. Roth IRA accounts have been available since 1997. Unlike a Traditional IRA, Roth IRA contributions are taxed in the year of the contribution but never taxed again if certain requirements are met.

If you are a single filer with gross income of up to $52,525 or joint filers with gross income of up to $105,050 for the 2020 tax year, all of your income is taxed at 12% or less, and we strongly encourage you to make Roth IRA contributions rather than Traditional IRA contributions. The magic of compounding means, the earlier you start, the greater the tax-free growth within the account. If you are 20 when you start making contributions, you could be looking at four doubles of your original contribution by the time you retire at age 60. That means a $6,000 contribution this year could grow to $96,000, creating $90,000 of tax-free income for your retirement years. With today’s historically low income-tax rates, it would be prudent to put as much money as one can into a Roth IRA. Always consult your CPA before making this decision, but one could argue the tax-free growth and withdrawals outweigh the hurt of paying today’s top tax rates. Contribution and Income Limits For 2021 eligible individuals can contribute up to $6,000 if they are under age 50 and $7,000 over the age of 50. You can contribute 100% of any eligible income up to these limits. For single filers with Adjusted Gross Income of less than $125,000 ($124,000 for 2020) can make a full Roth IRA contribution. If the adjusted gross income is between $125,000 and $140,000 ($124,000 to $139,000 for 2020) they can make a partial Roth IRA contribution. For joint filers the threshold is below $198,000 AGI ($196,000 for 2020)and the phaseout is between AGI of $198,000 to $208,000 for 2021 ($196,000 to $206,000 for 2020). For adjusted gross incomes above these amounts, a back-door Roth IRA strategy will be needed. Back-Door Roth IRA Contributions Without income limitations for converting assets in a Traditional IRA to a Roth IRA, many who are disqualified for income resort to the back-door method for funding a Roth IRA. This works because anyone may open and contribute to a non-deductible Traditional IRA, even if you are covered by a qualified retirement plan. Once the funds are deposited into the non-deductible Traditional IRA, they can then be converted to a Roth IRA. This has the same net income-tax effect as contributing directly to a Roth IRA. The IRS recently loosened the back-door conversion rules and allow for immediate conversions, where in the past investors were recommended to wait a few months before converting to satisfy the IRS. The 5 Year Rule Another reason to open a Roth IRA is the flexibility it can provide to fund emergencies that may arise over your life. You can always withdraw any Roth IRA contributions you have made without taxes, after all, you paid income tax on the money prior to making the contribution. However, if you haven’t had the Roth IRA open for at least five years, your distribution could still be subject to a 10% tax penalty, similar to the early withdrawal penalty for Traditional IRAs. The five years for withdrawals begins on January the 1st of the year you open the account, not when you make subsequent contributions. There is also a five-year rule for Roth IRA conversions that start in January of the year you make a conversion; this prevents someone from using a Roth IRA conversion to avoid early distribution penalties from early Traditional IRA withdrawals. The Younger, The Better Tax-free growth and tax-free distributions are very enticing, especially for young investors. The more time your account grows tax-free, the better. Another point to make is that the more of your nest egg you have in a Roth IRA, the less your Required Minimum Distributions (RMDs) will be during retirement. Which inherently leads to you and your financial advisor having more ability to control/minimize income taxes during retirement years.  If you're age 72 or older you probably know you must begin taking distributions from your IRA -- whether you want to or not. The IRS life expectancy tables determine your Required Minimum Distribution (RMD) based on the previous years ending balance for your IRA and your attained age for the tax year. The Qualified Charitable Distribution (QCD) rules provide those subject to RMDs an option that can help them reduce their income tax liability by having certain charitable contributions made directly to a qualified charity. Given the changes to itemized deductions and the standard deduction in the 2017 tax law update, the Qualified Charitable Distribution rules for your IRA account becomes even more important. If you make charitable contributions throughout the year, it would be wise to consider making those contributions directly from your IRA. Up to $100,000 of charitable distributions from each IRA owner's accounts can be excluded from your taxable income each year. Say you plan to give $10,000 to your church or another qualified charity and you're receiving taxable distributions from your IRA. If you make the contribution to the charity directly from your IRA, your $10,000 gift will not be reported as income on your income tax return. If you instead receive these funds as income from your IRA distribution and then send the same $10,000 to the charity, it is included in your taxable income and could result in higher Medicare premiums and a higher percentage of your Social Security income being taxable. If you don't have itemized deductions that exceed the new $24,000 per couple or $12,000 per individual standard deduction, you could lose all the tax benefits of your generosity. By having the distributions sent directly to the qualified charity from your IRA, you will exclude the amount from your taxable income, potentially lowering your Medicare premiums, the taxable portion of your social security benefits, and your overall income tax rate at both the federal and state level. If you follow this strategy, be sure to let your income tax preparer know. There may be no indicator on the 1099R you receive at the end of the year that shows that part of your distribution is non-taxable, so there is a chance many people using this strategy are over-paying their income taxes each year. |

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed