|

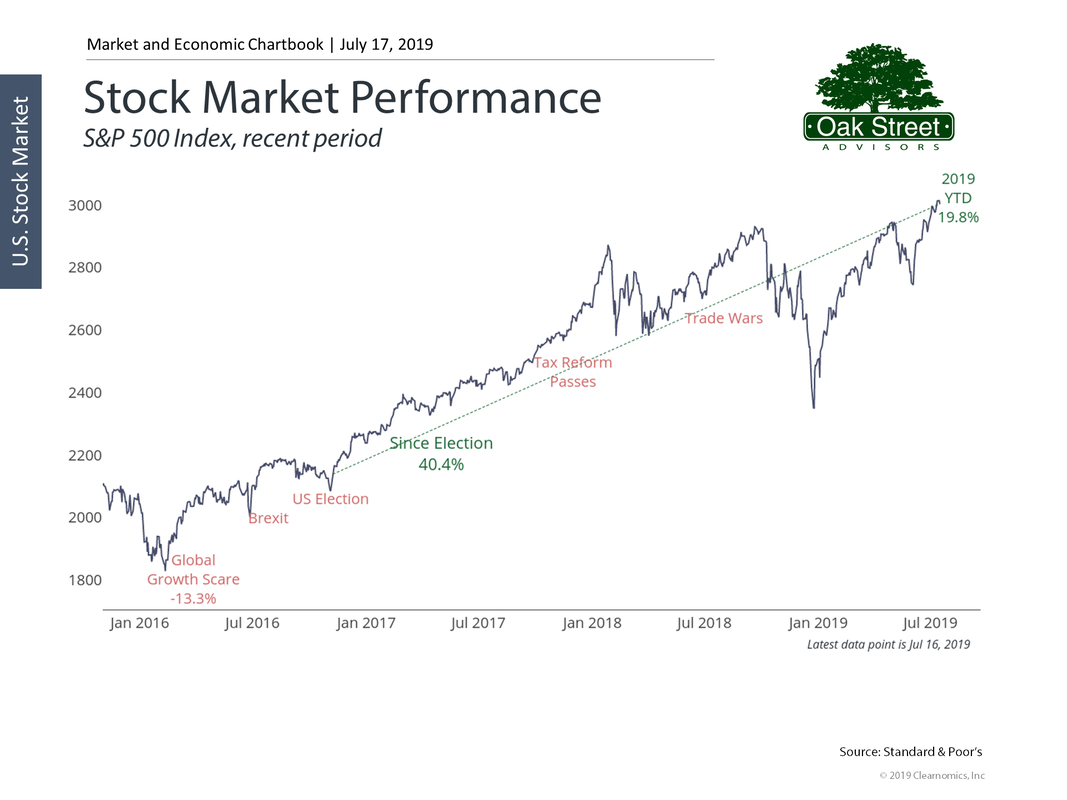

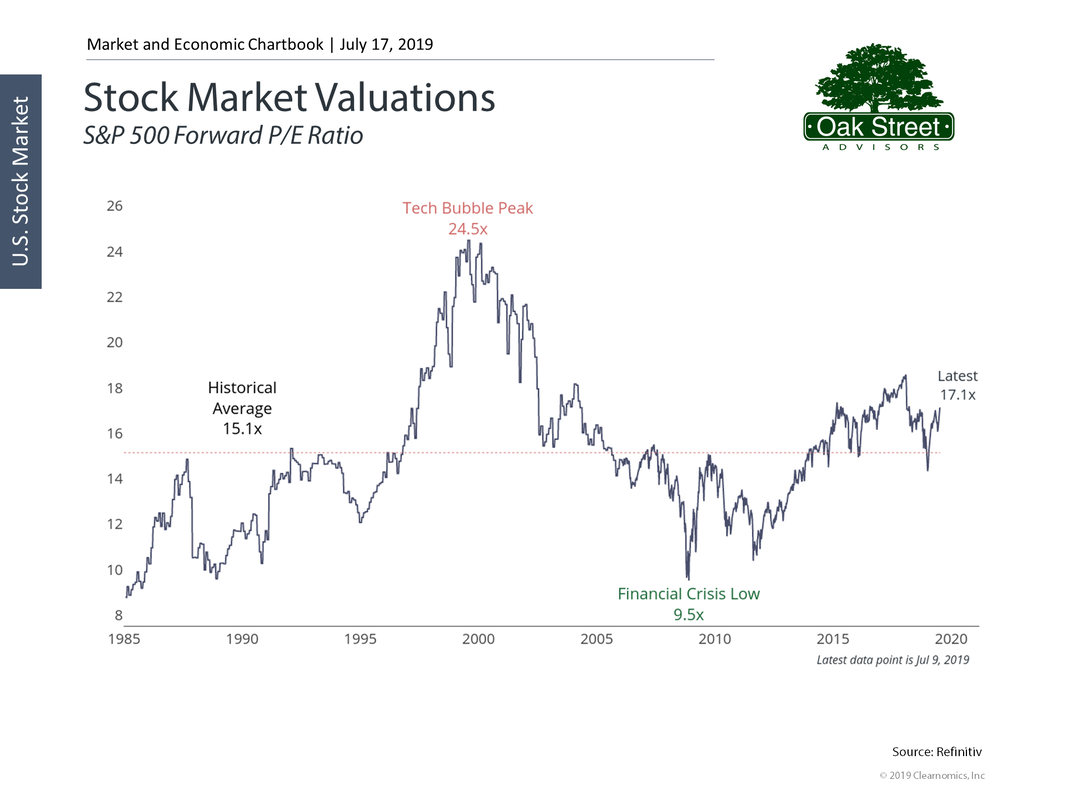

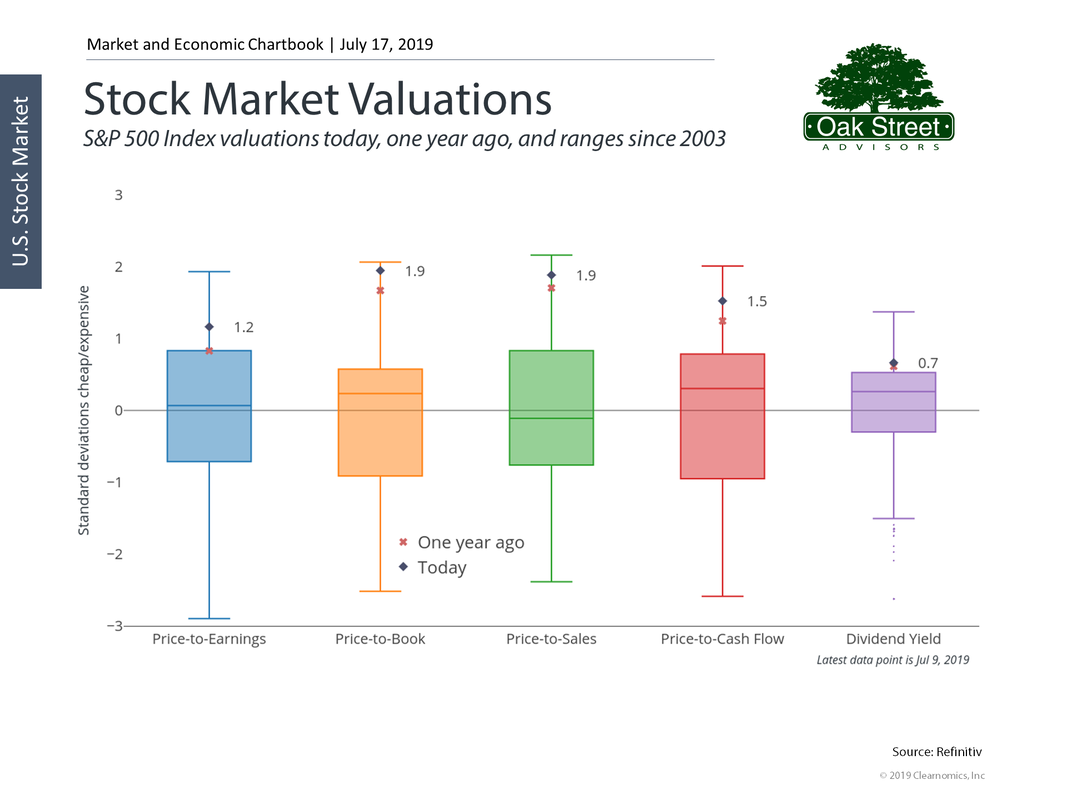

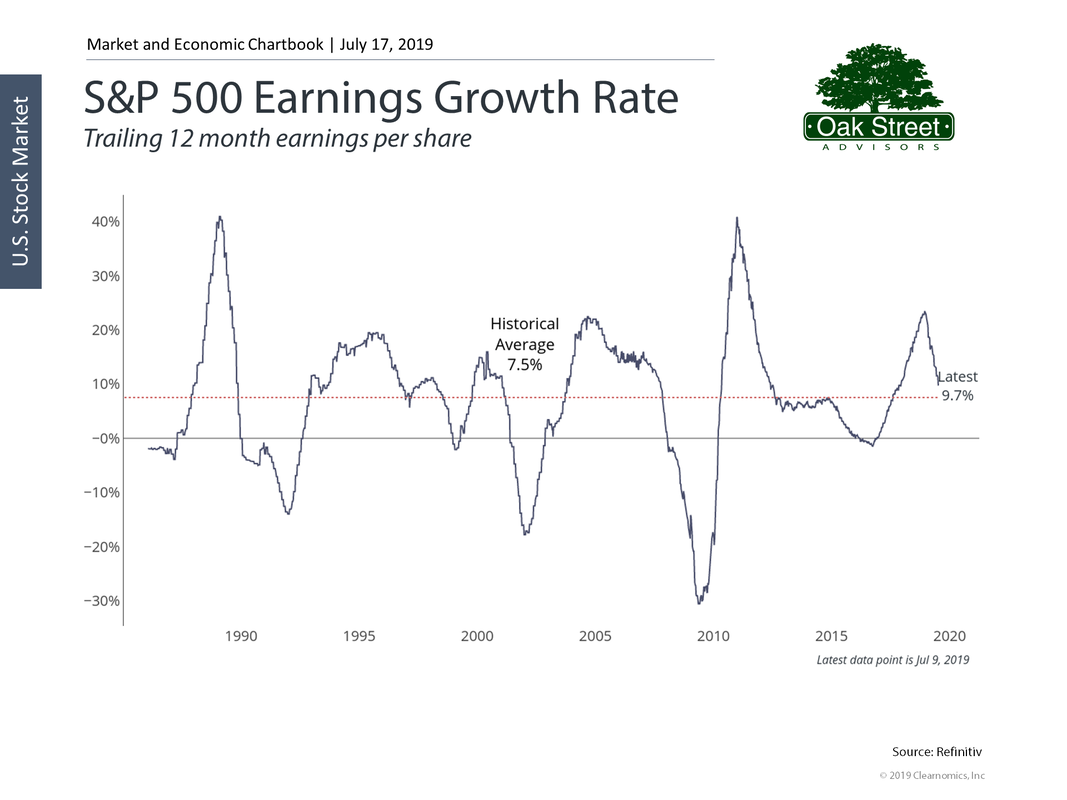

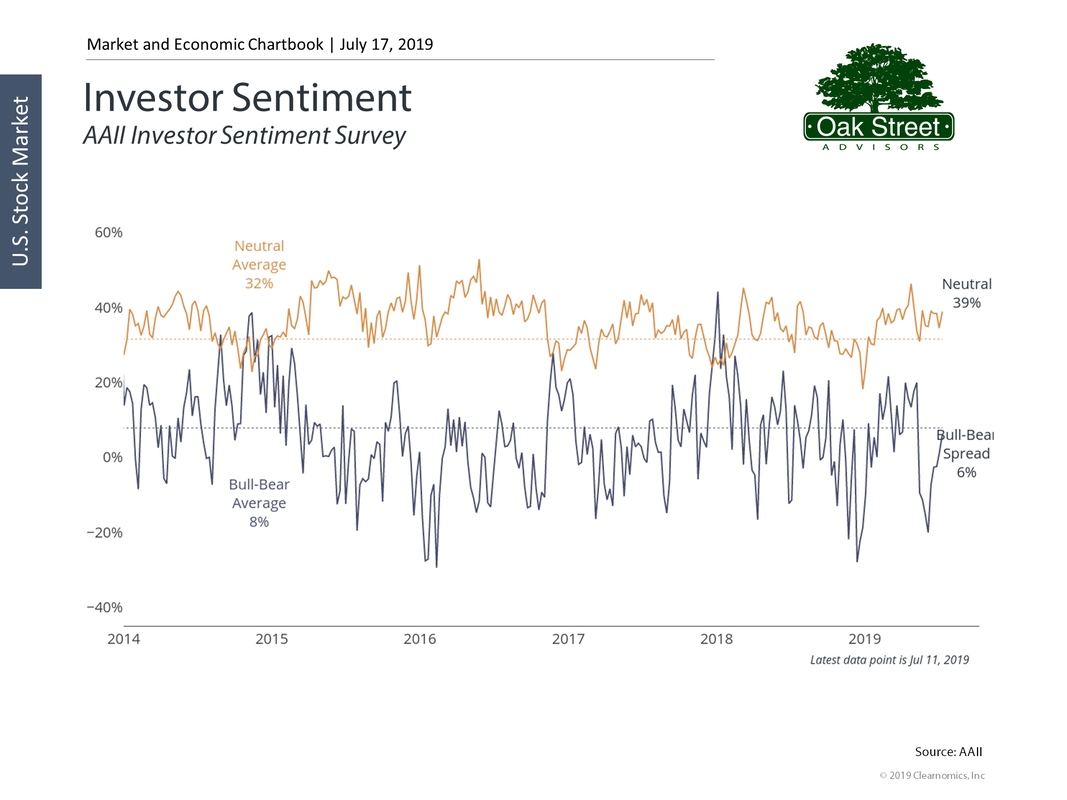

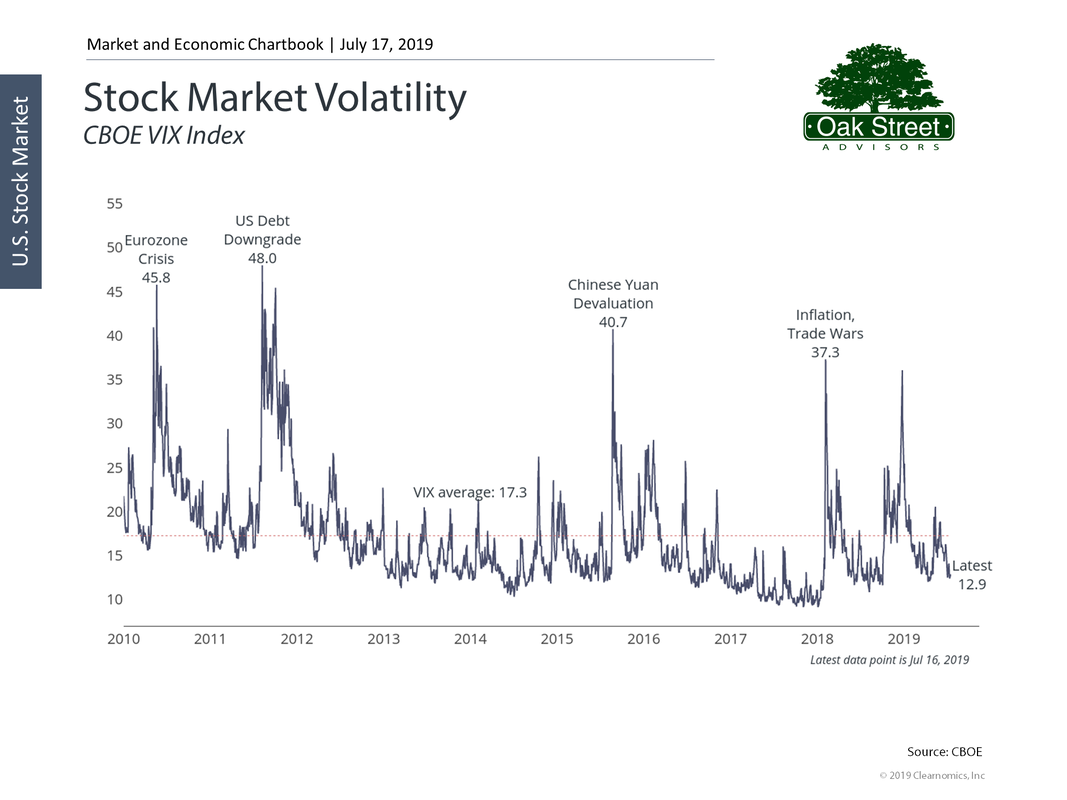

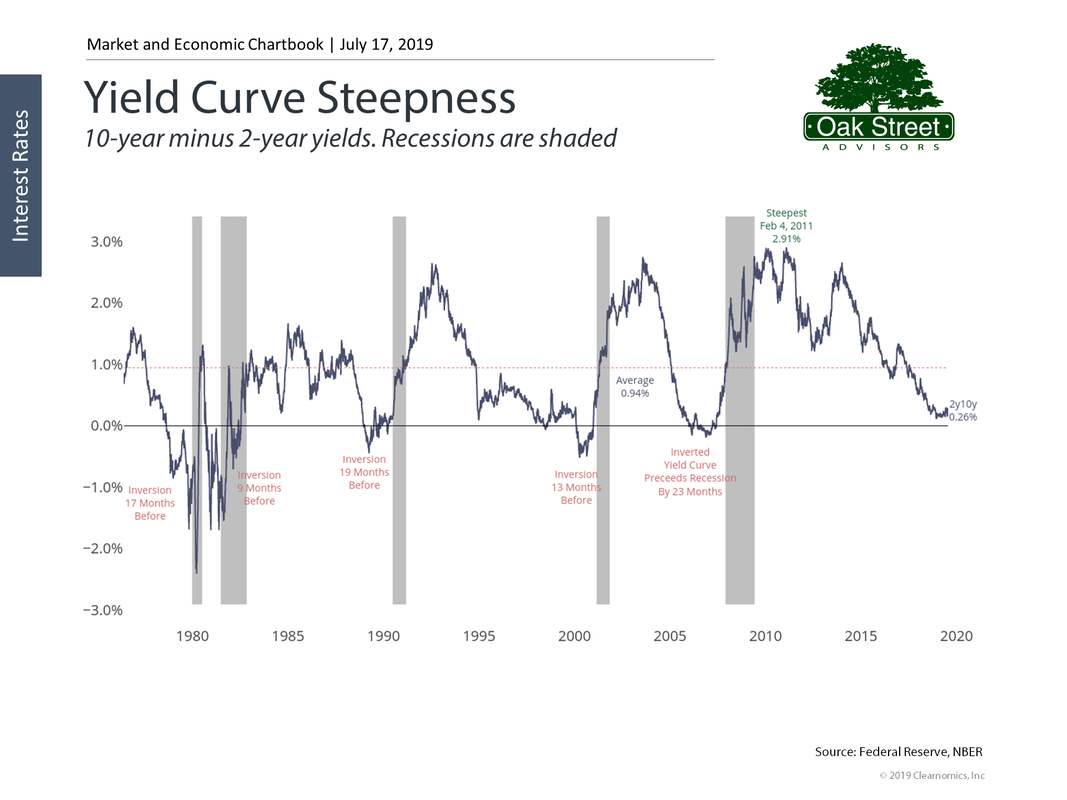

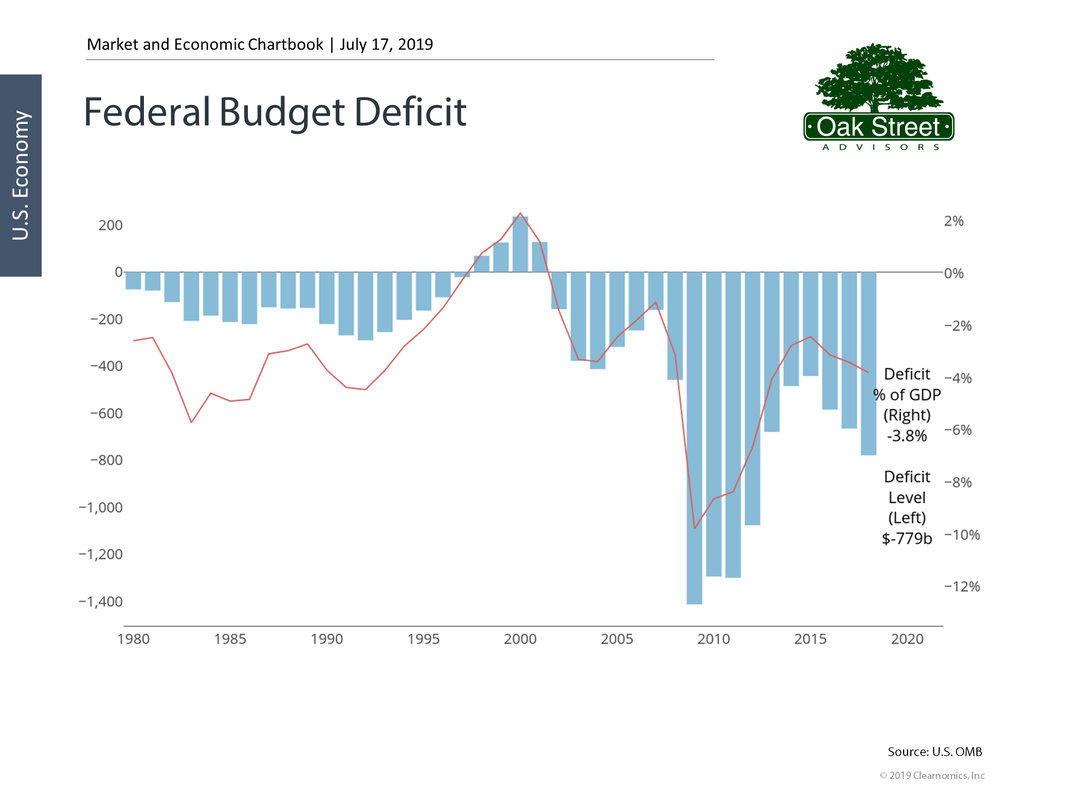

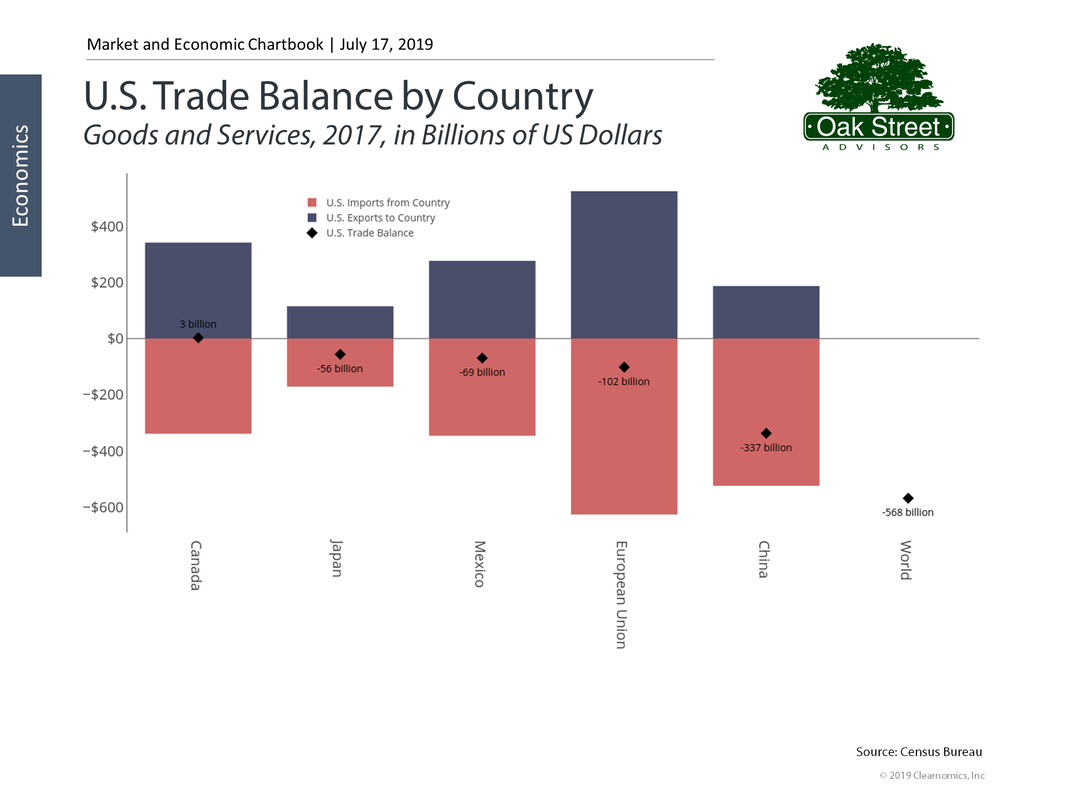

It’s been a stellar start to the year. The S&P 500 has risen nearly 20%--crossing the 3,000 mark for the first time on June 12th, 2019. Stock market valuations are getting a bit high and investor confidence remains unchecked. While corporate earnings growth is slowing. And as a contrarian indicator, investors remain very upbeat about the market… …while volatility remains low. The Fed seems to be caving to political pressure and markets believe we’ll get one or two rate cuts during the second half of 2019. The yield curve has avoided a major inversion as short-term rates have continued to fall. Other things that we find worrisome: Treasury Secretary Mnuchin indicated the government may run out of funds by early September. However, Congress is scheduled for a summer recess and politicians seem to be more divided than ever so the Federal budget could become a big deal. Although the markets seem to have priced-in an easing of trade tensions, there may be no quick end to the US trade war with China Here’s What Oak Street Advisors is Doing Now:

When making any decisions we need to ask ourselves “Can I afford to be wrong?”. The long-term lesson of the markets dictates that our default position should be fully invested. The markets may go down-- but they do not stay down-- and the price of the permanent ups is the short-term downs. With that said, and knowing we may be wrong, we have made some changes to our stock portfolios. We’ve taken about 10% out of the stock allocation in the equity portion of your portfolio and are holding those funds as extra cash positions. This means if the stock market were to gain an additional 10% from now until year-end, we would only achieve a 9% gain. However, if the market were to pull back from here by 10%, we would only fall the same 9% and would have cash available to reinvest at lower prices. Only time will tell if our caution is justified. Note. This information does not constitute investment advice. It is merely posted so clients can understand the thought process that goes into managing their portfolios. Each individual’s circumstances and needs are unique. No one can predict the future or the valuation of any financial market with accuracy. Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed