|

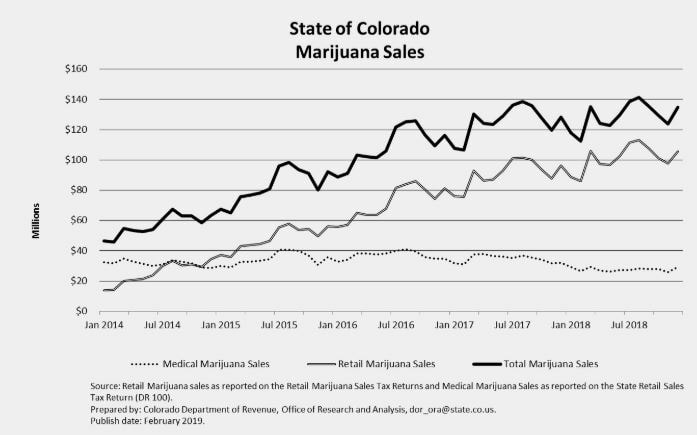

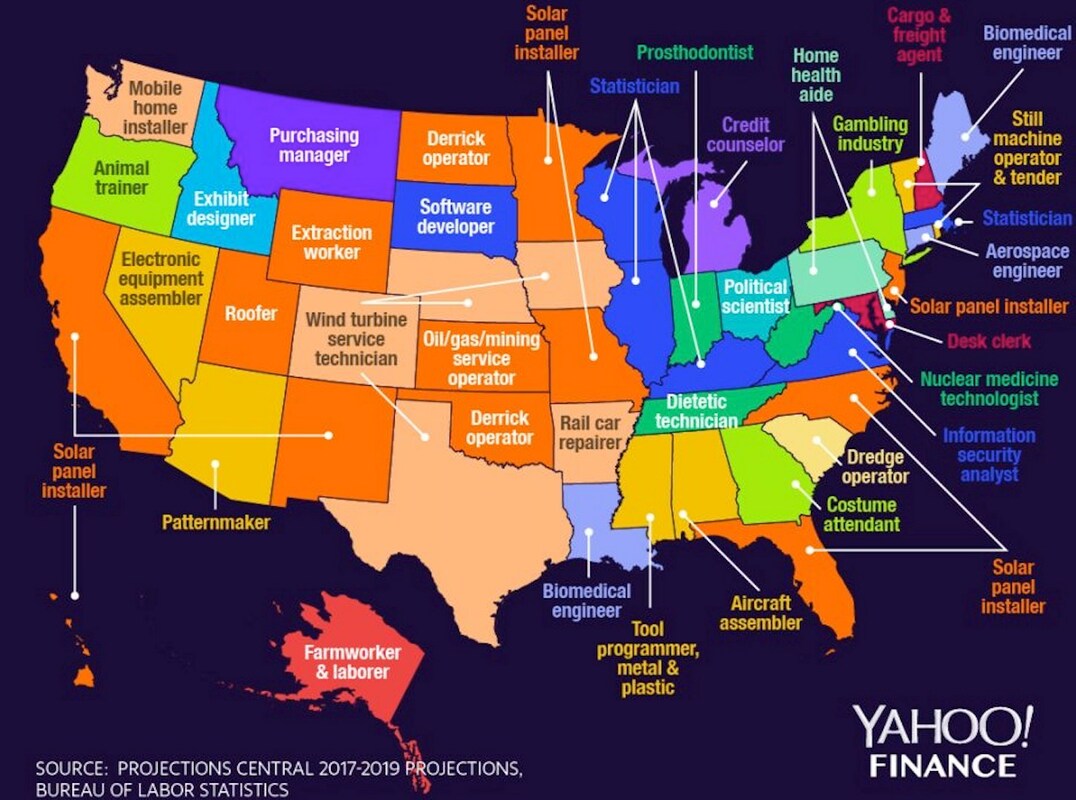

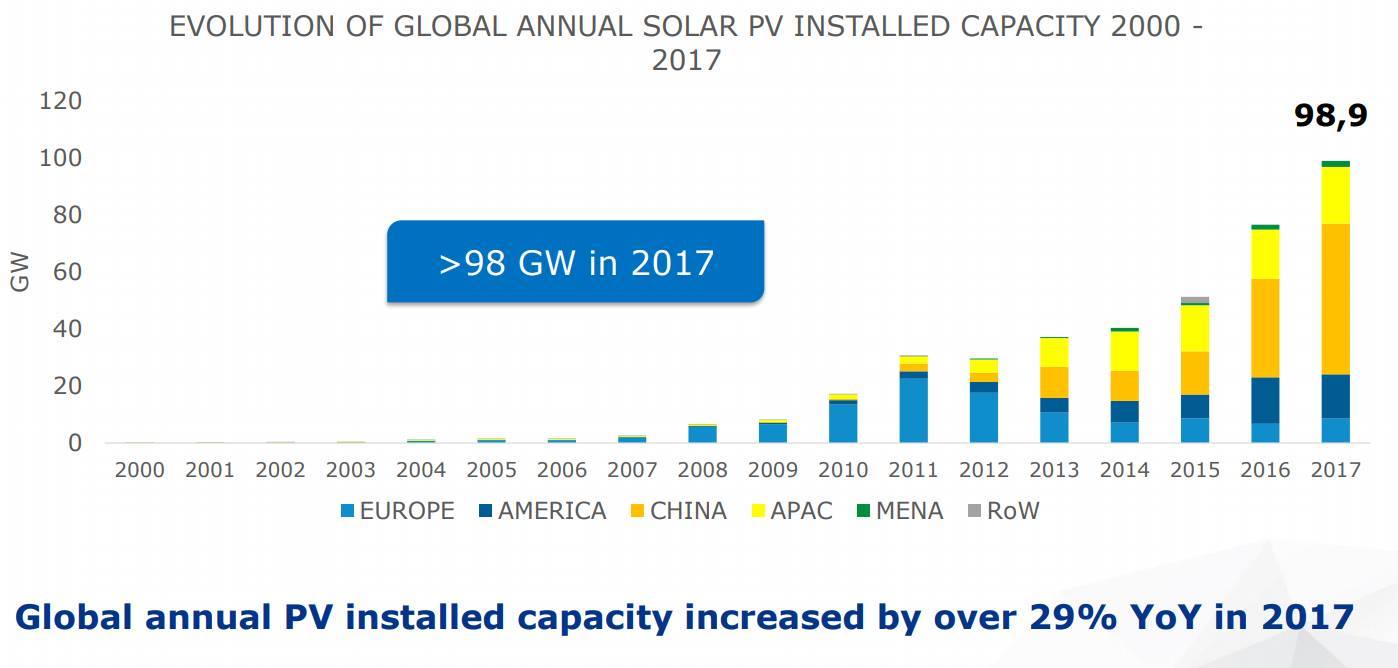

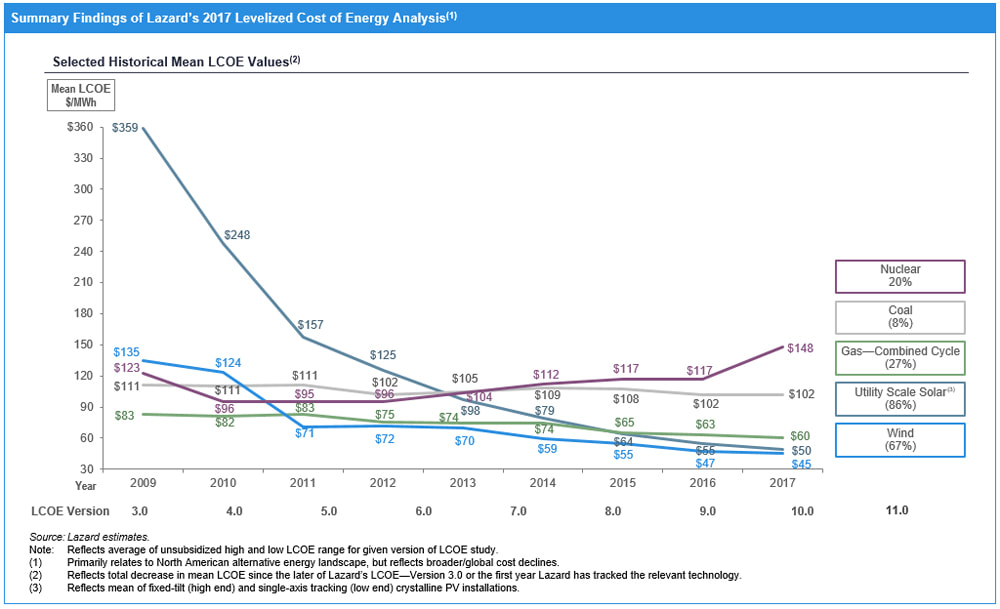

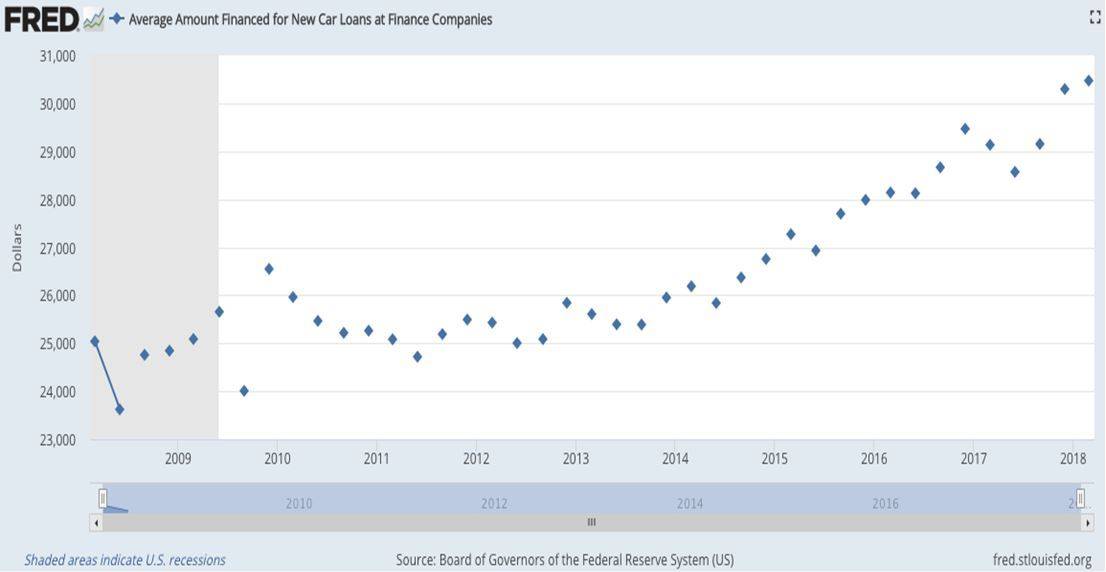

Over the course of my thirty-year career in the financial services industry I have seen and continue to hear many investment theses. Some brilliant, some not so much so. I have also witnessed a number of changes that in retrospect were obvious and inevitable. The personal computer revolution was one of the first. I recall there were many would be winners that vanished into dust, but some of the early players like Intel, Microsoft, and Cisco became the next generation of mega-cap companies. Likewise, with the internet boom. Companies came and went, but some like Amazon and Google became behemoths. Cell phones were the stuff of dreams in my youth, but the ability to access people and information, no matter where you are, was inevitable and although early participants like Nokia and Motorola have become footnotes, Apple and Samsung have had explosive growth and rewarded investors many times over. Recognizing inevitable change is only half of the battle for successfully profiting in new industries and market opportunities. Diversification and patience are more important long-term ingredients to financial success. If you put all your eggs in the Commodore computers basket you were a loser. The same for eToys.com or Lycos, or Palm Inc. Even if you recognized the inevitable, it was still much too easy to lose all or most of your investment. Perhaps, though you were bright enough or lucky enough to pick the winners. On 3/24/1980 you could have bought Intel for just $0.32 adjusted for splits. By 10/20/1980 it had already soared 56% to $0.50. A year later, the price had fallen about 48% to just $0.26 per share. Would you have held on? Would you still have faith that this was inevitable? It wasn’t until the second quarter of 1983 that Intel reached that $0.50 peak again. Today, no one gets very excited about Intel, but the stock price has reached $51 per share netting those long-term patient investors $100,000 for every $1,000 they invested nearly 40 years ago. So, although you can find inevitable investment opportunities, today the rush of the quick pop in price per share will not always be there. Sometimes, it is just waiting, and waiting, and waiting. With those words of warning, we will share with you four inevitable investment opportunities we feel all investors should be considering right now. Cannabis In January of 2012, marijuana became legal for medicinal and recreational use in Colorado. In 2018, it became legal for the entire country of Canada. Around the world attitudes toward “pot” are changing rapidly. We are now witnessing the birth of an entirely new industry. We believe the opportunity is akin to the liquor industry at the end of prohibition, and we are not alone. On November 1, 2018, Constellations Brands (STZ) closed a $5 billion investment in Canadian cannabis producer Canopy Growth (CGC). On August 1, 2018, Molson-Coors (TAP) announced a joint venture with Canadian cannabis company HEXO Corp. (HEXO) to develop non-alcoholic cannabis infused beverages. Additionally, in December of 2018, Philip Morris (PM) invested $2.4 billion in the Canadian cannabis company Cronos (CRON). What do these large multi-national companies see in the future of the cannabis market? Take a look at some of the numbers. In four and a half years, total sales of cannabis have more than doubled in the state of Colorado, jumping from $683 million to over $1.5 billion. Colorado ranks 21st in the US by population with about 5.7 million residents. That works out to sales of about $263 per year per person. There are now ten states in the US where cannabis is legal for both medicinal and recreational use. This includes California, ranked number 1 by population and Michigan ranked number 10. These states in aggregate have a population of about 80 million. Throw in New Jersey and New York who are likely to follow suit and that means about one third of American’s live in states where cannabis is legal. Even if Colorado is an outlier and sales in other states are only say 70% as high (haha) or $184 per person that works out to a market of $14 billion. Maybe Constellation Brands and Molson-Coors envision a day when you stop by your local pub for a cannabis infused drink rather than a beer. For comparison, the US market for beer topped $35 billion in 2018. Like the acceptance of the lottery, there will be many states reluctant to join the party for moral reasons, but sooner or later acceptance is inevitable. Renewable EnergyNo, you don’t have to be a tree hugger to realize that renewable energy is inevitable. Take a look at this chart from Yahoo Finance showing the fastest growing jobs in every state. In eight states, the fastest growing job is solar panel installer. In four states, the fastest growing job is wind turbine service technician. Climate change concerns aside, it is obvious renewable energy is becoming a much bigger deal both in the US and abroad. Although, starting from a low base the following chart from the Yale School of Forestry illustrates the beginnings of an explosive growth in solar energy production worldwide. Much like the tipping point in software adoption, we believe solar installation will reach a critical mass that will one day lead to a distributed production model for energy use. With a large installed base of photovoltaic solar panels, today’s electric utility could evolve into a sort of common carrier like the Telcos, moving electricity from areas of high production to areas of high consumption. Your rooftop solar array and the arrays across the nation would provide power for homes and factories across the country. Rather than spending most of their capital on new power generation assets, they might spend more on upgrading and improving the efficiency of our electric grid instead. Both utility scale solar and wind systems currently provide the lowest power costs available. As photovoltaic systems improve, and manufacturing systems evolve, the price will head only one way – down, as illustrated in this chart from Lazard on levelized energy costs. Autonomous VehiclesYou have likely heard about the Tesla (TSLA) cars with autopilot, or maybe Google’s Waymo division. The first generation of self-driving vehicles is nearly here, and it means big change for the entire transportation industry. It will change the way automobiles are used, change the ways roads are built, and change the way freight is shipped. Like most people in America, you own a car that sits parked in your garage or at your place of employment 90% of the time. Cars are expensive. There was a time when the average family could buy a vehicle and pay for that vehicle with three-year financing. Today dealers are stretching that financing out to six or even seven years to make ownership possible. Imagine getting up in the morning and using a smartphone app, you summon your ride to work. On the way you are free to check your email, read the news, or even just nap because you are not driving the vehicle - it is driving itself. In 2018, the average payment for a new car in the US was $523 per month. That doesn’t include insurance, fuel, or maintenance. It is easy to guess that the total cost of car ownership to be around $700 per month. With autonomous vehicles, you would pay only for the time you are using the vehicle and various companies would own fleets of vehicles around the country. They would pay for the maintenance and insurance, you would just rent a ride. Again, once critical mass is reached with autonomous vehicle adoption, our roads would become safer, parking garages would go the way of payphones, and travel becomes less frustrating. How many traffic jams would be eliminated if crashes were rare and rubbernecking were eliminated? Shipping freight will change radically as well. Without the need for human drivers, shipping companies would program their trucks for fuel efficiency rather than speed. Trucks would travel the highways 24/7. If you have ever been on an interstate highway in the wee hours of the morning, you know there is almost no one using the highway. This becomes prime time for shippers, resulting in less congested roads and decreased need for new road construction. For all these reasons and more, we see autonomous vehicles as an inevitable change. The Wilshire 5000 Yep, it’s as simple as that. History has shown that investing is common stocks for the long run inevitably creates wealth. Markets go down but they do not stay down. You don’t have to be a genius or a prognosticator to participate and profit from the inevitable growth generated by a group of great American companies. Back to our question about Intel. Did you buy it? Did you hold it? The Wilshire Index did. Same for Apple, Netflix, Tesla, and many other great and not so great companies. Some companies that were in the index disappeared, but the growth of market value marched on anyway. The Wilshire 5000 Index is a market cap weighted index of all the actively traded stock on all the US exchanges. Originally named the 5000 because when the index was first constructed in 1977, there were about 5,000 companies actively traded in the US. As of June 30, 2018, there were 3,486 companies in the index. You will find the components of all the inevitable trends we covered here, and some that we may not be aware of included in the index. If new companies come to market in the future, they will be added too. The companies in the index are updated monthly to include IPOs and corporate spinoffs and also to remove companies that move to the pink sheets or cease to trade actively.

Comments are closed.

|

Archives

April 2024

Categories

All

|

RSS Feed

RSS Feed