|

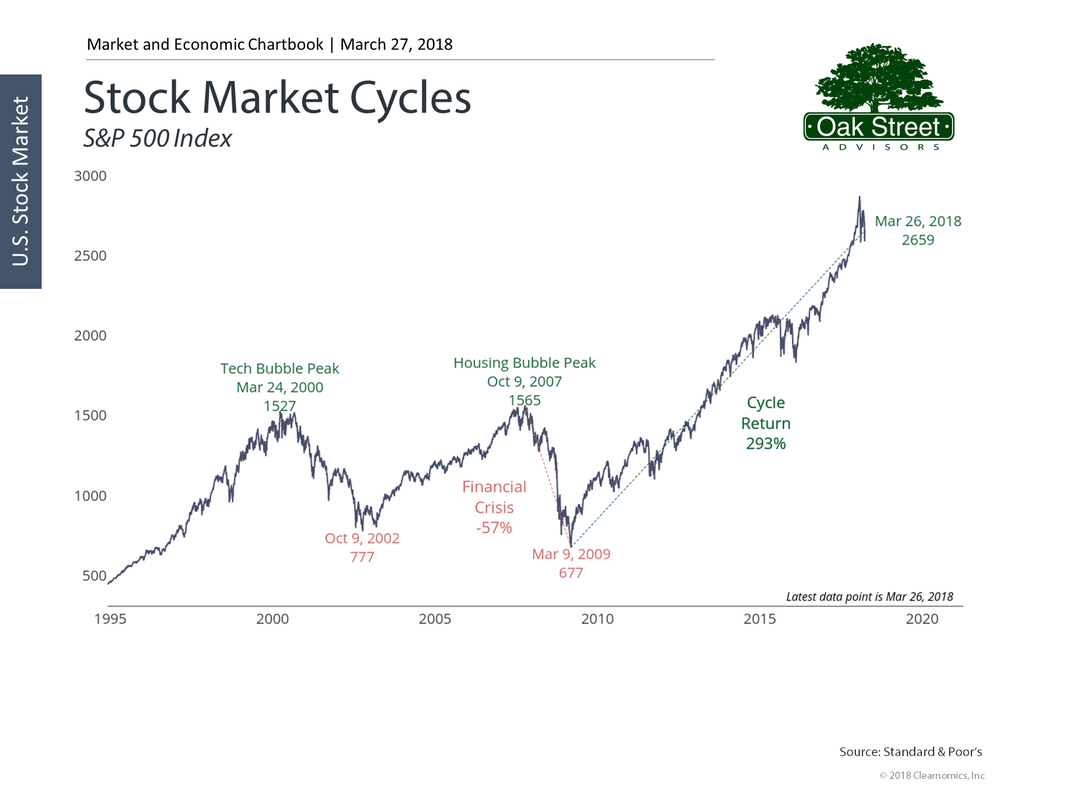

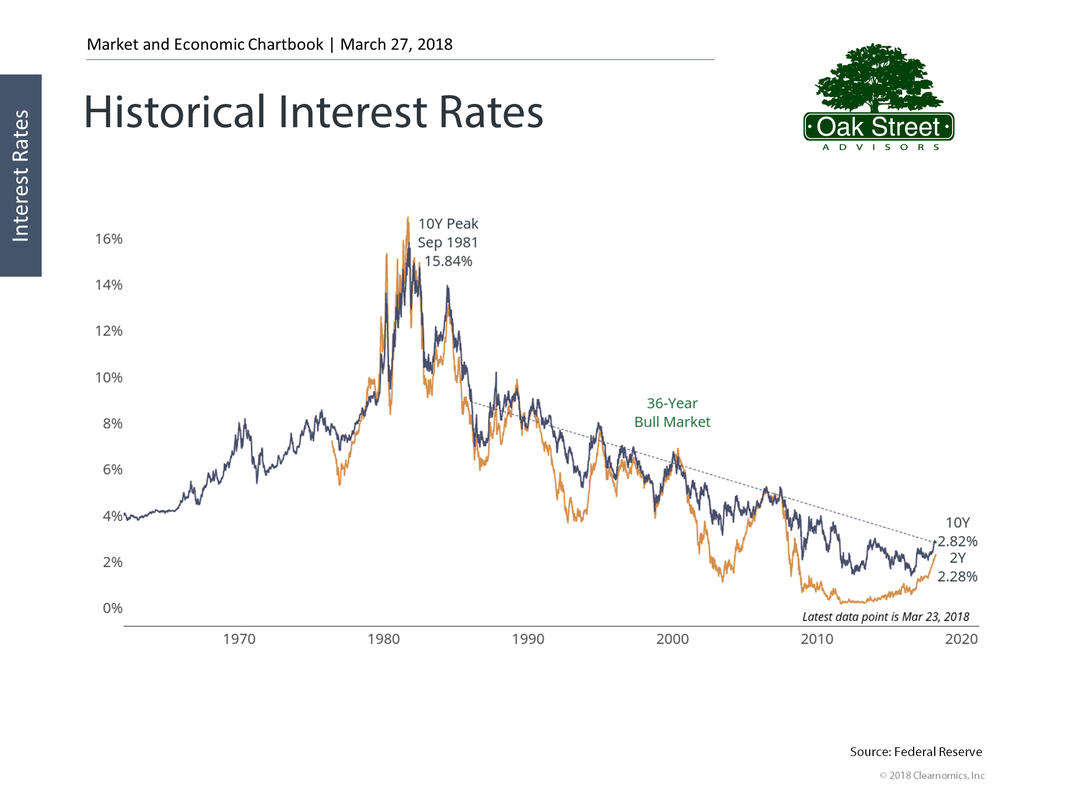

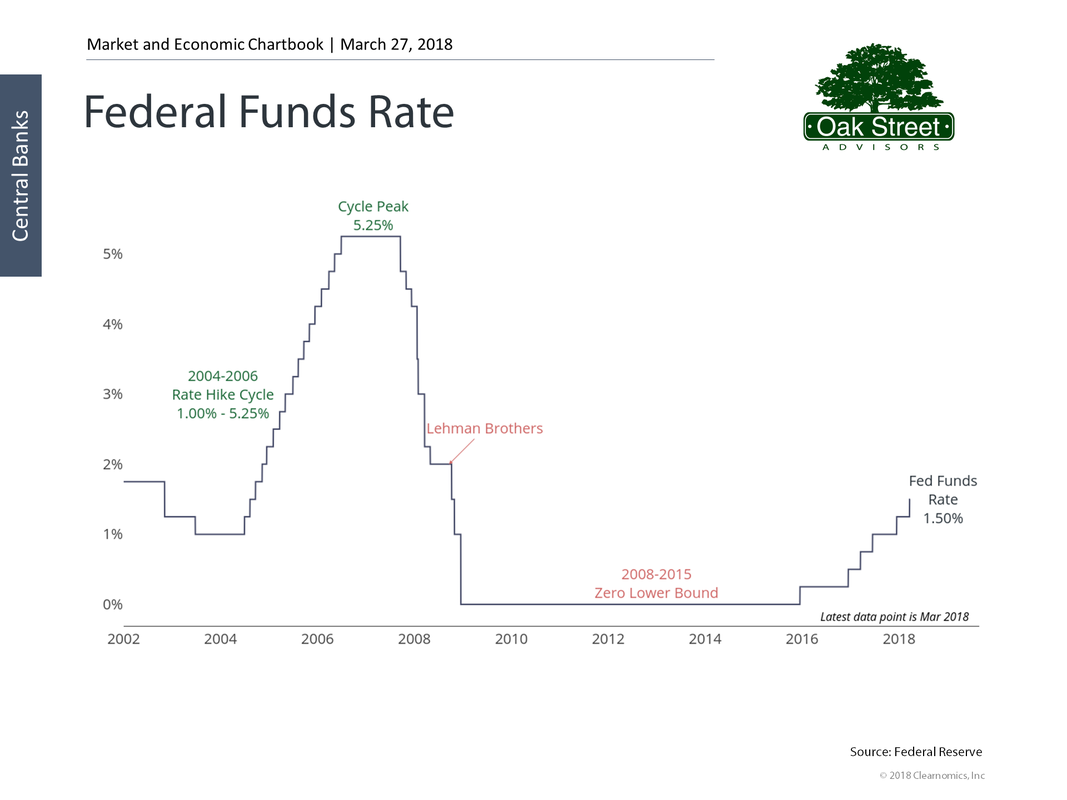

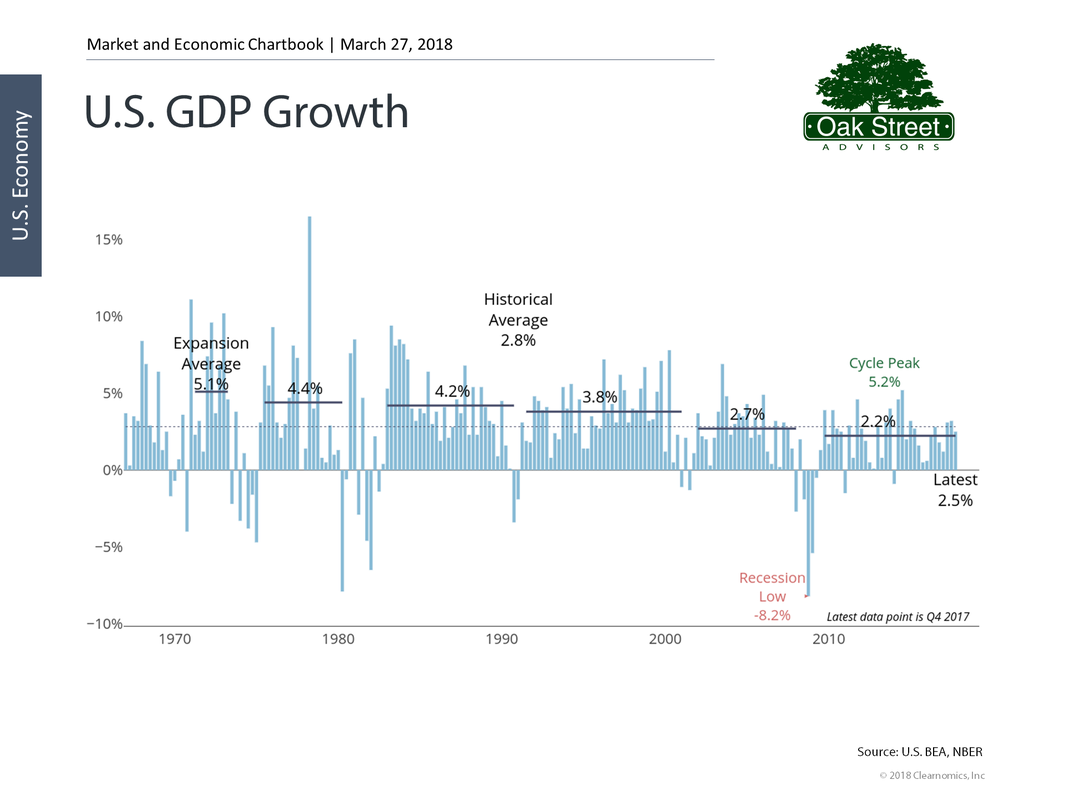

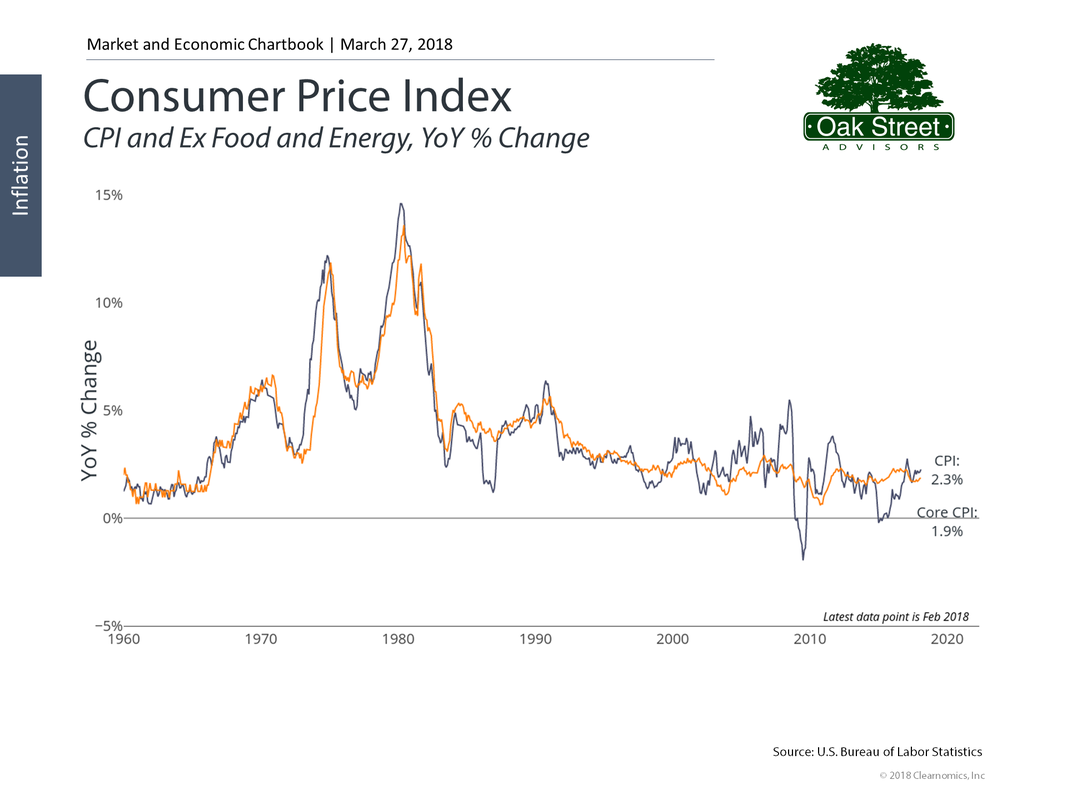

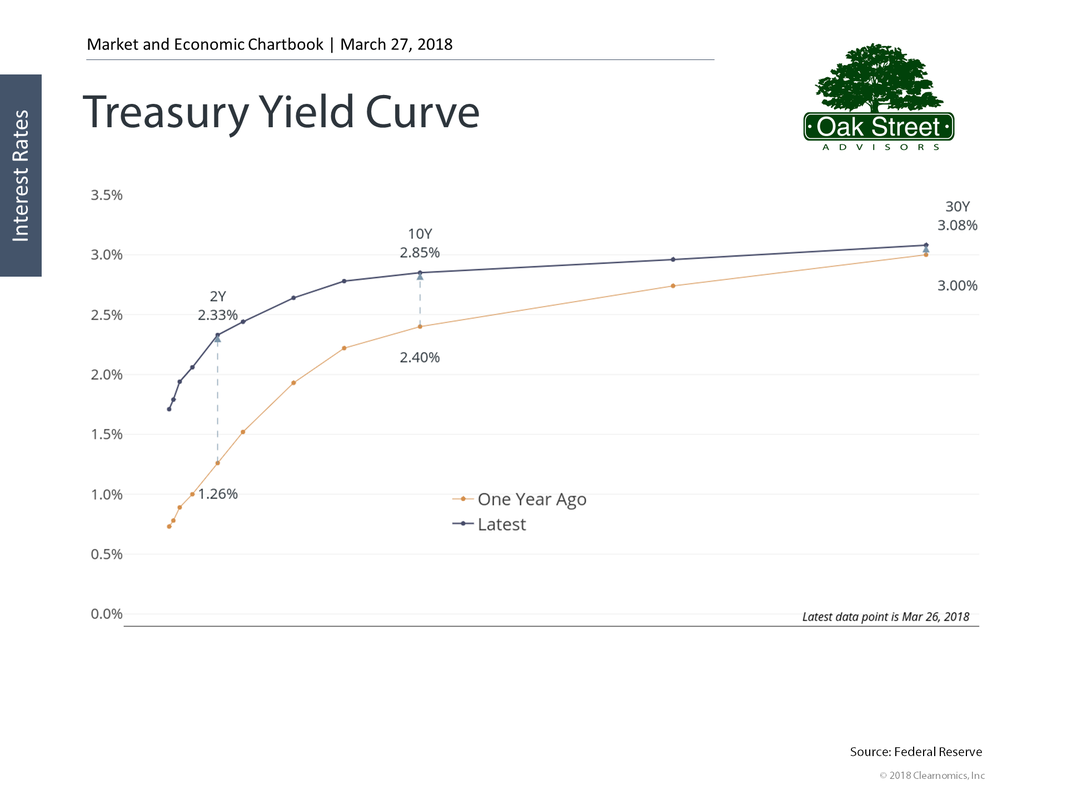

The popular press is fond of pointing out how old the bull market for stocks is. After bottoming in 2009 we have seen stocks march upward for for nearly a decade. Many of today’s younger investors, say those in their thirties, have seen the stock market fall, but never felt the pain in their own portfolio.  Yet for another class of investor, those who have invested in bonds, the bull market run has been even longer. Going back to the days of President Jimmy Carter in 1981, bond yields have fallen, year after year. Because bond prices move inversely to interest rates, bond prices have been rising for the last 36 years. That means someone who entered the workforce in the early eighties, bond prices have always gone up. For some perspective the Certified Financial Planner Board of Standards was formed in 1985. As a group, CFP® practitioners have never experienced a true bear market in fixed income securities. Although the credit freeze that coincided with the great recession bear market for stocks, had a short, sharp panic in the fixed income markets; a long drawn out bear market for fixed income has been an experience the profession will for the most part find alien. The closest thing to the pain of a bear market in bonds experienced by this group was the 2004 to 2006 Chinese water torture of the Greenspan/Bernanke Fed. During the thirteen months that spanned June of 2005 to July of 2006, the Federal Reserve raised rates 25 basis points every time they met. Although the aggregate bond index only fell in price by about 5%, the constant barrage of interest rate increases was hard to live through. That pain was nothing compared to the Burns/Miller/Volker era where we saw the Fed raise rates from 4.75% in November of 1976 to the 20% Fed Funds rate of May 1981. That was the last true bear market for fixed income products in the United States. Although your grandfather might wistfully talk about getting 18% on his CDs, the path that led to those astronomical rates was littered with bond investors who saw the value of longer term bonds fall by 50% or more. When I hear today’s press ask what will happen if the 10-year Treasury bond breaches 4% I am astonished. It is not a question of if, but a question of when. If we can avoid creating a trade war with the rest of the world, there are some very expansive monetary policies recently enacted by congress and the Trump administration investors can benefit from. The tax overhaul will provide a good measure of impetus to the economy, and the budget bill recently signed into law gets us away from the restrictive spending of the sequestration agreement and into a more expansive government spending era. Yet, the Federal Reserve must walk a fine line between economic growth and containing inflation. GDP growth has entered a more normal territory. Inflation, while still subdued, has shown signs of rebounding. The uptick in inflation is related to a small increase in wage growth, which is in turn related to the continued implosion of our unemployment rate. You also will note a similar uptick in mortgage rates. As investors search for yield in a low rate world, we have seen a compression in the interest rate spreads between high quality bonds and low quality (junk) bonds. With rates as low as they are today and with the economy growing it is inevitable that interest rates will rise. The end of the 36-year bond bull market is likely upon us. A flattish yield curve where the difference in a two-year treasury and a ten-year treasury is a mere 52 basis points, puts bond investors in a peculiar spot where an interest rate increase of just 1% could potentially wipe out three to five years of interest income. The take away from all this is bonds are a minefield for investors today. A small misstep can be very costly and the rewards for investment are very small. Many advisors are ill-prepared for a world of falling bond prices.

Unless you or your advisor are true experts with fixed income investments, your best option in today's environment is to keep your maturities very short. That means you should be selling any bonds or bond mutual funds that have long durations. You should direct those allocations to short term treasuries, certificates of deposit, and bonds in the 1 to 3 year maturity range. Hopefully you will ladder those investments so you have new money available to invest at progressively higher rates throughout this interest rate cycle.  Every year about this time, the popular press comes out with predictions for the new year. We all know that no one has a crystal ball but we read them anyway. Happily, Google never forgets. Here are some of the predictions made for 2016.

So, read the predictions for 2017 with a healthy dose of skepticism, it’s just for fun.

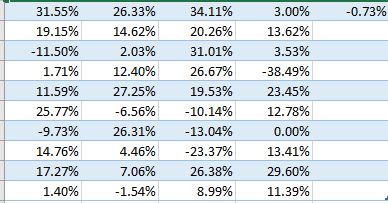

Over the last 80 years the stock market has advanced an average of 10% each year, but average is not normal when it comes to the stock market. The table pictured on the left shows the actual returns for the S&P 500 each year since 1975. How many of those returns were 10%? How many fell between 9% an 11%? Not many were even close to average.  So while you may be hoping for your investments to look like this.  You will likely experience something like this.  Bob Clark, a columnist for Investment Advisor magazine, recently said, "...the role of advisors is to protect their clients from the financial services industry". Many times the products pushed by the large financial service firms do more harm to investors than good. The "hot" product du jour is currently the Equity Index Annuity. While the equity index Annuity itself is not an evil thing, the way they are presented to investors is many times misleading, and they are often pushed to be a much larger part of a portfolio than prudence would justify. In brief, an equity index annuity, provides returns that a related to some stock market index. As such they can be viewed as an equity derivative (remember those?). Investors typically receive a return that is some portion of the return of an index like the S&P 500 (for example 90% of the point to point return of the price increase of the index, not including dividends), the average monthly return of the index over a predetermined period (again not including dividends), or the monthly gain of the index with a predetermined cap (often 2-3% per month cap). The big draw is that you receive a guarantee that your account will not have a negative return over some period of time. Often touted as "heads you win, tails you don't loose". On the face that sounds enticing. It is only if you kick the tires that problems become apparent. First, like most annuities there is a long period of time where you a charged a surrender charge if you want or need to withdraw more funds than allowed in the contract (I have even seen instances where the surrender charge is applied to any withdrawal except in the case of annuitization). Second, any gain from annuities is considered to be distributed first, and taxed as ordinary income (you do not get favorable dividend of capital gain rate when you file your taxes), and any distribution before age 59 1/2 could be subject to a 10% premature distribution tax penalty. Worst of all the returns investors receive will likely not measure up to expectations. The pitfalls of monthly caps and averaging returns requires some contemplation to understand. Let's say you are credited with any market gains up to 2% each month. That means if the index you participate in goes up by 2% you are credited with the full 2%, if the index goes up 3%, sorry, you are still only credited with 2%. Okay, you say, that's not so bad, I can still earn a whopping 24% in a year! In theory yes, in practice, no. See sometimes, even in a very good year, markets will fall back some months. And you equity indexed annuity lets you participate fully in the monthly market drops, as long as the account moves no further than 0% in a year. If the index you participate in rises by 3% one month, the 1% the next month, but falls by 3% the following month, your account earns zero, nada, zilch. You were credited with 2% the first month, then 1% the second month, but got dinged for the full minus 3% in the third month. It's all very confusing, and people hear what they want to hear. That is what the insurance companies and agents who sell equity index annuities are counting on. Heads the insurance company wins, tails, you lose.  Individuals with special needs and families that seek to help, have long been hamstrung by the Catch 22 of public assistance. If a family provides too much financial assistance, the beneficiary loses access to government assistance. If the family does not help the individual may suffer from lack of access to housing and education. For special needs individuals to receive an inheritance they needed a special needs trust or the inheritance was quickly depleted until the special needs individual once again attained poverty level to qualify for public assistance. In 2014 congress passed the ABLE act to allow special needs beneficiaries’ families to establish a savings vehicle funded with up to $14,000 per year (adjusted for inflation) to supplement public assistance. The account may be used to pay for needs such as housing, education, transportation, and other expenses that improve the quality of life for those with disabilities. Similar to 529 college saving plans, ABLE accounts are established by the states, but you can participate in the plan of a state other than your home state if you choose. The account may not hold more than $100,000 of assets without running afoul of the Supplemental Security Income rules, but still this is an improvement over the expense and complexity of using a special needs trust. For many families this account will prove invaluable. To qualify for an account, the individual must have significant disabilities and the age at onset of the disability must be prior to attaining age 26. At the death the state where the beneficiary resides may be able to claim any balance remaining in the account under the Medicare payback rules. Currently ABLE plans have been established by Florida, Nebraska, Ohio, and Tennessee. If you are not a resident of one of these states non-residents are allowed to establish accounts in Nebraska, Ohio, and Tennessee. For more information, you can visit the ABLE National Resource Center online.  As the Summer Olympics in Rio kicked offed this past weekend, it is time again for us to marvel at the prowess of the best athletes in the world. They deserve all the awe we can muster, training that hard for that long- many of them all their lives- to finally compete for their respective countries in front of millions and millions across the globe. The process is truly amazing, and the reward of just competing on that big a stage is just as memorable. Whether you’re a veterinarian, bus driver, CPA or welder- everyone can be their own champion when it comes to their finances. If you practice determination, discipline and hard work in your financial planning you too can achieve a level of awe in yourself. The level of achievement will be different for each circumstance, but the feeling of being in control of your retirement planning, college savings for your children, investments or debt management, can be just as remarkable as the Olympians we’ll be watching over the next month. So challenge yourself to start, or continue, a healthy routine with your finances. This may require speaking with a financial advisor, reviewing your current financial plan, or simply saving an extra $10 each week. However, with enough tenacity and hard work, you too can bask in the glory that is being financially comfortable and prepared for the many obstacles everyday life will throw your way.  It was about three weeks ago, June 23rd to be exact, that the fears of the Brexit flooded the markets and it seemed as if everything was going down, way down. Now look at what has come to fruition over the past two weeks. Almost all global markets are trending upwards, especially the US markets, which have seen the Dow Jones and S&P 500 hit record intraday highs over the past 2 days alone. Throughout all of this chaotic market volatility, we come back to the same recurring theme. Yes, markets will go down, yes, markets will go up. Both sides of this coin are unpredictable, so we look again towards the long run where the markets have continuously trended up over time. When another scare comes around, stand firm, and if you can't, reach out to an advisor who will help you do so.  We are in the midst of another US Presidential election cycle and again clients are worried about the effect the election will have on the stock market. While nothing can be predicted with certainty, we can look at history to get a feel for what might happen. Since 1944 all presidential elections coincided with a gain in the stock market, except two years that appear to be outliers. In 2000 as the tech bubble burst and in 2008 as the housing bubble burst and the credit markets froze stocks ended the election year lower. But barring any black swan event later in this year, I would expect a return to historical norms and a positive end to 2016 for equities. In the end it is profits not politics that rule the stock market.  Warren Buffett is the man. The Oracle of Omaha just seems to make the right move almost all of the time. One of my favorite Buffett moves has been 8 years in the making…so far. About 8 years ago Warren made a $1 million bet with a hedge fund company that a simple S&P Index Fund would outperform a group of hedge funds over a 10-year span. The winnings will go to a charity of the victor’s choice and right now, Buffett’s less managed and much more affordable Index Fund is crushing its competition. Of course, we can learn yet another vital lesson from Warren. It’s not always the flashy, trendy, and often times much more expensive investments that perform the best. Often times, as history has proven to us over and over, a simple index fund and the stock market’s consistent rise over time can turn out to be the strongest investment of all. It may not be a flashy way of investing, but it sure pays off in the end. |

Archives

September 2023

Categories

All

|

RSS Feed

RSS Feed